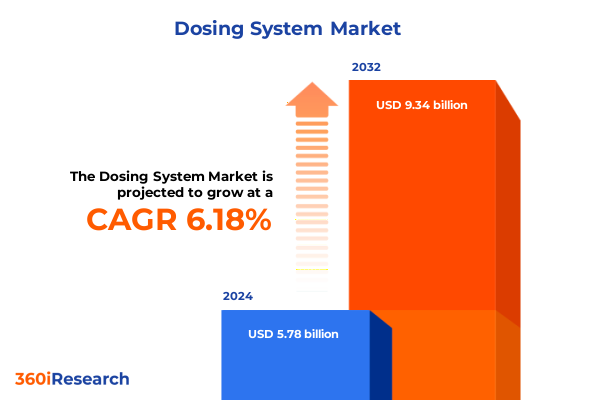

The Dosing System Market size was estimated at USD 6.04 billion in 2025 and expected to reach USD 6.31 billion in 2026, at a CAGR of 6.42% to reach USD 9.34 billion by 2032.

Navigating the Evolving Landscape of Dosing Systems With a Comprehensive Overview of Key Drivers Innovations and Strategic Imperatives Shaping Future Healthcare Delivery

The dosing systems market is at a pivotal juncture, driven by the intersection of technological advancement, regulatory evolution, and shifting patient expectations. Growing emphasis on patient-centric care has propelled demand for precision delivery solutions that enhance therapeutic outcomes while simplifying administration. Simultaneously, digital health platforms, remote monitoring technologies, and smart connectivity features are rapidly being incorporated into next-generation systems to improve adherence, safety, and data interoperability.

Against this backdrop, stakeholders must navigate a complex environment characterized by stringent compliance requirements, disruptive new entrants, and global supply chain challenges. This executive summary offers a concise yet comprehensive overview of the most critical trends shaping the landscape today. From the rise of self-injection devices to the emergence of novel pulmonary and topical delivery modalities, the analysis highlights the factors redefining competitive advantage and outlines the strategic levers industry participants can deploy for lasting success.

With a focus on actionable insights rather than volumetric metrics, this introduction frames the discussions that follow, providing readers with a clear understanding of the forces at play and a roadmap for interpreting the subsequent deep-dive analyses. Whether you are a manufacturer, distributor, investor, or healthcare provider, this summary equips you with the context necessary to anticipate market shifts and make informed decisions.

Uncovering the Paradigm Shifts Driving Dosing System Evolution Through Regulatory Advances Patient Empowerment and Technological Integration

Over the past several years, the dosing systems arena has undergone a profound transformation underpinned by rapid technology adoption and changing stakeholder priorities. The integration of Internet of Medical Things (IoMT) features into auto-injectors and infusion pumps has enabled real-time monitoring of patient adherence and device performance, fostering a more proactive approach to therapy management. Remote patient monitoring coupled with artificial intelligence–driven analytics now facilitates early intervention and personalized dosing regimens that minimize adverse events.

In parallel, regulatory bodies have accelerated the approval pathways for digital and combination products, reflecting a broader trend toward supporting innovation that enhances patient safety and outcomes. The advent of simplified pre-filled syringes and wearable patches with embedded sensors has further elevated expectations around ease of use and patient engagement. Manufacturers are now collaborating with software developers and payers to bundle smart delivery systems with value-based care models, aligning economic incentives with improved clinical results.

As these transformative shifts continue to gain momentum, companies must adapt by reimagining traditional product portfolios and forging cross-industry partnerships. New entrants are capitalizing on modular design platforms that can be rapidly customized for different drug formulations, while incumbents are investing heavily in digital ecosystems to maintain relevance. This tectonic evolution highlights the importance of agile innovation strategies and underscores the competitive advantage of organizations that can seamlessly blend hardware, software, and data services.

Assessing the Ripple Effects of 2025 United States Tariffs on the Dosing Systems Market Including Supply Chains Cost Structures and Competitive Dynamics

The implementation of new tariffs by the United States in early 2025 has introduced fresh complexities for global dosing system manufacturers and their supply networks. Increased duties on imported components have amplified input costs for devices reliant on specialized plastics, electronic sensors, and glass cartridges. This has prompted many suppliers to reassess their manufacturing footprints, seeking to mitigate exposure by diversifying production across lower-tariff jurisdictions or by onshoring critical assembly processes.

These adjustments have had a trickle-down effect on pricing strategies and margin structures throughout the value chain. Device makers have been compelled to engage in proactive negotiations with contract manufacturers and to explore vertical integration opportunities to safeguard against future tariff fluctuations. Concurrently, distributors and healthcare providers have experienced shifts in inventory management practices as lead times lengthen and cost pressures mount, reinforcing the need for transparent supplier partnerships and dynamic procurement frameworks.

Looking ahead, the ability to anticipate policy changes and to model their financial impact will be crucial for preserving competitive positioning. Organizations that invest in advanced supply chain analytics and strategic sourcing capabilities can better absorb tariff-related shocks while maintaining service levels. Ultimately, the cumulative impact of the 2025 tariff measures underscores the critical importance of resilience and flexibility in the dosing systems ecosystem.

Decoding Market Segmentation Insights Across Product Technology End User and Distribution Dimensions to Reveal Growth Opportunities and Investment Priorities

A nuanced understanding of market segmentation is essential for identifying growth pockets and tailoring value propositions to distinct customer needs. When dissecting the market by product type, it is evident that injectable dosing systems remain a cornerstone segment, with auto-injectors gaining traction due to their user-friendly design and growing acceptance in self-administration settings. Pre-filled syringes and vial and syringe combinations continue to serve high-volume therapeutic categories, but innovators are focusing on modular platforms that can accommodate biologics and complex formulations. In the oral segment, liquid dispensers, powder dispensers, and tablet dispensers offer low-cost alternatives, yet they face competitive pressure from digital adherence tools that monitor dosing events.

The technology landscape further refines these distinctions: infusion pumps and metered dose inhalers deliver high precision for hospital and home settings, whereas pre-filled syringes, available in glass and plastic cartridge subtypes, strike a balance between disposability and performance. Dry powder inhalers, metered dose inhalers, and nebulizers each possess unique attributes that align with specific respiratory therapies, influencing manufacturer go-to-market strategies.

Who ultimately administers these products also influences demand dynamics. Clinics and large hospitals prioritize scalability and integration with electronic health record systems, while home care environments seek portability and ease of use. Small hospitals and specialty centers often demand cost-effective, off-the-shelf solutions with minimal training requirements. Distribution channels add yet another dimension: direct sales enable high-touch customer engagement, while distributors-both national and regional-extend reach into diverse markets. Online retailers and traditional pharmacies offer convenient access for patient-purchased products, shaping omnichannel distribution models.

Strategic investors and executives must therefore align their portfolios with the specific requirements of each segment, calibrating R&D priorities and commercial tactics to capture value across these intersecting dimensions.

This comprehensive research report categorizes the Dosing System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Distribution Channel

Analyzing Regional Dynamics of the Dosing Systems Market Across the Americas Europe Middle East And Africa and Asia Pacific to Identify Tailored Growth Strategies

Regional variations in regulatory frameworks, healthcare infrastructure, and payer systems have produced distinct market dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, mature reimbursement pathways and a strong emphasis on chronic disease management have fostered early adoption of connected dosing systems, with an expanding array of partnership models between device makers and digital health start-ups. Meanwhile, supply chain resilience has become a strategic imperative, spurring localized manufacturing and distribution networks.

Across Europe Middle East & Africa, policy harmonization initiatives and public health campaigns are driving wide-scale uptake of auto-injectors and pre-filled syringes, particularly in immunization and biologics administration. Regulatory convergence under regional blocks accelerates product launches, yet manufacturers must navigate varying national pricing and health technology assessment processes. In the Middle East and select African nations, public-private collaborations are enhancing access to advanced delivery systems, although infrastructure limitations may slow deployment timelines.

Asia-Pacific represents a heterogeneous mix of markets ranging from highly advanced systems in Japan and Australia to rapidly growing opportunities in Southeast Asia and India. Cost sensitivity and local manufacturing capabilities influence the adoption curve, with domestic players competing alongside multinational conglomerates. These regional pockets present both high-volume potential and unique challenges related to regulatory complexity, reimbursement policy, and distribution logistics.

Savvy industry participants will tailor their regional strategies by combining global best practices with localized commercial models, ensuring that product configurations, pricing frameworks, and channel partnerships align with the specific needs of each geography.

This comprehensive research report examines key regions that drive the evolution of the Dosing System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players’ Strategic Initiatives Collaborations And Innovation Portfolios That Are Shaping The Competitive Dosing Systems Arena

Key industry participants have adopted a diverse set of strategies to secure market leadership and foster sustained growth in the competitive dosing systems sector. Leading medical device corporations are accelerating investments in smart device portfolios, integrating sensors and connectivity to differentiate their offerings. Strategic alliances between device manufacturers and digital health innovators are becoming more commonplace, enabling the co-development of platforms that merge hardware precision with predictive analytics capabilities.

Simultaneously, established players have pursued bolt-on acquisitions to expand their therapeutic footprint and to gain access to novel drug-device combination technologies. These transactions not only fortify product pipelines but also facilitate cross-selling opportunities through existing distribution networks. In parallel, pure-play injector specialists and niche inhalation device companies are carving out defensible positions by focusing on specific therapeutic areas and by leveraging lightweight manufacturing processes to bring customizable solutions to market at accelerated speeds.

Collaborative research agreements with biopharmaceutical firms are yielding co-branded smart delivery systems, aligning device innovation cycles with drug development timelines. This trend underscores the importance of interoperability standards and shared data governance frameworks, as stakeholders seek to harness real-world evidence to support regulatory filings and to inform payer negotiations. Lastly, customer engagement programs and outcomes-based contracting models have emerged as critical differentiators, particularly in markets where payers demand demonstrable value beyond traditional product specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dosing System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue-White Industries, Ltd.

- Cetoni GmbH

- Dover Corp.

- DXP Pacific

- EMEC S.r.l.

- Gemmecotti srl

- Grosvenor Pumps

- Grundfos Holding A/S

- Idex Corporation

- Ingersoll Rand Inc.

- Iwaki Co Ltd

- LEWA GmbH

- Magnatex Pumps, Inc.

- Minimax Pumps Pvt. Ltd.

- Netzsch Pumpen System GmbH

- Nikkiso Co., Ltd.

- Prominent GmbH

- Seko SpA

- Sera GmbH

- Takasago Holdings, Inc.

- Verder International, Inc.

- W.E.S. Ltd.

- Walchem Corp.

Delivering Actionable Recommendations For Industry Leaders To Drive Innovation Optimize Supply Chains And Capitalize On Emerging Dosing System Market Trends

To capitalize on the rapidly evolving dosing systems landscape, industry leaders should prioritize the integration of digital health capabilities with core device platforms. Investing in sensor technologies and secure connectivity protocols will enable the generation of actionable adherence and performance data, creating new value propositions for payers and providers. In tandem, organizations must strengthen supply chain resilience by leveraging advanced analytics to model tariff scenarios, optimize inventory buffers, and identify near-shore manufacturing partners.

Moreover, cultivating strategic partnerships across the healthcare ecosystem can accelerate innovation cycles and expand market reach. Alliances with software vendors, contract research organizations, and leading biopharmaceutical companies can facilitate co-development initiatives that align device functionalities with evolving treatment paradigms. It is equally critical to enhance regulatory foresight by engaging proactively with health authorities and by shaping emerging standards for combination products and digital therapeutics.

On the commercial front, adopting omnichannel go-to-market strategies will be essential to address the diverse preferences of clinics, hospitals, pharmacies, and home care providers. Tailoring engagement models to each end-user segment-whether through dedicated sales teams, distributor networks, or online channels-will maximize market penetration and customer satisfaction. Finally, embedding robust post-market surveillance and outcomes measurement capabilities into product lifecycles will support value-based contracting and foster long-term payer confidence.

Outlining A Rigorous Research Methodology Combining Primary Engagements Secondary Analysis And Quantitative Assessments To Ensure Robust Market Insights

This report employs a multi-layered research methodology designed to ensure the rigor and reliability of its findings. Primary research activities comprised in-depth interviews with senior executives at device manufacturers, technology integrators, contract manufacturers, and key opinion leaders in clinical care settings. These conversations provided critical insights into strategic priorities, innovation roadmaps, and perceived market barriers.

Secondary research encompassed a thorough review of publicly available sources such as regulatory filings, patent databases, corporate presentations, and peer-reviewed literature. Market data triangulation techniques were applied to synthesize information from multiple outlets, ensuring consistency and addressing potential discrepancies. Quantitative analyses incorporated shipment volumes, installed base metrics, and historical pricing trends to contextualize qualitative findings.

Validation workshops with cross-functional experts were conducted to test preliminary hypotheses and to refine scenario modeling. These sessions also facilitated the identification of emerging disruptors and blue-sky innovation themes. Throughout the process, strict quality control protocols- including data verification checks and methodological peer reviews-were upheld to deliver robust, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dosing System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dosing System Market, by Product Type

- Dosing System Market, by Technology

- Dosing System Market, by End User

- Dosing System Market, by Distribution Channel

- Dosing System Market, by Region

- Dosing System Market, by Group

- Dosing System Market, by Country

- United States Dosing System Market

- China Dosing System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Core Findings And Strategic Implications To Equip Stakeholders With Clear Insights For Navigating The Complex Dosing Systems Market Landscape

The dynamic evolution of the dosing systems market underscores the importance of agility, collaboration, and foresight. As digital health integration accelerates, manufacturers must continually reassess their value propositions and strategic partnerships to maintain a competitive edge. Tariff-driven supply chain uncertainties reinforce the need for diversification and advanced analytics to mitigate risk and to preserve service levels.

Segmentation insights reveal that targeted innovation across product, technology, end-user, and distribution dimensions will unlock new avenues for growth and differentiation. Regional analyses highlight the necessity of tailoring approaches to the unique regulatory and commercial landscapes of the Americas, Europe Middle East & Africa, and Asia-Pacific. Finally, the strategies employed by leading companies illustrate the critical role of smart devices, collaborative models, and outcomes-based engagements in shaping the future of dosing systems.

By leveraging the insights and recommendations presented herein, stakeholders are better equipped to navigate market complexities and to capitalize on emerging opportunities. The path forward requires a balanced blend of innovation, operational excellence, and strategic alignment with healthcare ecosystem priorities.

Engage With Ketan Rohom To Access The Full Dosing Systems Market Executive Summary And Leverage Data-Driven Insights For Strategic Advantage

If you are looking to harness comprehensive insights that can inform critical decisions and accelerate growth in the dosing systems space, our detailed executive summary is the resource you need. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this report can illuminate market dynamics, reveal untapped opportunities, and support your organizational objectives. By partnering with Ketan, stakeholders will gain tailored guidance on strategic positioning, competitive benchmarking, and future-proof investment priorities. Reach out today to secure your copy of the report and begin leveraging data-driven insights for a sustainable competitive edge in the evolving dosing systems market.

- How big is the Dosing System Market?

- What is the Dosing System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?