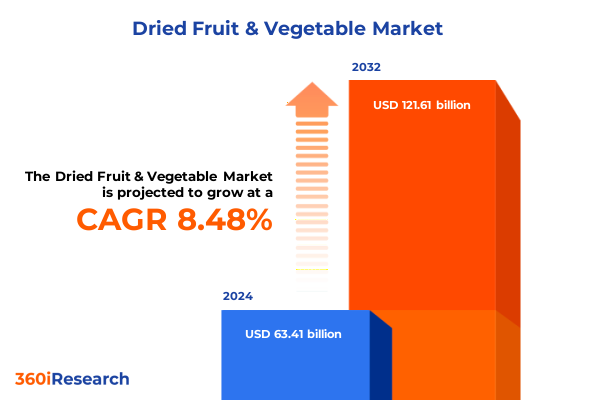

The Dried Fruit & Vegetable Market size was estimated at USD 68.71 billion in 2025 and expected to reach USD 74.46 billion in 2026, at a CAGR of 8.49% to reach USD 121.61 billion by 2032.

Exploring the Surge in Demand and Nutritional Appeal Driving Growth in the Dried Fruit and Vegetable Market among Health-Focused Consumers

The dried fruit and vegetable market has transcended its traditional status as a niche snacking category to emerge as a mainstream staple across retail shelves, foodservice menus, and manufacturing lines. Fueled by increasing health consciousness, the sector benefits from consumers seeking convenient yet nutritious alternatives to fresh offerings. As demand for clean-label ingredients and shelf-stable produce accelerates, manufacturers are compelled to innovate product formulations, enhance processing technologies, and expand distribution networks to capture evolving preferences. Moreover, sustainability considerations and resource constraints have intensified focus on optimizing supply chains, from cultivation practices to dehydration methods, ensuring minimal environmental impact without compromising quality.

In tandem with these dynamics, shifting demographics and lifestyle patterns are reshaping consumption behaviors. Younger generations prioritize portability, functionality, and experiential flavors, driving experimentation with exotic fruit blends and vegetable crisps. Meanwhile, growing interest in plant-based diets has elevated dried produce as a protein-rich and fiber-packed option, suitable for on-the-go snacking, culinary applications, and food manufacturing. Against this backdrop, industry stakeholders must navigate a complex matrix of regulatory requirements, tariff fluctuations, and competitive pressures, making a data-driven approach essential to identify growth pockets and mitigate risks.

Disruptive Innovations Regulatory Shifts and Consumer Behavior Changes Reshaping the Dried Produce Industry Landscape Globally

The dried fruit and vegetable landscape is undergoing a rapid metamorphosis, propelled by technological breakthroughs and evolving regulatory frameworks. Recent advances in dehydration processes and packaging innovations have extended shelf life, preserved nutritional integrity, and enhanced flavor retention, enabling a broader array of product offerings. At the same time, regulatory bodies are harmonizing quality and safety standards, driving consolidation among suppliers equipped to meet stringent traceability requirements. These shifts create both challenges and opportunities, as smaller producers seek partnerships to scale operations while larger players leverage vertical integration to control every stage of the value chain.

Concurrently, consumer preferences are tilting towards gourmet and functional products, with exotic fruit varieties and vegetable-based snacks capturing premium price points. Sustainability credentials have moved from the periphery to the core of purchasing decisions, prompting brands to adopt eco-friendly packaging and transparent sourcing promises. The confluence of these factors is prompting a wave of strategic collaborations, joint ventures, and targeted acquisitions, aimed at bolstering product portfolios and expanding geographic reach. As innovation cycles accelerate, agility and strategic foresight will determine which companies can effectively align R&D capabilities with emerging market demands to sustain competitive advantage.

Evaluating the 2025 United States Tariff Adjustments Impact on Supply Chains Pricing Structures and Trade Dynamics in Dried Produce

In 2025, the United States implemented a series of tariff adjustments targeting key agricultural imports, directly influencing the cost structures and supply chain strategies of dried fruit and vegetable suppliers. These measures, designed to protect domestic producers and encourage localized processing, have resulted in increased duties on certain dehydrated fruit varieties and vegetable powders imported from select regions. Consequently, importers have restructured logistics, shifting volumes towards duty-free suppliers and renegotiating contracts to mitigate cost escalations. Simultaneously, domestic dehydrators have enhanced capacity investments, capitalizing on favorable margins to penetrate categories previously dominated by imports.

While higher tariffs have elevated retail prices for some imported specialties, they have also spurred innovation in sourcing and processing efficiencies. Companies are exploring alternative raw material origins, adopting nearshore suppliers, and leveraging advanced dehydration technologies to offset duty impacts. Parallel to these adaptations, there has been a heightened emphasis on value-added processing within U.S. boundaries, including flavor infusion and fortified blends. These strategies not only navigate the tariff landscape but also align with consumer demand for traceable, homegrown ingredients. As the market continues to recalibrate, stakeholders will need to closely monitor policy shifts to anticipate future cost implications and supply chain adjustments.

Integrating Product Type Distribution Channel Packaging Type End User Product Form and Application Segmentation to Reveal Market Nuances

A granular analysis of segmentation reveals nuanced performance drivers underpinning the dried produce sector’s trajectory. Within the product type dimension, the dried fruit category, encompassing apricots, banana chips, berries such as blueberries, cranberries, and strawberries, dates, mixed fruit, and raisins, remains the primary growth engine. Berries stand out for their antioxidant-rich profiles, appealing to health-driven consumers, while banana chips and dates cater to indulgent snack occasions. The dried vegetable segment, which includes mixed vegetables, peas, potatoes, and tomatoes, is gaining traction among gourmet and culinary applications, particularly as plant-based diets expand.

Examining distribution channels, the market’s evolution reflects a balance between traditional offline retail and burgeoning online platforms. Brick-and-mortar grocers continue to offer visibility and immediate access, whereas e-commerce channels provide personalized subscription models and direct-to-consumer convenience. Packaging type further differentiates market offerings, with bulk packaging solutions targeting B2B food manufacturers, flexible packaging serving retail consumers seeking convenience, and rigid packaging options like canisters and containers appealing to premium and gift markets. End users span food manufacturers, from bakery confectionery operations and ready meal producers to snack makers, all driven by ingredient standardization demands; hospitality segments, including cafeterias, hotels, and restaurants, seeking consistent quality; and households prioritizing shelf stability and portion control.

Product form and application insights underscore the sector’s diversification. While chips and whole formats dominate snacking occasions, pieces-whether diced or sliced-and powder forms find extensive use in baking, cereals, and ready meals. Applications in bakery confectionery, such as cake pastries and chocolate confections, join cereal uses in granola bars and muesli oatmeal, as well as ready meal and snack deployments. These intersecting segmentation dimensions shape targeted strategies for product development, marketing, and supply chain alignment.

This comprehensive research report categorizes the Dried Fruit & Vegetable market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Product Form

- Packaging Type

- Distribution Channel

- Application

- End User

Contrasting Regional Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia-Pacific Dried Produce Markets

Regional analysis highlights distinct growth trajectories and strategic imperatives across three key geographies. In the Americas, North America leads with robust consumer demand for functional snacks and high-fiber ingredients, while Latin American markets are characterized by rising disposable incomes and shifting dietary patterns favoring westernized snacking trends. The United States, in particular, is experiencing rapid expansion of e-commerce subscriptions for health-forward dried fruit blends and vegetable crisps. Conversely, in Canada and Mexico, localized sourcing partnerships are gaining momentum to reduce import dependencies and manage cross-border regulatory complexities.

The Europe, Middle East & Africa region presents a tapestry of mature and emerging markets. Western Europe remains a hub for premium, organic, and certified produce, with consumers prioritizing clean labels and sustainability commitments. In contrast, Middle Eastern markets are witnessing accelerated modernization of retail infrastructure, enabling wider distribution of value-added dried vegetable snacks, while Africa’s nascent dehydrated fruit sector is capitalizing on abundant raw material supply chains to serve both domestic and export markets. Across this vast region, regulatory harmonization and trade agreements continue to shape export opportunities and competitive positioning.

Asia-Pacific displays the highest growth potential, driven by rapid urbanization and shifting dietary preferences in China, India, Southeast Asia, and Australia. Consumers in these markets are increasingly incorporating dried fruits into traditional recipes and innovative snack formats. Investments in processing facilities are rising in India, while Australia leverages abundant sun-drying resources for sustainable production. E-commerce marketplaces and modern trade channels are proliferating, enabling niche products and premium brands to capture health-conscious segments at scale.

This comprehensive research report examines key regions that drive the evolution of the Dried Fruit & Vegetable market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Dried Fruit and Vegetable Companies Spotlighting Innovation Strategies Partnerships and Competitive Positioning Trends

A thorough review of leading market participants reveals a competitive landscape defined by scale, innovation, and strategic alliances. Established global players have strengthened their positions through capacity expansions and targeted acquisitions, securing access to premium raw materials and advanced dehydration technologies. At the same time, specialized regional firms have differentiated themselves via product innovation, launching fortified fruit blends, single-origin vegetable flakes, and tailored spice-infused offerings. Collaborative ventures between ingredient suppliers and food manufacturers are also accelerating, fostering co-development of functional formulations and private-label partnerships.

Sustainability and traceability have emerged as critical focus areas, with forward-looking companies investing in blockchain-enabled supply chain platforms and regenerative agriculture initiatives. These efforts not only enhance transparency but also resonate with institutional buyers and end consumers demanding accountability. Furthermore, several market leaders are piloting circular economy programs, converting processing by-products into animal feed or bioenergy, thereby improving resource efficiency. These strategic moves, combined with robust R&D pipelines, position these companies to capture premium segments and maintain resilience amid evolving regulatory and tariff environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dried Fruit & Vegetable market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrana Beteiligungs-AG

- Al Foah

- Angas Park Fruit Co.

- Baobab Foods And Agro

- Batory Foods, Inc.

- Bella Viva Orchards

- Bergin Fruit and Nut Company Inc.

- California Dried Fruit Inc.

- Del Monte Foods Private Limited

- Eden Foods, Inc.

- FutureCeuticals, Inc.

- General Mills, Inc.

- GEOBRES S.A - NEMEAN CURRANTS & SULTANA RAISINS

- Graceland Fruit, Inc.

- Herbafood Ingredients GmbH

- ITC Limited

- Jain Farm Fresh Foods Limited

- Kanegrade Limited

- Kiantama Ltd

- Lion Raisins

- Milne MicroDried

- Nutradry Pty Ltd

- Olam Group Limited

- Paradise Fruits Solutions GmbH & Co. KG

- Saipro Biotech Private Limited

- Sun-Maid Growers of California

- Sunbeam Foods Pty Ltd

Actionable Recommendations to Strengthen Competitive Positioning Supply Chain Resilience and Product Portfolio Diversification Strategies

Industry leaders should prioritize a dual strategy of portfolio diversification and supply chain fortification to navigate market complexities effectively. Expanding product portfolios to include fortified and functional variants can address emerging health trends, while strategic alliances with technology providers can accelerate innovation in dehydration and preservation techniques. Concurrently, optimizing procurement networks through nearshoring and multi-origin sourcing will mitigate tariff impacts and logistical disruptions.

Embracing digitalization across distribution channels is indispensable, as e-commerce platforms and direct-to-consumer models continue to disrupt traditional retail. Leveraging data analytics for demand forecasting and personalized marketing can enhance customer engagement and inventory efficiency. Sustainability must be integrated into every operational facet, from adopting eco-friendly packaging solutions to embedding regenerative sourcing practices; these commitments will bolster brand equity and meet escalating regulatory expectations. Finally, investing in talent development and cross-functional innovation teams will enable organizations to anticipate market shifts and respond with agility.

Clarifying the Comprehensive Research Methodology Detailing Data Collection Analytical Frameworks and Validation Protocols Applied in Market Study

This study is grounded in a hybrid research methodology combining extensive primary interviews with key stakeholders and comprehensive secondary data analysis. Primary research included structured discussions with manufacturers, distributors, retailers, and end users to capture firsthand perspectives on market drivers, challenges, and emerging trends. Secondary research drew upon industry publications, trade association reports, regulatory databases, and company filings to establish a robust data foundation and validate qualitative insights.

Data triangulation was employed to reconcile disparate sources, ensuring the accuracy and consistency of segment-level interpretations. Quantitative models were constructed to analyze segmentation dimensions, while scenario analyses assessed the impact of tariff adjustments on cost structures and trade flows. Rigorous validation protocols, including expert panels and cross-referencing with public domain case studies, further enhanced the reliability of findings. This transparent approach provides stakeholders with a clear lineage of data inputs and analytical frameworks, underpinning the study’s authoritative conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dried Fruit & Vegetable market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dried Fruit & Vegetable Market, by Product Type

- Dried Fruit & Vegetable Market, by Product Form

- Dried Fruit & Vegetable Market, by Packaging Type

- Dried Fruit & Vegetable Market, by Distribution Channel

- Dried Fruit & Vegetable Market, by Application

- Dried Fruit & Vegetable Market, by End User

- Dried Fruit & Vegetable Market, by Region

- Dried Fruit & Vegetable Market, by Group

- Dried Fruit & Vegetable Market, by Country

- United States Dried Fruit & Vegetable Market

- China Dried Fruit & Vegetable Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Concluding Insights Summarizing Core Findings Implications for Stakeholders and Guiding Next Steps in the Dried Produce Market Journey

This report has elucidated the multifaceted drivers shaping the dried fruit and vegetable sector-from evolving consumer preferences and technological innovations to regulatory reforms and regional market dynamics. The 2025 U.S. tariff adjustments have underscored the importance of agile supply chain strategies and domestic processing investments. Segmentation analysis has revealed critical variances in product applications, packaging preferences, distribution channels, and end-user requirements, offering a lens through which stakeholders can tailor their approaches.

Regional insights demonstrate that while mature markets demand premium, certified offerings, emerging economies present fertile ground for scaled implementations and value-added innovations. Leading companies continue to refine their competitive positions through strategic partnerships, sustainability initiatives, and advanced R&D capabilities. By integrating the actionable recommendations outlined herein-spanning diversification, digitalization, and regenerative practices-industry participants can position themselves to capture growth while safeguarding against future disruptions. Ultimately, this study serves as a blueprint for navigating the dynamic dried produce landscape and achieving sustainable success.

Act Now to Secure Your In-Depth Market Research Report on Dried Fruits and Vegetables with Expert Guidance from Ketan Rohom

To gain a comprehensive understanding of how these findings impact your strategic objectives and explore tailored solutions for your organization’s unique challenges, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating market insights into actionable business strategies will guide you through the nuances of supply chain optimization, product portfolio enhancement, and market entry planning. Schedule a personalized consultation to delve deeper into data-driven recommendations, obtain supplementary analyses, and discuss bespoke research options. Secure your copy of the detailed market research report today and leverage Ketan’s strategic guidance to stay ahead of emerging trends, navigate regulatory complexities, and unlock new growth opportunities in the dynamic dried fruits and vegetables landscape.

- How big is the Dried Fruit & Vegetable Market?

- What is the Dried Fruit & Vegetable Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?