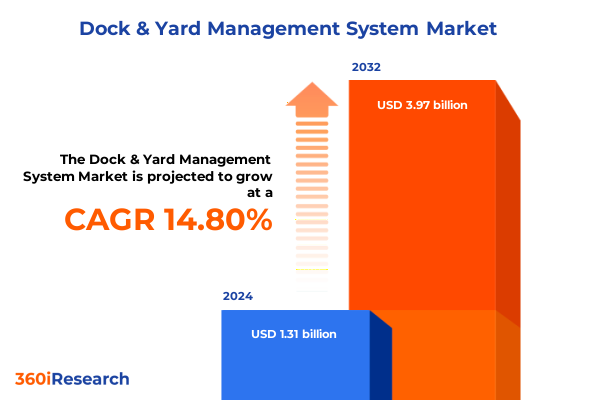

The Dock & Yard Management System Market size was estimated at USD 1.50 billion in 2025 and expected to reach USD 1.72 billion in 2026, at a CAGR of 14.84% to reach USD 3.97 billion by 2032.

Setting the Scene for Next-Generation Dock and Yard Management Systems in an Evolving Logistics Ecosystem Shaped by Digital Transformation

Dock and yard management has emerged as a pivotal component of modern supply chains, enabling organizations to synchronize inbound and outbound movements with unprecedented precision. As customer expectations evolve toward faster delivery cycles and transparent status updates, the pressure on terminals, distribution centers, and logistics providers has intensified. In response, decision makers are investing in technologies that facilitate real-time visibility, collaborative workflows, and data-driven planning.

Recent advancements have underscored the need for integrated platforms that unify hardware components such as automated doors and vehicle guidance systems with software modules for scheduling, analytics, and reporting. Concurrently, service offerings that encompass support and maintenance as well as training and consulting have become essential to ensure smooth deployment and continuous improvement. This introduction sets the stage for a deeper exploration of the forces reshaping dock and yard operations and lays the groundwork for strategic insight into emerging market dynamics.

A comprehensive dock and yard management strategy extends beyond technology selection to include cross-functional alignment among operations, IT, and procurement teams. Establishing clear performance metrics, such as dock turnaround times and yard dwell duration, is essential for measuring return on technology investments. As companies navigate fluctuating demand patterns and workforce constraints, the introduction of standardized operating procedures and collaborative communication channels further enhances operational resilience. This introduction provides a foundational overview of the strategic imperative for modernizing dock and yard processes and underscores the need for a cohesive approach that unites technology, people, and processes.

Navigating Transformative Shifts in Dock and Yard Operations Driven by Automation, AI-Enabled Scheduling, and Sustainable Process Innovations

Automation and digitization have driven a radical transformation of dock and yard operations, ushering in an era where manual processes yield to intelligent, connected systems. Artificial intelligence-enabled scheduling engines now leverage historical dock utilization data to allocate resources dynamically, reducing dwell times and boosting throughput. Meanwhile, Internet of Things sensors embedded in handling equipment and container locks provide granular status updates, enabling predictive maintenance and real-time exception alerts.

Sustainability has also taken center stage, with stakeholders prioritizing energy efficiency and emissions reduction. Solar-powered yard lighting, electric yard tractors, and eco-friendly materials handling solutions are being integrated into broader operational strategies. These innovative technologies, coupled with cloud computing frameworks that facilitate seamless data exchange among ports, carriers, and shippers, illustrate the depth of the paradigm shift underway in dock and yard management.

Collaboration across the extended logistics ecosystem has become increasingly vital as data sharing and process integration drive mutual success. Secure cloud infrastructures and encrypted communication protocols are enabling multiple stakeholders to exchange real-time information while safeguarding sensitive cargo and operational data. Cybersecurity measures, including network segmentation and intrusion detection systems, are now integral to solution roadmaps, ensuring that digital transformation initiatives do not introduce vulnerabilities. Together, these transformative shifts highlight the convergence of innovation, security, and sustainability priorities in shaping the future of dock and yard management.

Assessing the Cumulative Impact of Recent United States Tariffs on Dock and Yard Management Ecosystems through Regulatory and Operational Lenses

United States tariff adjustments implemented in the first half of 2025 have reverberated across dock and yard management ecosystems, influencing equipment sourcing, infrastructure investments, and service models. Tariffs on steel and aluminum imports have increased the cost base for hardware providers, prompting a reevaluation of procurement strategies and supplier partnerships. In many cases, original equipment manufacturers have sought alternative materials or reconfigured product designs to mitigate increased input expenses.

Similarly, tariffs targeting specific finished goods have altered container routing patterns and capacity planning. Logistics service providers and terminal operators have encountered shifts in cargo flow as importers reroute orders through tariff-exempt channels or consolidate shipments to optimize duties. This dynamic environment underscores the importance of adaptable dock and yard management solutions that can accommodate evolving regulatory and economic landscapes.

Moreover, the evolving tariff environment has accelerated interest in localized manufacturing and nearshoring strategies, prompting stakeholders to reassess network footprints and adapt dock configurations to support multi-modal inbound flows. This strategic pivot underscores the necessity for flexible yard layouts and modular dock configurations that can accommodate varying container sizes and cargo types. Ultimately, the ability to reconfigure operations swiftly in response to tariff-driven supply shifts will distinguish leaders in dock and yard management and enhance long-term competitiveness.

Unveiling Crucial Segmentation Perspectives That Illuminate Component, Deployment, Application, End User, and Organization Size Dynamics

Insight into the market’s component landscape reveals that hardware investments remain foundational, yet the services domain is gaining momentum as organizations demand comprehensive support and training offerings to maximize system utility. Within services, the demand for robust support and maintenance agreements is intensifying in parallel with specialized training and consulting engagements that empower teams to adopt advanced features and best practices.

Deployment preferences illuminate a growing bifurcation: cloud-based solutions are increasingly favored for their scalability and remote accessibility, while on-premises platforms continue to play a critical role where data sovereignty and offline reliability are paramount. Application driven analysis shows that analytics and reporting functionalities serve as the bedrock of strategic decision making, while asset tracking and container handling modules address the operational core. Gate operations and yard planning and scheduling applications further enhance workflow orchestration and throughput optimization.

End user segmentation highlights that logistics service providers are at the forefront of technology adoption, seeking to differentiate through value-added services, whereas ports and terminals emphasize integration with broader infrastructure ecosystems to support high-volume throughput. Warehouses and distribution centers prioritize flexibility, often balancing between rapid deployment cycles and customization to meet diverse customer demands. Additionally, organizational size dictates solution scale, with large enterprises investing in enterprise-grade architectures and small and medium enterprises gravitating toward nimble, cost effective offerings that can deliver immediate value without extensive resource commitments.

When these segmentation perspectives are considered collectively, a holistic ecosystem view emerges, revealing interdependencies that must be managed in concert. For example, large enterprises deploying cloud-native analytics and reporting solutions often require advanced container handling and yard planning modules to support high-volume throughput, while small and medium enterprises may integrate on-premises gate operations tools with targeted support services to optimize capital expenditure. Recognizing and orchestrating these segment interactions enables market participants to deliver tailored solution bundles that resonate with diverse customer profiles and drive sustained adoption.

This comprehensive research report categorizes the Dock & Yard Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Application

- End User

- Organization Size

Exploring Distinct Regional Dynamics Across the Americas, Europe-Middle East-Africa, and Asia-Pacific That Shape Dock and Yard Management Priorities

As market dynamics unfold across different geographies, the Americas region continues to prioritize modernization of aging port and terminal assets with an emphasis on upgrading dock door controls and integrating yard management suites to address growing e-commerce volumes. Investments in intermodal connectivity and rail integration are reshaping how goods traverse inland corridors, fostering demand for unified management platforms that link sea, rail, and road operations. Regulatory frameworks and trade agreements within the Americas also influence solution customization, particularly for cross-border movements.

In Europe, the Middle East, and Africa, the convergence of stringent environmental regulations and ambitious digitalization roadmaps has accelerated the adoption of energy efficient dock and yard technologies. Pilot projects exploring electric yard trucks and AI-based scheduling are becoming prevalent across key ports. Ecosystem collaborations and public-private partnerships are central to driving scale, enabling stakeholders to share data and co-develop interoperability protocols. Africa’s burgeoning logistics infrastructure, coupled with Middle Eastern investments in free zone expansions, further underscores the region’s strategic importance.

Asia-Pacific remains a powerhouse of capacity expansion and automation, with many leading ports deploying cutting-edge robotics and autonomous guided vehicles to handle surging container volumes. Government initiatives targeting smart port development, particularly in China, Singapore, and Australia, are catalyzing large-scale digitization efforts. The region’s emphasis on rapid innovation cycles compels solution providers to maintain pace through continuous product updates and localized service networks.

Cross-regional collaboration is fostering the diffusion of best practices and technology standards, creating opportunities for solution providers to develop interoperable platforms that transcend geographic boundaries. Joint research initiatives and global industry consortia are instrumental in harmonizing data schemas and communication protocols, facilitating smoother integration for multinational operators. As a result, customers can achieve consistent performance benchmarks across their international footprint, reducing complexity and enabling more effective global supply chain optimization.

This comprehensive research report examines key regions that drive the evolution of the Dock & Yard Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Innovations That Are Defining Competitive Dynamics in Dock and Yard Management Solutions

An analysis of the competitive landscape reveals a diverse array of stakeholders ranging from hardware innovators to software vendors and full-suite integrators. Hardware manufacturers are increasingly forging partnerships with technology firms to embed sensors and connectivity protocols directly into docking equipment. Software providers, in turn, are broadening their offerings with advanced analytics modules and cloud orchestration capabilities, positioning themselves as critical enablers of end-to-end visibility and control.

Services oriented companies are distinguishing themselves by bundling support agreements with proactive monitoring and remote diagnostics, while consultants are offering strategic workshops to align system capabilities with business objectives. Several key players are investing heavily in research and development to advance AI-driven scheduling engines, modular yard management architectures, and digital twins. Competitive differentiation is further enhanced by alliances between industry incumbents and start-ups, facilitating rapid innovation adoption and tailored client implementations.

In addition to organic innovation, the competitive landscape is witnessing consolidation through strategic mergers and acquisitions. Integrators are seeking to augment their portfolios with complementary capabilities-such as robotic automation or advanced AI analytics-while software vendors aim to expand their service offerings via bolt-on acquisitions of specialized consulting firms. This trend is reshaping the market structure and creating new collaboration pathways, as combined entities can offer end-to-end solutions encompassing hardware, software, and professional services under unified governance frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dock & Yard Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4SIGHT Logistics Solution

- C3 Solutions

- Descartes Systems Group Inc.

- DispatchTrack

- E2open Parent Holdings, Inc.

- Exotrac LLC

- GPS Insight

- HighJump Software, Inc.

- IntelliTranS, LLC

- Konecranes

- Loadsmart Inc.

- Made4net

- Manhattan Associates, Inc.

- MobiWork LLC

- Navis Corporation

- Oracle Corporation

- ProAct International Ltd.

- Queueme Technologies Pvt Ltd.

- Rose Rocket Inc.

- Royal 4 Systems

- Samsara Inc.

- Siemens Logistics GmbH

- Softeon Inc.

- Trimble Inc.

- UROUTE LLC

- Verizon Connect

- VTS Solutions Inc.

- WorkWave LLC

- YardView

- Zebra Technologies Corp.

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Technological Advances and Enhance Operational Agility

Industry leaders must prioritize the integration of AI-driven scheduling and routing engines to dynamically allocate dock resources, thereby reducing idle time and boosting throughput. By establishing strategic partnerships with advanced analytics vendors, companies can leverage predictive insights to anticipate peak periods and proactively allocate staffing and equipment. Simultaneously, investing in modular, scalable platforms will allow rapid adaptation to shifts in cargo types and volumes without disrupting existing workflows.

Upskilling the workforce through comprehensive training and consulting engagements is equally critical to maximize technology ROI and foster a culture of continuous improvement. Stakeholders should evaluate pilot programs that explore emerging technologies such as autonomous guided vehicles and digital twin simulations to de-risk large-scale rollouts. Additionally, embedding sustainability objectives into technology roadmaps-through energy efficient hardware selections and emissions tracking-will not only meet regulatory requirements but also deliver operational cost savings over time.

Leaders are encouraged to establish innovation labs or centers of excellence dedicated to piloting emerging technologies and fostering continuous improvement. By collaborating with technology providers in co-development initiatives, organizations can influence feature roadmaps and accelerate time to value. Active participation in industry standard bodies and working groups will also ensure that new solutions align with evolving interoperability and safety requirements, positioning stakeholders at the forefront of ecosystem evolution.

Outlining a Rigorous Research Framework Employing Qualitative and Quantitative Approaches to Ensure Insightful and Reliable Dock and Yard Management Analysis

This study employed a rigorous research framework that combined qualitative interviews with executives across ports, logistics service providers, and warehouses, alongside quantitative surveys that captured technology adoption rates and investment priorities. Secondary research was conducted through analysis of industry publications, trade journals, academic papers, and government regulations to contextualize market drivers and regulatory influences. Data triangulation techniques, including cross-validation and sensitivity analysis, were utilized to verify insights and ensure consistency across multiple sources. An iterative validation process with industry stakeholders further refined the findings, ensuring that perspectives from diverse operational environments were accurately represented.

The research process also incorporated in-depth case study analysis of successful dock and yard management implementations to distill best practices and identify common challenges. Statistical trend analysis and benchmarking methodologies were applied to map technology maturity across regions and end-user segments. Ethical data handling policies and confidentiality agreements were adhered to throughout the study, safeguarding participant privacy and proprietary information. Throughout the methodology, adherence to stringent data integrity protocols and transparent documentation ensured that findings are both actionable and reflective of current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dock & Yard Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dock & Yard Management System Market, by Component

- Dock & Yard Management System Market, by Deployment Type

- Dock & Yard Management System Market, by Application

- Dock & Yard Management System Market, by End User

- Dock & Yard Management System Market, by Organization Size

- Dock & Yard Management System Market, by Region

- Dock & Yard Management System Market, by Group

- Dock & Yard Management System Market, by Country

- United States Dock & Yard Management System Market

- China Dock & Yard Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing Conclusive Insights That Synthesize Strategic Trends, Operational Challenges, and Future Pathways for Dock and Yard Management Excellence

As the dock and yard management landscape continues to evolve, the convergence of automation, digital platforms, and sustainability imperatives will redefine operational paradigms. Organizations that adopt integrated solutions spanning hardware, software, and services are best positioned to respond to dynamic cargo flows and regulatory shifts. The insights detailed herein underscore the critical role of strategic technology investments and collaborative partnerships in achieving operational excellence.

Looking ahead, the successful providers will be those that can seamlessly blend AI-driven optimization with robust service models, while maintaining the agility to pivot as market conditions change. Stakeholders who internalize these lessons and embed them into their strategic planning will secure a lasting competitive advantage and unlock the next wave of efficiency gains in dock and yard management.

Establishing continuous monitoring frameworks and performance dashboards will enable organizations to track key operational indicators and rapidly adjust to shifts in cargo profiles or regulatory changes. Future research endeavors will delve deeper into the impact of emerging technologies such as blockchain for supply chain provenance and digital twin simulations for real-time operational modeling. Together, these initiatives will empower stakeholders to maintain leadership in dock and yard management and continuously elevate service standards.

Engage with Key Experts to Secure Comprehensive Dock and Yard Management Intelligence and Unlock Competitive Advantage through Tailored Market Insights

To gain full access to the comprehensive market intelligence and strategic recommendations outlined in this executive summary, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to explore how tailored insights into dock and yard management can empower your organization to accelerate digital transformation, optimize resource allocation, and drive sustainable growth. By partnering with seasoned experts in logistics technology research, you will unlock exclusive analyses, benchmark comparisons, and hands-on implementation guidance. Contact Ketan today to secure your organization’s competitive advantage in a rapidly evolving logistics ecosystem.

- How big is the Dock & Yard Management System Market?

- What is the Dock & Yard Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?