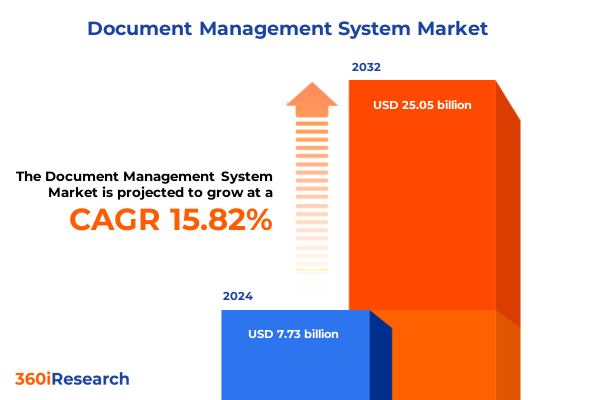

The Document Management System Market size was estimated at USD 8.90 billion in 2025 and expected to reach USD 10.26 billion in 2026, at a CAGR of 15.92% to reach USD 25.05 billion by 2032.

Embracing the Digital Revolution to Transform Document Management Workflows While Elevating Security and Enabling Agile Organizational Performance

The accelerating shift toward digital workplaces has rendered traditional paper-centric processes obsolete and ushered in a new era of dynamic document management. With organizations facing increasing demands for secure collaboration, regulatory compliance, and cost containment, modern document management systems serve as the backbone of enterprise efficiency. These systems not only centralize critical information but also provide the agility needed to adapt to evolving business models and distributed teams.

Amid the rise of remote and hybrid work environments, organizations are prioritizing platforms that deliver seamless access to documents from any location while enforcing stringent security controls. Advanced encryption, role-based access, and audit trails have become non-negotiable features, ensuring that sensitive data remains protected against internal missteps and external threats. Concurrently, the need for quick retrieval, automated versioning, and integrated workflows underscores the importance of embedding intelligence at the heart of document processes.

As we delve deeper into this executive summary, it becomes clear that the modern document management paradigm extends beyond mere storage and retrieval. It encompasses intelligent automation, real-time analytics, and end-to-end governance, enabling organizations to transform raw information into strategic assets. This report charts the key drivers, emerging trends, and practical insights you need to navigate this landscape with confidence and clarity.

Harnessing AI, Cloud and Collaborative Technologies to Redefine Document Management and Accelerate Intelligent Information Governance Strategies

Today’s document management ecosystem is being reshaped by the convergence of cloud computing, artificial intelligence, and collaborative platforms. Cloud-native deployments have liberated enterprises from the constraints of on-premises infrastructure, offering scalable environments that adapt to fluctuating workloads and streamline global collaboration. As organizations shed hardware dependencies, they are embracing subscription-based models that deliver continuous feature updates, robust disaster recovery, and rapid provisioning of new users.

Artificial intelligence and machine learning are further revolutionizing document-centric workflows. Automated classification, intelligent metadata extraction, and natural language processing now accelerate content discovery and compliance checks, minimizing manual intervention and human error. By harnessing AI-driven insights, enterprises can surface critical data points in real time, enabling faster decision-making and reducing operational bottlenecks.

Moreover, the proliferation of integrated collaboration suites has transformed document management from a solitary task into a dynamic, cross-functional process. Embedded commenting, version tracking, and seamless hand-off between teams foster transparency and accountability. Mobile-first interfaces ensure that stakeholders remain connected, whether in the office, at home, or on the move. In tandem, low-code and no-code platforms are lowering the barrier to customizing workflows, empowering citizen developers to tailor document processes to their precise business needs.

Analyzing the Pervasive Influence of 2025 United States Tariffs on Infrastructure Costs, Cloud Adoption and Strategic Document Management Decisions

The United States’ implementation of reciprocal tariffs in 2025 has introduced significant implications for document management infrastructure and vendor strategies. With duties as high as 34% on tech equipment imported from China, Taiwan, and South Korea, enterprises are confronting steeper costs for servers, storage arrays, and networking devices required to support on-premises deployments and private cloud initiatives. These increased capital expenditures have placed on-premises solutions at a comparative disadvantage, prompting many organizations to re-evaluate hardware refresh cycles and to explore more flexible alternatives.

Cloud providers, while less directly impacted than traditional hardware vendors, are feeling the ripple effects as their infrastructure requirements grow. Internal guidance from leading hyperscalers instructs account teams to address customer inquiries about potential price adjustments by emphasizing existing pricing commitments and local data center capacity. This approach seeks to preserve customer trust amid uncertainties, even as future tariff expansions threaten to tighten supply chains for critical components like GPUs and networking chips.

Beyond direct pricing pressures, the new tariff regime has disrupted global supply chains, extending lead times for equipment deliveries and compelling procurement teams to diversify sourcing across non-tariffed geographies. Enterprises report extended project timelines as vendors navigate customs clearance delays and component scarcity, underscoring the strategic imperative of resilience planning. In response, many organizations are accelerating their migration to public and hybrid cloud models, where capital spending is replaced by operational consumption and providers shoulder the hardware risk.

Software vendors, while insulated from tariffs on pure code, face second-order effects as clients balance their total cost of ownership. Support contracts, maintenance agreements, and professional services engagements are under renewed scrutiny, driving a shift toward modular, cloud-native offerings that minimize upfront hardware dependencies. This broader recalibration highlights the interdependence of trade policy and digital strategy in shaping the future of enterprise document management.

Leveraging Comprehensive Segmentation Dimensions to Uncover Nuanced User Needs and Drive Targeted Document Management Solutions Across Varied Use Cases

A nuanced understanding of the document management market emerges when we examine how enterprises make decisions based on the interplay of components and software. On the services side, managed services provide end-to-end support, professional services enable tailored implementations, and support services ensure ongoing operational excellence. In parallel, application software delivers tailored user experiences, security software enforces data protection, and system software underpins performance and scalability. This component blend defines how organizations optimize their technology stacks to meet diverse operational objectives.

When content flows into the system, it arrives in various shapes-emails containing legal disclaimers, multimedia files in marketing campaigns, scanned images of signed contracts, and raw text documents produced by collaborative editing. Each document type requires specialized ingestion pipelines, from optical character recognition and metadata tagging to advanced search capabilities. These processes ensure that every piece of content can be accurately indexed, retrieved, and secured according to its unique risk profile and business value.

The purpose to which documents are put also shapes solution requirements. Whether managing core content repositories, capturing and imaging physical records, overseeing regulated retention schedules, or orchestrating complex approval workflows, organizations demand platforms that unify these capabilities. Moreover, the system’s adaptability to industry-specific needs-from stringent compliance in banking, financial services and insurance to secure patient records in healthcare-determines its effectiveness across banking, government, healthcare, IT and telecom, manufacturing, and retail environments.

Finally, deployment preferences and organizational scale exert a profound influence on adoption. Some enterprises pursue cloud-first strategies to maximize agility, while others maintain on-premise installations to leverage existing investments and address data sovereignty concerns. Large enterprises often require global platform consistency and full customization, whereas small and medium organizations prioritize rapid deployment and lower total cost of ownership. Recognizing how these segmentation dimensions interweave is essential to delivering solutions that resonate with each unique constituency.

This comprehensive research report categorizes the Document Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Document Type

- Application

- Industry Vertical

- Deployment Type

- Organization Size

Understanding Dynamics Across the Americas, Europe Middle East and Africa, and Asia-Pacific to Tailor Document Management Strategies for Market Realities

Regional dynamics shape not only adoption rates but also strategic priorities in document management implementations. In the Americas, organizations benefit from a mature cloud ecosystem, abundant data center capacity, and a regulatory environment that demands robust privacy controls without imposing excessive localization requirements. American enterprises often lead with cloud deployments, integrating deep analytics and AI capabilities to drive competitive differentiation and operational resilience.

Across Europe, the Middle East and Africa, regulatory diversity and data sovereignty remain paramount. GDPR in Europe has set a global benchmark for privacy, compelling organizations to implement stringent access controls, audit trails, and consent management. Meanwhile, emerging markets in the Middle East and Africa are accelerating digital transformation initiatives, balancing rapid modernization against resource constraints. Hybrid architectures frequently emerge as pragmatic solutions, enabling centralized governance while accommodating local hosting requirements.

In the Asia-Pacific region, the pace of digital adoption is among the fastest globally, powered by government-led smart city projects and a vibrant SME landscape. Organizations here are keen to leverage cloud services to leapfrog legacy infrastructure, yet they must also navigate complex regulatory frameworks across multiple jurisdictions. The diversity of market maturity-from highly sophisticated economies to rapidly developing nations-demands flexible solutions that can scale horizontally and adapt to local operational realities while maintaining global governance standards.

This comprehensive research report examines key regions that drive the evolution of the Document Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Strengths and Innovations from Leading Technology Providers Shaping the Future of Document Management Solutions Globally

Leading technology providers are investing heavily in AI-driven metadata enrichment and advanced security frameworks to differentiate their document management offerings. One major vendor has integrated generative AI into its platform, enabling automated summary generation and contextual tagging directly within the repository. Another global player is embedding zero-trust principles at every layer, offering end-to-end encryption and continuous risk assessment to meet the most demanding compliance regimes.

Meanwhile, cloud-native specialists are capitalizing on microservices architectures to deliver highly modular, API-first platforms that seamlessly interoperate with broader enterprise ecosystems. These providers emphasize rapid deployment through marketplace integrations and pre-built connectors, enabling organizations to extend document workflows into CRM, ERP, and low-code automation tools with minimal configuration.

Established incumbents are leveraging their extensive partner networks to offer comprehensive managed and professional services, focusing on large-scale migrations, global rollout programs, and vertical-specific accelerators. Their ability to bundle security, analytics, and collaboration modules into unified suites appeals to enterprises seeking end-to-end solutions under a single vendor umbrella. At the same time, smaller pure-plays are capturing niche segments by delivering ultra-streamlined interfaces and targeted innovations, such as mobile-first capture for field service teams or blockchain-based audit trails for regulated industries.

Across the board, these companies are placing a premium on continuous innovation cycles, delivering monthly feature updates, transparent roadmaps, and extensive developer ecosystems. Their competitive differentiation lies in balancing technological leadership with operational maturity, ensuring that innovations translate into real-world outcomes for diverse user personas.

This comprehensive research report delivers an in-depth overview of the principal market players in the Document Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accurent

- Ademero, Inc.

- Adobe Inc.

- Amazon Web Services, Inc.

- Box, Inc.

- Canon Inc.

- Dropbox, Inc.

- FileHold Systems Inc.

- Hyland Software, Inc.

- IBM Corporation

- Konica Minolta, Inc.

- Kyocera Document Solutions Inc.

- Laserfiche, LLC

- LSSP Corporation

- M-Files Corporation

- MasterControl Solutions, Inc.

- Microsoft Corporation

- OpenText Corporation

- Oracle Corporation

- Ricoh Company, Ltd.

- SAP SE

- Tungsten Automation Corporation

- Xerox Holdings Corporation

- Zoho Corporation Pvt. Ltd.

Implementing Strategic Roadmaps and Best Practices to Enhance Document Management Resilience, Drive Innovation and Ensure Sustainable Organizational Performance

Industry leaders should prioritize a cloud-first document management roadmap that emphasizes modularity and continuous improvement. By selecting platforms that support both public and hybrid cloud models, organizations can optimize cost structures and maintain business continuity, even amid trade-related hardware disruptions. A deliberate focus on API-based integrations will enable seamless data flow between document repositories, collaboration suites, and enterprise applications, fostering cross-functional synergy.

Embedding artificial intelligence and analytics within document workflows is equally critical. Automated classification, smart search, and predictive compliance alerts reduce manual bottlenecks and enhance decision-making speed. Organizations should partner with solution providers offering built-in AI services or open frameworks that allow bespoke model training on proprietary datasets, ensuring alignment with specific operational contexts.

To fortify security and governance, enterprises must adopt zero-trust access controls, continuous identity verification, and comprehensive audit capabilities. Proactive risk management-through automated policy enforcement and real-time monitoring-ensures that sensitive content remains protected across internal and external collaborations. Regular security assessments, combined with incident response playbooks, will help teams mitigate emerging threats and demonstrate compliance to regulators.

Finally, empowering business users through low-code workflow automation and extensive training programs accelerates adoption and promotes sustainable change management. By establishing center-of-excellence communities and providing role-based learning paths, organizations can cultivate digital champions who drive continuous process optimization and foster a culture of innovation.

Detailing Rigorous Research Methodology Integrating Primary and Secondary Insights to Deliver Credible Findings on Document Management System Dynamics

This research leverages a dual approach, combining primary engagements with industry stakeholders and rigorous secondary analysis. Primary data collection involved structured interviews with CIOs, IT directors, and compliance officers across multiple verticals, capturing firsthand perspectives on emerging challenges and technology adoption patterns. In parallel, vendor briefings and solution demonstrations provided insights into roadmap priorities, feature trajectories, and service models.

Secondary research encompassed a thorough review of peer-reviewed journals, reputable technology publications, and public filings, ensuring a comprehensive baseline of market knowledge. We cross-referenced technical white papers, regulatory documentation, and thought leadership pieces to validate observed trends and to contextualize evolving policy landscapes. This triangulation process underpins the report’s credibility by aligning qualitative insights with documented evidence.

Data synthesis was guided by a structured framework that maps segmentation variables-such as component mix, document type, application area, industry vertical, deployment preference, and organizational scale-to observed adoption behaviors. Regional analyses were refined through the examination of local regulations, infrastructure availability, and competitive dynamics. Throughout, key findings were subjected to peer review by senior analysts to ensure accuracy and objective interpretation.

These methodological rigor and transparency measures guarantee that the resulting insights accurately reflect the complex interplay of technology, policy, and user requirements shaping the modern document management domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Document Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Document Management System Market, by Component

- Document Management System Market, by Document Type

- Document Management System Market, by Application

- Document Management System Market, by Industry Vertical

- Document Management System Market, by Deployment Type

- Document Management System Market, by Organization Size

- Document Management System Market, by Region

- Document Management System Market, by Group

- Document Management System Market, by Country

- United States Document Management System Market

- China Document Management System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings and Strategic Imperatives to Empower Decision Makers in Navigating Document Management Challenges and Future Opportunities

The document management landscape stands at a pivotal juncture, driven by the intersecting forces of digital transformation, evolving regulatory demands, and trade-driven infrastructure challenges. Organizations that embrace cloud-native architectures, harness AI-enabled automation, and fortify security and governance frameworks will unlock new levels of operational agility and resilience. At the same time, they must remain mindful of regional nuances-whether privacy regulations in Europe, infrastructure constraints in emerging markets, or competitive innovations in Asia-Pacific.

Segmented insights reveal that success hinges on aligning platform capabilities with the specific needs of each user persona, from high-volume financial services firms to agile small businesses, and from government agencies requiring bullet-proof audit trails to retail operations prioritizing fast content turnaround. A one-size-fits-all approach no longer suffices; instead, tailored solutions underpinned by modular services and flexible deployment models are essential.

The cumulative impact of 2025 tariff measures further underscores the importance of strategic sourcing decisions and cloud migration strategies. By shifting much of the hardware burden onto service providers and by adopting consumption-based pricing, organizations can shield themselves from future supply-chain shocks. Simultaneously, continuous evaluation of emerging security threats and compliance landscapes will ensure that document management systems remain both a catalyst for innovation and a bastion of trust.

In sum, informed decision makers can leverage the insights and recommendations in this report to chart a clear path forward, transforming document management from a back-office function into a strategic enabler of competitive advantage.

Connect with Ketan Rohom to Secure Exclusive Access to Comprehensive Market Intelligence and Unlock Strategic Advantages in Document Management Today

Don’t miss the opportunity to gain a definitive edge in document management by connecting with Ketan Rohom today. As Associate Director of Sales & Marketing, Ketan is ready to guide your team through the wealth of insights contained in this comprehensive market research report, ensuring you receive bespoke support tailored to your unique operational challenges and strategic ambitions. Whether you seek in-depth segmentation analysis, nuanced regional evaluations, or forward-looking recommendations, this report delivers the actionable intelligence you need to make informed decisions and stay ahead of competitive pressures. Reach out now to secure your copy, unlock exclusive advisory sessions, and set your organization on a path to maximizing efficiency, mitigating risk, and capitalizing on emerging opportunities within the document management landscape.

- How big is the Document Management System Market?

- What is the Document Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?