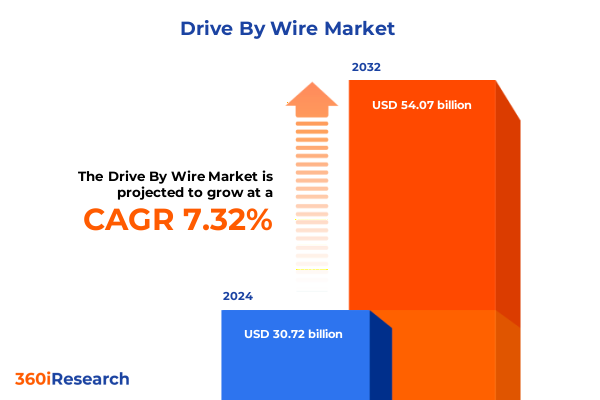

The Drive By Wire Market size was estimated at USD 32.42 billion in 2025 and expected to reach USD 34.22 billion in 2026, at a CAGR of 7.58% to reach USD 54.07 billion by 2032.

Introduction to next-generation drive-by-wire technologies reshaping automotive control systems and redefining driver experience through digital innovation

The evolution of drive-by-wire technology represents a defining moment in automotive control systems, where mechanical linkages give way to precision-engineered electronic interfaces. This transition has been driven by the quest for greater efficiency, lighter architectures, and seamless integration of advanced driver assistance systems. As electrification mandates tighten worldwide and consumers demand more intuitive vehicle dynamics, manufacturers are embracing electronic throttle, steering, brake, and transmission controls to deliver responsive performance while meeting regulatory targets for emissions and fuel economy.

In parallel with regulatory drivers, the rapid advancement of software-defined vehicle architectures has catalyzed the convergence of vehicle control, connectivity, and safety features. Tier-1 suppliers are now scaling integrated platforms that unify throttle-by-wire, brake-by-wire, and steer-by-wire functions under consolidated electronic control units, enabling centralized compute strategies and reducing the weight and complexity of vehicle harnesses. This shift is not merely a component upgrade but a fundamental reimagining of how human intentions translate into vehicular actions, setting the stage for fully autonomous mobility ecosystems.

How rapid electrification automation and autonomous mobility are driving transformative shifts in the drive-by-wire landscape and ecosystem integration

The drive-by-wire landscape is undergoing transformative shifts driven by the interplay of electrification, autonomy, and digital integration. Automotive manufacturers are increasingly embedding software-defined platforms that orchestrate real-time vehicle dynamics across multiple axes, enabling drive-by-wire systems to function as the core interface between driver inputs and high-precision actuator responses. Modern vehicles now rely on advanced electronic control software to manage torque distribution, braking modulation, and steering ratios dynamically, reflecting a departure from static mechanical linkages toward adaptable, networked architectures.

Electrification mandates and fuel-efficiency regulations continue to propel the adoption of drive-by-wire components, as electronic actuators and sensors offer superior packaging flexibility and weight savings compared to traditional assemblies. The integration of SiC-based power electronics and high-density e-axle modules further enhances powertrain efficiency by reducing conversion losses and enabling regenerative braking that feeds directly into the battery management system. These advances foster a more seamless driver experience while unlocking novel functional possibilities such as haptic feedback steering and predictive energy recuperation profiles.

Autonomous mobility ambitions amplify these trends as drive-by-wire systems become the critical enablers of fail-operational architectures. Redundant data buses, multi-path signal routing, and built-in self-test routines are hallmarks of next-generation drive-by-wire frameworks designed to satisfy stringent safety integrity levels. By disentangling mechanical dependencies and embracing electronic control, OEMs are poised to deliver higher levels of vehicle autonomy, greater cockpit redesign freedom, and a host of advanced driver assistance features that redefine the automotive experience.

Assessing the complex cumulative effects of the 2025 United States tariffs on automotive supply chains semiconductors and global drive-by-wire component manufacturing

The cumulative impact of the United States’ 2025 tariffs on automotive imports and components has reverberated through global supply chains, exerting cost pressures on both manufacturers and end consumers. Tariffs of up to 25 percent on assembled vehicles came into effect in April, followed by similar levies on imported automotive parts in May. Industry associations warned that sudden tariff implementation would scramble an already fragile multinational supply network, leading to higher vehicle prices, lower dealership sales, and increased servicing costs as suppliers contend with disrupted inputs and strained production schedules.

Corporate America has largely absorbed these tariffs rather than passing them entirely through to consumers. Many automakers and aftermarket suppliers have hesitated to raise retail prices for fear of eroding market share, even as tariff hikes have translated into significant additional costs collected by the U.S. Treasury. This reluctance to pass on expenses underscores the competitive intensity within the automotive sector and highlights the strategic importance of tariff mitigation strategies, such as nearshoring production and renegotiating supplier contracts.

In the semiconductor domain, proposed 25 percent duties on imported chips pose a particular challenge for advanced driver assistance systems that rely on high-performance integrated circuits. S&P Global Mobility data indicates that U.S. vehicles will contain over one thousand dollars’ worth of semiconductors on average by 2025, with nearly two-thirds sourced from foreign suppliers. Tariff imposition could add hundreds of dollars to each vehicle’s cost of electronic content, compelling OEMs to reevaluate sourcing strategies and accelerate localization efforts through partnerships with domestic fabs or joint ventures-even as the long lead times in semiconductor development limit immediate supply chain realignment.

As automakers adapt to tariff-induced cost shifts, the focus has turned toward enhancing supply chain resilience. Strategic collaboration with alternate semiconductor foundries, diversified logistics corridors, and investment in modular drive-by-wire architectures can help mitigate tariff risks. Yet, the industry must balance these measures against the imperatives of scale, margin preservation, and regulatory compliance, making tariff management a critical dimension of strategic planning for control systems innovation.

Deep dive into critical segmentation dimensions from throttle and transmission controls to braking and steering mechanisms shaping the drive-by-wire market

A comprehensive understanding of market segmentation reveals the multifaceted nature of drive-by-wire control disciplines. Within throttle control, the landscape is defined by two principal dimensions: actuator and sensor types. Actuator options range from robust DC motors suited for high-torque demands to stepper motors offering precise incremental adjustments, while sensor selections pivot between Hall effect devices and potentiometers, each influencing system responsiveness and feedback accuracy.

Transmission control segmentation underscores variations in both transmission architectures and vehicle propulsion systems. The market encompasses automated manual, conventional automatic, continuously variable, and dual-clutch transmission formats, all of which interact differently with electronic shift-by-wire modules. Simultaneously, propulsion segmentation delineates battery electric and fuel cell electric platforms, various hybrid topologies including full, mild, and plug-in hybrids, and traditional internal combustion powertrains utilizing diesel or gasoline fuels-each scenario dictating unique control strategies and energy management protocols.

Brake control segmentation further articulates system typologies and application contexts. Electrohydraulic, hydraulic, and regenerative braking systems each embody distinct trade-offs in terms of redundancy, energy recuperation, and pedal feel. These system types serve a diverse vehicle portfolio encompassing commercial trucks, off-highway machinery, passenger cars, and two-wheeler platforms, necessitating tailored control logic and safety calibrations for each use case.

Steering control is similarly divided by mechanical configuration and actuation technology. Steering mechanisms such as column, intermediate, and rack-and-pinion designs dictate packaging considerations and mechanical leverage, while steering technology options span electric power steering, electrohydraulic power steering, and hydraulic power steering. These combinations influence system complexity, fault-tolerance schemes, and the degree of integration achievable within software-defined vehicle architectures.

This comprehensive research report categorizes the Drive By Wire market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Actuator Type

- Steering Technology

- Transmission Type

- Vehicle Propulsion

- Vehicle Type

Uncovering the pivotal regional dynamics in Americas EMEA and Asia-Pacific shaping adoption and growth of drive-by-wire applications in automotive markets

Regional dynamics exert a profound influence on the adoption and innovation of drive-by-wire solutions. In the Americas, the confluence of fuel-economy regulations and the commercialization of autonomous mobility programs propels demand for electronic control systems. U.S. federal safety roadmaps have mandated advanced collision-avoidance functionalities, indirectly boosting actuator penetration, while California’s zero-emission fleet requirements incentivize brake-by-wire integration in commercial and heavy-duty vehicle applications. Canada’s automotive hubs, concentrated in Ontario, reinforce supply chain resilience through specialized harness design and validation facilities.

Europe, Middle East & Africa presents a landscape where stringent emission and safety regulations shape control system priorities. The Euro 7 brake-particle standard and ISO 26262 functional safety requirements, alongside evolving cybersecurity frameworks, establish high entry barriers that favor early-mover OEMs and tier-one suppliers. German and French supplier clusters leverage silicon photonics and redundant bus architectures to deliver ASIL-D certified drive-by-wire modules, while premium OEMs pioneer volume applications of steer-by-wire and brake-by-wire technologies to meet the region’s exacting performance and luxury benchmarks.

Asia-Pacific stands at the forefront of drive-by-wire market leadership, driven by robust manufacturing ecosystems and governmental support for electrification and autonomous mobility. China’s aggressive EV rollout and public autonomous shuttle trials underscore regulatory momentum, with notable projects such as NIO’s steer-by-wire collaboration with ZF signaling domestic appetite for high-precision control platforms. Japan’s focus on emission reduction and robotics integration, along with South Korea’s semiconductor supply chain advantages fueling e-corner module innovations, collectively position the region as a vital hub for scale and competency in drive-by-wire adoption.

This comprehensive research report examines key regions that drive the evolution of the Drive By Wire market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic partnerships and technological leadership defining the competitive landscape among leading drive-by-wire solution providers

A survey of key industry players reveals a competitive landscape defined by strategic partnerships, technological differentiation, and platform-scale ambitions. NIO’s collaboration with ZF for a production-ready steer-by-wire system exemplifies OEM-supplier synergies, with NIO integrating advanced motion control features into its electric vehicle portfolio. Concurrently, General Motors has teamed with NVIDIA to develop centralized compute platforms capable of coordinating chassis-level control, underpinning future drive-by-wire rollouts in mass-market vehicles.

Bosch continues to lead in braking and steering innovations, as exemplified by its public road trials of a new hydraulic brake-by-wire system that completed a 2,050-mile test across varied climate zones en route to the Arctic Circle. This solution eschews the traditional mechanical linkage in favor of redundant signal lines and dual hydraulic actuators, with volume production slated for late 2025. Bosch’s strategic alliance with the startup Arnold NextG further accelerates steer-by-wire commercialization, combining multi-redundant design expertise to enable scalable manufacturing of retrofit and OEM-grade modules by mid-decade.

Continental maintains momentum through its software-defined vehicle showcase at CES 2025, highlighting integrated brake-by-wire systems and in-wheel Drive-Brake Unit prototypes that blend electric motor drive with friction braking for torque vectoring and packaging efficiencies. The company’s Future Brake System roadmap outlines a transition toward fully electro-mechanical braking architectures, reducing module weight and eliminating hydraulic fluid dependency to meet the evolving demands of electrified and autonomous platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drive By Wire market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- BorgWarner Inc.

- Continental AG

- Curtiss-Wright Corporation

- Denso Corporation

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Kongsberg Automotive

- Nissan Motor Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Implement resilient supply chain partnerships adopt fail-operational safety designs and leverage regional incentives to accelerate drive-by-wire adoption and growth

Industry leaders must prioritize collaboration with semiconductor manufacturers and in-vehicle software developers to mitigate tariff-related cost pressures and secure component availability. By fostering joint development agreements with domestic fabs and investing in modular ECU architectures, OEMs and tier-one suppliers can insulate their drive-by-wire portfolios from external shocks and shifting trade policies.

Accelerating adoption of redundant communication protocols and fail-operational design practices is critical for satisfying emerging safety standards and fostering consumer trust in drive-by-wire systems. Companies should engage in cross-industry consortia to establish interoperability guidelines and cybersecurity benchmarks, ensuring a harmonized approach to ASIL-D certification and mitigating fragmentation risks in electronic control ecosystems.

To capitalize on regional opportunities, go-to-market strategies must align with localized regulatory incentives and infrastructure developments. In Asia-Pacific, joint ventures with local OEMs and participation in public EV charging and smart city initiatives can accelerate market penetration, while in EMEA, early conformity with Euro 7 and cybersecurity mandates can secure first-mover advantages in premium and commercial vehicle segments.

Finally, embracing a services-oriented model for drive-by-wire platforms-including over-the-air updates, predictive maintenance offerings, and data-driven performance optimization-can unlock new revenue streams and deepen customer relationships. By shifting from one-time hardware sales to ongoing software support contracts, providers can enhance profit margins while delivering continuous value in an increasingly software-defined mobility landscape.

Comprehensive methodology integrating primary interviews secondary data synthesis and multi-layer validation for drive-by-wire market analysis

This research combines primary and secondary methodologies to deliver robust, triangulated insights into drive-by-wire market dynamics. Primary investigations involved in-depth interviews with automotive OEM engineers, electronic control module developers, and system integrators to capture firsthand perspectives on technology roadmaps, functional safety strategies, and procurement priorities.

Secondary research encompassed an extensive review of industry publications, technical standards documentation, patent filings, and regulatory guidelines from agencies such as the National Highway Traffic Safety Administration and the European Commission. Public financial disclosures and press releases from key suppliers provided data points on product launches, strategic alliances, and technological investments.

Data synthesis employed a multi-layer validation process, cross-referencing supplier claims, OEM feedback, and independent testing benchmarks to ensure accuracy and consistency. Market segmentation was structured around control functions-throttle, transmission, braking, and steering-with further breakdowns by actuator and sensor technologies, vehicle type, and regional end-use applications. The resulting analysis offers an actionable blueprint for stakeholders navigating the rapidly evolving drive-by-wire ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drive By Wire market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drive By Wire Market, by Actuator Type

- Drive By Wire Market, by Steering Technology

- Drive By Wire Market, by Transmission Type

- Drive By Wire Market, by Vehicle Propulsion

- Drive By Wire Market, by Vehicle Type

- Drive By Wire Market, by Region

- Drive By Wire Market, by Group

- Drive By Wire Market, by Country

- United States Drive By Wire Market

- China Drive By Wire Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusion summarizing the strategic imperatives opportunities and regional dynamics shaping the future of drive-by-wire systems

Drive-by-wire systems are poised to revolutionize vehicle control by supplanting mechanical linkages with electronic interfaces that enhance efficiency, safety, and design flexibility. The convergence of electrification mandates, autonomous driving ambitions, and software-defined vehicle architectures has created an inflection point where electronic throttle, brake, steering, and transmission controls transition from niche features to mainstream standards.

Emerging regional dynamics reveal varied adoption curves, with Asia-Pacific leading in volume and manufacturing scale, EMEA defining rigorous safety and cybersecurity benchmarks, and the Americas balancing regulatory incentives with market-driven autonomy programs. Tariffs and trade tensions have injected new imperatives around supply chain resilience and localization, further shaping strategic priorities for OEMs and suppliers.

Looking ahead, the successful commercialization of drive-by-wire will hinge on collaborative ecosystems that integrate semiconductor development, software orchestration, and fail-operational safety frameworks. Companies that proactively engage in standardized protocols, regional partnerships, and recurring software-as-a-service offerings will be best positioned to capture the transformative opportunities presented by this next frontier in automotive control.

Take the next step toward automotive control leadership by contacting Ketan Rohom for tailored drive-by-wire market research solutions and insights

Seize the opportunity to gain unparalleled insights into the drive-by-wire market and empower your strategic decision-making by securing a comprehensive copy of the detailed market research report. Engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss customized data packages and licensing options tailored to your organization’s needs. Reach out to unlock in-depth analyses, proprietary competitive intelligence, and expert guidance on implementing innovative control solutions. Take the next step toward future-proofing your operations and ensuring a leadership position in the rapidly evolving automotive control systems landscape by contacting Ketan Rohom today to purchase the full market study.

- How big is the Drive By Wire Market?

- What is the Drive By Wire Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?