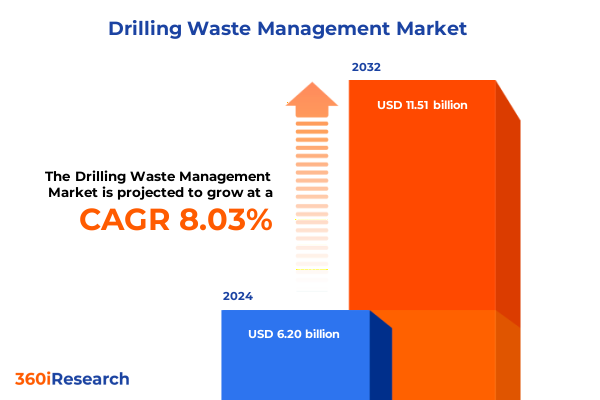

The Drilling Waste Management Market size was estimated at USD 6.69 billion in 2025 and expected to reach USD 7.08 billion in 2026, at a CAGR of 8.05% to reach USD 11.51 billion by 2032.

Understanding the Role of Innovation and Sustainability in Drilling Waste Management for Advancing Environmental Stewardship and Operational Excellence

The drilling waste management sector stands at the intersection of operational efficiency and environmental responsibility. As oil and gas activities intensify globally, the volume of waste generated by drilling operations has surged, creating both challenges and opportunities. Organizations are under increased pressure to reduce ecological footprints while maintaining productivity, necessitating innovative approaches that blend engineering precision with environmental compliance. This introduction underscores the urgency of adopting best practices and advanced solutions to address toxic byproducts of drilling such as cuttings, fluids, and produced water.

Within this evolving landscape, companies recognize that traditional disposal methods are no longer sufficient. Stakeholders are demanding greater transparency and accountability, and regulatory bodies have responded by implementing stricter discharge limits and treatment standards. In parallel, technological breakthroughs have unlocked new pathways for recycling and remediation, transforming waste streams into potential resources for reuse. Framing the market context through these dual lenses of sustainability and innovation establishes the foundation for understanding how drilling waste management is poised to drive significant operational and environmental value.

Highlighting the Transformative Shifts Shaping Drilling Waste Management Through Technological Innovation and Regulatory Evolution

Over the past decade, drilling waste management has undergone a profound transformation driven by converging forces of technological advancement and regulatory reform. Emerging digital tools have enabled real-time monitoring of waste parameters, allowing operators to optimize treatment processes and minimize environmental risks. Concurrently, breakthroughs in treatment technologies-ranging from biological processes that degrade hydrocarbons to thermal systems that recover valuable hydrocarbons-have expanded the toolkit available to address diverse waste types.

On the regulatory front, agencies have introduced more stringent criteria for waste classification, disposal, and reporting, compelling operators to invest in compliance infrastructure and advanced treatment solutions. Incentives for circular economy practices have encouraged partnerships between oil companies and environmental service providers, fostering collaborative ecosystems that elevate waste from a liability to a potential asset. As a result, the industry is witnessing a shift from linear disposal models toward integrated waste management frameworks that enhance resource efficiency and drive cost savings.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Drilling Waste Management Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariffs impacting the importation of drilling waste treatment chemicals and specialized equipment. These measures have reverberated across the supply chain, leading to recalibrated procurement strategies and heightened scrutiny of domestic versus international sourcing options. The tariffs have elevated input costs for certain synthetic-based fluids and advanced treatment modules, compelling operators to reevaluate vendor partnerships and inventory buffers to mitigate price volatility.

Moreover, the cumulative effect of these duties has accelerated interest in locally manufactured alternatives and spurred investment in modular treatment units that can be deployed on-site. While short-term operational budgets have felt the impact of increased capital expenditures, many organizations view this as an impetus to bolster supply chain resilience and develop in-house treatment capabilities. Looking ahead, companies that strategically align procurement, logistics, and technology roadmaps will be best positioned to absorb tariff-induced cost pressures while maintaining compliance and operational continuity.

Delivering Key Segmentation Insights to Illuminate Market Dynamics Across Waste Technology Drilling Type Application and End-User Categories

Insights across the various market segments reveal distinct drivers and challenges that inform strategic decision-making. Within waste types, drilling fluids represent a focal point as operators balance the performance benefits of oil-based and synthetic-based fluids against the environmental advantages of water-based alternatives. Completion fluids and produced water streams call for specialized treatments to comply with evolving discharge limits, prompting service providers to refine their process portfolios.

In the realm of treatment technologies, biological systems leveraging aerobic and anaerobic processes are gaining traction for their low energy profiles and ability to degrade complex hydrocarbons. Chemical and mechanical treatments continue to play critical roles in conditioning waste streams for disposal or reuse, while thermal methods offer the dual benefit of waste reduction and resource recovery. Each approach presents trade-offs between cost, efficiency, and regulatory acceptance.

Different drilling methodologies-conventional versus unconventional, including horizontal and extended reach techniques-generate variable waste compositions, necessitating adaptable management strategies. Onshore operations typically leverage centralized facilities, whereas offshore sites demand compact, modular solutions. End users, from major oil and gas producers to specialized environmental services firms, are tailoring offerings to meet the precise needs of each drilling scenario, underscoring the importance of segmentation-driven innovation.

This comprehensive research report categorizes the Drilling Waste Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Waste Type

- Technology

- Drilling Type

- Application

- End-User

Exploring Key Regional Insights to Understand How Americas Europe Middle East & Africa and Asia-Pacific Drive Distinct Market Opportunities

Regional dynamics play a pivotal role in shaping drilling waste management practices, with each geography presenting unique regulatory, operational, and economic considerations. In the Americas, a combination of mature infrastructure and robust environmental regulations has driven the adoption of advanced treatment systems, with onshore shale plays catalyzing demand for modular and transportable solutions. North America’s strong service provider ecosystem supports rapid technology deployment and iterative process optimization.

Across Europe, the Middle East, and Africa, regulatory frameworks vary widely, creating a mosaic of compliance landscapes. In regions with stringent environmental oversight, waste volumes are meticulously tracked and processed through multi-stage treatment trains. Meanwhile, emerging markets in the Middle East are investing in capacity expansion, often partnering with international technology licensors to establish localized treatment hubs. Africa’s market remains nascent, with growth potential tied to expansions in upstream production and infrastructure modernization.

Asia-Pacific showcases diverse market maturity levels, from highly regulated markets in Australia and Japan to rapidly developing sectors in Southeast Asia. Offshore drilling waste management has become particularly significant in this region, driving demand for compact, high-efficiency technologies capable of meeting stringent discharge standards. Cross-border collaboration and technology licensing are key themes as regional operators seek to balance cost pressures with environmental stewardship.

This comprehensive research report examines key regions that drive the evolution of the Drilling Waste Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Key Company Strategies and Competitive Strengths Driving Innovation and Growth in the Drilling Waste Management Sector

Several leading companies are shaping the future of drilling waste management through targeted R&D investments, strategic partnerships, and service diversification. Industry incumbents are leveraging integrated offerings that combine mechanical separation, chemical conditioning, and biological remediation, thereby streamlining vendor engagements and reducing project timelines. Startups are entering the space with niche technologies such as advanced membrane filtration and on-site thermal desorption units, challenging established players to accelerate innovation.

Moreover, alliances between technology developers and environmental service providers are becoming more prevalent, enabling collaborative models that optimize end-to-end waste handling. Joint ventures focusing on drilling fluid recycling and cuttings reuse exemplify this trend, demonstrating how synergies can unlock cost efficiencies while achieving environmental compliance. As companies vie for competitive advantage, intellectual property portfolios and demonstrated field performance emerge as key differentiators in procurement processes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drilling Waste Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aipu Solids Control

- ARMOS EXIM L.L.C.

- ASAP Fluids Pvt. Ltd.

- Augean PLC

- Baker Hughes Company

- Bowron Environmental Group Ltd.

- CCI Solutions

- Clear Environmental Solutions

- CVA Group

- Derrick Equipment Company

- Gen7 Environmental Solutions Ltd.

- GN Solids Control

- Halliburton Company

- Hebei GN Solids Control Co. Ltd.

- Imdex Limited

- KOSUN Machinery Co., Ltd

- National Oilwell Varco, Inc

- Nuverra Environmental Solutions by Select Water Solutions

- Qmax Colombia

- Ridgeline Canada Inc. by Ambipar Group

- SAS Environmental Services

- Schlumberger Limited

- Scomi Group Berhad

- Secure Energy Services, Inc.

- The Initiates PLC

- Turnkey Environmental Management Services Limited

- Weatherford International PLC

- Wellsite Environmental Inc.

- Xian KOSUN Environmental Engineering Co., Ltd.

Providing Actionable Recommendations for Industry Leaders to Navigate Challenges and Harness Opportunities in Drilling Waste Management

Industry leaders should prioritize the integration of digital monitoring with advanced treatment technologies to streamline operations and enhance compliance. By deploying real-time sensors and analytics platforms, companies can proactively adjust treatment parameters, reducing downtime and ensuring continuous adherence to environmental thresholds. It is also essential to cultivate partnerships with domestic equipment manufacturers to mitigate the effects of import tariffs and build resilient supply chains.

Further, organizations should invest in pilot programs to validate emerging treatment methods, such as crossflow membrane systems or microbial consortia tailored for hydrocarbon degradation. These pilots offer valuable insights into performance under field conditions and inform scaling decisions. To capitalize on regional opportunities, stakeholders must develop flexible service models that accommodate varying regulatory regimes, leveraging modular treatment units for offshore applications and centralized facilities for onshore operations.

Detailing the Rigorous Research Methodology Employed to Ensure Robust Data Collection Analysis and Insight Generation in This Study

This study employs a multi-phase research methodology combining primary interviews with industry experts and secondary data analysis from regulatory filings and technical journals. Initially, qualitative interviews with drilling operators, waste treatment specialists, and regulatory authorities provided firsthand insights into operational challenges and emerging regulatory trends. These discussions informed the development of a comprehensive framework for categorizing waste types and treatment technologies.

Subsequently, quantitative validation was conducted by analyzing procurement contracts and equipment utilization data from leading service providers, ensuring that the qualitative framework aligns with actual market practices. Multiple rounds of data triangulation were performed to reconcile discrepancies and validate trend projections. The final phase involved collaborative workshops with cross-functional stakeholders, enabling iterative feedback loops to refine thematic findings and ensure that the research conclusions are both actionable and grounded in real-world operational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drilling Waste Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drilling Waste Management Market, by Waste Type

- Drilling Waste Management Market, by Technology

- Drilling Waste Management Market, by Drilling Type

- Drilling Waste Management Market, by Application

- Drilling Waste Management Market, by End-User

- Drilling Waste Management Market, by Region

- Drilling Waste Management Market, by Group

- Drilling Waste Management Market, by Country

- United States Drilling Waste Management Market

- China Drilling Waste Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Critical Findings and Strategic Implications for Stakeholders in the Evolving Drilling Waste Management Ecosystem

The evolution of drilling waste management reflects the broader transition toward sustainable and efficient resource utilization within the oil and gas industry. Key findings highlight the pivotal role of technology integration, regulatory compliance, and supply chain resilience in shaping future market trajectories. Companies that successfully align their strategic roadmaps with segmentation insights-across waste types, technologies, drilling methods, applications, and end-user requirements-will gain a competitive edge.

Looking forward, the convergence of digitalization, circular economy principles, and regional collaboration promises to unlock new avenues for value creation. Stakeholders equipped with a deep understanding of tariff impacts, regional nuances, and treatment technology advancements will be better positioned to drive both environmental stewardship and operational excellence. Ultimately, proactive adaptation and continuous innovation will define leadership in the drilling waste management ecosystem.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Drilling Waste Management Market Research Report Today

Act now to unlock unparalleled insights tailored to your strategic objectives in drilling waste management by connecting with Ketan Rohom Associate Director Sales Marketing at 360iResearch. Ketan brings a wealth of expertise in market dynamics and can guide you through the report’s comprehensive analyses, ensuring you gain actionable intelligence on emerging technologies, regulatory shifts, and regional opportunities. Engaging with Ketan will provide you a personalized walkthrough of the report’s in-depth coverage of waste type treatments, technology applications, drilling methods, and end-user demands, helping you pinpoint growth avenues and operational efficiencies.

By partnering with Ketan Rohom, you gain access to exclusive data visualizations and scenario planning tools that illuminate tariff impacts, competitive landscapes, and segmentation drivers. His consultative approach ensures your questions are addressed in real time, allowing you to align the research findings with your organizational priorities. Secure your copy of the drilling waste management market research report today to stay ahead of market disruptions and capitalize on the transformative trends reshaping the industry.

Reach out to Ketan to discuss tailored licensing options, bespoke data services, or enterprise subscriptions that best suit your needs. Don’t miss this opportunity to reinforce your decision-making with robust market insights and position your organization at the forefront of sustainable drilling waste management.

- How big is the Drilling Waste Management Market?

- What is the Drilling Waste Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?