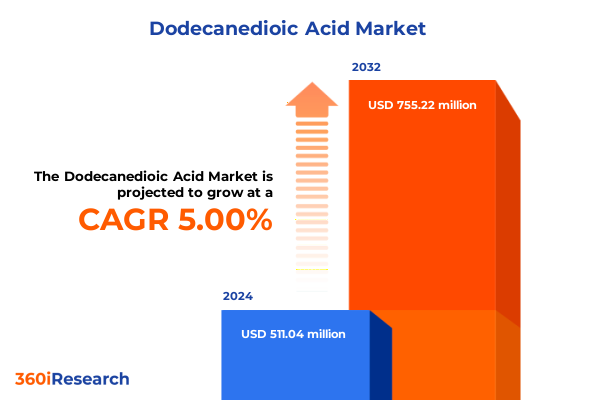

The Dodecanedioic Acid Market size was estimated at USD 536.18 million in 2025 and expected to reach USD 563.54 million in 2026, at a CAGR of 5.01% to reach USD 755.22 million by 2032.

Unveiling the Dual Production Pathways and Evolving Strategic Importance of Dodecanedioic Acid in Contemporary Specialty Chemicals

Over the past decade, dodecanedioic acid (DDDA) has become a cornerstone in the formulation of high-performance polymers, coatings, and specialty chemicals. Its unique molecular structure, featuring two terminal carboxyl groups separated by a twelve-carbon chain, imparts exceptional flexibility, thermal stability, and chemical resistance, making it indispensable for engineering applications. While petrochemical pathways historically dominated production, recent advances in bioprocessing have unlocked bio-based routes that leverage renewable feedstocks such as palm kernel and coconut oils. This dual availability underscores a pivotal transition in the industry, driven by the imperative for sustainability and supply chain resiliency. RSC research highlights that commercial production volumes of DDDA reached approximately 70 kilotonnes per annum as of 2018, with bio-based and synthetic processes each contributing substantial shares of the market, showcasing commercial viability at scale.

Moreover, the surge in global environmental regulations and corporate decarbonization targets has catalyzed adoption of bio-sourced DDDA, which offers lower carbon intensity compared to its petroleum-derived counterpart. Industry analysts note that microbial oxidation and fermentation technologies now deliver high-purity DDDA, meeting stringent performance criteria for applications ranging from polyamides to powder coatings. These technological breakthroughs, coupled with expanding capacity expansions in North America and Asia, signal a paradigm shift toward greener supply chains. In parallel, strategic collaborations between chemical manufacturers, biotechnology firms, and methanol-to-fatty acid innovators are accelerating commercialization timelines, setting the stage for DDDA’s broader penetration into automotive, electronics, and consumer goods segments.

In this context, the dodecanedioic acid market stands at a confluence of material science innovation, regulatory dynamics, and evolving end-user demand. The subsequent sections of this executive summary unpack the transformative trends, policy impacts, segmentation nuances, regional dynamics, leading competitors, and strategic imperatives that will define the next phase of DDDA’s growth trajectory.

Exploring the Cutting-Edge Technological, Supply Chain, and Sustainability-Driven Dynamics Reshaping the Dodecanedioic Acid Ecosystem

The landscape of dodecanedioic acid production and distribution is undergoing profound transformations driven by technological breakthroughs and shifting market imperatives. On one front, bioprocessing innovations have elevated fermentation and microbial oxidation techniques, enabling cost-effective, high-purity DDDA manufacture at commercial scale. Partnerships such as the one forged by BASF’s Care Chemicals division with Acies Bio demonstrate how synthetic biology platforms can convert renewable methanol and captured carbon into fatty acids, thereby reinforcing a circular economy ethos while reducing reliance on petrochemical feedstocks. Concurrently, the rapid expansion of bio-based polyesters, notably PBAT and PTA, underscores an emerging segment that leverages DDDA’s biodegradability and performance parity with conventional polymers to meet stringent environmental targets in packaging and textile applications.

Equally significant are supply chain realignments prompted by global geopolitics and energy price volatility. The volatile pricing of key raw materials such as butadiene and adipic acid has spurred manufacturers to diversify feedstock portfolios, shifting portions of production toward bio-sourced routes. This rebalancing is complemented by investments in regional capacity expansions, particularly in Asia, where downstream processing hubs are scaling up to capture growth in automotive and electronics industries. Meanwhile, procurement strategies are evolving to incorporate dual-sourcing arrangements and vertical integration models, enhancing resilience against trade disruptions. Taken together, these shifts are redefining competitive dynamics, favoring agile players that can integrate technological innovation with robust supply chain strategies.

Assessing the Compound Impact of 2025 U.S. Tariff Measures and Reciprocal Trade Policies on Dodecanedioic Acid Supply Chains and Cost Structures

The imposition of sweeping tariff measures by the United States in 2025 has introduced an unprecedented cost headwind for import-dependent segments of the dodecanedioic acid supply chain. Following proclamations that elevated ad valorem duties from 10 percent to 25 percent on specified chemical derivatives-effective as of March 12, 2025-the cumulative burden on materials such as DDDA imported from key trading partners has surged, prompting immediate reassessments of sourcing strategies. Simultaneously, the broader application of universal “reciprocal tariffs” under the International Emergency Economic Powers Act, averaging 10 percent on all imported goods, further compounds input costs for domestic manufacturers reliant on overseas feedstocks. These layered tariffs have collectively driven procurement costs up by double-digit percentages for certain import-exposed companies, squeezing margins and accelerating the offshoring of reactive chemical capacities back to North America and Europe.

Moreover, the accelerated tariff schedule has led to material delays and inventory buildups as logistics providers and port operators adapt to new compliance protocols. Chemical processors now contend with extended lead times and elevated landed costs, spurring a recalibration toward locally sourced or vertically integrated production models. In response, several market participants have accelerated investments in onshore DDDA facilities, aligning capital expenditures with the goal of mitigating trade-policy risks. The net effect of these policy shifts is a reconfiguration of the global DDDA value chain, characterized by enhanced domestic capacity, strategic alliances between feedstock producers and converters, and a renewed emphasis on tariff engineering to optimize supply routes.

Deciphering the Multi-Dimensional Segmentation Landscape Driving Tailored Insights and Product Positioning in the Dodecanedioic Acid Marketplace

A detailed examination of segmentation across application, end-use industry, purity grade, form, and distribution channel reveals distinct growth drivers and competitive landscapes within the dodecanedioic acid market. When viewed through the application lens, DDDA’s utility spans from adhesives and sealants to coatings, lubricants, plasticizers, polyamide, and polyester resins, each category exhibiting unique performance requirements and margin profiles. In adhesives and sealants, for example, formulation specialists prioritize tack and adhesion, whereas polyamide and polyester resin producers focus on molecular weight distribution and crystallinity control.

Turning to end-use industries, the automotive sector continues to demand high-performance polymer precursors for under-the-hood components and vibration-damping applications, while electrical and electronics manufacturers leverage DDDA-derived polyamides for connectors and insulators. Packaging producers, meanwhile, are increasingly integrating DDDA into biodegradable film and molded products, aligning with sustainability mandates. The segmentation by purity grade underscores a clear bifurcation: industrial grade DDDA underpins most commodity applications, whereas medical grade variants-characterized by stringent impurity thresholds-serve niche markets in pharmaceuticals and medical devices.

Form factor also plays a pivotal role, as the granular and flake presentations facilitate downstream handling and melt-processing consistency, while powder formulations offer superior reactivity in catalyzed polymerization systems. Finally, the distribution channel dynamic oscillates between direct sales agreements, which provide high-volume purchasers with supply security and technical support, and distributor networks that enable rapid response to spot market fluctuations. Understanding these intersecting segmentation dimensions is instrumental for stakeholders seeking to tailor product portfolios and optimize go-to-market strategies.

This comprehensive research report categorizes the Dodecanedioic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Form

- Application

- End Use Industry

- Distribution Channel

Profiling Regional Dynamics and Growth Drivers Influencing Dodecanedioic Acid Demand Across the Americas, EMEA, and Asia-Pacific

Regional dynamics in the dodecanedioic acid market are shaped by differing regulatory frameworks, feedstock availability, and end-use demand profiles across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a robust chemical manufacturing base, supported by abundant petrochemical feedstocks and advancing biomanufacturing infrastructure, has fostered a balanced portfolio of synthetic and bio-based DDDA production. Government incentives and R&D investments in sustainable chemicals have further reinforced North America’s role as both a consumption hub and an innovation leader.

Across Europe, Middle East & Africa, energy and feedstock costs, coupled with stringent environmental regulations, exert pressure on conventional DDDA producers. At the same time, policy frameworks such as the European Green Deal are accelerating the adoption of bio-based monomers, driving capital deployment into fermentation-based DDDA plants in regions with renewable energy potential. The Middle East, buoyed by integrated petrochemical complexes and expanding logistics corridors, serves as a strategic export platform for both commodity and specialty grades of DDDA to adjacent markets.

Asia-Pacific emerges as the fastest-growing region, underpinned by large-scale chemicals production capacities in China, South Korea, Japan, and India. As China continues to command over 40 percent of global chemical output, investments in advanced downstream processing for engineering polymers have elevated local DDDA consumption. Emerging economies within Southeast Asia and South Asia are likewise ramping up capacities to meet burgeoning demand in automotive components, electronics assembly, and packaging. This confluence of scale, cost competitiveness, and market demand cements Asia-Pacific as a critical growth engine for the global DDDA industry.

This comprehensive research report examines key regions that drive the evolution of the Dodecanedioic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Petrochemical and Biotechnology Firms in the Dodecanedioic Acid Value Chain

The competitive landscape for dodecanedioic acid is characterized by a blend of established petrochemical giants and agile bioscience innovators. BASF SE stands at the forefront of green chemistry initiatives, leveraging its OneCarbonBio platform to convert captured carbon and renewable methanol into critical fatty acids, including DDDA. This strategic collaboration with Acies Bio underscores BASF’s drive to integrate synthetic biology into its supply chains and reduce carbon footprints across its materials portfolio.

Meanwhile, Cathay Industrial Biotech has demonstrated commercialized bio-based DDDA production at scale, achieving 100 percent biomass-derived output in March 2024 and showcasing the feasibility of fermentation processes for long-chain diacids. This milestone highlights the growing competitiveness of bio-routes against conventional petrochemical synthesis. Evonik and UBE Industries continue to advance proprietary catalytic and oxidative processes, focusing on yield optimization and impurity control to serve high-purity market segments in nylon and specialty resins. Additionally, Merck KGaA’s launch of a new DDDA product line in January 2023 has broadened application scopes in coatings, adhesives, and nylon production, reinforcing its position in the fine chemicals arena.

Smaller players such as Verdezyne, despite past restructuring, maintain a pipeline of fermentation-derived diacid technologies that could reemerge as strategic assets under renewed investment. Collectively, these companies are shaping the future DDDA landscape through a mix of capacity expansions, technology licensing, and sustainability-focused partnerships. A clear competitive edge will favor organizations that can seamlessly integrate end-to-end value chain control with eco-efficient production methodologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dodecanedioic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acadechem Company Limited

- Azelis Americas, LLC

- BASF SE

- Biosynth International, Inc.

- Cathay Biotech Inc.

- ChemCeed LLC

- Corvay GmbH

- Haihang Industry Co., Ltd.

- Hairui Chemical

- INVISTA

- LGC Limited

- Merck KGaA

- Muscat chemical

- Santa Cruz Biotechnology, Inc.

- Selleck Chemicals

- Shandong Guangtong New Materials Co., Ltd.

- Spectrum Laboratory Products, Inc

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Toronto Research Chemicals Inc

- UBE Corporation

- Verdezyne, Inc

- VWR International, LLC

- Zibo Guangtong Chemical Co., Ltd

Strategic and Operational Roadmap for Enhancing Supply Chain Resilience, Sustainability, and Innovation in the Dodecanedioic Acid Industry

To navigate the complexities of today’s dodecanedioic acid market, industry leaders should implement a multidimensional strategy that balances cost efficiency, sustainability, and resilience. First, companies must diversify feedstock sources by establishing alliances with bio-based feedstock suppliers while optimizing existing petrochemical routes. Second, targeted investments in modular, flexible production units will enable rapid capacity scaling and facilitate technology upgrades as process innovations emerge.

Third, proactive tariff engineering-such as leveraging free trade agreements and securing tariff exclusions-can mitigate import cost volatility and optimize global sourcing footprints. In parallel, forging cross-sector partnerships with end-use stakeholders, including automotive OEMs and electronics manufacturers, will drive co-development of DDDA-based solutions tailored to specific performance and sustainability criteria. Further, embedding life-cycle assessment frameworks and circular economy principles into product development cycles will enhance market acceptance among increasingly eco-conscious buyers.

Finally, fostering a culture of continuous innovation through collaborative R&D programs and participation in industry consortia will ensure rapid adoption of emerging bioprocessing, catalysis, and digital monitoring technologies. By executing these strategic and operational recommendations, stakeholders can capitalize on evolving market opportunities while safeguarding against policy shifts, raw material disruptions, and competitive pressures.

Outlining a Robust Mixed-Methodology Approach Utilizing Primary Interviews, Secondary Data Analysis, and Quantitative Modeling to Evaluate the Dodecanedioic Acid Market

This analysis is grounded in a rigorous research methodology that amalgamates primary and secondary data sources to ensure comprehensive market coverage and analytical integrity. Primary research comprised in-depth interviews with key executives across polymer producers, chemical distributors, and research institutions, providing qualitative insights into current challenges, procurement priorities, and technology adoption timelines.

Secondary research involved a meticulous review of industry publications, trade association reports, patent filings, and regulatory announcements to capture macroeconomic indicators, trade policy developments, and sustainability mandates. Data triangulation techniques were applied to reconcile information across multiple sources, ensuring robustness in segmentation analysis and trend validation. Supply-chain mapping exercises identified critical nodes and bottlenecks, enabling targeted assessment of tariff impacts and logistical risks.

Quantitative analyses employed statistical modeling and scenario planning to evaluate the sensitivity of market drivers-such as feedstock price fluctuations and regulatory changes-on DDDA demand trajectories. The result is a data-driven, actionable intelligence framework designed to support strategic decision-making for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dodecanedioic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dodecanedioic Acid Market, by Purity Grade

- Dodecanedioic Acid Market, by Form

- Dodecanedioic Acid Market, by Application

- Dodecanedioic Acid Market, by End Use Industry

- Dodecanedioic Acid Market, by Distribution Channel

- Dodecanedioic Acid Market, by Region

- Dodecanedioic Acid Market, by Group

- Dodecanedioic Acid Market, by Country

- United States Dodecanedioic Acid Market

- China Dodecanedioic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights on Navigating Strategic Imperatives and Growth Opportunities in the Evolving Dodecanedioic Acid Market Landscape

Dodecanedioic acid stands at the nexus of performance chemistry and sustainable innovation, with its dual synthetic and bio-based production pathways offering a blueprint for circular materials. The convergence of escalating tariff regimes, technological advancements in bioprocessing, and heightened environmental imperatives underscores both challenges and opportunities ahead. Market participants who proactively adapt feedstock strategies, invest in modular capacities, and engage in collaborative innovation will lead in capturing growth across diversified application and regional segments.

As the industry evolves, the ability to navigate policy landscapes, align with end-use sustainability targets, and deploy cutting-edge production technologies will dictate competitive positioning. By integrating the insights and recommendations detailed herein, decision-makers can chart a course toward resilient, cost-effective, and environmentally responsible growth in the dynamic dodecanedioic acid market.

Contact Ketan Rohom to Access Exclusive Dodecanedioic Acid Market Research and Unlock Critical Strategic Insights

Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive Dodecanedioic Acid market research report. Gain exclusive access to in-depth analysis, strategic insights, and actionable recommendations tailored for industry decision-makers. Let Ketan guide you through subscription options, customization services, and licensing models that align with your organization’s needs. Contact him today to unlock robust data, expert perspectives, and market intelligence that will equip your business for sustained growth and competitive advantage in the evolving landscape of dodecanedioic acid.

- How big is the Dodecanedioic Acid Market?

- What is the Dodecanedioic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?