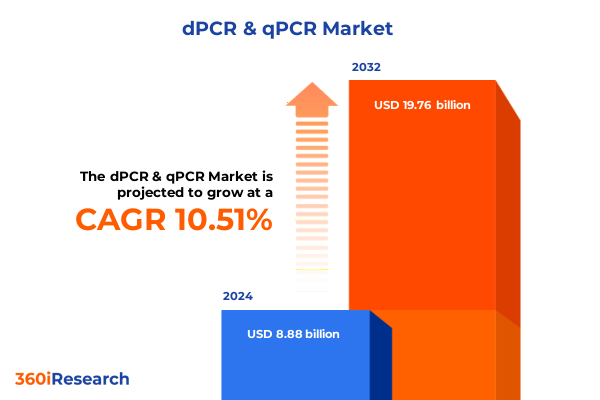

The dPCR & qPCR Market size was estimated at USD 9.80 billion in 2025 and expected to reach USD 10.81 billion in 2026, at a CAGR of 10.53% to reach USD 19.76 billion by 2032.

Unveiling the Next Frontier of Molecular Analysis: Digital and Quantitative PCR Driving Precision, Sensitivity, and Revolutionary Discoveries

Since its inception, polymerase chain reaction has redefined molecular biology by enabling researchers to amplify minute strands of DNA into quantities sufficient for detailed analysis. Quantitative PCR has provided real-time measurement of nucleic acid levels, offering relative quantification across a wide dynamic range. Meanwhile, digital PCR has emerged as the gold standard for absolute quantification, partitioning samples into thousands of individual reactions to allow precise detection of rare targets. Together, these complementary technologies have ushered in a new era of sensitivity and reproducibility, underpinning breakthroughs in fields from oncology research to environmental monitoring.

This executive summary distills the pivotal developments shaping the digital and quantitative PCR landscape, identifying the technological innovations that are driving methodological shifts. It examines the broader policy environment, including the effects of recent United States tariff changes, and delivers in-depth segmentation and regional analyses to clarify market nuances. In addition, key insights into leading industry participants and actionable recommendations for strategic decision-makers will provide the foundation for informed investments and partnership strategies. By navigating this synthesis, readers will gain a comprehensive understanding of the forces accelerating the adoption and evolution of digital and quantitative PCR platforms.

Unraveling Paradigm-Changing Advances in PCR Technology That Redefine Sensitivity, Speed, and Scalability to Propel Molecular Science into a New Era

Over the past five years, the PCR industry has witnessed a series of paradigm-shifting advances that are elevating laboratory performance to unprecedented levels. Integration of automated sample processing has accelerated throughput while minimizing human error, paving the way for large-scale studies that once seemed out of reach. Concurrently, enhancements in reagent formulations and microfluidic chip design have enabled more efficient reagent usage and reduced per-test costs, further democratizing access to high-sensitivity assays.

Artificial intelligence and machine learning algorithms have become integral to data interpretation workflows, rapidly parsing complex amplification curves and flagging anomalies in real time. This analytical automation not only streamlines decision-making but also enhances reproducibility across multi-site studies. Moreover, the evolution of multiplexing capabilities has empowered researchers to detect multiple biomarkers in a single run, dramatically expanding the scope of clinical and academic investigations.

Collectively, these technological strides are redefining expectations for assay speed, accuracy, and scalability. As laboratories increasingly demand end-to-end solutions that unify instrumentation, consumables, and software, vendors are responding with interoperable ecosystems designed to optimize performance metrics while ensuring regulatory compliance and data integrity. These transformative shifts underscore the maturation of digital and quantitative PCR from specialized techniques into indispensable tools for precision science.

Analyzing How New United States Tariffs of 2025 Are Reshaping Supply Dynamics, Cost Structures, and Innovation Trajectories in Global PCR Markets

In 2025, new tariff regulations implemented by the United States added complexity to global supply chains for reagents, plasticware, and instruments essential to PCR workflows. Import duties on critical consumables such as microfluidic chips and master mixes led many laboratories to renegotiate contracts and seek alternative suppliers closer to home. While short-term cost increases were largely absorbed through operational efficiency improvements, the policy shift has accelerated interest in localization strategies to mitigate future exposure to cross-border price fluctuations.

The ripple effects extended to instrument manufacturers that rely on imported electronic components, prompting several to diversify their supplier base across North America and select Asia-Pacific markets. These strategic changes have necessitated extended collaboration between procurement, quality assurance, and R&D teams to qualify novel materials without compromising assay performance. Simultaneously, some vendors adjusted pricing models by bundling software and service agreements, effectively offsetting tariff-driven margin pressures while preserving end-user affordability.

Overall, the 2025 tariff environment has catalyzed a reevaluation of supply chain resilience within the PCR sector. Organizations that have proactively mapped critical nodes in their procurement networks and invested in dual-sourcing strategies are demonstrating greater stability in meeting research and diagnostic demands. As geopolitical dynamics continue to evolve, these insights will be central to sustaining reliable access to high-precision PCR technologies.

Discerning Market Opportunities Through Comprehensive PCR Segmentation by Product, Technology, Application, and End-User Profiles

A nuanced understanding of the PCR landscape emerges when examining the interplay between product categories, technology modalities, application sectors, and end-user profiles. Consumables represent a foundational layer, where kits and reagents encompass PCR master mixes optimized for specific chemistries alongside probe and primer sets tailored for target specificity. Complementing these are plasticware components such as microfluidic chips, which enable digital partitioning, and traditional plates and tubes designed for high-throughput qPCR assays. On the instrumentation side, digital PCR platforms facilitate absolute quantification, while real-time PCR instruments support rapid amplification monitoring across diverse applications. Underpinning both workflows are data analysis software packages that deliver robust analytics, alongside maintenance and support services that ensure ongoing operational reliability.

From a technology vantage point, the market bifurcates into digital and quantitative PCR methods. Both maintain strong growth drivers but serve distinct experimental needs-digital PCR for rare target detection and absolute quantification, and qPCR for relative quantification in high-throughput contexts. Application diversity further shapes demand: academic research labs leverage both techniques for gene expression and functional studies; clinical diagnostics entities prioritize infectious disease and oncology testing protocols; food testing and agricultural organizations focus on GMO analysis and pathogen detection; and pharmaceutical research teams require precision solutions for drug discovery and pharmacogenomics investigations. End users range from academic and research institutes exploring basic science questions, to forensic laboratories requiring ultra-sensitive assays, hospitals and diagnostic labs enforcing stringent regulatory compliance, and pharmaceutical and biotechnology companies driving therapeutic innovation.

Integrating these segmentation dimensions reveals strategic areas of opportunity, guiding stakeholders to align product development, service offerings, and market outreach with the specific workflow demands of each user segment.

This comprehensive research report categorizes the dPCR & qPCR market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Type

- Application

- End-User

Uncovering Powerful Regional Dynamics Shaping PCR Adoption Across Americas, Europe Middle East Africa, and Asia-Pacific Research and Diagnostics Ecosystems

Regional dynamics play a pivotal role in shaping the adoption and evolution of digital and quantitative PCR technologies. In the Americas, strong research funding coupled with a robust clinical diagnostics infrastructure has spurred widespread uptake of advanced platforms. Laboratories throughout North America are prioritizing high-throughput capabilities to accommodate large patient cohorts in oncology and infectious disease testing, while Latin American academic centers are increasingly integrating portable qPCR units to expand field-based environmental monitoring.

Europe, the Middle East, and Africa display a heterogeneous landscape. Western Europe’s stringent regulatory frameworks and emphasis on precision medicine have driven demand for digital PCR for its absolute quantification reliability. Meanwhile, emerging markets in Eastern Europe and the Middle East are focusing on cost-effective qPCR solutions for food safety and agricultural testing, leveraging governmental support initiatives. Across Africa, capacity-building efforts are introducing qPCR platforms in public health laboratories to strengthen pathogen surveillance and outbreak response.

In the Asia-Pacific region, rapid economic growth and state-sponsored research programs have catalyzed significant investments in both dPCR and qPCR systems. High population density and a growing biotechnology sector underpin strong volume demand for consumables, while collaborative initiatives between industry and academic institutions fuel innovation in multiplex assay development. Collectively, these regional patterns underscore the importance of tailored market strategies that reflect local regulatory environments, funding landscapes, and disease burden profiles.

This comprehensive research report examines key regions that drive the evolution of the dPCR & qPCR market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Moves and Partnerships Driving Leading PCR Industry Players Toward Enhanced Capabilities and Competitive Differentiation

Leading participants in the PCR arena are forging strategies to reinforce their positions through technology integration, strategic alliances, and portfolio diversification. Major instrument manufacturers are investing in modular platforms that seamlessly transition between qPCR and digital PCR modalities, empowering end users to optimize workflows without redundant capital expenditure. Partnerships with software providers are enhancing analytical ecosystems, embedding AI-driven insights directly into instrument interfaces to streamline data interpretation and report generation.

Several organizations have pursued targeted acquisitions of reagent specialists to secure proprietary chemistries optimized for high-fidelity amplification and multiplexing applications. Concurrently, service providers offering preventive maintenance and regulatory compliance support have gained prominence as laboratories prioritize uptime and audit readiness. This convergence of hardware, chemistry, and service models reflects an industry shift toward holistic solutions that address the full spectrum of laboratory requirements.

Collaborative consortia between manufacturers and academic research centers are also emerging to co-develop next-generation assays for precision oncology and infectious disease panels. By combining deep domain expertise with manufacturing scale, these alliances accelerate time to market for novel diagnostics while fostering a community-driven approach to validation and standardization of digital and quantitative PCR methodologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the dPCR & qPCR market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Analytik Jena AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- BioMerieux SA

- Biosearch Technologies

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Fluidigm Corporation

- Merck KGaA

- Meridian Bioscience, Inc.

- Promega Corporation

- Qiagen N.V.

- Siemens Healthineers AG

- Stilla Technologies

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Empowering Industry Leaders with Pragmatic PCR Strategy Recommendations to Accelerate Innovation, Optimize Operations, and Secure Market Leadership

To navigate the accelerating pace of innovation, industry leaders should prioritize the development of integrated solutions that unify instrumentation, consumables, and analytical software into cohesive platforms. Embracing modular architectures enables laboratories to adapt workflows dynamically, deploying qPCR or digital PCR capabilities as project requirements evolve. Strengthening supply chain resilience through diversified sourcing agreements and regional manufacturing partnerships will mitigate exposure to tariff fluctuations and geopolitical disruptions.

Investments in advanced automation and artificial intelligence must be accompanied by comprehensive training programs to maximize user proficiency and maintain regulatory compliance. Cultivating strategic alliances with academic institutions and clinical networks can accelerate assay development pipelines and broaden the validation base for new applications. Additionally, embedding sustainability principles in product design-such as reducing single-use plastic consumption and developing eco-friendly reagents-will resonate with stakeholders increasingly focused on environmental impact.

Finally, fostering community engagement through transparent data sharing and open innovation forums will enhance collective knowledge and drive broad adoption of best practices. By implementing these actionable recommendations, stakeholders can not only optimize operational efficiency but also position themselves as pioneers in the rapidly evolving landscape of digital and quantitative PCR.

Detailing the Rigorous Research Framework and Analytical Techniques Underpinning Comprehensive Examination of Digital and Quantitative PCR Markets

This analysis is grounded in a comprehensive research framework that integrates multiple data sources and analytical techniques to ensure robust findings. Secondary research included an exhaustive review of publicly available literature, peer-reviewed studies, regulatory filings, and industry white papers to map the evolution of digital and quantitative PCR technologies. Concurrently, primary research comprised structured interviews with R&D scientists, laboratory directors, and procurement executives across academic, clinical, and industrial settings to capture firsthand perspectives on market drivers and emerging challenges.

Quantitative vendor benchmarking involved performance evaluations of leading instrument and reagent suppliers, examining metrics such as assay sensitivity, dynamic range, throughput, and cost per test. These insights were supplemented by expert panel workshops, where cross-functional stakeholders discussed future applications, standardization needs, and integration hurdles. All data points underwent rigorous validation through triangulation across multiple sources, ensuring consistency and minimizing bias.

Our methodology also incorporated scenario analysis to assess the potential impact of evolving trade policies, regulatory changes, and technological breakthroughs. By synthesizing qualitative and quantitative inputs within a structured research design, this approach delivers actionable intelligence that can support strategic planning, investment decisions, and partnership development in the digital and quantitative PCR domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our dPCR & qPCR market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- dPCR & qPCR Market, by Product Type

- dPCR & qPCR Market, by Technology Type

- dPCR & qPCR Market, by Application

- dPCR & qPCR Market, by End-User

- dPCR & qPCR Market, by Region

- dPCR & qPCR Market, by Group

- dPCR & qPCR Market, by Country

- United States dPCR & qPCR Market

- China dPCR & qPCR Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Insights into the Evolutionary Trajectory and Future Potential of PCR Technologies to Inform Strategic Decision-Making

The convergence of digital and quantitative PCR technologies is driving a renaissance in molecular analysis, enabling researchers and clinicians to achieve unprecedented levels of sensitivity, precision, and throughput. Transformative trends-from automated workflows and AI-integrated analytics to strategic supply chain realignment-are collectively reshaping the landscape. Meanwhile, nuanced segmentation across product types, technology modalities, applications, and end users reveals targeted opportunities for tailored solutions.

Regional insights underscore the importance of localized strategies that account for distinct regulatory environments, funding models, and disease priorities across the Americas, Europe Middle East Africa, and Asia-Pacific. Leading industry participants are responding through modular platforms, strategic partnerships, and value-add services that foster end-to-end solutions. Actionable recommendations emphasize integration, resilience, sustainability, and community-driven innovation, equipping stakeholders to anticipate evolving demands and maintain competitive advantage.

As digital and quantitative PCR continue to mature, organizations that adopt a proactive, data-driven approach will be best positioned to capitalize on emerging applications in precision medicine, environmental monitoring, and beyond. This synthesis of insights provides the strategic framework necessary to navigate the next chapter of molecular diagnostics transformation.

Connect with Associate Director Sales and Marketing to Unlock PCR Market Intelligence Insights and Drive Growth through Actionable Research Acquisition

By partnering with Associate Director Ketan Rohom, organizations can gain unparalleled access to expert guidance on leveraging digital and quantitative PCR intelligence. Engaging directly will enable you to translate these analytical insights into tangible growth strategies, ensuring you remain at the forefront of molecular diagnostics innovation. Reach out today to explore tailored solutions and secure your competitive edge through acquisition of the full comprehensive report, empowering your next strategic milestone with data-driven clarity.

- How big is the dPCR & qPCR Market?

- What is the dPCR & qPCR Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?