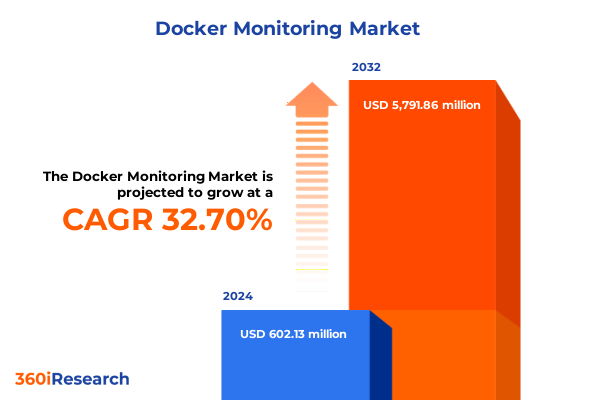

The Docker Monitoring Market size was estimated at USD 799.51 million in 2025 and expected to reach USD 1,066.01 million in 2026, at a CAGR of 32.69% to reach USD 5,791.85 million by 2032.

Setting the Stage for Comprehensive Container Visibility and Performance Assurance Across Hybrid and Multi-Cloud Environments with Docker Monitoring

In recent years, containerization has emerged as a foundational pillar for modern application delivery, empowering organizations to develop, deploy, and scale microservices architectures with unprecedented agility. Docker has spearheaded this transformation by offering a lightweight, portable format that abstracts away infrastructure differences. As a result, enterprises are increasingly adopting container-based deployments across on-premise data centers and cloud platforms to accelerate time to market and enhance operational flexibility. However, this shift has introduced new complexities, as dynamic container workloads require continuous oversight to prevent performance bottlenecks, ensure service reliability, and maintain security compliance across distributed environments.

Moreover, the convergence of DevOps practices with cloud-native strategies has elevated the importance of container monitoring as a strategic imperative rather than a peripheral concern. Real-time observability into container metrics, logs, and events enables engineering teams to diagnose issues swiftly, optimize resource utilization, and deliver seamless user experiences. Emerging observability stacks that integrate open standards such as OpenTelemetry, together with visualization tools like Grafana and advanced analytics powered by machine learning, are redefining how teams detect anomalies and predict resource constraints before they impact end users. This executive summary synthesizes critical insights into the current state of Docker monitoring, explores the transformative trends reshaping the landscape, examines the cumulative impact of pertinent policy developments, and highlights key segmentation and regional dynamics. By distilling these findings, decision makers can align technology investments with organizational goals, mitigate emerging risks, and capitalize on opportunities to drive operational excellence across complex containerized ecosystems.

Unveiling the Paradigm-Shifting Innovations and Emerging Trends Redefining Container Monitoring in a Rapidly Evolving Cloud-Native Ecosystem

The container monitoring landscape has undergone a rapid evolution, driven by paradigm-shifting innovations that redefine how visibility and performance data are collected, processed, and acted upon. Kubernetes integration has become a cornerstone for orchestrating container clusters at scale, and observability tools have evolved to offer native API integrations that surface pod-level metrics without disrupting application pipelines. Service mesh telemetry further enhances this visibility by capturing low-latency data on inter-service communication, while open-source frameworks such as Prometheus and OpenTelemetry have democratized access to robust monitoring capabilities. As a result, organizations can now implement unified observability platforms that span infrastructure, services, and applications, delivering a holistic view of system health across every layer of the stack.

Furthermore, artificial intelligence and machine learning are gaining traction as strategic enablers for proactive anomaly detection, root-cause analysis, and capacity planning. Advanced analytics engines can identify subtle performance degradation patterns, correlate events across microservices, and trigger automated remediation workflows before incidents escalate. At the same time, the rise of edge computing and serverless architectures is expanding the scope of container monitoring beyond traditional data centers and cloud regions. In this new reality, decentralized observability approaches are emerging, enabling real-time insights at the network edge and within ephemeral workloads. Taken together, these transformative shifts are empowering IT leaders to evolve from reactive troubleshooting toward predictive, self-healing infrastructures that optimize application reliability and drive continuous delivery.

Assessing the Multifaceted Reverberations of 2025 United States Tariff Measures on Container Monitoring Infrastructure Costs and Adoption Patterns

In early 2025, the United States government implemented a series of tariff measures targeting imported hardware components commonly used in on-premise data centers, including high-performance servers, network interface cards, and specialized storage arrays. While these measures were primarily designed to bolster domestic manufacturing competitiveness, they have had significant downstream effects on organizations maintaining local container orchestration platforms. The increased import duties have elevated capital expenditures for on-premise infrastructure, prompting many IT teams to reassess the cost-benefit balance of maintaining in-house environments for containerized workloads.

As a direct consequence, the total cost of ownership for on-site monitoring appliances and commercial support contracts has risen, creating a compelling case for revisiting cloud-based deployment models. The shift away from capital-intensive hardware investments has accelerated the adoption of managed container services, where monitoring capabilities are provisioned as part of the overall platform. Organizations are leveraging this trend to reduce upfront costs, simplify capacity planning, and benefit from pay-as-you-go pricing structures for observability. Moreover, vendors specializing in container monitoring have responded by enhancing their SaaS offerings, optimizing data ingestion pipelines to minimize egress expenses, and introducing tiered storage options that balance performance with cost efficiency.

Despite these headwinds, on-premise deployments remain critical for industries with stringent data sovereignty and latency requirements. To mitigate tariff-driven budget pressures, IT leaders are exploring hybrid cloud models that distribute container workloads across domestic data centers and public cloud regions. This hybrid posture preserves control over sensitive workloads while allowing non-critical services to migrate to cloud environments with minimal licensing overhead. Ultimately, the 2025 tariff measures have catalyzed a strategic realignment of container monitoring strategies, underscoring the importance of flexible deployment models that adapt to shifting policy landscapes.

Illuminating Critical Segmentation Dimensions that Drive Customized Docker Monitoring Strategies Tailored to Deployment, Component, and Vertical Specificities

Based on deployment type, the distinction between cloud and on-premise environments offers critical insights into how organizations tailor their Docker monitoring strategies. Cloud deployments, encompassing hybrid cloud, private cloud, and public cloud models, demand solutions that seamlessly traverse dynamic virtual networks and ephemeral workloads. Hybrid landscapes, for instance, require unified dashboards that reconcile disparate metric sources, while private cloud implementations prioritize compliance-focused telemetry that remains within corporate firewalls. Public cloud environments, by contrast, emphasize integration with native service provider APIs to leverage built-in scaling and high-availability features without sacrificing deep visibility into container performance.

Based on component, the interplay between services and software defines the contours of value creation in the monitoring ecosystem. Services such as professional consulting, custom integration, and managed support ensure that deployments align with organizational standards and evolve alongside architectural shifts. Meanwhile, software platforms-ranging from self-hosted engines to fully managed SaaS offerings-offer distinct licensing models and extensibility options. Organizations seeking rapid time to value often favor turnkey cloud-native solutions, whereas those with stringent security requirements invest in on-premise editions that grant full control over data collection and retention policies.

Based on vertical, the specialized demands of industry segments shape the required monitoring capabilities. Financial services and insurance stakeholders focus on transaction-level auditability and ultra-low latency to uphold service-level commitments. Healthcare organizations prioritize fault tolerance and regulatory reporting for patient-centric platforms, while IT and telecom enterprises demand massive scale and network-heavy telemetry to sustain global connectivity. In retail and e-commerce, peak-season traffic surges and dynamic pricing experiments call for elastic observability that can handle sudden spikes in container spin-ups and teardown cycles. By aligning monitoring strategies with these dimensional insights, decision makers can ensure that their Docker observability investments deliver maximum business impact.

This comprehensive research report categorizes the Docker Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Vertical

Exploring Distinct Regional Dynamics Shaping Docker Monitoring Adoption Across the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

In the Americas, adoption of Docker monitoring solutions is driven by a robust digital transformation agenda and a culture of rapid innovation. North American enterprises benefit from mature cloud marketplaces and a wealth of third-party integrations that accelerate observability deployments. Regulatory frameworks such as the California Consumer Privacy Act and federal cybersecurity guidelines influence feature priorities around data encryption, log retention, and access controls. Organizations in Latin America are increasingly leveraging hybrid architectures to balance regional data sovereignty concerns with the scalability of global cloud providers, creating a growing market for cross-region monitoring solutions that can reconcile regulatory requirements.

In Europe, the Middle East & Africa, regulatory complexity and geographic fragmentation present both challenges and opportunities for Docker monitoring vendors. The General Data Protection Regulation has set a high bar for privacy and data handling, causing customers to seek observability platforms that offer granular consent management and localized data storage. In the Middle East, state-backed cloud initiatives are fostering demand for regionally compliant container services, while African markets are gradually embracing cloud-native patterns as telecom infrastructure matures. This diverse landscape encourages vendors to develop modular architectures that can be tailored to specific jurisdictions without compromising on global feature consistency.

In the Asia-Pacific region, the relentless pace of enterprise modernization fuels a voracious appetite for advanced observability tools. Cloud service penetration is rising sharply in markets such as China, India, Australia, and Southeast Asia, and local data center expansions by hyperscalers are lowering barriers to entry. Cost optimization remains a top priority, prompting organizations to adopt monitoring solutions that offer granular control over metric storage and query frequency. Additionally, government-led initiatives around digital innovation and smart cities are creating new use cases for container deployment at the network edge, further expanding the scope of monitoring requirements across distributed IoT and microservices workloads.

This comprehensive research report examines key regions that drive the evolution of the Docker Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves and Innovation Pathways of Leading Docker Monitoring Vendors Fuelling Competitive Differentiation and Partnership Synergies

The competitive landscape of Docker monitoring is defined by a mix of established infrastructure players and innovative pure-play specialists. Firms such as Datadog and Dynatrace have fortified their container observability portfolios through aggressive feature expansion, embedding AI-driven anomaly detection and automated remediation workflows directly into their platforms. New Relic continues to refine its full-stack monitoring suite with enhanced Kubernetes native support, while Splunk has broadened its appeal by integrating container logs and metrics into its broader data analytics environment. These incumbents leverage extensive partner networks and global sales channels to maintain differentiation in an increasingly commoditized market.

At the same time, open-source and lean-boutique vendors are carving out niches by focusing on specialized requirements. Grafana Labs, home to the popular Prometheus framework, offers managed observability services that emphasize extensibility and community-driven innovation. Sysdig delivers a security-centric monitoring approach, combining runtime threat detection with performance analytics to address the growing convergence of DevOps and DevSecOps practices. Emerging providers are also exploring edge monitoring solutions designed for disconnected or intermittently connected container environments, tapping into the demand generated by IoT expansions and latency-sensitive workloads.

Strategic acquisitions and partnerships continue to reshape vendor positioning. Large cloud providers collaborate with specialized monitoring firms to embed container observability directly into their managed services catalogs, while pure-play monitoring vendors integrate into leading CI/CD platforms to automate telemetry instrumentation earlier in the development lifecycle. These alliances not only broaden distribution channels but also streamline integration complexity for end users, enabling seamless workflows from code commit through production deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Docker Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BMC Software, Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- CubeAPM

- Datadog, Inc.

- Dynatrace, Inc.

- Elastic N.V.

- Elasticsearch B.V.

- Grafana Labs

- IBM Corporation

- InfluxData Inc.

- New Relic, Inc.

- Prometheus

- ScienceLogic, Inc.

- Sematext Group, Inc.

- SolarWinds Corporation

- Splunk Inc.

- Sumo Logic, Inc.

- Sysdig, Inc.

- VMware, Inc.

- Zabbix LLC

Empowering Industry Leaders with Targeted Action Plans to Enhance Container Observability, Operational Resilience, and Security Posture in Docker Environments

To harness the full benefits of container observability, industry leaders should adopt unified monitoring platforms that consolidate infrastructure, application, and network data into a single operational view. By standardizing on open telemetry protocols and centralizing metrics, logs, and traces, teams can accelerate incident response workflows, reduce alert fatigue, and foster cross-functional collaboration between development and operations personnel. Transitioning from fragmented point tools to a cohesive observability architecture streamlines troubleshooting and creates a single source of truth for service health.

Embedding security monitoring into the observability stack is equally critical. Organizations must integrate runtime threat detection, vulnerability scans, and behavioral analytics directly into their Docker monitoring processes to detect anomalies that may signal malicious activity. Real-time policy enforcement and automated remediation scripts can block suspicious containers at the first sign of compromise, while audit trails captured as part of the monitoring pipeline support regulatory compliance and forensic investigations. This proactive approach ensures that security posture and operational resilience advance in parallel, rather than in silos.

Finally, leaders should cultivate strategic partnerships and talent development programs that align with evolving container ecosystems. Collaborating with cloud providers and specialized monitoring vendors accelerates access to new capabilities such as AI-powered forecasting and customizable dashboards. Investing in continuous training for DevOps and site reliability engineering teams guarantees that personnel can leverage advanced analytics and automation frameworks effectively. By blending people, processes, and technology investments, organizations can transform Docker monitoring from a tactical necessity into a strategic differentiator that drives continuous innovation.

Detailing Rigorous Research Methodology Integrating Primary Interviews, Secondary Analysis, and Data Triangulation for Docker Monitoring Insights Generation

This research harnesses a structured methodology designed to deliver reliable insights into Docker monitoring dynamics. Primary data was collected through in-depth interviews and surveys involving senior IT leaders, site reliability engineers, and DevOps practitioners across multiple industries. These firsthand perspectives illuminated real-world challenges in container observability, including integration complexities, performance bottlenecks, and security requirements that shape deployment decisions across diverse organizational contexts.

Complementing the primary research, secondary analysis incorporated a comprehensive review of industry white papers, technical documentation from leading vendors, conference proceedings, and peer-reviewed publications. This aggregated body of knowledge provided a broad base of quantitative and qualitative information, enabling the identification of prevailing trends, technology adoption patterns, and vendor differentiation strategies. Publicly available regulatory guidelines and compliance frameworks were also examined to contextualize the impact of policy developments on monitoring requirements.

To ensure the utmost credibility, findings were subjected to rigorous data triangulation, cross-referencing multiple sources to validate consistency and accuracy. An expert panel comprising cloud architects, security specialists, and systems engineers conducted iterative reviews of emerging insights, challenging assumptions and refining conclusions. Quality assurance protocols were applied at every stage, including peer audits of interview transcripts and statistical verification of survey results. This multifaceted approach guarantees that the report’s recommendations are grounded in a robust evidence base and reflect the complex realities of modern container monitoring landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Docker Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Docker Monitoring Market, by Component

- Docker Monitoring Market, by Deployment Type

- Docker Monitoring Market, by Vertical

- Docker Monitoring Market, by Region

- Docker Monitoring Market, by Group

- Docker Monitoring Market, by Country

- United States Docker Monitoring Market

- China Docker Monitoring Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesizing Strategic Imperatives and Trajectories of Docker Monitoring Technologies to Drive Operational Excellence and Business Value in Modern Enterprises

As containerization continues to redefine application delivery paradigms, robust monitoring strategies have emerged as a strategic imperative for organizations striving to maintain performance and security at scale. The insights presented here underscore the transformative power of unified observability, the critical influence of regulatory and policy environments, and the importance of aligning monitoring solutions with distinct segmentation and regional dynamics. Armed with an understanding of deployment-based requirements, targeted vertical demands, and evolving vendor landscapes, technology leaders are better equipped to optimize Docker monitoring across hybrid and multi-cloud ecosystems.

Looking forward, the trajectory of Docker monitoring will be shaped by advances in artificial intelligence, automated remediation, and edge observability. Embracing open standards and fostering integration across development pipelines will accelerate innovation and reduce time to resolution during incidents. At the same time, embedding security controls into the monitoring fabric will ensure that compliance and threat detection evolve in lockstep with performance visibility.

Ultimately, the strategic imperative for enterprises is clear: monitoring must transition from a purely operational function to a catalyst for continuous improvement and business value creation. By investing in flexible, intelligent observability platforms and cultivating the organizational capabilities to leverage them effectively, companies can navigate the complexities of modern container ecosystems and drive sustainable growth.

Unlock Comprehensive Docker Monitoring Intelligence Today by Partnering with Ketan Rohom for Customized Insights and Actionable Market Research Guidance

We invite you to unlock the full potential of container observability and operational resilience by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s extensive expertise in Docker monitoring solutions will guide you through a tailored exploration of the report’s findings, ensuring that you receive customized insights aligned with your organization’s strategic objectives.

By partnering with Ketan, you will gain direct access to in-depth analysis of emerging trends, competitive positioning of leading vendors, and region-specific deployment considerations. This collaboration will empower your team to make data-driven decisions that optimize performance, bolster security, and drive sustainable innovation within your containerized environments. Reach out today to secure your comprehensive market research package and transform your Docker operations with actionable guidance from a seasoned industry professional.

- How big is the Docker Monitoring Market?

- What is the Docker Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?