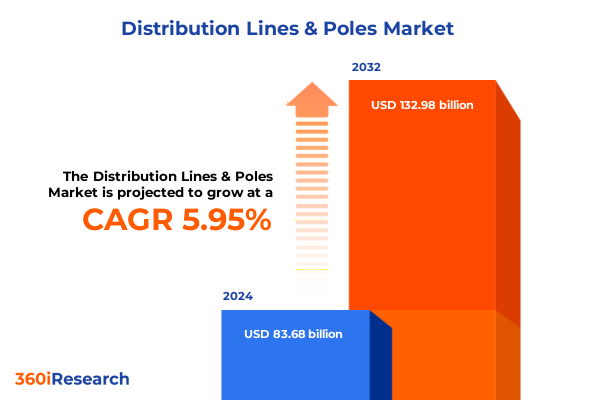

The Distribution Lines & Poles Market size was estimated at USD 88.43 billion in 2025 and expected to reach USD 93.45 billion in 2026, at a CAGR of 6.00% to reach USD 132.98 billion by 2032.

Unveiling the Critical Role of Distribution Lines and Poles in Securing Reliable Power Delivery Amid Evolving Infrastructure Challenges

Distribution lines and poles represent the backbone of modern electrical grids, channeling power from substations to homes, businesses, and critical infrastructure across diverse geographies. As utilities contend with rising demand driven by electrification trends, urban expansion, and distributed energy resources, the reliability and resilience of this network have become more vital than ever. Recent extreme weather events and evolving cyber-physical threats have underscored the importance of robust distribution infrastructure that can withstand storms, temperature extremes, and malicious interference without compromising service continuity.

In this context, stakeholders must recognize that incremental upgrades are no longer sufficient to meet future needs. Instead, a holistic approach that incorporates cutting-edge materials, advanced monitoring solutions, and strategic planning is essential to enhance grid performance and manage operational risks. From the integration of distributed solar and storage to the proliferation of electric vehicles and smart home technologies, the pressures on distribution lines and poles are intensifying. Consequently, decision-makers face the dual challenge of accelerating infrastructure modernization while controlling costs and minimizing customer impact.

This executive summary consolidates critical findings on market dynamics, regulatory influences, technological innovations, and competitive landscapes that shape the distribution lines and poles sector. It illuminates transformative shifts, evaluates the cumulative effects of recent trade measures, and offers strategic recommendations designed to empower industry leaders as they navigate a rapidly changing environment.

Assessing How Technological Innovations and Renewable Integration Are Redefining Overhead and Underground Power Distribution Networks Worldwide

The distribution lines and poles landscape is undergoing a fundamental reinvention driven by simultaneous breakthroughs in materials science and digital technologies. Composite poles made from fiber-reinforced polymers are rapidly gaining traction, replacing traditional wood, steel, and concrete alternatives due to superior durability, lightweight properties, and corrosion resistance. In regions prone to hurricanes and coastal corrosion, these composite structures have demonstrated remarkable resilience, standing firm where older wooden assets succumbed to environmental stresses. Furthermore, industry associations are updating standards to ensure uniform quality and accelerate adoption of these advanced materials across North America.

Parallel to materials evolution, the embedding of sensors and communication modules into pole structures is transforming maintenance paradigms. Utilities are now leveraging real-time data on pole health, load conditions, and environmental factors to preemptively address issues before they escalate into service disruptions. Recent deployments of smart composite poles in urban centers have exceeded 46,000 units, supporting automated lighting controls and predictive grid analytics that enhance operational efficiency. These capabilities are particularly valuable as grids adapt to bidirectional power flows from distributed renewable generation and accommodate the rapid expansion of electric vehicle charging networks.

Understanding the Cumulative Effects of Recent US Trade Tariffs on Material Costs Supply Chains and Infrastructure Investment in Distribution Networks

Since the start of 2025, sweeping U.S. tariff measures have imposed a 25% duty on steel and aluminum imports from major trading partners and an additional 10% levy on selected Chinese electrical equipment. Such policies aim to bolster domestic manufacturing, yet they have exerted upward pressure on material costs critical to distribution infrastructure projects. According to leading utilities, the tariffs have directly increased prices for grain-oriented electrical steel, transformers, and conductor assemblies essential to both overhead and underground line deployments.

Amid these challenges, equipment manufacturers like WEG have restructured their supply chains to mitigate impacts, planning to divert exports destined for the U.S. through regional hubs in Mexico and India. This strategic reorientation underscores how global players seek to navigate tariff-induced complexities while sustaining project timelines. However, regulatory filings by FirstEnergy and American Electric Power reveal that higher procurement costs and extended lead times have already triggered project deferrals and scope reductions, particularly affecting transformer replacement programs and proactive resiliency upgrades.

Looking ahead, tariff-driven cost escalation may prompt utilities to pass through expenses via rate cases, intensifying the debate on affordability and investment prioritization. As policymakers review long-term trade frameworks, utilities must balance compliance with initiatives to modernize aging infrastructure and reinforce grid resilience against increasing climate-related risks.

Exploring How Installation Method Voltage Material Circuit Configuration and End Use Segmentation Shapes Power Distribution Market Dynamics

The market’s segmentation structure unveils critical insights that inform strategic positioning and targeted investments across the distribution lines and poles sector. Installation methodologies bifurcate into overhead systems-where replacement and new installation projects address aging assets and capacity growth-and underground configurations, which encompass direct-buried and duct bank installations suited for urban and high-value corridors. This dimensional view helps stakeholders align product portfolios with project specifications and regulatory incentives. Meanwhile, circuit configurations span single-circuit lines, often deployed for localized reliability, and double-circuit arrangements that deliver enhanced redundancy for critical load centers. Voltage classifications further differentiate the market, stretching from low-voltage residential feeders to high-voltage primary distribution lines, with medium-voltage tiers subdivided into specific ranges of 115–230 kV, 35–69 kV, and 69–115 kV. Materials science plays a pivotal role, as utilities weigh composite alternatives-such as carbon fiber reinforced polymers and fiberglass reinforced polymers-against concrete, steel, and traditional wood solutions based on performance, lifecycle costs, and environmental considerations. Finally, end-use contexts reveal distinct demand drivers: commercial and industrial facilities prioritize reliability and capacity, residential networks demand safety and aesthetics, while the utility segment-encompassing cooperatives, investor owned utilities, and municipals-navigates regulatory landscapes and budget cycles to guide capital allocation.

This comprehensive research report categorizes the Distribution Lines & Poles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation Method

- Circuit Configuration

- Voltage

- Material

- End Use

Analyzing Regional Variations in Demand Technology Adoption and Infrastructure Investment Across the Americas EMEA and Asia-Pacific Markets

Regional market behavior varies significantly across the Americas, Europe Middle East and Africa, and the Asia-Pacific, reflecting disparities in regulatory regimes, infrastructure maturity, and investment priorities. In the Americas, North American utilities are contending with grid modernization mandates and resilience imperatives, with federal grant programs stimulating upgrades to overhead lines and accelerated replacement of wood poles with corrosion-resistant materials. Latin American markets, by contrast, exhibit strong interest in underground distribution projects to enhance urban reliability, although financing gaps and policy volatility temper long-term planning.

In Europe Middle East and Africa, advanced economies are driven by decarbonization targets and smart grid deployments. Here, utilities emphasize digital integration and standardized pole frameworks to streamline multinational operations, while emerging markets in the Middle East and Africa focus on extending basic access and leveraging modular pole systems to expedite rural electrification. The Asia-Pacific region serves as a dynamic growth engine, characterized by rapid urbanization in Southeast Asia and extensive renewables integration in Australia. Regulatory incentives and public private partnerships are catalyzing microgrid and distributed network pilots, requiring versatile pole solutions capable of supporting hybrid overhead and underground configurations under diverse climatic conditions.

This comprehensive research report examines key regions that drive the evolution of the Distribution Lines & Poles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Priorities Innovations and Collaborative Efforts of Leading Players Powering the Distribution Lines and Poles Sector

Leading corporations within the distribution lines and poles arena are prioritizing innovation, collaboration, and value chain integration to sustain competitive advantage. Global technology firms are investing in advanced materials research and automating manufacturing processes to deliver lightweight, high-strength poles at scale, aligning production with Build America Buy America requirements. Equipment suppliers are forging strategic alliances with digital platform providers to integrate condition monitoring and predictive analytics directly into pole hardware, enabling utilities to transition from reactive maintenance to data-driven asset management.

At the same time, specialist pole manufacturers are expanding their geographic footprints, establishing localized production hubs to reduce lead times and navigate evolving trade policies. Partnerships between utilities and original equipment manufacturers are increasingly common, focusing on co-development of standardized pole designs that harmonize performance specifications with installation efficiencies. Several multinational consortia are exploring joint ventures to develop regional sourcing networks for fiber-reinforced polymers and precast concrete, thereby mitigating material cost volatility and enhancing supply chain resilience. This collaborative landscape underscores the industry’s shift toward holistic solutions that integrate hardware, software, and services under unified delivery models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distribution Lines & Poles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Bolt Products LLC

- Creative Composites Group by Hill and Smith Holding, PLC

- Eaton Corporation PLC

- Electro Poles Products Pvt. Ltd

- ElSewedy Electric

- Hitachi Energy Ltd

- Honeywell International Inc.

- Hubbell Incorporated

- KEI Industries Limited

- Koppers Inc.

- Mac Tech International Private Limited

- MacLean Power, LLC

- Nexans S.A.

- NOV Inc.

- P&B WEIR ELECTRICAL LTD

- Preformed Line Products Company

- Riyadh Cables

- Sabre Industries, Inc.

- Schneider Electric SE

- Stella-Jones Inc.

Delivering Actionable Strategies and Best Practices for Industry Leaders to Strengthen Resilience Optimize Operations and Drive Sustainable Growth

Industry leaders must adopt multifaceted strategies to navigate current market complexities while positioning their organizations for long-term success. First, forging closer partnerships with materials innovators and research institutions can accelerate access to next-generation pole composites and conductive alloys that reduce lifecycle expenses. By co-investing in pilot programs, stakeholders can validate emerging technologies under real-world conditions and refine standards to expedite wider deployment.

Second, diversifying sourcing pathways across regional manufacturing hubs and leveraging nearshoring opportunities can shield project pipelines from tariff shocks and logistical bottlenecks. In parallel, integrating advanced analytics and digital twins into distribution planning will empower utilities to optimize line routing, maintenance intervals, and emergency response protocols, thereby enhancing operational agility. Equally important is engaging proactively with regulatory bodies to shape incentive structures and advocate for harmonized permitting processes that reduce project lead times.

Finally, embedding sustainability criteria into procurement decisions-such as evaluating the carbon footprint of pole production and end-of-life recyclability-will not only align with environmental mandates but also resonate with increasingly conscientious stakeholders. By executing these initiatives in concert, industry leaders can fortify resilience, unlock new revenue streams, and accelerate the transition toward a modern, sustainable distribution grid.

Detailing a Rigorous Research Methodology Combining Primary Interviews Secondary Data Analysis and Robust Validation Techniques

This research draws upon a rigorous methodology designed to ensure depth, accuracy, and relevance across every analytical dimension. Primary data were collected through structured interviews with senior executives, line engineers, and regulatory experts from utilities, manufacturing firms, and standards organizations, providing firsthand perspectives on current challenges and future priorities. Concurrently, secondary sources-including public filings, trade association reports, technical standards, and peer-reviewed studies-were systematically reviewed to contextualize market dynamics and validate qualitative inputs.

Quantitative analyses were conducted by integrating historical project data with engineering specifications and material price indices, enabling granular segmentation by installation method, voltage class, and end-use category. Data triangulation techniques ensured consistency across varied inputs, while scenario modeling assessed the impacts of tariff shifts, technological adoption rates, and policy interventions on distribution infrastructure deployment. Finally, all findings underwent peer review by independent grid infrastructure specialists to confirm methodological robustness and interpretive soundness. This comprehensive approach underpins the credibility and applicability of the insights presented herein, equipping decision-makers to make informed, strategic investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distribution Lines & Poles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distribution Lines & Poles Market, by Installation Method

- Distribution Lines & Poles Market, by Circuit Configuration

- Distribution Lines & Poles Market, by Voltage

- Distribution Lines & Poles Market, by Material

- Distribution Lines & Poles Market, by End Use

- Distribution Lines & Poles Market, by Region

- Distribution Lines & Poles Market, by Group

- Distribution Lines & Poles Market, by Country

- United States Distribution Lines & Poles Market

- China Distribution Lines & Poles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Critical Takeaways and Future Outlook for Distribution Lines and Poles Stakeholders Navigating an Evolving Infrastructure Landscape

The analysis underscores that distribution lines and poles are at an inflection point, shaped by technological breakthroughs, policy shifts, and evolving customer expectations. Advanced materials such as composites and high-performance alloys are redefining durability and lifecycle economics, while embedded digital sensors and analytics platforms are transitioning maintenance strategies from reactive to predictive. Concurrently, trade policies and tariff structures continue to influence material costs and supply chain resilience, compelling utilities and manufacturers to adopt more flexible sourcing and localized production models.

Regional dynamics further highlight the importance of tailored approaches: while mature markets concentrate on grid modernization and smart integration, emerging economies focus on basic access and scalable infrastructure solutions. Leading companies are responding with collaborative partnerships that integrate hardware, software, and services into cohesive value propositions. To sustain momentum, industry stakeholders must prioritize innovation ecosystems, regulatory engagement, and sustainability imperatives within their strategic roadmaps.

Ultimately, success in the distribution lines and poles sector will hinge on the ability to align technological advancements with pragmatic investment frameworks. By embracing a holistic perspective that recognizes the interdependencies between installation techniques, material science, regulatory forces, and digital capabilities, organizations can drive resilient, efficient, and future-ready power delivery networks.

Connect with Ketan Rohom to Unlock Comprehensive Market Insights and Secure Your Customized Distribution Lines and Poles Research Report Today

Don’t miss the opportunity to gain unparalleled clarity on how distribution lines and poles will evolve in an increasingly complex energy ecosystem. Engage directly with Ketan Rohom to explore tailored insights that align with your specific challenges and strategic objectives. By connecting with a dedicated expert, you will ensure timely access to the definitive market research report, complete with detailed analyses, segmentation deep dives, and region-specific evaluations. Reach out today to secure your comprehensive research package and equip your team with the actionable knowledge needed to stay ahead of the curve in power distribution infrastructure.

- How big is the Distribution Lines & Poles Market?

- What is the Distribution Lines & Poles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?