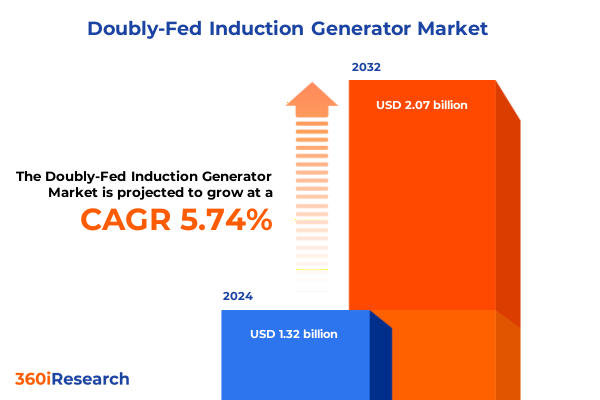

The Doubly-Fed Induction Generator Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.47 billion in 2026, at a CAGR of 5.77% to reach USD 2.07 billion by 2032.

Unveiling the Critical Role and Emerging Opportunities of Doubly-Fed Induction Generators in the Transition to Next-Generation Renewable Energy Systems

The introduction to the doubly-fed induction generator (DFIG) market foregrounds a pivotal moment in the trajectory of renewable energy generation technologies. As grid operators and project developers navigate the dual imperatives of reliability and flexibility, DFIG systems have emerged as a transformative solution capable of reconciling fluctuating wind patterns with stringent grid codes. By allowing variable-speed operation and controlled reactive power, DFIGs enable higher energy capture and improved voltage stability, addressing critical challenges in modern power systems.

Against this backdrop, stakeholders across the value chain-from turbine manufacturers to utility-scale developers-are recalibrating their strategies to leverage the inherent advantages of DFIG technology. Research networks and industry consortia are increasingly allocating resources toward enhancing converter designs, optimizing rotor-side control algorithms, and integrating advanced materials that reduce maintenance overhead. Consequently, this technology is shaping new project benchmarks related to capacity factor, power quality, and grid interconnection timelines.

Moreover, the convergence of policy support for decarbonization and the decline of lumpy capital costs for power electronics has propelled DFIGs into the mainstream. In tandem with evolving ancillary service markets, these machines are not only fulfilling energy production targets but also contributing to system resilience through dynamic voltage support. This comprehensive introduction sets the stage for a deeper exploration of the forces molding the DFIG arena.

Charting the Transformative Shifts Driving the Evolution of Doubly-Fed Induction Generators Across the Energy Landscape

Over the past decade, the DFIG landscape has undergone several transformative shifts, driven by both technological innovation and policy reform. Initially, the focus rested on mitigating mechanical stress through robust gearbox configurations and pioneering rotor-circuit topologies. However, recent advancements have expanded this focus toward integrated converter packages that offer seamless grid compliance and superior fault ride-through capabilities. These enhancements have not only refined the operational envelope of DFIG installations but have also cut commissioning timelines, enabling swifter project realization.

In parallel, the transition from traditional fixed-speed induction machines to power-electronic-enhanced configurations has redefined performance metrics. Enhanced cooling solutions and modular converter architectures have facilitated the deployment of mid-megawatt turbines outfitted with DFIG systems. These developments coincide with rising demand for turbines capable of sustaining output in low-wind regimes, thereby broadening site selection parameters and unlocking new geographic markets.

Complementing these technological strides is a shift in financing models. Lenders are now recognizing the lower volatility profile and positive cash flow potential afforded by DFIG projects with reactive power capabilities. Consequently, power producers are leveraging this perception to secure more competitive financing packages. Taken together, these transformative shifts underscore the dynamic interplay between innovation, market demand, and capital availability that continues to accelerate the evolution of the DFIG segment.

Assessing the Cumulative Impact of 2025 United States Tariffs on Doubly-Fed Induction Generator Supply Chains and Project Economics

The introduction of new United States tariffs in 2025 marks a significant inflection point for the DFIG supply chain and project economics. Tariffs levied on imported components-particularly converters, castings, and specialized steel-have the potential to raise turbine capital expenditures by several percentage points. Given that key subsystems are sourced from North American neighbors and select Asian markets, import duties have prompted developers to reevaluate sourcing strategies and consider near-shoring assembly operations.

Project owners have begun incorporating tariff risk into procurement contracts, carving out clauses that allow for pass-through of additional costs or supplier substitution. This reactive posture reflects the direct impact of a 25 percent levy on components from Canada and Mexico, alongside a 10 percent margin on certain Asian-origin goods. While some manufacturers have attempted to absorb duties through price adjustments and volume discounts, the resultant margin compression has, in some cases, delayed contract signing and shifted commissioning dates.

In response, supply chain actors are accelerating efforts to qualify domestic suppliers and retool existing facilities for localized converter production. These strategic pivots aim to mitigate exposure to potential future escalations and preserve project bankability. Simultaneously, industry alliances are advocating for tariff carve-outs on critical grid-support hardware, citing broader reliability objectives. As tariff negotiations continue and eligibility thresholds evolve, stakeholders must remain agile in their sourcing and financial planning to navigate the cumulative impacts on the DFIG market.

Deep Dive into Power Ratings, Generator Types, Cooling Methodologies and Application Verticals Shaping the DFIG Market Landscape

The DFIG market exhibits nuanced dynamics when examined through the lens of power rating segmentation. Units up to 1.5 megawatts occupy a distinct niche, serving distributed generation and off-grid applications where simplicity and cost-effectiveness reign supreme. Within that bracket, smaller variants under 750 kilowatts address remote microgrid needs, while the 750 kilowatt to 1.5 megawatt range targets community-scale projects. Transitioning upward, the 1.5 to 3 megawatt class has bifurcated into subcategories focused on mid-range turbines optimized for moderate wind regimes and high-output machines designed to capitalize on more robust wind corridors.

Above the 3 megawatt threshold, the market includes heavy-duty configurations tailored for utility-scale deployments. Turbines from three to five megawatts leverage advanced rotor dynamics for enhanced energy capture, while multi-megawatt platforms exceeding five megawatts push the boundaries of DFIG integration with high-capacity converters and specialized cooling systems. This granularity enables project developers to match resource profiles to the optimal machine class.

Beyond power rating, generator type segmentation delineates permanent magnet assisted designs, which boast higher efficiency and lower maintenance cycles, from wound rotor variants that offer proven reliability and modular repair pathways. In parallel, cooling method distinctions highlight air-cooled solutions favored for their simplicity against water-cooled systems selected in high-temperature or densely populated installations. Finally, application segmentation spans distributed generation projects, standalone power systems for remote or backup needs, and sprawling utility-scale parks that form the backbone of grid-level renewable portfolios. These interwoven segmentation dimensions underscore the tailored strategies manufacturers and developers employ to unlock performance and economic value across diverse use cases.

This comprehensive research report categorizes the Doubly-Fed Induction Generator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Rating

- Component

- Connectivity Type

- Installation Type

- End User

- Sales Channel

Exploring Regional Dynamics and Strategic Growth Drivers for Doubly-Fed Induction Generators Across Global Energy Zones

Regional dynamics exert a profound influence on the trajectory of DFIG adoption, reflecting divergent energy policies, resource endowments, and manufacturing footprints. In the Americas, especially in the United States, supportive renewable mandates and maturing supply chains have fostered a robust environment for mid-megawatt DFIG turbines, with local industrial capacity expansion underway to meet onshore wind pipeline objectives. This region also serves as a testing ground for grid-interactive converter functions, as system operators seek greater ancillary service contributions.

Across Europe, the Middle East and Africa, a mix of established offshore installations in northern Europe and burgeoning onshore ambitions in emerging markets underscores the strategic importance of DFIG reliability in diverse climatic contexts. Offshore projects leverage the ability of DFIG systems to deliver fault ride-through during grid disturbances, while onshore desert deployments in the Middle East rely on specialized cooling systems to maintain performance under extreme heat.

In the Asia-Pacific arena, rapid capacity additions in China and India underscore the scale potential for high-megawatt DFIG platforms, often paired with local supply networks that drive cost efficiencies. Southeast Asian nations are increasingly integrating DFIG-equipped turbines into hybrid renewable solutions, pairing wind with solar and energy storage to optimize capacity factors. These regional insights illustrate how geographic nuances shape technology priorities, regulatory incentives, and partnership strategies throughout the DFIG market.

This comprehensive research report examines key regions that drive the evolution of the Doubly-Fed Induction Generator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Steering Advances in Doubly-Fed Induction Generator Technology and Adoption

Leading companies within the DFIG sector have cultivated distinct competitive advantages through targeted investments and strategic alliances. Established turbine OEMs have enhanced their converter portfolios by forging partnerships with power electronics specialists, enabling accelerated time to market for next-generation DFIG systems. Concurrently, regional manufacturers have deepened their aftermarket service offerings by deploying digital condition-based monitoring platforms, creating recurring revenue streams through predictive maintenance contracts.

Innovation hubs have emerged around centers of excellence in Europe, North America and Asia, where cross-disciplinary research initiatives bring together material scientists, control engineers and grid integration experts. These collaborations have yielded breakthroughs in high-temperature superconducting rotor designs and silicon carbide converter modules, driving incremental improvements in efficiency and reliability. Meanwhile, several companies have pursued joint ventures to localize production of key subsystems, thus reducing lead times and shielding operations from tariff volatility.

As competition intensifies, market leaders are differentiating through comprehensive service ecosystems that include virtual commissioning, remote diagnostics and digital twin applications. These capabilities not only optimize lifecycle costs but also reinforce barriers to entry for newer players. The evolving corporate landscape underscores the importance of agility, technical prowess and strategic partnerships in defining leadership within the DFIG realm.

This comprehensive research report delivers an in-depth overview of the principal market players in the Doubly-Fed Induction Generator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Adani Energy Solutions Ltd

- CRRC Zhuzhou Electric Co.,ltd

- Envision Group

- Flender

- GE Vernova

- Goldwind Americas by Goldwind Science & Technology, Co., Ltd.,

- Hitachi Energy Ltd.

- Ingeteam S.A.

- Ming Yang Smart Energy Group

- Plexim GmbH

- Shanghai Electric Power Co., Ltd.

- Siemens AG

- Suzlon Energy Limited

- TD Power Systems

- Voith GmbH & Co. KGaA

- WEG S.A.

- XEMC Darwind B.V.

- Yalong Intelligent Equipment Group Co.,Ltd

Actionable Strategies for Industry Leaders to Optimize Supply Chains, Drive Innovation and Sustain Growth in the DFIG Sector

To thrive in the evolving DFIG market, industry leaders must embrace multifaceted strategic imperatives that span supply chain resilience, technological innovation and market outreach. Companies should prioritize diversification of component sourcing by nurturing relationships with regional converter manufacturers and forging supply-risk mitigation frameworks that include dual-sourcing agreements. This approach will help alleviate exposure to geopolitical headwinds and import duties.

At the same time, advancing product roadmaps for higher-power converters and next-generation rotor designs is essential. Firms should channel R&D resources toward integrating wide-bandgap semiconductors and refining control algorithms that enhance grid support functions. Such investments not only strengthen market positioning but also prepare the platform for evolving grid codes and more stringent reliability requirements.

Equally important is the cultivation of end-user partnerships through pilot projects that validate advanced DFIG capabilities under real-world conditions. Demonstration programs focusing on hybrid renewable sites or microgrid deployments can create reference cases that accelerate customer adoption. In parallel, establishing comprehensive digital service portfolios-featuring predictive analytics, remote tuning and lifecycle management tools-will drive sustained value capture and deepen customer engagement throughout the asset lifecycle.

Comprehensive Research Methodology Underpinning the Analysis of the Doubly-Fed Induction Generator Market Landscape

The research underpinning this analysis melds insights from primary and secondary sources to create a holistic view of the DFIG ecosystem. Primary research involved interviews with senior executives from OEMs, component suppliers and project developers, providing firsthand perspectives on technological roadmaps, regulatory impacts and competitive strategies. Complementing this, conversations with grid operators and financial stakeholders illuminated evolving market drivers and investment decision criteria.

Secondary data collection encompassed a thorough review of industry white papers, technical journals and regulatory filings to map historical deployment trends and anticipate future policy shifts. A cross-validation process reconciled disparate data points by triangulating information across multiple sources, ensuring analytical rigor. The segmentation framework was iteratively refined through expert workshops, aligning power rating, generator type, cooling methodology and application categories with real-world market behaviors.

Quantitative inputs-including tariff schedules and component lead-time metrics-were synthesized with qualitative insights to produce a balanced narrative. Throughout the methodology, key assumptions were tested via sensitivity scenarios to gauge the robustness of emerging insights. This systematic research approach ensures that the findings are grounded in empirical evidence and reflective of the dynamic forces reshaping the DFIG market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Doubly-Fed Induction Generator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Doubly-Fed Induction Generator Market, by Type

- Doubly-Fed Induction Generator Market, by Power Rating

- Doubly-Fed Induction Generator Market, by Component

- Doubly-Fed Induction Generator Market, by Connectivity Type

- Doubly-Fed Induction Generator Market, by Installation Type

- Doubly-Fed Induction Generator Market, by End User

- Doubly-Fed Induction Generator Market, by Sales Channel

- Doubly-Fed Induction Generator Market, by Region

- Doubly-Fed Induction Generator Market, by Group

- Doubly-Fed Induction Generator Market, by Country

- United States Doubly-Fed Induction Generator Market

- China Doubly-Fed Induction Generator Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings and Strategic Imperatives for Harnessing the Potential of Doubly-Fed Induction Generators in Energy Transition

This study culminates in a synthesis of pivotal insights and strategic imperatives for stakeholders across the DFIG value chain. By tracing the trajectory of technological innovation, it becomes clear that the integration of power-electronic converters and advanced rotor designs will define the next wave of performance improvements. Likewise, the stakeholder response to United States tariffs highlights the need for agile sourcing strategies and targeted domestic capacity expansion.

Segmentation analysis reveals that machine classes-from sub-megawatt assemblies to multi-megawatt behemoths-will continue to cater to distinct project archetypes, ensuring that developers can optimize financial and resource characteristics for a variety of use cases. Regionally, the interplay of policy incentives, grid requirements and manufacturing ecosystems underscores a differentiated set of priorities across the Americas, Europe, the Middle East & Africa and Asia-Pacific.

Collectively, these insights point toward a market where adaptability, technical sophistication and proactive risk management form the cornerstone of success. As the energy transition accelerates, stakeholders who align their strategies with these imperatives will be best positioned to capture the full potential of doubly-fed induction generators.

Engage with Ketan Rohom to Access the Definitive Market Research Report on Doubly-Fed Induction Generators and Drive Strategic Initiatives

To explore the full scope of opportunities and deepen your strategic advantage in the rapidly evolving market of doubly-fed induction generators, reach out to Ketan Rohom, Associate Director, Sales & Marketing. With personalized guidance and detailed insights tailored to your organization’s objectives, Ketan can facilitate access to the comprehensive market research report that will equip your team with actionable intelligence. Initiate a conversation today to secure your copy and harness the detailed analysis, proprietary data, and forward-looking perspectives that underpin informed decision-making in this dynamic sector.

- How big is the Doubly-Fed Induction Generator Market?

- What is the Doubly-Fed Induction Generator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?