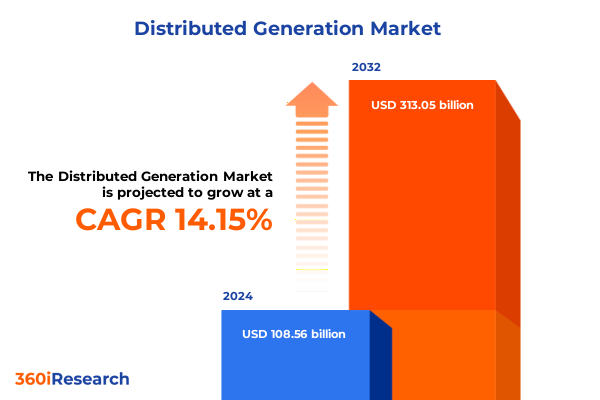

The Distributed Generation Market size was estimated at USD 122.96 billion in 2025 and expected to reach USD 139.28 billion in 2026, at a CAGR of 14.28% to reach USD 313.05 billion by 2032.

An Empowering Overview of Distributed Generation’s Evolution, Its Role in Energy Resilience, Sustainability, and the Decentralized Power Revolution

The global energy sector is undergoing a profound transformation as distributed generation emerges at the forefront of a decentralized power paradigm. Once relegated to niche applications, localized power sources now play an integral role in enhancing energy reliability, reducing transmission losses, and supporting sustainability goals. Distributed assets empower communities and enterprises to generate electricity closer to point of use, harnessing diverse resources from solar photovoltaic panels on rooftops to microturbines on industrial campuses.

Growing concerns around climate change, coupled with the need for resilient infrastructure, are driving stakeholders to reevaluate the traditional utility model. Distributed generation offers a pathway to decarbonization by integrating renewable and low-carbon technologies directly into the grid edge. Simultaneously, digital innovations enable real-time monitoring and control, facilitating demand-response programs and enhancing grid stability. As policy frameworks evolve to incentivize clean energy adoption, distributed generation is set to redefine energy ownership and trading, unlocking new business models and revenue streams for prosumers, utilities, and service providers alike.

Looking ahead, the convergence of regulatory support, technological innovation, and shifting consumer expectations positions distributed generation as a cornerstone of the modern energy ecosystem. In this executive summary, we examine the landscape’s transformative shifts, tariff impacts, segmentation dynamics, regional variances, and strategic imperatives that every stakeholder must consider to thrive in this dynamic environment.

Unveiling the Transformative Forces Driving Distributed Generation: Digitalization, Regulatory Evolution, and the Rise of Renewable Integration

The distributed generation landscape is shaped by converging forces that are redefining power production and consumption. At the forefront is the acceleration of digitalization, which is transforming isolated assets into interconnected grid participants. The deployment of smart meters and advanced inverters has surged globally, enhancing visibility and control of distributed resources through network monitoring devices and sophisticated analytics systems. This digital revolution enables virtual power plants and energy-as-a-service models, unlocking value streams for both end users and system operators.

Equally significant are shifting policy and regulatory frameworks that influence adoption rates. In several major markets, incentive structures have evolved, with new budget bills recalibrating tax credits and subsidy schemes. Recent changes in clean energy incentives have introduced uncertainty, prompting developers to navigate a dynamic regulatory terrain to secure funding and project viability. In tandem, innovations in financing-such as green bonds and community funding platforms-are democratizing access to distributed assets, enabling broader participation by residential and commercial stakeholders.

Furthermore, the integration of energy storage and hybrid solutions is reshaping project economics. As battery costs decline and performance improves, pairing storage with renewable generation optimizes value by smoothing output, maximizing self-consumption, and providing ancillary services. Together, these transformative shifts are driving a fundamental reconfiguration of energy systems, where decentralized, digital, and flexible resources coalesce to deliver resilient and sustainable power.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Distributed Generation Supply Chains and Technology Adoption

In 2025, a series of tariff measures introduced by the United States government have created lasting ramifications for the distributed generation sector. High duties on imported solar modules-set at 60% for Chinese products and 20% on other trading partners-are projected to reduce U.S. solar installations by 9% through 2035 under a “global tensions escalate” scenario, while energy storage deployments could decline by 4% over the same period. These elevated costs stem from the added financial burden of tariffs on photovoltaic cells, inverters, and balance-of-system components essential to utility-scale and distributed solar projects.

Onshore wind projects have similarly felt the impact of import restrictions, with tariffs of up to 25% on inputs from Mexico and Canada and 10% on Chinese components leading to an estimated 7% rise in turbine costs and 5% to 7% increase in overall project expenses. This cost escalation has the potential to curtail new wind capacity expansions by as much as 9% annually through 2028, with sustained tariff scenarios possibly shrinking deployment by 20% to 30% in the following decade.

Moreover, the storage segment is not immune; proposed duties on imported lithium-ion cells and battery components are driving up the capital costs for integrated solar-plus-storage systems, introducing delays and deferrals in project pipelines. In response, industry participants are exploring supply chain diversification strategies, including greater localization of manufacturing, rerouting of procurement channels, and collaboration on domestic gigafactory initiatives. These adaptive measures aim to mitigate tariff exposure while preserving the momentum of distributed generation deployments across the United States.

Unlocking Market Dynamics Through Technology, Power Rating, Grid Type, Application, and End User Segmentation in Distributed Generation

A nuanced understanding of market segmentation reveals critical insights into the distributed generation ecosystem. By technology, the spectrum ranges from established solar photovoltaic installations and wind turbines to emerging options such as biomass generators, fuel cells, and microturbines. Each technology presents distinct performance characteristics, capital requirements, and lifecycle considerations, shaping adoption patterns across diverse environments.

Examining power rating categories uncovers unique value propositions within residential, commercial, industrial, and utility-scale contexts. Residential systems under 100 kilowatts cater to individual homeowners seeking energy independence and cost savings, while commercial installations in the 100 kilowatt to one-megawatt range serve offices and retail operations with a balance of performance and affordability. Larger industrial and community systems between one and five megawatts support manufacturing and institutional campuses, and installations above five megawatts address utility-scale distributed scenarios where economies of scale are paramount.

Grid connectivity further stratifies the market into on-grid and off-grid applications, highlighting the dual priorities of grid support and remote power solutions for areas lacking reliable infrastructure. Application-driven segmentation spans backup power, combined heat and power, peak shaving, prime power, and grid support services, with backup applications distinguished by either long-duration or short-duration requirements. This diversity underscores the need to tailor system design to specific operational demands.

End users also drive differentiation, encompassing commercial sectors such as healthcare and hospitality, industrial segments including chemical and oil and gas operations, and residential categories spanning single-family and multi-family dwellings. These end-user profiles influence financing structures, regulatory compliance, and service models, rendering segmentation a pivotal consideration for stakeholders formulating targeted strategies.

This comprehensive research report categorizes the Distributed Generation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Power Rating

- Grid Type

- Application

- End User

Navigating Diverse Regional Drivers and Opportunities in Distributed Generation Across the Americas, Europe Middle East & Africa and Asia Pacific

Regional landscapes exhibit distinct drivers and barriers that shape distributed generation trajectories around the world. In the Americas, policy frameworks, such as state-level net metering and federal clean energy incentives, continue to spur rooftop solar adoption and community solar projects. The United States leads with extensive deployment of residential PV systems and growing integration of battery storage, while Latin American markets leverage abundant renewable endowments to pursue rural electrification and industrial energy resilience.

Across Europe, Middle East & Africa, ambitious decarbonization targets and stringent emissions regulations are accelerating microturbine and fuel cell implementations in urban centers. European Union directives and national subsidy programs underpin the expansion of combined heat and power solutions, and Middle Eastern initiatives are diversifying energy portfolios through solar-plus-storage microgrids in remote installations. In Africa, off-grid solar and hybrid systems are delivering critical power access to communities beyond established grid networks.

In the Asia-Pacific region, rapid electrification, urbanization, and rising energy demand drive diversified deployment strategies. China’s aggressive capacity additions for solar PV and energy storage reflect strong government backing, while India’s rural microgrid programs address reliability challenges in underserved regions. Southeast Asia’s island economies adopt small-scale hydropower and wind turbines to reduce diesel reliance, and Australia’s commercial and industrial segments embrace peak-shaving solutions to manage volatile tariffs and network constraints.

These regional insights underscore the imperative for tailored approaches that respond to local regulatory landscapes, resource availability, and consumer preferences, informing market entry strategies and partnership models for distributed generation stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Distributed Generation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping Innovation, Partnerships, and Competitive Strategies in the Distributed Generation Ecosystem

Leading industry players are actively shaping distributed generation through targeted investments, strategic collaborations, and technology innovation. Siemens Energy has accelerated the deployment of microgrid control systems and advanced inverter solutions, partnering with utility distributors to pilot virtual power plant services that aggregate residential and commercial resources. General Electric leverages its gas turbine and grid solutions expertise to integrate backup generation and energy management platforms for critical infrastructure.

Caterpillar and Cummins maintain strong positions in the reciprocating engine market, expanding their offerings to include hydrogen-blended fuel cells and hybrid powertrains designed for combined heat and power applications. Wärtsilä and Mitsubishi Power focus on modular gas and steam turbine packages tailored for community-scale projects, while also collaborating on large-scale battery integration to optimize output and grid reliability. ABB and Schneider Electric drive digitalization through grid-edge monitoring devices, enabling real-time analytics and remote dispatch of distributed assets for frequency regulation and peak-shaving services.

Emerging entrants and cross-sector partnerships are challenging incumbents by developing energy-as-a-service models that bundle hardware, software, and financing. Technology alliances between battery manufacturers and solar developers are standardizing plug-and-play solutions, while joint ventures between equipment suppliers and energy providers unlock new asset-management capabilities. Together, these strategic maneuvers underscore a competitive landscape in which innovation, agility, and ecosystem collaboration are essential for advancing distributed generation agendas.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distributed Generation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Green Energy Limited

- Aggreko PLC

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- Canadian Solar Inc.

- Capstone Turbine Corporation

- Caterpillar Inc.

- Cummins Inc.

- Doosan Corporation

- First Solar, Inc.

- General Electric Company

- JinkoSolar Holding Co., Ltd.

- Kohler Co.

- Mitsubishi Electric Corporation

- Rolls-Royce plc

- Schneider Electric SE

- Siemens Energy AG

- Tata Power Company Limited

- Vestas Wind Systems A/S

- Wärtsilä Corporation

Strategic Actionable Recommendations to Enhance Competitive Positioning and Drive Sustainable Growth in the Distributed Generation Sector

To capitalize on the momentum of distributed generation and navigate emerging complexities, industry leaders should pursue a multi-faceted strategic agenda. First, integrating advanced digital platforms and predictive analytics tools will enhance asset performance and grid integration, enabling real-time optimization of distributed resources and dynamic demand management.

Second, diversifying supply chains through regional manufacturing partnerships and modular assembly hubs can mitigate tariff exposure and logistical bottlenecks. By advancing localization initiatives and forging alliances with component producers, companies can secure cost-competitive access to critical equipment while ensuring compliance with evolving trade policies.

Third, expanding hybrid project portfolios that pair renewable generation with energy storage and flexible backup options strengthens value propositions. This holistic approach not only maximizes system utilization but also unlocks ancillary services revenue streams, such as frequency response and capacity procurement.

Fourth, engaging proactively with regulators and standard-setting bodies will help shape conducive policies and streamline interconnection protocols. Collaborative pilot programs and industry consortiums can demonstrate technical viability, inform policy frameworks, and de-risk market entry for new technologies.

Finally, developing tailored customer engagement models that address financing, operations, and maintenance-coupled with performance guarantees-will foster trust and accelerate adoption across residential, commercial, and industrial segments. By executing these recommendations, stakeholders can secure competitive advantage and drive sustainable growth amid a rapidly evolving distributed generation landscape.

Detailed Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation for Distributed Generation Insights

This research combines rigorous primary and secondary methodologies to deliver comprehensive insights into the distributed generation market. Primary data was collected through in-depth interviews with senior executives, project developers, grid operators, and policy makers, ensuring direct perspectives on technology adoption, regulatory changes, and market challenges. A total of 25 interviews were conducted between January and April 2025, covering North America, Europe, Middle East & Africa, and Asia-Pacific.

Secondary research involved an extensive review of industry publications, government reports, and trade association data. Sources included regulatory filings, technical standards documents, and open-access datasets to corroborate market trends and supply chain dynamics. Additionally, academic journals and white papers were consulted to evaluate technological innovations, digital integration strategies, and environmental impact assessments.

Data triangulation was performed by cross-referencing interview insights with publicly available data and proprietary databases to validate findings and identify discrepancies. A panel of experts reviewed the draft analysis to ensure methodological rigor and factual accuracy. Quantitative models were then employed to analyze segmentation trends and regional variances, though no market sizing or forecasting outputs were included in this summary.

Quality assurance procedures encompassed source authentication, consistency checks, and editorial reviews to maintain the highest standards of clarity, reliability, and impartiality. This structured approach underpins the actionable insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distributed Generation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distributed Generation Market, by Technology

- Distributed Generation Market, by Power Rating

- Distributed Generation Market, by Grid Type

- Distributed Generation Market, by Application

- Distributed Generation Market, by End User

- Distributed Generation Market, by Region

- Distributed Generation Market, by Group

- Distributed Generation Market, by Country

- United States Distributed Generation Market

- China Distributed Generation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Strategic Insights and Future Outlook for Distributed Generation to Empower Stakeholders in a Decentralized Energy Landscape

The distributed generation sector stands at a pivotal juncture, driven by digitalization, policy shifts, and technology innovation. Despite tariff-induced headwinds, the resilience of solar, wind, and hybrid systems has been demonstrated through adaptive supply chain strategies and localization efforts. Segmentation analyses reveal tailored growth opportunities across technology types, power rating tiers, grid connectivity modes, application categories, and end-user profiles.

Regional disparities underscore the importance of context-specific approaches-whether leveraging policy incentives in the Americas, navigating regulatory frameworks in Europe, Middle East & Africa, or addressing rapid electrification challenges in the Asia-Pacific region. Leading companies are responding with strategic partnerships and advanced solutions that optimize performance and drive new revenue streams through virtual power plants and ancillary services.

As stakeholders refine their market entry and expansion strategies, the recommendations outlined-centered on digital integration, supply chain diversification, hybrid system deployment, regulatory engagement, and customer-centric service models-provide a clear roadmap for success. The collective insights distilled within this executive summary equip decision makers with the knowledge to navigate complexity and harness the full potential of distributed generation.

In sum, distributed generation is reshaping the energy landscape, offering a resilient, sustainable, and decentralized alternative to conventional power systems. By aligning technological capabilities with strategic foresight, organizations can unlock value and contribute to a more flexible and carbon-constrained energy future.

Partner with Industry Expert Ketan Rohom to Gain Customized Distributed Generation Insights and Propel Strategic Decision Making

To secure comprehensive and tailored insights into the evolving dynamics of the distributed generation market, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating complex research findings into strategic value will guide you in making informed decisions that align with your organizational objectives and risk tolerance. Engaging directly with Ketan ensures that you receive a customized briefing on key trends, competitive benchmarks, regulatory impacts, and segmentation analyses most relevant to your operations and growth ambitions.

By partnering with Ketan, you gain access not only to the full scope of our market research report but also to ongoing support for data interpretation, scenario planning, and bespoke advisory services. This collaborative approach empowers you to leverage the report’s insights for investment prioritization, technology adoption strategies, and regulatory compliance planning. Reach out to Ketan Rohom today to discuss your requirements and unlock the strategic advantages offered by our in-depth distributed generation analysis. Your next steps toward informed decision making and competitive leadership start with a conversation.

- How big is the Distributed Generation Market?

- What is the Distributed Generation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?