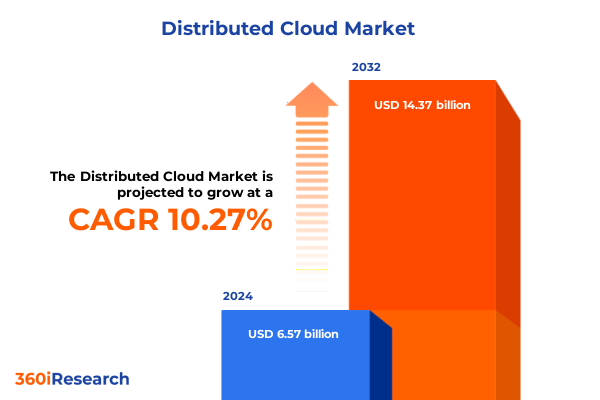

The Distributed Cloud Market size was estimated at USD 7.22 billion in 2025 and expected to reach USD 7.94 billion in 2026, at a CAGR of 10.32% to reach USD 14.37 billion by 2032.

Distributed cloud emerges as a paradigm shift empowering organizations to unify hybrid architectures while ensuring data sovereignty and operational agility

Distributed cloud extends public cloud services to edge infrastructures managed by cloud providers, enabling organizations to deploy workloads closer to data sources while leveraging centralized control planes. This paradigm transcends traditional cloud boundaries by unifying disparate compute, storage, and network resources across on-premises, colocation, and edge environments. Driven by the need for low-latency processing, robust data sovereignty, and seamless workload mobility, distributed cloud empowers digital leaders to architect resilient applications that meet evolving performance and compliance demands. As demand for real-time analytics intensifies and regulatory frameworks tighten, the distributed cloud model bridges gaps between centralized cloud capabilities and edge requirements, unlocking new operational possibilities.

As enterprises increasingly adopt hybrid and multi-cloud strategies, distributed cloud emerges as a cornerstone for next-generation architecture. It fosters greater agility by automating deployment across remote sites and orchestrating resources through unified management consoles. By blending centralized governance with localized data processing, organizations can accelerate time-to-insights while maintaining control over critical information assets. This introduction sets the stage for an in-depth analysis of landscape shifts, tariff implications, segmentation dynamics, and strategic recommendations that will inform executive decision-making for distributed cloud initiatives. The chapters that follow will delve into transformative market shifts, examine tariff influences shaping infrastructure costs, reveal deep segmentation insights, and present regional and competitor analyses to equip stakeholders with actionable intelligence.

Emerging drivers and technological inflection points are redefining the distributed cloud landscape to unlock unprecedented agility and performance gains

Technological breakthroughs and evolving business imperatives are driving a radical transformation in the distributed cloud landscape. Accelerated rollout of 5G networks is enabling high-throughput, low-latency connectivity at the edge, while advances in edge computing hardware and software frameworks are democratizing access to distributed processing power. Moreover, the proliferation of AI and machine learning workloads at the network perimeter is prompting providers to integrate specialized accelerators and inference engines into remote nodes. At the same time, sustainability goals are catalyzing innovation in energy-efficient architectures, with providers experimenting with carbon-neutral edge sites and dynamic workload scheduling to minimize environmental impact.

Regulatory developments are also reshaping strategic priorities. Heightened data sovereignty requirements across jurisdictions are compelling enterprises to localize sensitive workloads, reinforcing demand for distributed cloud deployments. Concurrently, cybersecurity threats are driving investments in zero-trust security models that extend from centralized clouds to disparate edge locations. Furthermore, the rise of digital twins, augmented reality, and immersive IoT experiences is creating new use cases that rely on distributed cloud capabilities for real-time processing. Together, these technological and regulatory shifts are converging to redefine service delivery models, making distributed cloud an essential enabler of next-generation applications.

Assessing the cumulative effects of United States tariff measures in 2025 on distributed cloud infrastructure costs and strategic resilience

United States tariff measures implemented through 2025 have introduced a complex set of cost pressures that ripple throughout the distributed cloud ecosystem. Tariffs on hardware components, including specialized edge servers and network appliances, have increased procurement costs and disrupted established supplier relationships. In response, infrastructure teams are recalibrating sourcing strategies, exploring nearshoring and diversification of component origins to mitigate cost volatility. These developments have underscored the importance of flexible supply chains and have spurred collaboration between cloud providers and their hardware partners to secure preferred pricing and buffer against further tariff escalations.

The cumulative tariff impact extends beyond equipment to influence service delivery economics, as provider costs for rolling out and maintaining remote nodes have risen. Consequently, end users are reevaluating service-level agreements and exploring alternative consumption models, such as pay-per-use or capacity-based billing, to absorb incremental expenses. To maintain competitiveness, organizations are investing in automation and predictive analytics to optimize workload placement and reduce idle resource allocations. This systematic approach to cost management and strategic resilience ensures that distributed cloud initiatives continue to deliver value, even amidst an evolving tariff landscape that demands agility and foresight.

Revealing how segmentation dimensions across infrastructure models, service categories, organizational sizes, applications, and industry verticals shape adoption

Analysis of distributed cloud adoption reveals distinct dynamics across infrastructure models, service categories, organizational tiers, application contexts, and industry domains. When viewed through the lens of deployment type, adoption varies significantly between Infrastructure as a Service, Platform as a Service, and Software as a Service offerings, with each model presenting unique integration, customization, and governance considerations. Service categories further differentiate market behavior: solutions centered on data security, those focused on scalable data storage, and offerings designed to optimize networking each attract specialized workloads and investment priorities.

The size of an organization shapes distributed cloud strategies in meaningful ways. Large enterprises leverage extensive capital and existing data center footprints to build sophisticated hybrid environments, often integrating distributed cloud as a means to extend legacy systems. Small and medium-sized enterprises gravitate toward managed services that reduce operational overhead while providing seamless access to edge capabilities. Application use cases such as content delivery, edge computing workloads, and Internet of Things deployments drive tailored feature sets and deployment patterns. Industry domain influences are equally pronounced: financial services demand rigorous compliance and encryption services, energy and utilities prioritize real-time operational monitoring, government and public sector entities emphasize sovereignty, healthcare focuses on patient privacy and interoperability, IT and telecom players integrate with core networks, manufacturing relies on deterministic control loops, and retail and consumer goods enterprises seek enhanced customer experiences through proximity computing.

This comprehensive research report categorizes the Distributed Cloud market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Service Type

- Application

- Industry Verticals

- Organization Size

Examining regional dynamics and strategic adoption trends that propel distributed cloud innovation across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics are playing a pivotal role in shaping distributed cloud innovation across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States leads with mature adoption driven by hyperscale providers partnering with telco operators to deploy edge nodes in urban and rural markets alike. Canadian enterprises are following suit, propelled by data residency regulations that mandate localized processing for regulated sectors. Latin American markets are emerging as growth areas, with service providers leveraging distributed architectures to improve connectivity in underserved regions.

Europe Middle East & Africa exhibits a diverse regulatory landscape that both challenges and accelerates adoption. The European Union’s data protection framework has catalyzed investments in sovereign edge infrastructures, while Middle Eastern nations are channeling public-private partnerships into smart city initiatives powered by distributed clouds. African markets are experimenting with leapfrog technologies to bridge digital divides, focusing on low-power edge designs and satellite-backed connectivity. In Asia-Pacific, rapid digital transformation is evident as governments and enterprises invest heavily in artificial intelligence, IoT, and 5G initiatives. Regional alliances are fostering standardized distributed cloud frameworks to accommodate linguistic, cultural, and compliance requirements across a vast and varied geography.

This comprehensive research report examines key regions that drive the evolution of the Distributed Cloud market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading strategic initiatives and competitive differentiators of major distributed cloud providers and ecosystem partners driving market momentum

Leading providers have intensified efforts to differentiate their distributed cloud portfolios through strategic investments, partnerships, and feature innovation. Public cloud giants are integrating edge nodes into existing global footprints while forging alliances with telecom operators to extend coverage into dense urban cores and manufacturing hubs. These providers are incorporating advanced orchestration tools, AI-driven monitoring, and built-in security services to streamline deployment complexities and enhance reliability. Strategic partnerships with semiconductor manufacturers and network equipment vendors are ensuring optimized performance for latency-sensitive workloads at remote locations.

At the same time, ecosystem partners and emerging challengers are carving out niche positions. Specialized managed service firms are bundling distributed cloud solutions with professional services, offering end-to-end implementations for regulated industries requiring hands-on expertise. Telecom companies are launching their own edge platforms, leveraging network assets and local facilities to provide differentiated connectivity and compliance guarantees. Systems integrators and software vendors are developing industry-specific distributed cloud frameworks for retail, healthcare, and manufacturing, embedding verticalized workflows that accelerate time to value and reduce integration risks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distributed Cloud market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Akamai Technologies, Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Cloud Sigma AG

- Cloudflare, Inc.

- Cohesity, Inc.

- DELL TECHNOLOGIES INC.

- DigitalOcean Holdings, Inc.

- Equinix, Inc.

- F5, Inc.

- Google LLC by Alphabet Inc.

- HEWLETT PACKARD ENTERPRISE COMPANY

- Huawei Investment & Holding Co., Ltd.

- Infosys Limited

- International Business Machines Corporation

- Kinetica DB, Inc.

- Lumen Technologies, Inc.

- Microsoft Corporation

- Oracle Corporation

- Rackspace Technology, Inc.

- Telefonaktiebolaget LM Ericsson

- Tencent Holding Limited

- Teradata Corporation

- VMware, Inc. by Broadcom, Inc.

- Wind River Systems, Inc.

- Wipro Limited

Providing recommendations to guide industry leaders in harnessing distributed cloud for operational efficiency, compliance, and competitive differentiation

To harness the full potential of distributed cloud, industry leaders should prioritize targeted investments in edge infrastructure while building robust governance frameworks. A phased approach to deployment will enable organizations to validate performance gains and security postures in controlled environments before scaling. Partnering with specialized security and compliance experts can accelerate adherence to data sovereignty and privacy requirements, minimizing time to value. Embedding automation and infrastructure-as-code practices will streamline management of distributed nodes and reduce the risk of configuration drift across geographies.

Talent and organizational readiness are equally crucial. Upskilling IT teams on distributed cloud architectures and edge-native application development will unlock innovative use cases and foster a culture of continuous improvement. Leaders should also develop cross-functional councils to oversee data residency, network optimization, and sustainability objectives, ensuring that distributed cloud initiatives align with broader corporate strategies. Finally, scenario planning exercises that factor in evolving tariff landscapes and geopolitical considerations will strengthen resilience and enable proactive adaptation to emerging risks.

Detailing the comprehensive research framework and data validation processes underpinning the rigorous analysis of distributed cloud market dynamics and trends

This research draws upon a robust framework that combines primary interviews with cloud architects, CIOs, and telco executives alongside secondary analysis of industry publications, regulatory filings, and technology roadmaps. A stratified sampling approach ensured representation across a range of organization sizes, industry verticals, and geographic regions, with particular emphasis on high-growth edge markets. Data collection spanned in-depth interviews, workshops, and surveys to capture both quantitative metrics and qualitative insights into deployment motivations, technology preferences, and strategic challenges.

Collected data underwent rigorous validation through cross-referencing with public disclosures, vendor documentation, and expert panel reviews. A triangulation methodology aligned findings from vendor-sponsored case studies with independent user experiences and academic research. Throughout the process, strict confidentiality protocols safeguarded proprietary information. Analytical techniques included thematic coding for qualitative data and trend analysis to identify inflection points in adoption patterns. This comprehensive methodology underpins the credibility of the insights presented and ensures that the report delivers a balanced, evidence-based perspective on distributed cloud dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distributed Cloud market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distributed Cloud Market, by Type

- Distributed Cloud Market, by Service Type

- Distributed Cloud Market, by Application

- Distributed Cloud Market, by Industry Verticals

- Distributed Cloud Market, by Organization Size

- Distributed Cloud Market, by Region

- Distributed Cloud Market, by Group

- Distributed Cloud Market, by Country

- United States Distributed Cloud Market

- China Distributed Cloud Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Converging insights emphasize the imperative of embracing distributed cloud to ensure resilience, drive innovation, and build future-ready digital architectures

The convergence of emerging technologies, evolving regulatory landscapes, and strategic imperatives has elevated distributed cloud from an experimental concept to a foundational element of digital transformation strategies. Organizations that embrace this model will realize significant benefits in resilience, agility, and data sovereignty, positioning themselves ahead of competitors constrained by legacy centralization. By integrating distributed cloud architectures with advanced analytics, AI, and automation, enterprises can unlock new revenue streams and deliver differentiated customer experiences at unprecedented speed.

Moreover, the adaptable nature of distributed cloud enables dynamic alignment with shifting cost structures and geopolitical landscapes. Business leaders who implement robust governance frameworks and cultivate in-house expertise will be equipped to navigate tariff fluctuations and compliance mandates with confidence. Ultimately, distributed cloud represents more than a technological evolution-it embodies a strategic imperative for enterprises seeking to build future-ready digital architectures that can scale securely and sustainably.

Connect with Ketan Rohom to acquire the comprehensive distributed cloud market research report and unlock strategic insights for competitive advantage

Engaging directly with Ketan Rohom offers an efficient pathway to secure the comprehensive distributed cloud market research report tailored to your strategic priorities. Through a collaborative consultation, you will gain clarity on how the latest insights align with your organizational objectives, ensuring you extract maximum value from the analysis. The report delivers in-depth coverage of transformative landscape shifts, tariff impacts, segmentation and regional dynamics, and competitive intelligence-and connects each finding to actionable strategic guidance.

By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you can customize deliverables to address specific industry challenges, such as optimizing edge deployments or navigating complex regulatory environments. The structured purchase process is designed to be seamless: you will discuss scope and deliverables, finalize an engagement plan, and receive the report along with complementary briefings for your leadership team. Reach out to Ketan Rohom to initiate a discovery call and position your organization to harness the power of distributed cloud with confidence and precision

- How big is the Distributed Cloud Market?

- What is the Distributed Cloud Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?