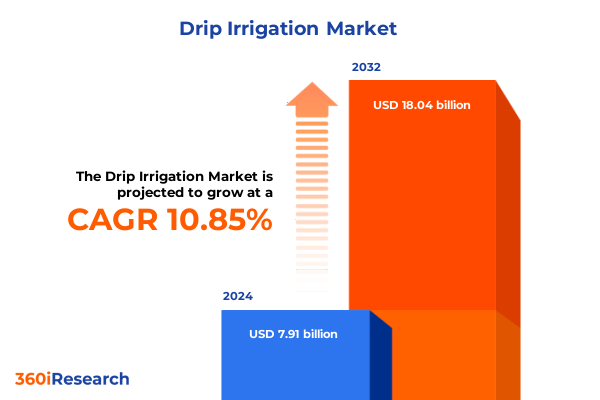

The Drip Irrigation Market size was estimated at USD 8.77 billion in 2025 and expected to reach USD 9.66 billion in 2026, at a CAGR of 10.84% to reach USD 18.04 billion by 2032.

Unveiling the Core Principles and Foundational Significance of Drip Irrigation as a Water-Saving Innovation Shaping Modern Agricultural Practices

Drip irrigation stands at the forefront of modern agricultural innovation, offering a critical solution to the mounting global challenge of water scarcity. With an estimated four billion people experiencing severe water shortages for at least one month each year, the imperative to optimize every drop of available water has never been greater. Originating as a concept in the early 20th century and refined through decades of engineering, drip irrigation now represents the most precise and efficient method for delivering water and nutrients directly to the plant root zone while minimizing evaporation and runoff. This system’s capacity to conserve up to 60 percent more water than traditional flood irrigation underscores its transformative potential for resource stewardship.

As of 2023, only 3 percent of the world’s farmers employ drip irrigation, a figure that highlights both the technology’s nascent global diffusion and its vast growth prospects. Adoption has been driven by a confluence of factors, including escalating concerns over climate variability, the depletion of freshwater sources, and the rising cost of energy for pumping. Consequently, governments, development agencies, and private enterprises are increasingly prioritizing micro-irrigation solutions as a cornerstone of sustainable agriculture strategies. Drip irrigation’s ability to tailor water delivery to the specific needs of various crops, soil types, and climatic conditions positions it as an indispensable tool for enhancing crop yields, preserving soil health, and reducing environmental impact.

This executive summary provides an authoritative overview of the drip irrigation landscape, integrating technological, regulatory, and market developments. Through a rigorous exploration of the sector’s transformative shifts, tariff dynamics, segmentation insights, and regional trends, readers will gain a holistic understanding of the strategic forces shaping this market. Whether you are an industry executive, policy-maker, or agricultural stakeholder, this analysis delivers the clarity needed to navigate a rapidly evolving field with confidence and strategic foresight.

Identifying the Transformative Technological, Environmental, and Regulatory Shifts Redefining the Drip Irrigation Landscape Worldwide

The drip irrigation sector has undergone profound technological, environmental, and regulatory revolutions in recent years, redefining how water-efficient agriculture is implemented across the globe. Advances in digital farming solutions such as sensor networks, satellite imagery, and AI-driven analytics have elevated precision irrigation from a niche practice to a scalable, data-centric discipline. For example, Netafim’s integration of Treetoscope’s plant sensing technology into its GrowSphere™ digital platform exemplifies how direct measurement of plant water status can transform irrigation decision-making, enabling real-time adjustments to optimize both water use and crop performance under varying field conditions.

Concurrently, growing regulatory emphasis on water conservation has spurred the adoption of drip irrigation in both emerging and mature markets. Subsidy programs, tax incentives, and public-private partnerships in countries like India and Israel underscore water scarcity’s centrality to national agricultural policies. The psycho-social shift among stakeholders-driven by heightened awareness of climate risks-has accelerated investments in soil moisture sensors, flow meters, and pressure-compensated emitters, ensuring that every component of an irrigation network contributes to maximum efficiency. The result is a reimagined landscape where interdisciplinary collaboration unites agronomy, engineering, and environmental science to deliver sustainable outcomes.

Third-party commitments to sustainability, such as Netafim’s fully circular dripline recycling initiative, further illustrate the transformative momentum in the industry. By reclaiming used polyethylene dripline and reintroducing recycled resin into new products, companies are addressing end-of-life challenges while reinforcing their ESG credentials. This holistic approach to resource use and lifecycle management signals a broader shift toward closed-loop systems in irrigation, marking a departure from linear manufacturing models and underscoring the sector’s role as a catalyst for circular economy practices.

Examining the Extensive Cumulative Impact of 2025 United States Tariff Measures on the Drip Irrigation Supply Chain and Cost Structures

In 2025, the United States implemented a sweeping 10 percent universal tariff on all imports as a baseline, complemented by elevated reciprocal duties of 34 percent on Chinese goods, 20 percent on European Union imports, and up to 46 percent on Vietnamese products. These measures, announced in early April, represent a significant recalibration of U.S. trade policy that has reverberated across agricultural supply chains, including micro-irrigation equipment. Coupled with separate 25 percent duties on steel and aluminum imports, these tariffs have introduced fresh cost pressures on manufacturers that rely on globally sourced components such as tubing, controllers, and valves.

The phased implementation of tariffs on Canada, Mexico, and China-scheduled to take effect on March 4, 2025-further compounded supply chain uncertainties. With a 25 percent duty on Canadian and Mexican imports and a 10 percent increase on Chinese goods, many irrigation component suppliers faced abrupt cost escalations that translated into higher prices for end users. These decisions have prompted industry stakeholders to reassess sourcing strategies, with several U.S.-based manufacturers exploring nearshoring opportunities to mitigate disruptions.

The cumulative impact has been uneven across the value chain. Distributors and contractors dependent on imported emitters and filtration units report increased project costs and extended lead times, while some domestic producers have benefited from reduced foreign competition. Yet, the net effect remains one of volatility, as both raw material and finished product costs fluctuate in response to evolving trade negotiations. Observers caution that retaliatory tariffs from affected trading partners could further constrain U.S. agricultural exports, potentially dampening demand for irrigation installations abroad.

Looking ahead, ongoing consultations between U.S. trade representatives and key allies offer a window for policy adjustments. However, in the near term, industry players must navigate heightened cost structures, reevaluate supplier portfolios, and strengthen advocacy efforts to ensure that tariff policy supports, rather than undermines, the sector’s mission to enhance water-use efficiency.

Decoding Key Segmentation Insights Revealing Application, System Type, Crop Use, and Component Dynamics Driving Drip Irrigation Markets

A nuanced understanding of drip irrigation market segments reveals how tailored product offerings and targeted applications drive adoption across diverse contexts. Consider the realm of application, where conventional agriculture commands the bulk of installations, yet specialized uses such as golf course turf management, greenhouse cultivation, and ornamental landscaping are carving out fast-growing niches. These distinct end-user environments demand solutions that balance water precision with aesthetic or yield-specific requirements, creating opportunities for brands to deliver differentiated service models.

Delving into system types illuminates another layer of differentiation. Surface drip systems, prized for their straightforward deployment and ease of maintenance, dominate field-level crop installations, whereas subsurface configurations-buried below the root zone-are increasingly leveraged in high-value greenhouses and orchards seeking to further curtail evaporation losses and optimize water distribution uniformity. The choice between surface and subsurface designs often reflects a calculated trade-off among installation complexity, long-term efficiency gains, and crop-specific needs.

Crop end-use segmentation further clarifies market dynamics. In open-field scenarios, drip systems underpin field crop operations such as row vegetables and specialty grains, delivering precise moisture control that mitigates drought risk. Meanwhile, high-value fruits and vegetables benefit from customized emitter layouts that support delicate root architectures and staggered growth stages. Landscape plants in urban and suburban settings highlight aesthetic imperatives, prompting innovation in low-profile tubing and discreet emitter assemblies. Additionally, nuts and oilseed orchards frequently adopt subsurface driplines to protect against surface damage and ensure consistent hydration over extensive perennials.

Component-level insights complete the segmentation picture. Controllers, bifurcated into sensor-based and timer-based platforms, shape the degree of automation and decision-making intelligence embedded in each system. Emitters are categorized as inline or on-line, each offering specific advantages in clog resistance and flow regulation. Filters-whether sand or screen-provide critical safeguarding against particulate ingress, preserving downstream performance. Tubing choices range from flexible polyethylene tracts to specialized drip tape designs, while valve options span manual hand-operated units to electronically actuated solenoid arrays. This granular segmentation underscores the multifaceted nature of the drip irrigation landscape and the imperative for solution providers to align product portfolios with end-user priorities.

This comprehensive research report categorizes the Drip Irrigation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Application

- End Use

Analyzing Pivotal Regional Dynamics and Divergent Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Zones

Geographic diversity in drip irrigation adoption is shaped by region-specific priorities, infrastructure maturity, and policy interventions. Across the Americas, the United States leads with more than 3.1 million hectares under drip systems, buoyed by federal cost-share programs that supported 13,000 new installations in 2023 and by California’s enduring focus on drought mitigation through advanced irrigation technologies. Canada has similarly expanded its footprint in high-value horticultural zones, particularly in British Columbia and Ontario, where vineyard and berry growers have tapped provincial incentives to modernize irrigation networks.

In Europe, Middle East & Africa, water scarcity in southern Europe has galvanized adoption, with Spain alone utilizing some 760,000 hectares of drip for olive groves and vineyards under EU-backed sustainability schemes. Environmental targets under the European Green Deal and growing regulatory pressure to curb agricultural runoff have propelled smart driplines and sensor-based controllers into mainstream agricultural practice. In the Middle East and North Africa, Israel’s pioneering leadership has driven drip installations across 90 percent of its arable land, while emerging economies such as Kenya, Nigeria, and Ethiopia have deployed tens of thousands of new units through a mix of NGO support and government-led adaptation programs.

Asia-Pacific emerges as the largest market by absolute area, reflecting both green revolution momentum and current water stress in key production zones. India allocated $635 million under its PMKSY micro-irrigation subsidy scheme to expand drip coverage across fruits, vegetables, and cash crops, while China reported over 2.2 million hectares of drip installations for cotton, grapes, and specialty vegetables. Japan and South Korea are integrating drip networks into controlled-environment agriculture, posting double-digit growth rates in greenhouse deployments. Meanwhile, Southeast Asian nations are piloting solar-powered drip arrays to serve remote, off-grid communities.

These regional patterns underscore the interplay of government backing, resource constraints, and commercial demand in shaping localized drip irrigation trajectories. They also highlight the critical role of cross-border technology transfer and knowledge-sharing in accelerating global uptake.

This comprehensive research report examines key regions that drive the evolution of the Drip Irrigation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Drip Irrigation Innovators and Their Strategic Initiatives Shaping Technological Leadership and Global Market Influence

The corporate landscape of drip irrigation is defined by continuous innovation and strategic global expansion. Netafim, a precision agriculture business of Orbia, has introduced the world’s first patented Hybrid Dripline, which integrates integral dripline technology with built-in outlets to eliminate manual outlet placement and enhance operational efficiency in vineyards, orchards, and greenhouses. Additionally, Netafim’s collaboration with Treetoscope brings plant-centric sensing directly into its GrowSphere™ platform, offering real-time irrigation recommendations based on direct measurement of plant water status.

Rivulis has pursued scale and product diversification through strategic mergers and capacity expansions. The combination of Rivulis and Eurodrip created a unified micro-irrigation leader with 18 factories across five continents and a workforce of 1,800, drawing on flagship product lines such as T-Tape™, Ro-Drip™, and D5000 PC to serve diverse crop and terrain requirements. Further, Rivulis’s investment to boost production in San Juan, Argentina, by 40 percent highlights the company’s commitment to meeting rising regional demand, elevating annual output from 70 million to over 100 million meters of driplines.

These initiatives reflect a broader industry imperative to align manufacturing footprints with market needs, enhance R&D pipelines, and deepen digital agriculture capabilities. Emerging players and established incumbents alike are leveraging IoT integration, circular economy models, and advanced materials science to differentiate their offerings. As competitive dynamics intensify, companies are also emphasizing service-based revenue streams-such as satellite crop monitoring and data analytics subscriptions-to augment traditional product sales and foster long-term customer partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drip Irrigation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Antelco Pty Ltd

- AutoAgronom Ltd.

- Chinadrip Irrigation Equipment Co., Ltd.

- Driptech Incorporated

- Elgo Irrigation Ltd.

- Eurodrip S.A.

- Hunter Industries

- Irritec S.p.A.

- Jain Irrigation Systems Ltd.

- Kisan Irrigation Ltd.

- Lindsay Corporation

- Mahindra EPC Irrigation Limited

- Metzer Group

- Netafim Ltd.

- Rain Bird Corporation

- Rivulis Irrigation Ltd.

- Shanghai Irrist Corp., Ltd.

- The Toro Company

- Valmont Industries, Inc.

Outlining Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Drip Irrigation’s Evolving Market and Technological Trends

Industry leaders should prioritize the deployment of advanced sensor networks and AI-driven irrigation management systems to capture real-time field data, enabling dynamic water scheduling that responds to crop needs, weather variations, and soil moisture profiles. By integrating digital farming platforms, organizations can elevate service offerings and differentiate through precision-driven outcomes.

Supply chain resilience must be reinforced through diversified sourcing strategies. Companies should expand nearshore manufacturing capacities to mitigate tariff-driven cost volatility, while fostering strategic partnerships with local producers. Concurrently, adopting circular economy principles-such as in-house recycling programs for polyethylene driplines-will align operations with sustainability goals and enhance stakeholder trust.

Collaborative engagement with policy-makers and industry associations is essential for securing favorable regulatory frameworks and subsidy programs. By articulating the societal and environmental benefits of drip irrigation-namely water conservation, yield stability, and reduced nutrient runoff-companies can influence policy development and access funding schemes that accelerate market penetration.

Finally, targeted investment in end-user education programs and demonstrative pilots will break down adoption barriers. Demonstration sites showcasing yield gains and resource savings can catalyze farmer confidence and unlock latent demand. Tailored financing models, including leasing and pay-as-you-grow structures, should be developed to address initial cost hurdles and expand reach among smallholder and commercial growers alike.

Detailing the Rigorous Multi-Source Research Methodology Underpinning Comprehensive Insights into the Drip Irrigation Market Landscape

This research synthesizes primary insights obtained through in-depth interviews with key stakeholders, including irrigation equipment manufacturers, agricultural distributors, and leading agronomists, ensuring that industry perspectives drive contextual accuracy. Secondary data was collated from authoritative sources such as government irrigation surveys, trade association reports, and public policy releases, thereby grounding our analysis in established metrics and regulatory frameworks.

Complementing qualitative inputs, rigorous data triangulation was employed to reconcile disparate information streams, validate emerging trends, and quantify segmentation parameters. Comparative case studies of regional subsidy programs and manufacturing expansions provided a robust framework for assessing strategic impacts. Additionally, a detailed review of patent filings and technology whitepapers informed the evaluation of innovation trajectories.

Analytical methodologies encompassed both SWOT analysis and five forces modeling to elucidate competitive dynamics and identify strategic leverage points. Scenario planning exercises further illuminated potential market responses to shifting policy and trade environments. This comprehensive, multi-modal methodology ensures that findings are both actionable and resilient in the face of evolving industry conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drip Irrigation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drip Irrigation Market, by Type

- Drip Irrigation Market, by Component

- Drip Irrigation Market, by Application

- Drip Irrigation Market, by End Use

- Drip Irrigation Market, by Region

- Drip Irrigation Market, by Group

- Drip Irrigation Market, by Country

- United States Drip Irrigation Market

- China Drip Irrigation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Strategic Imperatives and Industry Outlook for Drip Irrigation in an Era of Water Scarcity and Technological Advancement

The drip irrigation sector is poised for sustained transformation as water scarcity amplifies the need for precision resource management. Technological innovations-spanning hybrid driplines, sensor-based controllers, and digital farming platforms-continue to lower barriers to adoption and enhance system scalability. Meanwhile, evolving trade policies and tariff frameworks underscore the importance of strategic supply chain planning and local capacity building.

Regional dynamics reveal that while Asia-Pacific maintains its leadership in absolute installation area, emerging opportunities in the Americas and EMEA hinge on targeted incentive programs and infrastructure modernization. Leading companies are differentiating through product innovation, circular economy initiatives, and service-based offerings, providing clear templates for success.

Looking forward, industry participants must navigate a complex matrix of stakeholder expectations, regulatory pressures, and environmental imperatives. By leveraging advanced analytics, diversifying manufacturing footprints, and fostering collaborative policy engagement, stakeholders can drive the next wave of drip irrigation expansion-ensuring that this essential technology fulfills its promise as a cornerstone of sustainable agriculture.

Seize the Opportunity Today by Connecting with Ketan Rohom to Acquire the Definitive Drip Irrigation Market Research Report and Drive Strategic Growth

Ready to transform your strategic approach and secure a competitive advantage in drip irrigation? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to procure the comprehensive market research report that offers in-depth analysis, actionable insights, and tailored guidance for your organization’s success in this dynamic industry. Don’t miss the opportunity to leverage authoritative intelligence and position your business at the forefront of water-efficient agriculture-reach out today to initiate your purchase and empower your decision-making with data-driven clarity.

- How big is the Drip Irrigation Market?

- What is the Drip Irrigation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?