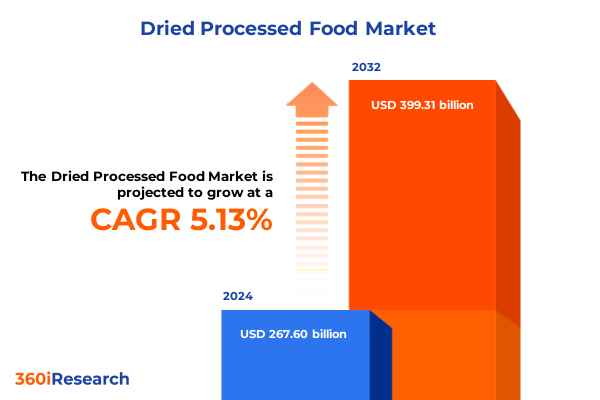

The Dried Processed Food Market size was estimated at USD 280.79 billion in 2025 and expected to reach USD 294.64 billion in 2026, at a CAGR of 5.15% to reach USD 399.31 billion by 2032.

A Comprehensive Overview of the Dried Processed Food Market Highlighting Key Drivers, Challenges, and Emerging Opportunities Driving Industry Evolution

The dried processed food sector occupies a pivotal position within the broader food ecosystem, delivering extended shelf life, enhanced convenience, and concentrated nutritional value across a wide array of products. From dried fruits that deliver versatile snacking and beverage infusion options to dried vegetables that extend ingredient usability in both retail and foodservice contexts, the market responds to evolving consumer behaviors shaped by health consciousness, on-the-go lifestyles, and sustainability considerations.

As consumers increasingly prioritize clean-label ingredients, minimal processing, and transparent sourcing, stakeholders across the value chain are adapting to meet these demands through innovative processing technologies and responsible supply chain practices. This executive summary provides an integrated overview of the transformative shifts redefining the industry, assesses the cumulative impact of trade policies enacted in 2025, and distills key insights across product, channel, user, and packaging dimensions. Stakeholders will also gain regional perspectives, competitive intelligence, actionable recommendations, and a clear outline of the research methodology underpinning these findings, establishing a strong foundation for strategic decision-making.

Emerging Consumer Preferences and Technological Innovations are Rewriting the Rules of the Dried Processed Food Market Landscape Today

The landscape of dried processed foods is undergoing a profound transformation as consumer preferences, technological advancements, and regulatory dynamics converge to reshape industry paradigms. Health-driven demand for functional snacking has spurred manufacturers to explore novel preservation techniques that retain bioactive compounds while reducing additives. In parallel, digitalization and automation have accelerated production efficiency, enabling smaller batch runs and greater product customization. These shifts are further amplified by sustainability mandates that compel stakeholders to minimize waste and decarbonize logistics through cold-chain integration and optimized packaging materials.

Meanwhile, the proliferation of direct-to-consumer digital channels and data-driven marketing strategies has empowered brands to foster deeper consumer relationships and rapidly adapt product assortments based on real-time feedback. Accordingly, strategic partnerships between ingredient suppliers, co-packers, and technology providers are becoming increasingly common, as end-to-end collaboration proves essential for driving innovation at pace. Together, these disruptive forces are collectively redefining competitive advantage within the dried processed food sector and laying the groundwork for enduring growth in an increasingly complex marketplace.

Assessment of the Cumulative Effects of United States Tariff Measures Enacted in 2025 on the Dried Processed Food Supply Chain and Profitability

In 2025, the United States implemented a series of tariff adjustments targeting a range of agrifood imports, including key categories of dried fruits and vegetables, with the stated objective of bolstering domestic production and protecting local processors. These cumulative measures have incrementally raised landed costs for importers, prompting many to reexamine their sourcing strategies and negotiate longer-term supply contracts to mitigate volatility. As a result, product cost curves have shifted, triggering price adjustments that reverberate through distributor margins and retail pricing models.

This tariff backdrop has also instigated a strategic pivot toward sourcing from alternative regions less affected by duties, driving increased procurement from Latin America and selected Asia-Pacific markets. Consequently, supply chain networks are being restructured to maintain product availability and quality standards, even as logistics timetables and transportation costs evolve. For brands and foodservice operators, this environment underscores the need to balance tariff-induced cost pressures with the imperative to uphold value propositions and ingredient transparency.

Insights into Diverse Segmentation Dimensions Uncovering Product, Distribution, End User, and Packaging Dynamics Shaping the Dried Processed Food Market

The dried processed food market exhibits distinctive trajectories when examined through the lens of product type segmentation. Dried fruits maintain robust consumer traction driven by demand for nutrient-dense snack options and functional ingredients in bakery and beverage formulations, while dried vegetables capitalize on convenience cooking and value-added meal kits.

Channel dynamics reveal that convenience stores deliver rapid purchase experiences for on-the-go consumers, whereas online retail continues to accelerate growth by offering subscription models and curated snack boxes through both proprietary e-commerce platforms and third-party marketplaces. Specialty stores appeal to niche audiences seeking premium or organic varieties, even as supermarkets and hypermarkets anchor volume sales and broad distribution reach.

End user segmentation further illustrates divergent demand patterns. Foodservice operators in cafeterias, hotels, and restaurants leverage dried ingredients for cost efficiency, menu innovation, and waste reduction. In parallel, household consumers drive consistent demand for versatile shelf-stable snacks, and industrial buyers within bakery and confectionery, beverage, and snack manufacturing channels integrate dried components to enhance product stability and flavor complexity.

Attention to packaging complexity reveals that bulk formats remain essential for industrial and foodservice procurement, while consumer-oriented bags and boxes-ranging from kraft and plastic bags to cartons and gift boxes-cater to retail presentation. Emerging pouch formats, including both flat and stand-up varieties, are gaining preference for their portability, resealability, and brand visibility on shelf.

This comprehensive research report categorizes the Dried Processed Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Distribution Channel

- End User

Key Regional Highlights Illuminating the Unique Consumption Patterns and Market Drivers Across the Americas, EMEA, and Asia-Pacific Domains

Regional consumption and growth drivers display meaningful contrasts across the Americas, EMEA, and Asia-Pacific geographies, each shaped by distinct culinary traditions, regulatory frameworks, and infrastructure capabilities. In the Americas, widespread demand for snack innovations and functional ingredients is underpinned by strong retail penetration of supermarkets and e-commerce platforms, as well as robust cold chain development in North America and emerging economies in Latin America.

Within the Europe, Middle East & Africa corridor, consumer scrutiny on ingredient provenance and sustainability credentials is intensifying, encouraging deeper investments in circular packaging and transparent sourcing. This region also exhibits a notable appetite for specialty and organic dried products, supported by stringent quality standards and robust certification programs.

In the Asia-Pacific realm, rapid urbanization and expanding foodservice networks are driving significant uptake of dried ingredients in restaurant and café menus, while digital-first retail ecosystems in markets like China and Southeast Asia facilitate fast adoption of novel snack formats and subscription-based offerings. Infrastructure modernization, particularly in cold storage and logistics, continues to enhance product accessibility and support market expansion across both mature and frontier markets.

This comprehensive research report examines key regions that drive the evolution of the Dried Processed Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Revealing How Leading Players Are Innovating, Collaborating, and Strategically Positioning Themselves in the Dried Processed Food Arena

Leading companies in the dried processed food landscape are distinguished by their integrated approaches to innovation, supply chain resilience, and brand storytelling. Industry pioneers are investing in advanced dehydration and encapsulation technologies to preserve nutrient profiles and extend shelf life, all while reducing energy consumption and water usage. Simultaneously, strategic acquisitions and joint ventures are enabling players to expand geographic footprints and enhance raw material sourcing capabilities, ensuring consistent quality at scale.

Marketing differentiation is increasingly anchored in traceability, with leaders deploying blockchain and IoT-enabled platforms to furnish end-to-end visibility from farm to fork. In tandem, partnerships with foodservice operators and international co-manufacturers are facilitating entry into new channels and demographics, reinforcing the competitive positioning of established brands. Through these combined efforts, top performers are setting new benchmarks for operational excellence and sustainable growth within the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dried Processed Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Associated British Foods plc

- Conagra Brands, Inc.

- Danone S.A.

- Dehydrates, Inc.

- General Mills, Inc.

- House Foods Group Inc.

- JBS S.A.

- Kellanova

- McCormick & Company, Incorporated

- Mondelez International, Inc.

- Nestlé S.A.

- PepsiCo, Inc.

- Saraf Foods Private Limited

- The Kraft Heinz Company

- Tyson Foods, Inc.

- Unilever PLC

- Van Drunen Farms, Inc.

Actionable Strategies and Tactical Recommendations Empowering Industry Leaders to Navigate Market Volatility, Regulatory Shifts, and Innovation Imperatives

To navigate accelerating market complexity and capitalize on emerging opportunities, industry participants should embrace a multifaceted strategy that integrates procurement flexibility, technological investment, and brand differentiation. Prioritizing the diversification of sourcing origins will mitigate tariff exposure and strengthen supply continuity, while targeted adoption of AI-driven demand forecasting can enhance inventory management and reduce waste.

Investing in packaging innovation-especially formats that resonate with eco-conscious consumers-will support premium positioning and foster brand loyalty. At the same time, forging strategic alliances with ingredient technology providers and foodservice partners can drive co-development of value-added products and expedite market entry for novel formulations. Internally, companies should cultivate cross-functional capabilities that align R&D, marketing, and operations, fostering agile decision-making and sustained innovation momentum.

Transparent and Rigorous Research Methodology Combining Quantitative Data Analysis, Primary Expert Interviews, and Rigorous Validation Protocols

This research synthesizes insights from a comprehensive desk-based analysis of trade publications, regulatory bulletins, and corporate disclosures, supplemented by primary interviews with industry veterans across production, distribution, and innovation functions. Quantitative data on trade flows, tariff schedules, and consumption patterns have been aggregated from authoritative government databases and reputable industry associations to ensure robustness.

Expert consultations across key geographies provided nuanced perspectives on regional dynamics, while iterative validation workshops with senior supply chain managers and R&D specialists solidified the triangulation of findings. All proprietary data has been subjected to rigorous quality checks and cross-referenced against secondary sources to minimize bias. The final report structure aligns with established best practices in market intelligence, offering transparent documentation of assumptions, data sources, and analytical methodologies to support informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dried Processed Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dried Processed Food Market, by Product Type

- Dried Processed Food Market, by Packaging Type

- Dried Processed Food Market, by Distribution Channel

- Dried Processed Food Market, by End User

- Dried Processed Food Market, by Region

- Dried Processed Food Market, by Group

- Dried Processed Food Market, by Country

- United States Dried Processed Food Market

- China Dried Processed Food Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Conclusive Insights Highlighting the Synthesis of Market Trends, Strategic Imperatives, and Future Outlook for Stakeholders in the Dried Processed Food Industry

The dried processed food industry stands at a crossroads where evolving consumer demands, technological advancements, and policy landscapes intersect to create both challenges and opportunities. Synthesizing the insights presented herein underscores the imperative for stakeholders to adopt agile supply chain strategies, invest in sustainable innovations, and tailor offerings to distinct regional and channel-based preferences.

As tariff environments continue to evolve and competitive pressures intensify, market participants who proactively embrace data-driven decision-making, foster strategic partnerships, and uphold transparent practices will be best positioned to drive value creation. With a clear understanding of segmentation nuances, regional dynamics, and company-level strategies, decision-makers can confidently chart a course toward long-term resilience and profitable growth in this dynamic sector.

Immediate Next Steps to Secure Comprehensive Market Intelligence and Strategic Advantage in the Dried Processed Food Sector Through Expert Consultation

For industry stakeholders seeking to deepen their market intelligence and secure a competitive position in the dynamic dried processed food sector, direct engagement and tailored consultation represent the most efficient path forward. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, organizations can gain customized insights aligned with their strategic objectives and receive guidance on leveraging the latest data to optimize supply chains, refine product portfolios, and capitalize on emerging consumer trends. This collaborative approach ensures that decision-makers are equipped with actionable recommendations that address both immediate operational challenges and long-term growth imperatives in a rapidly evolving market. To initiate this partnership and obtain the full scope of the comprehensive market research report, reach out today and transform strategic intentions into high-impact outcomes

- How big is the Dried Processed Food Market?

- What is the Dried Processed Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?