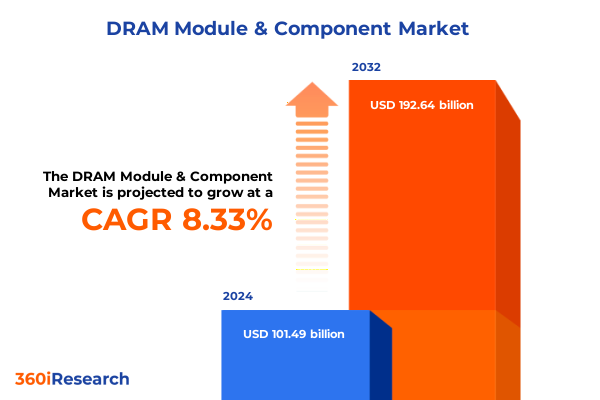

The DRAM Module & Component Market size was estimated at USD 109.59 billion in 2025 and expected to reach USD 118.34 billion in 2026, at a CAGR of 8.39% to reach USD 192.64 billion by 2032.

Setting the Stage for DRAM Module and Component Dynamics in an Era of Accelerating Digital Transformation and Memory Demands

In the face of unprecedented digital transformation and the relentless pursuit of higher computational capabilities, the DRAM module and component sector has emerged as a foundational pillar supporting every layer of the technology ecosystem. As data-intensive applications such as artificial intelligence, machine learning, and high-performance computing continue to proliferate, the demand for advanced memory solutions has surged. This executive summary establishes the context for understanding how evolving performance requirements and emerging use cases are reshaping the landscape.

Key technological inflections are marked by the industry’s transition from DDR4 to DDR5 architectures, the integration of high-bandwidth memory variants, and the increasingly sophisticated thermal management needs that come with elevated operating frequencies. Alongside these developments, supply chain resilience and geopolitical considerations have become critical factors influencing how manufacturers, integrators, and end users approach memory procurement and deployment. In parallel, market participants are grappling with heightened cost pressures, driven by both raw material volatility and strategic tariff measures, underscoring the importance of agile sourcing strategies.

Through this introduction, readers will gain a clear vantage point from which to explore the subsequent sections, which delve into transformative shifts in technology, the cumulative impact of U.S. tariff actions, segmentation insights, regional dynamics, leading company strategies, actionable recommendations, and research methodologies. Collectively, these components set the stage for a comprehensive understanding of the DRAM ecosystem’s current state and future trajectories.

Unveiling the Transformative Shifts Driving DRAM Module Engineering Supply Chain Innovation and Emerging Technology Adoption

The DRAM module and component market is undergoing a profound metamorphosis driven by several converging forces that extend well beyond incremental performance improvements. At the heart of this transformation lies the rising imperative for bandwidth optimization, as applications ranging from cloud computing to real-time analytics demand ever-faster data access. In this context, the industry’s pivot toward DDR5 memory modules signifies not only higher clock speeds and enhanced channel architectures but also the integration of on-die ECC and improved power efficiency to address next-generation workloads.

Moreover, the adoption of specialized memory variants such as high-bandwidth memory (HBM) in graphics processing units and AI accelerators has introduced new design paradigms and complex thermal management requirements. Addressing these challenges, suppliers of DRAM components have innovated advanced heat spreaders, reinforced printed circuit board substrates, and optimized connectors to sustain performance at scale. Concurrently, memory chip manufacturers are refining lithography processes to achieve greater density while mitigating yield constraints.

In parallel with technological evolution, supply chain recalibration has become a defining trend. Strategic partnerships between module assemblers and foundries are reshaping procurement models, fostering closer collaboration on wafer allocation, and enabling greater transparency in inventory management. Furthermore, sustainability initiatives have prompted a shift toward lead-free solder materials and recyclable packaging, reflecting the industry’s broader commitment to environmental responsibility. These overlapping shifts form the basis for an industry poised at a critical inflection point, where innovation and resilience converge.

Analyzing the Cumulative Repercussions of the 2025 United States Tariff Regime on DRAM Component Sourcing Cost Structures and Supply Chain Realignment

The introduction of broad-based tariff measures in the United States during 2025 has exerted a material influence on DRAM module and component sourcing strategies. By expanding the scope of Section 301 actions to encompass key memory chips and related hardware inputs, U.S. authorities effectively increased landed costs for importers, prompting OEMs and module integrators to reassess procurement geographies and to negotiate long-term supply commitments to mitigate pricing volatility.

In response, several market participants have accelerated efforts to diversify their supplier bases, shifting a portion of volume away from previously favored origins and toward partners in Southeast Asia, South Korea, and select domestic fabrication initiatives. This geographic rebalancing has entailed recalibrating logistics networks, expanding bonded warehouse capacity, and engaging in forward-looking hedging arrangements for currency and commodity exposures. Alongside cost mitigation, the tariff environment has heightened the appeal of near-shoring opportunities, with U.S. policy incentives driving investment in local assembly and testing facilities to secure supply chain resilience.

The downstream impact has been a redefinition of inventory management practices, as firms prioritize buffer stocks of critical memory components to hedge against potential disruptions. At the same time, pass-through costs have placed margin pressure on OEMs, propelling collaborative cost-reduction initiatives between buyers and suppliers. Although short-term dynamics have introduced complexity, the cumulative effect is an industry accelerating its shift toward agile, diversified sourcing frameworks that can withstand ongoing trade uncertainty.

Illuminating Critical Segmentation Perspectives on DRAM Module Product Variants Application Domains and Channel Strategies

A nuanced appreciation of market segmentation reveals distinct growth trajectories and investment priorities across product, application, and sales-channel dimensions. From a product perspective, the DRAM Components domain encompasses critical enablers such as heat spreaders, memory chips, printed circuit board substrates, and sockets and connectors, each of which commands focused innovation to address thermal, mechanical, and signal integrity requirements. In tandem, the DRAM Modules segment spans a diverse array of form factors, including DDR4 for established applications, DDR5 for next-generation computing, GDDR targeted at graphics and gaming, high-bandwidth memory tailored to AI and data analytics, and low-power DDR used in mobile and wearables contexts.

Application segmentation further underscores differentiated demand drivers. In automotive electronics, robust temperature tolerance and long lifecycle validation guide memory selection, while consumer electronics rely on LPDDR variants to balance performance and power consumption across laptops, smartphones, tablets, and wearable devices. Gaming consoles favor GDDR variants for intensive rendering workloads, whereas industrial equipment prioritizes durability and reliability under harsh conditions. Meanwhile, server and datacenter environments demand high-density, energy-optimized DDR5 and HBM modules to sustain large-scale virtualization and AI inference workloads.

Sales-channel dynamics reveal that Original Equipment Manufacturers often secure first-tier access to the latest module configurations and chip interconnect technologies, leveraging close collaboration to drive design-win outcomes. In contrast, the Aftermarket channel supports system upgrades and component replacements, where compatibility and cost-effectiveness are paramount. This three-dimensional segmentation framework equips stakeholders with the insight to tailor product roadmaps, marketing strategies, and supply-chain alignments to specific market niches.

This comprehensive research report categorizes the DRAM Module & Component market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Sales Channel

Delineating Key Regional Dynamics Shaping Demand and Innovation in the Americas EMEA and Asia Pacific DRAM Landscape

Regional market behaviors in the DRAM module and component industry reflect a tapestry of competitive strengths, policy environments, and end-market priorities. In the Americas, accelerated expansion of hyperscale datacenters and sustained investment under regional semiconductor acts have galvanized both domestic memory production and integration services. Beyond high-performance computing, the region’s automotive sector is driving incremental demand for advanced memory modules, as electric and autonomous vehicle platforms integrate sophisticated sensor arrays and in-vehicle computing nodes.

Across Europe, the Middle East, and Africa, the confluence of stringent data privacy regulations, infrastructure modernization programs, and a growing emphasis on digital sovereignty is shaping procurement policies. Regional integrators in EMEA have shown a preference for memory solutions that balance performance with energy efficiency, directly influenced by rising operational costs and decarbonization mandates. Meanwhile, government-backed research consortia and defense applications are stimulating interest in ruggedized module architectures and secure memory technologies.

In the Asia-Pacific arena, the sheer scale of consumer electronics manufacturing, coupled with leading chip fabrication hubs in South Korea, Taiwan, and China, maintains the region’s position as the dominant source of memory supply. Smartphone OEMs and consumer device makers generate high volumes of LPDDR and GDDR demand, while burgeoning cloud and edge computing deployments are driving uptake of DDR5 and HBM solutions. Nevertheless, regional geopolitics and evolving trade agreements continue to introduce both opportunities and constraints, elevating the importance of adaptive sourcing and regional compliance frameworks.

This comprehensive research report examines key regions that drive the evolution of the DRAM Module & Component market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Advancing DRAM Module and Component Capabilities Through Innovation and Strategic Partnerships

The competitive landscape of DRAM modules and components is led by a cohort of vertically integrated memory suppliers and specialized module assemblers pursuing technology leadership and market share gains. Major semiconductor manufacturers have prioritized scaling production capacity of cutting-edge memory nodes, advancing partnerships with lithography and materials innovators to sustain product roadmaps for DDR5 and beyond. This technological thrust is complemented by strategic investments in R&D centers focused on next-generation memory designs, including 3D stacking and heterogeneous integration techniques aimed at boosting bandwidth and energy efficiency.

Parallel to chip suppliers, leading module providers have concentrated on design differentiation through enhanced thermal solutions, multi-die packaging architectures, and firmware optimizations that enable intelligent power management. Alliances with hyperscale datacenter operators have accelerated co-development efforts for customized module configurations, while collaborations with automotive OEMs have yielded memory assemblies certified for extended temperature and vibration tolerances.

Emerging players specializing in HBM technologies and system-in-package integration are carving out niche positions, leveraging domain expertise in advanced packaging and high-density interconnects. Moreover, several companies are forging joint ventures to establish local assembly capabilities in strategic markets, thereby reducing lead times and aligning with national incentive programs. Collectively, these strategic initiatives underscore a fiercely competitive environment where technological innovation and supply-chain agility are decisive factors.

This comprehensive research report delivers an in-depth overview of the principal market players in the DRAM Module & Component market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADATA Technology Co., Ltd.

- Apacer Technology Inc.

- Avant Technology, Inc.

- Broadcom Inc.

- Buffalo Americas, Inc.

- Elite Semiconductor Memory Technology Inc.

- Etron Technology, Inc.

- Fujitsu Limited

- IBS Electronics Inc.

- Innodisk Corporation

- Kingston Technology Company, Inc.

- Micron Technology, Inc.

- Nanya Technology Corp.

- Patriot Memory, Inc.

- Patriot Memory, LLC

- PNY Technologies, Inc.

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Rohm Co., Ltd.

- Samsung Electronics Co., Ltd.

- Silicon Power Computer & Communications Inc.

- SK Hynix Inc.

- VisionTek Products, LLC

Offering Actionable Strategic Guidance for Industry Leaders to Navigate Supply Chain Vulnerabilities Technology Transitions and Tariff Headwinds

As market conditions evolve under the influence of technological breakthroughs and regulatory shifts, industry leaders should adopt a proactive stance to secure competitive advantage. First, diversifying procurement channels beyond traditional hubs will mitigate tariff exposure and supply disruptions. Establishing frameworks for multi-sourced component qualification and engaging in long-term inventory agreements can enhance supply resilience while optimizing working capital commitments.

Second, escalating investment in R&D for next-generation memory architectures-particularly in areas such as high-bandwidth memory, 3D stacking, and low-power DDR variants-will ensure alignment with the most demanding compute and edge applications. Collaborative development agreements between module integrators and foundries can accelerate time-to-market and foster co-innovation in thermal management and firmware intelligence.

Third, strengthening end-market partnerships will enable stakeholders to tailor offerings to the unique specifications of automotive, industrial, and hyperscale customers. By embedding design-for-reliability and security features early in development cycles, suppliers can address critical compliance requirements and differentiate on quality. Additionally, aligning sustainability goals-such as adopting recyclable materials and energy-efficient production methods-will enhance brand reputation and meet the growing expectations of environmentally conscious end users.

Finally, maintaining agility in response to policy and geopolitical developments requires ongoing scenario planning and monitoring of trade regulations. Proactive engagement with government incentive programs, coupled with robust risk management practices, will position organizations to capitalize on regional opportunities and navigate evolving market headwinds.

Detailing the Rigorous Research Methodology Underpinning the DRAM Module and Component Executive Summary’s Insights and Analytical Framework

This executive summary draws upon a multi-pronged research methodology designed to deliver rigorous and actionable insights into the DRAM module and component markets. Primary research comprised in-depth interviews with senior executives across memory chip manufacturers, module assemblers, OEMs, and distribution partners, enabling direct assessment of strategic priorities, technological development plans, and sourcing philosophies.

Supplementing these qualitative inputs, targeted desk research reviewed proprietary technical white papers, patent filings, and regulatory statements to map the evolution of memory architectures and tariff frameworks. Data triangulation involved cross-referencing shipment trends from industry sources with commentary provided by end users in automotive, consumer electronics, industrial, and datacenter segments to validate demand drivers and adoption timelines.

In addition, the study employed a robust segmentation analysis spanning product types-encompassing both DRAM Components such as heat spreaders, memory chips, PCB substrates, and connectors, and DRAM Modules including DDR4, DDR5, GDDR, HBM, and LPDDR-applications spanning automotive electronics, consumer-facing devices across laptops, smartphones, tablets, and wearables, gaming consoles, industrial equipment, and servers and datacenters, as well as sales channels through OEM and Aftermarket routes. Regional evaluation covered the Americas, EMEA, and Asia-Pacific territories to capture localized policy impacts and procurement nuances.

All findings were subjected to an editorial review process and a final validation workshop with external industry experts to ensure factual accuracy, relevance, and clarity. This comprehensive approach underpins the reliability of the insights presented throughout this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DRAM Module & Component market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DRAM Module & Component Market, by Product Type

- DRAM Module & Component Market, by Application

- DRAM Module & Component Market, by Sales Channel

- DRAM Module & Component Market, by Region

- DRAM Module & Component Market, by Group

- DRAM Module & Component Market, by Country

- United States DRAM Module & Component Market

- China DRAM Module & Component Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Concluding Insights Synthesizing DRAM Module and Component Market Trends Strategic Imperatives and Resilience Imperatives

The executive summary has outlined the critical junctures defining the DRAM module and component industry, from the acceleration of DDR5 and high-bandwidth memory adoption to the strategic ramifications of U.S. tariff actions in 2025. Through a deep segmentation lens, distinct opportunities emerge across product, application, and sales-channel dimensions, each underscored by unique technological and market drivers. Regional insights further emphasize the imperative of tailoring strategies to the policy landscapes and demand profiles of the Americas, EMEA, and Asia-Pacific markets.

Leading companies continue to differentiate through investment in advanced packaging, thermal management, and collaborative development with hyperscale and automotive partners. As the memory ecosystem grows more complex, stakeholders must remain nimble, leveraging diversified procurement strategies and ongoing scenario planning to address supply chain vulnerabilities and geopolitical uncertainties.

Ultimately, the path forward for DRAM module and component providers hinges on balancing ambitious innovation roadmaps with disciplined risk management practices. By synthesizing the insights provided in this summary, decision-makers are equipped to navigate emerging challenges and to capitalize on the transformative shifts driving the future of memory technology.

Engage with the Associate Director to unlock comprehensive DRAM module and component intelligence and drive strategic decisions

We invite industry leaders and technology strategists seeking a deeper understanding of dynamic memory markets to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in DRAM module and component landscapes ensures a tailored exploration of critical insights, from tariff implications to next-generation technology adoption.

By connecting with Ketan, decision-makers gain access to the full suite of analytical deliverables, including detailed segmentation breakdowns, regional evaluations, and strategic recommendations designed for actionable implementation. This personal consultation will outline how our comprehensive research can support procurement strategies, R&D investments, and competitive positioning.

To secure your organization’s competitive edge in volatile markets and leverage the latest intelligence on DRAM modules and components, reach out to schedule a briefing with Ketan. Unlock custom data interpretations, bespoke scenario planning, and expert guidance that will empower your team to make informed, future-ready decisions.

- How big is the DRAM Module & Component Market?

- What is the DRAM Module & Component Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?