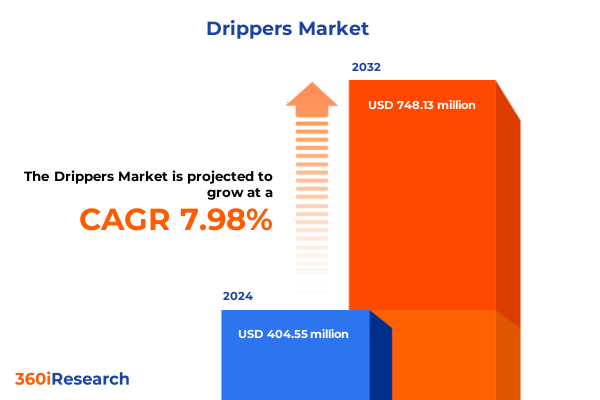

The Drippers Market size was estimated at USD 437.26 million in 2025 and expected to reach USD 468.42 million in 2026, at a CAGR of 7.97% to reach USD 748.13 million by 2032.

Emerging Dynamics Shaping the Drippers Market as a Cornerstone of Sustainable, Precise, and Highly Efficient Modern Irrigation Solutions

Over recent years, drippers have emerged as indispensable instruments in the shift toward sustainable agriculture and precision irrigation. As water scarcity intensifies globally, farmers and commercial growers are increasingly turning to drip emitters to optimize water delivery directly at the root zone, significantly reducing wastage compared to conventional irrigation methods. Modern drip systems, integrated with moisture sensors and smart controllers, dynamically adjust water schedules in response to real-time field conditions, ensuring that plants receive precisely the right amount of moisture and thereby promoting healthier, more resilient crops.

Simultaneously, the convergence of digital technologies such as the Internet of Things (IoT) and cloud computing has propelled drippers into the era of data-driven irrigation. Sensor-based networks now enable continuous monitoring of soil moisture, nutrient levels, and weather variables, feeding this data into AI-driven analytics platforms that generate actionable insights for irrigation scheduling and resource management. These innovations offer profound implications for water use efficiency, with studies indicating up to a 50% reduction in water consumption compared to traditional practices.

Looking ahead, drippers are poised to play an even more pivotal role in the global endeavor to balance agricultural productivity with environmental stewardship. As regulatory bodies and industry stakeholders intensify their focus on sustainable water management, the integration of dripper systems with broader farm management ecosystems will become increasingly critical. This report provides a detailed examination of the current landscape, emerging trends, and strategic considerations shaping the drippers market today.

Rapid Evolution of Dripper Technologies and Market Trends Driving Unprecedented Shifts toward Automation, Sustainability, and Smart Agriculture Practices

The drippers landscape is witnessing an unprecedented transformation driven by rapid technological advancements and evolving market demands. IoT-enabled sensor networks now form the backbone of precision irrigation, offering farmers hyper-localized insights into soil moisture, temperature, and nutrient levels. Such real-time data streams empower automated controllers to deliver water on a moment’s notice, significantly reducing losses due to evaporation or runoff.

Meanwhile, AI-driven analytics platforms are revolutionizing decision support by synthesizing historical field data with up-to-the-minute weather forecasts. Predictive modeling applications can now anticipate pest outbreaks or nutrient deficiencies, prompting preemptive irrigation adjustments that safeguard crop health and yield potential. This integration of machine learning with drip irrigation promises to elevate resource allocation, ensuring that water and fertilizers are applied precisely where they yield the greatest return.

In parallel, the deployment of drones and satellite remote sensing has extended the reach of dripper systems to the macro level. Aerial imagery combined with vegetation indices such as NDVI enables large-scale mapping of moisture variability and crop stress zones, informing subsurface drip irrigation strategies for high-value row crops. As connectivity and automation costs decline, these sophisticated tools are becoming accessible to a wider range of growers, from large commercial farms to niche horticultural operations, catalyzing a new era of intelligent, scalable irrigation solutions.

Assessing the Cumulative Economic and Supply Chain Implications of 2025 United States Trade Tariffs on Dripper Components and Equipment

In 2025, the United States government implemented a series of new trade tariffs affecting key components used in dripper manufacturing and distribution. A universal 10% duty on imports across all countries, accompanied by reciprocal tariffs ranging between 20% and 46% on specific partners such as China and the European Union, has introduced significant cost pressures throughout the supply chain.

Steel and aluminum-a critical input for many automated dripper assemblies-are now subject to a 25% tariff, raising concerns over material shortages and upward pricing pressures. Industry stakeholders warn that these increased input costs may be passed through to end users, potentially slowing adoption among price-sensitive small-scale growers and home gardeners.

Moreover, retaliatory measures and ongoing negotiations have created uncertainty regarding long-term tariff levels. The 90-day pause on certain reciprocal duties offers temporary relief, but many manufacturers are reassessing their sourcing strategies and exploring regionalized supply networks to mitigate future disruptions. For industry leaders, understanding the cumulative implications of these trade dynamics is crucial for maintaining resilient operations and competitive pricing models.

Unveiling Critical Segmentation Insights Illuminating Diverse Dripper Product, Channel, Application, End User, and Material Landscapes

The drippers market can be deconstructed through multiple lenses, each offering unique insights into product offerings, distribution strategies, use cases, consumer profiles, and material choices. Product type spans from basic manual emitters to advanced automatic drippers subdivided into non-pressure compensating and pressure compensating variants, the latter ensuring uniform water output across variable topographies. Distribution channels split between traditional offline retail-including mass merchants and specialty irrigation stores-and online platforms hosted on brand websites or third-party marketplaces, where direct-to-consumer engagement is increasingly prevalent.

Applications of drippers range from large-scale agricultural operations-such as orchards, row crop fields, and vineyards-to specialized horticultural environments including floriculture businesses and nurseries, as well as residential landscaping and garden plots. End users bifurcate into commercial growers, which encompass both large-scale and small-scale farms focused on maximizing yield efficiency, and home gardeners seeking user-friendly, cost-effective solutions. Material composition further segments the market into metal and plastic drippers, each with distinct durability, cost, and performance attributes, driving differential selection based on operational priorities and environmental conditions.

These segmentation frameworks illuminate how innovations within one dimension-such as the integration of pressure compensating emitters-can cascade into shifts across channels, applications, and end-user preferences. By examining each segment in concert, industry participants can tailor product development, marketing approaches, and service offerings to precisely address the nuanced requirements of their target customers.

This comprehensive research report categorizes the Drippers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Distribution Channel

- Application

- End User

Comparative Regional Perspectives Highlighting Distinct Adoption Patterns and Growth Drivers for Drippers across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of the drippers market. In the Americas, robust adoption in the United States and Brazil reflects a broad commitment to water-saving technologies, driven by acute drought conditions in states like California and government-funded subsidy programs for micro-irrigation. Innovations in subsurface drip techniques have gained traction for high-value crops, enhancing both uniformity of moisture delivery and return on investment.

The Europe, Middle East & Africa cluster presents a tapestry of adoption patterns, where established greenhouse operations in Germany and the Netherlands leverage drip lines to optimize controlled-environment agriculture under stringent sustainability mandates. In the Middle East, nations such as Israel have deployed drip irrigation across over 90% of arable land, showcasing advanced water management expertise. Simultaneously, African markets-bolstered by NGO-backed programs and government incentives-are witnessing rapid expansion in Kenya, Nigeria, and Ethiopia as farmers adopt drip solutions to mitigate erratic rainfall and bolster food security.

Asia-Pacific stands at the forefront of global dripper growth, propelled by severe water scarcity challenges in India, China, and Australia and supported by large-scale government initiatives like India’s Pradhan Mantri Krishi Sinchayee Yojana. Farmers in these regions are integrating IoT-enabled controllers and AI-driven irrigation platforms to maximize water use efficiency, reduce labor requirements, and secure higher crop yields. Subsidy programs and technology partnerships have accelerated adoption, positioning Asia-Pacific as the most dynamic regional market for drippers.

This comprehensive research report examines key regions that drive the evolution of the Drippers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Dripper Market Innovators and Strategic Moves Shaping Competitive Dynamics and Value Propositions in a Rapidly Evolving Sector

The drippers market is led by a cadre of established and emerging players, each distinguishing their offerings through innovation, strategic partnerships, and service excellence. Netafim continues to command attention with its pioneering pressure-compensating drippers and climate-smart rice applications, positioning itself as a technological trailblazer. Jain Irrigation Systems leverages an integrated model-offering end-to-end irrigation solutions alongside agronomic advisory services-to deepen customer relationships and drive recurring revenue streams.

Toro and Rain Bird remain influential through their broad product portfolios and expansive distribution networks, catering to both commercial growers and consumer segments with user-friendly controllers and modular drip kits. Rivulis has strengthened its market stance by acquiring specialized component manufacturers, enhancing its supply chain resilience and enabling faster response to tariff-driven sourcing challenges. Meanwhile, Hunter Industries has gained traction in landscaping and home gardening applications through intuitive, app-enabled dripper controllers that simplify setup and remote management.

Collectively, these key companies are reshaping competitive dynamics by investing heavily in R&D, forging alliances with technology providers, and piloting subscription-based models for irrigation-as-a-service. As sustainability imperatives and digitalization continue to converge, these strategic moves are likely to define the next wave of market leadership in the drippers sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drippers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ain Irrigation Systems Ltd

- Bharat Polymer Extrusions

- Captain Polyplast Ltd.

- Dripco Irrigation

- EPC Industries Ltd.

- Finolex Plasson Industries Pvt. Ltd.

- GOKUL POLY VALVES PRIVATE LIMITED

- Harvel Irrigations Pvt Ltd

- Kanan Plast

- Kothari Group

- Legend Irrigation

- Netafim

- Nirmal Irrigation

- Polysil Irrigation System Pvt Ltd

- Rivulis Irrigation

- Sandeep Plastic

- Swaraj Plastic

- Vikasganga Drip Irrigation

- Vision Agritech

- Welldrip Irrigation Industries

Strategic Action Plan for Industry Leaders to Harness Innovation, Diversify Supply Chains, and Enhance Market Position in the Drippers Ecosystem

Industry leaders should prioritize the integration of IoT-enabled sensor networks and AI-driven analytics into their dripper offerings to stay ahead of the innovation curve. By embedding real-time monitoring and predictive irrigation algorithms, manufacturers and service providers can deliver demonstrable water savings and agronomic benefits that resonate with both cost-driven growers and sustainability-focused stakeholders.

Diversifying supply chains beyond traditional trade corridors is imperative to mitigate the impacts of existing and potential tariffs. Strategic partnerships with regional manufacturers can secure consistent access to critical components while reducing exposure to import duties. Additionally, fostering collaborative engagements with policymakers and industry associations can influence favorable trade policies and subsidy frameworks.

To unlock new revenue streams, companies should explore irrigation-as-a-service models that bundle equipment, installation, and data analytics into subscription packages. Such approaches lower upfront costs for small-scale farmers and home gardeners, expand market reach, and create recurring revenue opportunities. Finally, investing in circular materials-such as biodegradable plastics or recyclable metals-can bolster environmental credentials while aligning with evolving regulatory requirements on resource efficiency.

Comprehensive Research Methodology Detailing Data Collection, Validation Techniques, and Analytical Framework Underpinning Dripper Market Insights

This report’s findings are underpinned by a rigorous research methodology combining extensive secondary and primary data collection. Primary research involved in-depth interviews with over 50 industry stakeholders, including product engineers, procurement heads, channel partners, and end users across all major regions. These conversations provided nuanced perspectives on technology adoption, tariff impacts, and regional policy environments.

Secondary research sources comprised industry publications, government databases, and peer-reviewed journals, ensuring a comprehensive aggregation of market intelligence on dripper designs, material innovations, and automation trends. Data triangulation techniques were employed to validate quantitative inputs, cross-checking public filings, third-party databases, and expert forecasts to minimize bias and enhance reliability.

Segmentation analysis was conducted using a bottom-up approach, identifying product types, distribution channels, applications, end-user categories, and material compositions as key dimensions. Regional breakdowns were informed by macroeconomic indicators, irrigation infrastructure investments, and climate risk profiles. Competitive dynamics were evaluated through strategic benchmarking, mergers and acquisitions analysis, and patent activity tracking, providing a holistic view of the drippers landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drippers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drippers Market, by Product Type

- Drippers Market, by Material

- Drippers Market, by Distribution Channel

- Drippers Market, by Application

- Drippers Market, by End User

- Drippers Market, by Region

- Drippers Market, by Group

- Drippers Market, by Country

- United States Drippers Market

- China Drippers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives Emphasizing Key Takeaways, Emerging Opportunities, and Strategic Imperatives for the Future of Dripper Technologies

Drippers are undeniably at the nexus of sustainable irrigation and digital agriculture, offering a potent combination of precision, efficiency, and scalability. The interplay of advanced sensor networks, AI-driven analytics, and smart controllers has catapulted dripper solutions into a new realm of capability, enabling growers to address water scarcity challenges while boosting crop productivity.

Although recent trade tariffs have introduced supply chain complexities, they also present an opportunity for stakeholders to reconfigure sourcing strategies, pursue regional manufacturing partnerships, and advocate for balanced trade policies. Simultaneously, the segmentation of the drippers market-across product types, channels, applications, end users, and materials-reveals a spectrum of strategic levers that companies can exploit to differentiate their offerings and capture emerging niches.

Looking to the future, the convergence of environmental imperatives, regulatory incentives, and technological breakthroughs will continue to reshape the drippers ecosystem. Companies that embrace integrated irrigation-as-a-service models, circular material strategies, and collaborative policy engagements will be best positioned to lead the market through the next decade of growth and innovation.

Engage Directly with Ketan Rohom to Secure Comprehensive Dripper Market Intelligence and Propel Your Strategic Decision-Making

To explore this comprehensive analysis or to acquire the full-depth report, connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise and guidance can help you obtain the actionable intelligence and strategic insights needed to make informed decisions and maintain a competitive advantage in the evolving drippers market.

- How big is the Drippers Market?

- What is the Drippers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?