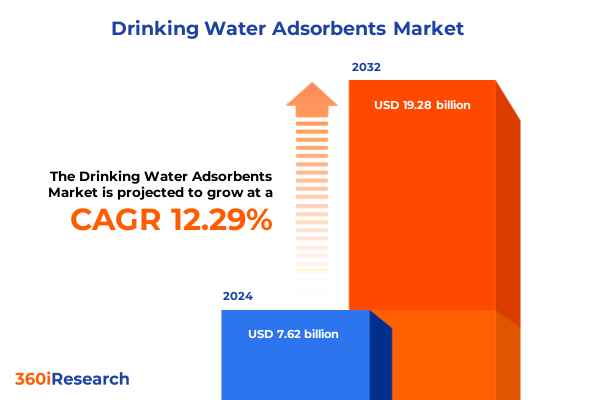

The Drinking Water Adsorbents Market size was estimated at USD 8.50 billion in 2025 and expected to reach USD 9.48 billion in 2026, at a CAGR of 12.40% to reach USD 19.28 billion by 2032.

Explaining the Critical Role of Advanced Adsorbents in Ensuring Safe and Sustainable Drinking Water in an Evolving Regulatory Environment

The imperative to safeguard potable water sources has never been more pronounced as aging infrastructure, emerging contaminants such as PFAS, and the pressures of urban expansion converge to challenge conventional treatment processes. Innovative adsorbent materials have emerged at the forefront of water purification protocols, offering high surface areas and tunable chemistries that remove a range of organic and inorganic pollutants with efficiency and reliability. As utilities, industrial users, and residential consumers demand both performance and sustainability, the development and deployment of advanced adsorbents is becoming a defining element of water security strategies worldwide.

Regulatory landscapes are evolving in parallel, with authorities implementing stringent maximum contaminant levels and incentivizing technologies that address persistent chemicals of concern. This dynamic environment underscores the critical role of comprehensive market analysis in guiding stakeholders through supply chain complexities, competitive positioning, and technological selection. By examining foundational drivers-material innovation, end-use requirements, and distribution networks-organizations can anticipate shifts in demand and align investments accordingly. The insights presented in this executive summary provide a strategic lens on the multifaceted forces reshaping the drinking water adsorbent sector.

Exploring Transformative Technological and Regulatory Shifts Redefining the Drinking Water Adsorbent Landscape for Stakeholders Worldwide

Recent years have witnessed a profound acceleration in the adoption of novel adsorption materials, catalyzed by breakthroughs in nanostructuring and surface functionalization techniques. Carbon-based sorbents, long valued for their versatility, now compete alongside engineered biochars derived from waste biomass and hybrid polymers designed for targeted contaminant capture. In parallel, digital monitoring platforms and remote sensing technologies are enabling real-time performance validation and predictive maintenance, transforming once manual operations into data-driven ecosystems.

On the regulatory front, the establishment of enforceable PFAS standards by the U.S. Environmental Protection Agency has intensified demand for robust adsorbent solutions capable of achieving sub-parts-per-trillion removal efficiencies. In Europe, the recast Drinking Water Directive has introduced lower parametric values and a watch list for emerging pollutants, prompting utilities to integrate advanced adsorption in their treatment trains. These policy shifts, combined with growing public awareness of water quality, are prompting water authorities and industrial operators to reassess legacy systems and adopt modular, scalable adsorption units that can adapt to evolving contaminant profiles.

Assessing the Far-Reaching Cumulative Effects of Recent US Trade Actions on Drinking Water Adsorbent Supply Chains and Cost Structures

The imposition of Section 301 tariffs on critical adsorbent materials has added a complex layer of cost and supply chain risk to the drinking water treatment market. As of January 1, 2025, a 25 percent duty applies to activated carbon under HTS 3802.10.00 and 3802.90.20, as well as ion-exchange resins classified under HTS 3914.00.60, and related zeolitic materials. For manufacturers and treatment plant operators reliant on imports, these levies have translated into immediate price increases, often passed downstream to capital project budgets and consumer tariffs.

Municipalities planning multi-year infrastructure upgrades have reported significant budget overruns, with unforeseen tariff costs compounding existing challenges such as shipping congestion and feedstock volatility. In response, several large utilities have deferred non-critical upgrades to secure additional funding or to renegotiate supplier contracts. Concurrently, domestic producers are capturing market share by leveraging near-shoring strategies and expanding reactivation capacities, thereby mitigating tariff exposure. The aggregate effect of these trade measures is reshaping procurement practices, driving heightened emphasis on contractual flexibility, and accelerating investments in regional manufacturing assets to fortify supply resilience.

Deep Diving into Material, Application, Form Factor, End User, and Distribution Channel Segmentation to Reveal Strategic Market Opportunities

The market segmentation by material type reveals a competitive balance between traditional activated carbon and emerging alternatives. While activated carbon remains the backbone of adsorption technologies due to its proven efficacy and extensive application knowledge base, biochar crafted from agricultural residues is gaining traction for its lower lifecycle carbon footprint. Ion-exchange resins, particularly those engineered for selective removal of charged contaminants, complement carbon‐based adsorbents in hybrid treatment schemes. Synthetic polymers with tailored pore structures and functional groups are also entering niche applications where targeted molecular interactions are essential, and zeolites, prized for their uniform microporosity, are leveraged in high-precision settings.

Application dynamics reflect divergent growth paths. Commercial and residential point-of-use systems continue to expand as public demand for on-demand, decentralized water purification intensifies. Within industrial applications, chemical processing and food and beverage operations prioritize adsorbents that deliver consistent performance under stringent quality standards. Oil and gas sectors focus on treatment solutions that minimize fouling in complex fluid streams, while pharmaceutical manufacturers require ultra-high-purity sorbents compliant with pharmacopeia guidelines. On the municipal side, large treatment plants are adopting advanced adsorption polishing units in addition to conventional treatment, balancing cost with regulatory compliance.

Form factor considerations further differentiate market offerings. Granular media maintain leadership in large-scale fixed-bed reactors due to low pressure drop and ease of mechanical handling. Pellets are favored in mobile service units for their structural integrity and low dust generation, whereas powdered adsorbents see application in specialized reactors and dosing systems for rapid contaminant uptake. End users, including bottled water manufacturers seeking consistent product quality, commercial establishments aiming for operational reliability, household consumers demanding user-friendly formats, and water utilities tasked with public health objectives, each navigate these product attributes to align performance, cost, and logistical requirements. Distribution channels, spanning direct sales agreements for high-volume contracts, distributors offering regional inventory buffers, and online retail catering to individual end-users, complete the network through which adsorbents reach diverse market segments.

This comprehensive research report categorizes the Drinking Water Adsorbents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Form Factor

- End User

- Distribution Channel

Understanding Regional Dynamics Shaping the Drinking Water Adsorbent Market Across the Americas, Europe Middle East Africa, and Asia Pacific

In the Americas, a confluence of regulatory advancements and infrastructure investment is driving demand for adsorbent solutions. The U.S. federal standard for PFAS has prompted municipalities nationwide to integrate granular activated carbon and ion exchange modules into water treatment facilities, supported by multibillion-dollar funding streams under the Bipartisan Infrastructure Law. Canada’s focus on watershed protection and emerging industry partnerships is fostering localized production of high-purity adsorbents, reducing reliance on imports.

Across Europe, Middle East, and Africa, evolving Drinking Water Directive requirements and ambitious environmental quality standards under the Water Framework Directive are compelling utilities to deploy advanced adsorption in both urban and rural contexts. Nations such as France, grappling with PFAS-related contamination events in Saint-Louis, are accelerating the installation of dedicated filtration systems, while regulatory bodies in Belgium’s Wallonia region are preemptively adopting stricter PFAS limits ahead of EU deadlines. In the Middle East and Africa, rapid urbanization and scarce freshwater resources are creating robust markets for compact, modular adsorbent units designed for decentralized water access.

Asia-Pacific markets are characterized by heterogeneous growth trajectories. China and India, with extensive rural populations lacking centralized treatment infrastructure, are driving innovation in low-cost biochar and hybrid resin solutions. Australia’s stringent drinking water standards are stimulating investments in reactivation facilities and technology partnerships. Southeast Asian economies, balancing affordability with performance, are adopting powdered and pellet-based adsorbents in both municipal plants and industrial effluent treatment, supported by targeted government incentives for water quality improvement.

This comprehensive research report examines key regions that drive the evolution of the Drinking Water Adsorbents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Driving Innovation, Expansion, and Collaboration in the Global Drinking Water Adsorbents Sector

Industry leaders are strengthening their market positions through strategic acquisitions, capacity expansions, and product innovation. Calgon Carbon has notably acquired Sprint Environmental Services’ industrial reactivation business and announced substantial investments in new production lines at its Mississippi facilities to boost virgin carbon output beyond 200 million pounds annually. These initiatives are designed to meet surging demand for PFAS removal media and to offer reactivation services that enhance circularity and cost efficiency.

Donau Carbon US LLC, formed through the merger of Standard Purification and Donau Carbon’s U.S. subsidiary, has expanded its footprint in Florida to serve municipal and industrial clients with an integrated portfolio of granular, powder, and extruded carbon products. Beyond reactivation services, the company is leveraging global logistics hubs to ensure robust supply chains and rapid delivery to key markets.

Other prominent participants such as Cabot Corporation and Osaka Gas Chemicals have introduced pharmaceutical-grade adsorbent lines compliant with USP and EP guidelines, catering to high-purity industrial applications. Kureha and Carbon Activated Corporation continue to invest in R&D for polymeric resins and biochar blends, while emergent manufacturers focus on modular service offerings and digital monitoring capabilities. The competitive landscape is evolving as these firms forge technology partnerships, optimize feedstock sourcing, and refine product differentiation strategies to address diverse end-user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drinking Water Adsorbents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Cabot Corporation

- Calgon Carbon Corporation

- Donau Carbon GmbH

- Jacobi Carbons AB

- Kuraray Co., Ltd.

- LANXESS Aktiengesellschaft

- Mitsubishi Chemical Corporation

- Purolite Corporation

- Zeochem AG

Actionable Recommendations for Industry Leaders to Strengthen Supply Resilience and Accelerate Technological Adoption in Water Adsorbent Markets

To navigate the evolving market and regulatory environment, industry stakeholders should prioritize strategic investments in domestic reactivation capacity to mitigate import tariffs and bolster supply resilience. By developing or partnering on regional processing hubs, companies can reduce lead times and leverage local feedstocks to enhance sustainability credentials. Such initiatives should be complemented by the adoption of advanced digital monitoring systems, which enable proactive maintenance and performance verification across treatment assets.

Firms are advised to deepen collaborations with technology providers to co-develop tailored adsorbent solutions that address site-specific challenges, such as high-value industrial effluents or municipal plant integrations. Joint ventures focusing on hybrid treatment trains, combining activated carbon, ion exchange, and membrane technologies, can unlock synergies in contaminant removal efficacy and operational cost savings. Market entrants and incumbents alike should also diversify their portfolios to include emerging adsorbents like engineered biochar and synthetic polymers, targeting niche applications where conventional media fall short.

Finally, aligning product development with forthcoming regulatory shifts-such as the EU’s 2026 PFAS watch list monitoring and evolving MCL frameworks-will be critical to securing long-term contracts. Engaging proactively with policymakers and participating in standards committees can ensure that new materials and processes are recognized within regulatory frameworks, thus facilitating market acceptance and reducing time-to-market for innovative adsorbent technologies.

Outlining the Rigorous Research Methodology Employed to Deliver Unbiased and Comprehensive Insights into Drinking Water Adsorbent Markets

This analysis integrates a dual research approach combining comprehensive secondary data review and targeted primary engagement. Secondary research encompassed an examination of government and regulatory publications, customs and tariff filings, industry whitepapers, and peer-reviewed journals to identify technological trends, policy evolutions, and competitive dynamics. Key sources included the U.S. Federal Register, EPA rulemaking notices, and European Commission directives to ensure accuracy on regulatory developments.

Primary research involved structured interviews with executives of leading adsorbent manufacturers, water treatment system integrators, and municipal procurement officials. Insights gleaned from these discussions were triangulated against published financial statements and investment announcements to validate strategic initiatives such as capacity expansions and M&A activity. The segmentation framework was developed through a combination of top-down market mapping and bottom-up stakeholder feedback, allowing for detailed analysis across material types, applications, form factors, end users, and distribution channels.

Data points were subject to rigorous cross-verification and quality checks, leveraging both quantitative metrics and qualitative assessments. This mixed-method approach ensures that the findings present an unbiased, in-depth perspective on the structural drivers of the drinking water adsorbent market and the strategic imperatives for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drinking Water Adsorbents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drinking Water Adsorbents Market, by Material Type

- Drinking Water Adsorbents Market, by Application

- Drinking Water Adsorbents Market, by Form Factor

- Drinking Water Adsorbents Market, by End User

- Drinking Water Adsorbents Market, by Distribution Channel

- Drinking Water Adsorbents Market, by Region

- Drinking Water Adsorbents Market, by Group

- Drinking Water Adsorbents Market, by Country

- United States Drinking Water Adsorbents Market

- China Drinking Water Adsorbents Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights on Market Dynamics, Strategic Imperatives, and the Future Outlook for Drinking Water Adsorbents in a Rapidly Evolving Sector

The drinking water adsorbent sector is at a strategic inflection point, driven by converging regulatory mandates, evolving contaminant profiles, and innovations in material science. The interplay of tariffs, policy shifts, and technological breakthroughs underscores the necessity for agile business models and diversified portfolios. Companies that invest in regional capabilities, embrace digital transformation, and collaborate across the value chain will be best positioned to capture emerging growth opportunities.

As utilities and industrial operators grapple with budget constraints, environmental objectives, and public health imperatives, the capacity to offer tailored adsorbent solutions-whether through reactivated carbon services, high-purity synthetic resins, or next-generation biochars-will become a defining competitive differentiator. In parallel, market participants must remain vigilant to regulatory evolutions in PFAS, endocrine disruptors, and other emerging contaminants to ensure compliance and maintain public trust.

Ultimately, the most successful organizations will be those that integrate strategic foresight with operational excellence, leveraging actionable insights to drive continuous innovation in product development, supply chain management, and stakeholder engagement. This report provides the foundational intelligence required to chart a strategic course in a rapidly changing environment, empowering decision-makers to capitalize on transformative shifts and sustain long-term value creation.

Take the Next Step to Leverage Comprehensive Market Intelligence on Drinking Water Adsorbents by Engaging with Ketan Rohom for Access

Ready to gain a competitive edge with unparalleled market intelligence on drinking water adsorbents? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive research report today. This tailored analysis equips you with actionable insights into evolving regulations, emerging technologies, and strategic opportunities. Don’t miss the chance to make data-driven decisions and fortify your strategic roadmap with expert guidance. Reach out now and propel your organization to the forefront of the water treatment industry.

- How big is the Drinking Water Adsorbents Market?

- What is the Drinking Water Adsorbents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?