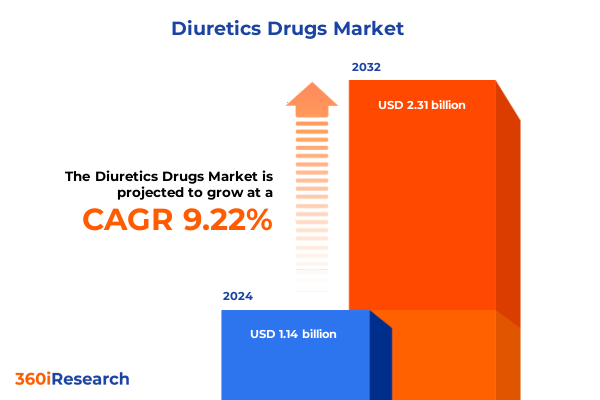

The Diuretics Drugs Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.31 billion in 2026, at a CAGR of 9.50% to reach USD 2.31 billion by 2032.

Setting the Stage for Modern Diuretic Therapies Amidst Evolving Clinical Needs and Regulatory Dynamics Impacting Treatment Pathways

The global diuretic landscape stands at a pivotal moment as therapeutic priorities converge with shifting patient demographics and an increasingly complex regulatory environment. Diuretic drugs have long underpinned cornerstone treatments for hypertension, heart failure, and renal dysfunction, yet recent advancements in precision medicine and evolving clinical guidelines have reinvigorated interest in both novel and established classes. Against this backdrop, stakeholders are compelled to reassess their strategies, from streamlined drug development pathways to differentiated value propositions.

Consequently, understanding the multifaceted drivers behind market evolution is essential. Innovations in drug delivery systems, the integration of digital health monitoring, and heightened scrutiny on cost containment are redefining competitive benchmarks. Furthermore, patient adherence and real-world evidence generation are becoming critical determinants of therapeutic success. In this context, a comprehensive view of technological, regulatory, and economic dynamics provides an indispensable foundation for informed decision-making and strategic planning.

Rapid Technological Advancements and Shifting Patient Demographics Are Redefining the Development and Adoption of Diuretic Therapeutics

The diuretic market is undergoing significant transformation propelled by technological breakthroughs and changing population health trends. First, precision pharmacology initiatives have led to the optimization of dosing regimens, reducing adverse events and improving patient outcomes. Simultaneously, the rise of digital health platforms offers real-time monitoring of fluid balance and blood pressure, fostering more proactive and personalized care strategies.

In addition, demographic shifts-most notably an aging global population with increasing prevalence of comorbidities-are expanding the addressable patient pool for diuretic therapies. Chronic conditions such as hypertension and heart failure demand more nuanced management approaches, creating opportunities for next-generation compounds and combination regimens. At the same time, payers and health systems are emphasizing value-based care, which drives manufacturers to demonstrate cost-effectiveness and long-term benefits through robust outcomes data. These transformative forces are converging to reshape research priorities, manufacturing processes, and market access models across the diuretic sector.

Emerging Tariff Regimes on Pharmaceutical Imports in the United States Are Reshaping Procurement Models and Supply Chain Resilience Across the Diuretic Market

Recent tariff measures imposed by the United States on imported pharmaceutical active ingredients and finished dosage formulations have had far-reaching consequences for supply chain strategies in the diuretic market. By increasing duties on key intermediates, manufacturers have confronted elevated raw material costs, prompting a reassessment of vendor portfolios and geographic sourcing decisions. These changes have introduced greater volatility in procurement budgets and have highlighted the risks associated with concentrated supplier bases.

Moreover, the cumulative effect of these trade policies has spurred investments in domestic API production capacities to mitigate exposure to tariff escalations. As a result, project timelines for new manufacturing facilities have shortened, while partnerships with contract development and manufacturing organizations have intensified. Parallel to cost pressures, regulatory agencies have fast-tracked review pathways for localized facilities, reinforcing the strategic imperative of onshore development. Altogether, these tariff interventions are reshaping cost structures, operational footprints, and long-term strategic roadmaps within the diuretic drug landscape.

Comprehensive Segmentation Analysis Reveals Nuanced Demand Patterns Driven by Therapeutic Class, Indication, Administration Routes, Formulations, and Distribution Networks

Analyzing the market through a multidimensional segmentation lens uncovers distinct demand patterns across therapeutic categories and distribution pathways. Based on Drug Class, the market is studied across Carbonic Anhydrase Inhibitors, Loop Diuretics, Osmotic Diuretics, Potassium-Sparing Diuretics, and Thiazide Diuretics, where the Carbonic Anhydrase Inhibitors segment is further evaluated through Acetazolamide and Dorzolamide, the Loop Diuretics segment encompasses Bumetanide, Ethacrynic Acid, Furosemide, and Torasemide, the Osmotic Diuretics segment centers on Mannitol, the Potassium-Sparing Diuretics segment includes Amiloride, Eplerenone, Spironolactone, and Triamterene, and the Thiazide Diuretics segment is examined via Bendroflumethiazide, Chlorthalidone, and Hydrochlorothiazide. Based on Indication, the market spans Edema, Glaucoma, Heart Failure, Hypertension, and Renal Disease. Based on Route Of Administration, demand is split between Oral and Parenteral options. Based on Dosage Form, adoption patterns emerge across Capsule, Injectable, Liquid, and Tablet preparations. Based on Distribution Channel, product flows occur through Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy networks.

Through this comprehensive structure, it becomes apparent that loop diuretics maintain strong clinical preference in acute care settings, particularly via parenteral formulations in hospital pharmacies, while thiazide and potassium-sparing diuretics dominate outpatient management through oral tablets and capsules distributed by retail and online pharmacies. Osmotic diuretics show niche application primarily in neurosurgical and ophthalmic contexts, whereas carbonic anhydrase inhibitors retain steady utilization in glaucoma and high-altitude physiology. Each segmentation perspective informs targeted strategies for product development, marketing, and distribution optimization.

This comprehensive research report categorizes the Diuretics Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Dosage Form

- Indication

- Distribution Channel

Divergent Growth Trajectories Across Americas, Europe Middle East Africa, and Asia Pacific Regions Highlight Varied Drivers and Market Maturation Levels

Regional dynamics within the diuretic sector display divergent growth drivers and maturity trajectories. In the Americas, well-established reimbursement frameworks and high per-capita healthcare spending have sustained consistent uptake of both branded and generic diuretic therapies, with particular emphasis on heart failure and hypertension management. Healthcare providers increasingly rely on real-world data to support formulary decisions, reinforcing efforts to demonstrate long-term cost savings through adverse event reduction and hospitalization avoidance.

Conversely, Europe, Middle East & Africa regions present a heterogeneous landscape marked by varying regulatory harmonization and pricing pressures. In Western Europe, centralized approvals streamline market entry, yet stringent health technology assessments demand robust pharmacoeconomic evidence. In contrast, emerging markets within the Middle East and Africa are characterized by growing public health initiatives targeting hypertension awareness and control, creating opportunities for lower-cost generics and localized manufacturing collaborations.

In the Asia-Pacific region, rapid urbanization and rising chronic disease prevalence are driving strong volume growth. Governments are implementing policies to expand healthcare access, accelerating tender-based procurement and boosting demand for essential medicine lists. Local API and formulation investments are accelerating to meet regional supply needs, while multinational players forge joint ventures with domestic partners to navigate complex regulatory environments and capitalize on high-growth markets.

This comprehensive research report examines key regions that drive the evolution of the Diuretics Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Leverage Strategic Partnerships, Product Differentiation, and Manufacturing Excellence to Secure Competitive Advantages in Diuretic Market

Key industry participants are executing strategic initiatives to secure leadership in the diuretic space. Major innovator and generic pharmaceutical companies are strengthening their pipelines through selective licensing and co-development agreements that focus on next-generation formulations and fixed-dose combinations to enhance patient adherence. Portfolio rationalization remains a priority for many organizations, with efforts concentrated on high-margin product lines and streamlined manufacturing operations.

Collaborations with specialized contract development and manufacturing organizations have become prevalent, enabling flexible capacity scaling and accelerated time to market. At the same time, digital therapeutics integration is emerging as a complementary offering, with some companies piloting remote fluid monitoring tools that integrate seamlessly with diuretic prescribing. Furthermore, M&A activity is shaping competitive landscapes by consolidating regional suppliers and creating vertically integrated supply chains that reduce tariff and logistics risks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Diuretics Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurobindo Pharma Limited

- Cipla Limited

- Dr. Reddy’s Laboratories Limited

- Fresenius Kabi AG

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Sandoz International GmbH

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Strategic Imperatives for Stakeholders to Navigate Regulatory Pressures, Optimize Supply Chains, and Enhance Clinical Value in Diuretic Therapies

Industry leaders can capitalize on several strategic imperatives to navigate evolving market complexities. First, diversifying API sourcing through strategic contracts or joint ventures will mitigate risks associated with tariff fluctuations and geopolitical disruptions. Investing in localized production capacity not only enhances supply chain resilience but also positions organizations to benefit from regulatory incentives for onshore manufacturing.

Second, forging data-driven collaborations with payers and healthcare systems to generate real-world evidence can substantiate long-term clinical and economic value, thereby strengthening formulary positioning. Concurrently, integrating digital health tools that monitor fluid status and patient adherence presents an opportunity to differentiate offerings and demonstrate tangible outcomes improvements.

Finally, optimizing product portfolios through lifecycle management-such as novel fixed-dose combinations and enhanced-release formulations-can sustain competitive margins. By aligning launch strategies with regional pricing and reimbursement landscapes and prioritizing high-impact indications, organizations will be better equipped to achieve sustainable growth and stakeholder buy-in.

Rigorous Multisource Research Approach Integrating Primary Expert Engagement and Secondary Industry Data Ensures Robust Market Intelligence Output

This research employs a rigorous multisource methodology to ensure the integrity and relevance of its insights. Extensive primary research involved structured interviews with industry executives, regulatory experts, and leading clinicians across key markets to capture real-time perspectives on treatment patterns, pricing pressures, and innovation pipelines. These qualitative inputs were complemented by a thorough review of peer-reviewed journals, regulatory filings, patent databases, and company disclosures to validate emerging trends and technological advancements.

Secondary research incorporated the analysis of government and industry databases, publications from global health authorities, and annual reports to quantify market dynamics, tariff impacts, and competitive positioning. Data triangulation techniques were applied to reconcile divergent estimates, and findings were subjected to multiple rounds of peer review within the research team to eliminate bias. This comprehensive approach ensures that the resulting analysis is both actionable and reflective of the most current diuretic market environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Diuretics Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Diuretics Drugs Market, by Drug Class

- Diuretics Drugs Market, by Route Of Administration

- Diuretics Drugs Market, by Dosage Form

- Diuretics Drugs Market, by Indication

- Diuretics Drugs Market, by Distribution Channel

- Diuretics Drugs Market, by Region

- Diuretics Drugs Market, by Group

- Diuretics Drugs Market, by Country

- United States Diuretics Drugs Market

- China Diuretics Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Market Dynamics and Strategic Pathways Highlights Critical Leverage Points for Sustained Leadership in the Global Diuretic Landscape

The convergence of technological innovation, shifting therapeutic priorities, and evolving policy landscapes has positioned the diuretic market at a strategic crossroads. Stakeholders who proactively address supply chain vulnerabilities, demonstrate robust real-world value, and differentiate through advanced formulations will secure a distinct competitive edge. Moreover, regional nuances underscore the need for tailored market entry strategies that align with local reimbursement frameworks and growth trajectories.

As onshore manufacturing gains prominence in response to tariff constraints, companies must balance capital investment with long-term operational agility. At the same time, the integration of digital health capabilities offers a promising avenue to enhance patient outcomes and substantiate the clinical value proposition of diuretic therapies. Overall, this analysis illuminates critical leverage points that can guide stakeholders toward sustainable leadership in a market defined by complexity and opportunity.

Engage with Ketan Rohom Today to Access In-Depth Market Intelligence and Propel Your Diuretic Portfolio to the Forefront of Industry Innovation

To secure comprehensive strategic guidance and an in-depth understanding of evolving diuretic market dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in tailored market intelligence will help you optimize product positioning, navigate regulatory shifts, and capitalize on emerging growth opportunities. Engage directly to obtain the complete report, gain exclusive access to proprietary data sets, and benefit from custom analyses that align with your organizational goals. Elevate your portfolio’s competitive edge by leveraging Ketan’s insights into pricing, reimbursement strategies, and supply chain resilience. Act now to transform these insights into actionable plans that drive both clinical impact and commercial success

- How big is the Diuretics Drugs Market?

- What is the Diuretics Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?