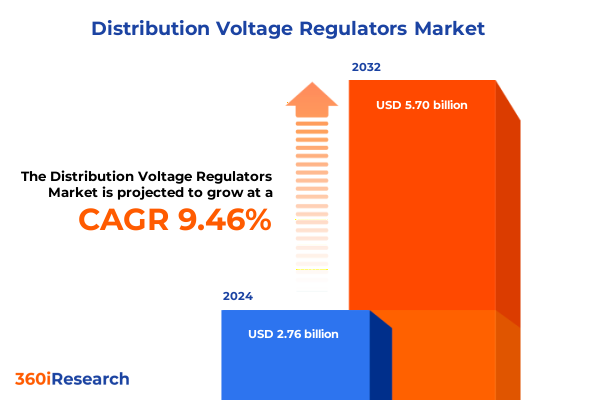

The Distribution Voltage Regulators Market size was estimated at USD 3.03 billion in 2025 and expected to reach USD 3.32 billion in 2026, at a CAGR of 9.45% to reach USD 5.70 billion by 2032.

Distribution Voltage Regulators Set to Revolutionize Power Delivery with Enhanced Stability, Efficiency and Grid Resilience Across Diverse Industrial and Commercial Applications

Distribution voltage regulators serve as critical components within electric power distribution networks, ensuring that end users receive consistent, reliable voltage levels despite fluctuations in load demand and upstream generation variability. By automatically adjusting voltage to maintain setpoints, these regulators mitigate equipment stress and prevent disruptions across industrial, commercial and utility operations. As electric grids evolve, there is a growing imperative for advanced voltage regulation solutions that can support expanding renewable energy integration, reduce losses and strengthen grid resilience in the face of extreme weather events and aging infrastructure.

Moreover, recent advancements in monitoring technologies and control algorithms have elevated regulator performance, transforming them from passive stabilizers into proactive network assets. These developments not only enhance voltage stability at the point of consumption, but also facilitate real�time grid analytics and fault detection, empowering operators to optimize system performance and prioritize maintenance. Consequently, the role of distribution voltage regulators has expanded beyond traditional voltage correction to encompass broader grid modernization objectives, including demand response support, power quality management and enhanced situational awareness.

In an environment characterized by rapid technological change, regulatory complexity and shifting customer expectations, understanding the current state of the distribution voltage regulator market is essential. This executive summary provides a concise yet comprehensive exploration of emerging trends, policy impacts, segmentation insights, regional dynamics and competitive strategies, offering the foundational context needed for informed decision�making and strategic planning in this dynamic sector.

Emerging Technological Innovations and Regulatory Dynamics Are Reshaping the Distribution Voltage Regulator Landscape to Meet Evolving Demands

The convergence of digitalization, advanced materials and regulatory modernization is driving unprecedented transformations within the distribution voltage regulator landscape. New semiconductorbased static regulators are displacing traditional ferroresonant designs by offering faster response times, lower maintenance requirements and enhanced energy efficiency. In parallel, the integration of embedded sensors and Internet of Things connectivity enables continuous monitoring of voltage profiles, temperature and equipment health, facilitating predictive maintenance and reducing unplanned downtime.

Furthermore, regulatory bodies are implementing stricter power quality and emissions standards, compelling operators to adopt regulators capable of tighter voltage tolerances and harmonic mitigation. As distributed energy resources proliferate, regulators that can dynamically coordinate with energy storage systems, photovoltaic inverters and demand response platforms are becoming indispensable. Consequently, manufacturers are investing heavily in control software upgrades and modular hardware configurations that allow seamless integration with smart grid architectures.

Moreover, evolving customer expectations around reliability and sustainability are reshaping product roadmaps, with suppliers prioritizing eco-friendly materials, extended equipment lifespans and remote firmware update capabilities. With grid operators increasingly focused on resilience, the ability of voltage regulators to execute adaptive control strategies during contingencies has emerged as a key differentiator. In light of these transformative shifts, stakeholders must navigate a rapidly evolving landscape where technological innovation and regulatory evolution intersect to redefine performance benchmarks for voltage regulation.

Impact of Recent Tariff Adjustments on Manufacturers, Supply Chains and Competitive Positioning within the United States Distribution Voltage Regulator Market in 2025

The introduction and continuation of several tariff measures in 2025 have exerted tangible pressure on the distribution voltage regulator supply chain, reshaping competitive dynamics and cost structures across the United States market. Aluminum and steel tariffs have increased the cost of core components by approximately ten to twenty-five percent, depending on product grade, prompting many suppliers to reassess procurement strategies and pursue alternative sourcing options domestically. Concurrently, Section 301 tariffs on select imported electronic regulation modules have driven manufacturers to localize production or identify new offshore partners to avoid steep duties.

Consequently, some component costs have risen sharply, leading to tighter margins for original equipment manufacturers and increasing the emphasis on supply chain resilience. In response, producers have accelerated investments in automation and lean manufacturing techniques to offset higher material expenses. Moreover, tariff-induced volatility has heightened the importance of long-term supplier contracts and strategic stockpiling of critical parts to ensure continuity of production and competitive pricing.

Despite these headwinds, the tariff environment has also galvanized domestic manufacturing growth, as firms capitalize on reshoring incentives and government programs designed to strengthen critical infrastructure capabilities. By collaborating with local foundries and electronics assemblers, many suppliers have maintained project timelines and delivered regulators that comply with new import tariffs without transferring excessive costs to end users. Overall, the 2025 tariff landscape has underscored the need for agile supply chains, diversified sourcing and a strategic balance between cost management and operational continuity.

Deep Dives into Segmentation Nuances by Type, End Use, Phase, Installation and Voltage Class Revealing Critical Decision Drivers

A nuanced understanding of market segmentation reveals critical drivers that influence product development, go-to-market strategies and customer value propositions. The choice between ferroresonant and static voltage regulators, based on type, hinges on tradeoffs between maintenance complexity and response speed. While ferroresonant units offer robust overload tolerance and straightforward passive operation, static designs excel in rapid voltage correction and digital control integration.

End use segmentation further illuminates demand patterns, as commercial applications prioritize reliability and aesthetic footprint, whereas utility operators emphasize system interoperability and remote management capabilities. Industrial customers exhibit diverse requirements, with automotive and manufacturing lines demanding precise voltage control to safeguard sensitive production equipment, while chemical and petrochemical facilities focus on surge protection and equipment life extension. Within process and discrete manufacturing, regulators must address distinct load profiles and prioritize either constant operational efficiency or rapid voltage stabilization during production cycles.

Phase considerations, namely single-phase versus three-phase configurations, dictate regulator sizing and control scheme complexity, directly impacting installation costs and performance outcomes. Installation approaches range from pad-mounted units suited for ground-level accessibility to pole-mounted regulators that optimize right-of-way use in urban and rural settings. Finally, voltage class preferences, spanning low to medium voltage deployments, reflect the scale of distribution networks and the criticality of maintaining power quality across various feeder lines. By dissecting these segmentation dimensions, stakeholders can tailor product offerings to align with customer needs and market niches.

This comprehensive research report categorizes the Distribution Voltage Regulators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Phase

- Installation

- Voltage Class

- End Use

Regional Market Dynamics Uncovered Across the Americas, Europe Middle East Africa and Asia Pacific Power Infrastructure Ecosystems

Regional dynamics play a pivotal role in shaping the adoption and evolution of distribution voltage regulators across global markets. In the Americas, aging grid infrastructure and heightened demand for grid modernization have spurred investments in both retrofit and greenfield regulator installations. Utility operators focus on reducing losses and enhancing reliability metrics as part of broader grid resilience initiatives, while commercial and industrial enterprises seek to minimize downtime and support sustainable power quality standards.

Across Europe, the Middle East and Africa, regulatory frameworks aimed at decarbonization and renewable integration have driven regulator manufacturers to design solutions compatible with variable power flows and bidirectional energy exchanges. The growing penetration of microgrids in remote African regions and renewablerich Middle Eastern markets emphasizes the need for adaptive voltage control that can manage intermittency and voltage unbalance. European grid codes mandating tight voltage tolerances further heighten demand for advanced static regulators equipped with precise digital control features.

In Asia Pacific, rapid urbanization, industrial expansion and electrification programs are fueling a surge in distribution network upgrades. Emerging economies prioritize cost-effective regulator designs that balance performance with affordability, while developed markets like Japan and Australia lead in deploying digitalized, networked regulator solutions as part of their smart grid roadmaps. Across all regions, the interplay between policy objectives, infrastructure maturity and technological readiness shapes the trajectory of voltage regulator adoption, underscoring the strategic importance of region-specific approaches.

This comprehensive research report examines key regions that drive the evolution of the Distribution Voltage Regulators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Advances Driving Competitive Edge and Technological Progress in Voltage Regulation

Leading players in the distribution voltage regulator arena are distinguished by their strategic investments in research and development, global manufacturing footprint and partnerships that enhance technology integration. Established conglomerates leverage decades of grid experience to deliver comprehensive solutions that combine hardware reliability with advanced digital controls and software analytics. They prioritize modular designs that facilitate remote upgrades and interoperability with grid management platforms, thereby reinforcing their competitive positioning.

Meanwhile, specialized manufacturers differentiate through niche offerings, such as regulators optimized for harsh environments or those engineered for seamless integration with renewable energy assets. They often collaborate with academic and technological institutes to pioneer materials research, sensor fusion techniques and edge computing capabilities that elevate voltage regulation performance. By fostering strategic alliances and pursuing targeted acquisitions, these firms expand their product portfolios and accelerate time-to-market for next-generation regulators.

Moreover, both multinationals and emerging innovators recognize the value of aftersales services and digital support offerings. They deploy expert teams for rapid field diagnostics, predictive maintenance and operator training, ensuring that customers maximize equipment uptime and lifespan. Together, these strategic maneuvers reflect a market where technological leadership, domain expertise and customer-centric services define company success in an evolving voltage regulation landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Distribution Voltage Regulators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Balaji Power Automation

- Belotti Variatori S.R.L.

- DAIHEN Corporation

- Eaton Corporation Plc

- General Electric Company

- Hindustan Power Control System

- Hitachi Energy Ltd.

- HV Power Measurements and Protection Ltd

- Leilang Electrical

- Mangal Engineers and Consultants

- Maschinenfabrik Reinhausen GmbH

- Purevolt

- Renesas Electronics Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Servokon Systems Ltd.

- Siemens AG

- STMicroelectronics International N.V.

- TAIXI Electric Co.,Ltd.

- TBEA Co., Ltd.

- Texas Instruments Incorporated

- Tortech Pty Ltd

- Toshiba Corporation

- TSI Power Corporation

- Utility Systems Technologies

Strategic Action Plans and Best Practices for Industry Leaders to Enhance Operational Efficiency, Strengthen Market Position and Innovate Solutions

Industry leaders must adopt a multifaceted strategy to navigate the rapidly shifting distribution voltage regulator market and capitalize on emerging opportunities. To begin, investing in digital transformation initiatives can unlock real-time visibility into regulator performance, enabling proactive maintenance and data-driven decision making. In addition, establishing partnerships with semiconductor suppliers and control software developers can accelerate the introduction of highspeed static regulators that meet stringent power quality requirements.

Furthermore, diversifying the supply chain by qualifying multiple sources for critical components such as specialty steel, transformer cores and electronic modules will mitigate risks associated with tariff volatility and geopolitical disruptions. Companies should also consider localized manufacturing and assembly options to reduce lead times and improve responsiveness to regional demand fluctuations. Equally important is engaging with regulatory authorities early in the product development cycle to ensure compliance with evolving grid codes and environmental standards.

Finally, fostering an agile organizational culture that emphasizes continuous innovation and crossfunctional collaboration will position organizations to adapt quickly to technological advances and market shifts. By prioritizing sustainability through the selection of eco-friendly materials and energy-efficient designs, firms can address stakeholder expectations while differentiating their offerings. Collectively, these actionable recommendations will enable industry players to strengthen market position, enhance operational efficiency and deliver next-generation voltage regulation solutions.

Comprehensive Research Approach Employing Primary and Secondary Data Collection to Deliver Accurate and Insightful Voltage Regulator Market Analysis

Our research methodology integrates both primary and secondary research approaches to ensure depth, accuracy and relevance of insights. Initially, we conducted structured interviews with technical experts, utility executives and equipment OEMs across multiple regions to capture firsthand perspectives on performance expectations, procurement challenges and technological priorities. These qualitative insights guided the development of targeted survey instruments and quantitative data collection frameworks.

Parallel to primary research, we performed an exhaustive review of regulatory filings, industry standards publications and patent databases to map the competitive landscape and identify emerging innovations. Secondary sources included technical white papers, trade journal articles and publicly available corporation disclosures to contextualize market trends and validate proprietary data. We also leveraged network analysis techniques to evaluate supply chain interdependencies and identify points of vulnerability under various tariff scenarios.

To synthesize findings, we applied a mixed-methods analytical approach combining thematic coding for qualitative inputs and statistical triangulation for quantitative metrics. This robust framework allowed us to cross-verify insights across data streams and ensure that strategic recommendations rest on a solid evidentiary foundation. Throughout the process, we adhered to strict protocols for data integrity and confidentiality, guaranteeing that all conclusions reflect the current state of the distribution voltage regulator landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Distribution Voltage Regulators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Distribution Voltage Regulators Market, by Type

- Distribution Voltage Regulators Market, by Phase

- Distribution Voltage Regulators Market, by Installation

- Distribution Voltage Regulators Market, by Voltage Class

- Distribution Voltage Regulators Market, by End Use

- Distribution Voltage Regulators Market, by Region

- Distribution Voltage Regulators Market, by Group

- Distribution Voltage Regulators Market, by Country

- United States Distribution Voltage Regulators Market

- China Distribution Voltage Regulators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Highlight Optimal Pathways for Stakeholders Navigating Complex Voltage Regulation Challenges in Modern Power Grids

In synthesizing the key insights from this analysis, several overarching themes emerge for stakeholders in the distribution voltage regulator market. Technological innovation stands at the forefront, with static regulators and digital enhancements defining new performance benchmarks and enabling advanced grid management capabilities. Tariff dynamics in 2025 have underscored the importance of flexible sourcing strategies and local manufacturing options to maintain cost competitiveness amid regulatory shifts.

Segmentation insights clarify that understanding customer needs-from low-voltage single-phase applications in commercial settings to robust three-phase units in heavy industrial environments-remains central to product differentiation and strategic positioning. Regional variations reveal that infrastructure maturity, regulatory stringency and renewable energy penetration shape both demand profiles and solution requirements, necessitating region-tailored go-to-market approaches.

Key company activities highlight that success hinges on a balanced focus across R&D investment, supply chain resilience and value-added services. By integrating actionable recommendations-spanning digital transformation, supply chain diversification, regulatory engagement and sustainability-leaders can navigate complexity and drive growth. Ultimately, a proactive, insights-driven strategy will empower stakeholders to capitalize on emerging opportunities and ensure the reliable, efficient delivery of power in modern electrical networks.

Engagement Invitation for Decision Makers to Explore In-Depth Distribution Voltage Regulator Market Insights with Our Expert Sales Liaison

We invite decision makers and technical specialists to engage directly with Ketan Rohom, our Associate Director of Sales & Marketing, to unlock the full breadth of insights offered in our comprehensive distribution voltage regulator market research report. By collaborating with Ketan, stakeholders can access tailored data, in-depth analyses and strategic guidance that align with specific organizational objectives. Our report delves into the latest technological innovations, regulatory developments, tariff impacts and competitive dynamics shaping the industry, providing a solid foundation for informed decision making and proactive strategy formulation. To obtain your copy, discuss customized research needs or explore partnership opportunities, please reach out to Ketan Rohom today. Seize the opportunity to fortify your market positioning and drive operational excellence with insights designed to empower leaders across utilities, industrial enterprises and technology providers. Your next competitive advantage starts with a conversation, so connect with Ketan and elevate your understanding of the evolving voltage regulation landscape.

- How big is the Distribution Voltage Regulators Market?

- What is the Distribution Voltage Regulators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?