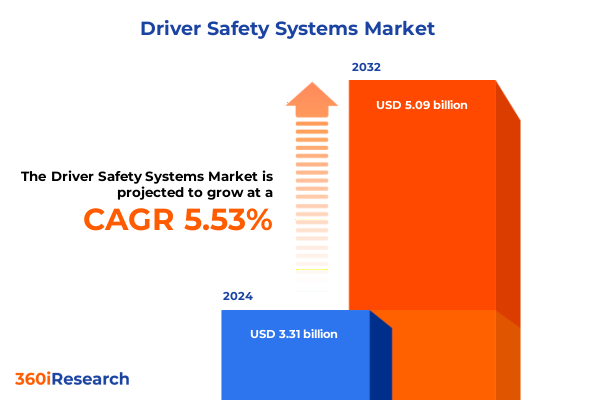

The Driver Safety Systems Market size was estimated at USD 3.47 billion in 2025 and expected to reach USD 3.65 billion in 2026, at a CAGR of 5.60% to reach USD 5.09 billion by 2032.

Navigating the Pathways of Driver Safety Systems: A Comprehensive Introduction to Current Technologies Market Drivers and Strategic Opportunities

In an era where vehicle safety converges with artificial intelligence and advanced sensing technologies, the driver safety systems landscape has undergone a profound metamorphosis. The introduction of features such as adaptive cruise control and automatic emergency braking has marked the beginning of a transition from reactive safety measures to proactive incident prevention. These systems are no longer optional add-ons but foundational elements redefining how drivers interact with their environments.

Emerging regulatory frameworks across major markets underscore the strategic importance of these innovations. Governments and industry bodies are progressively mandating sophisticated electronic stability control and lane departure warning solutions as standard equipment. This shift signals a pivotal moment for stakeholders, who must adapt to a rapidly evolving competitive terrain characterized by fast innovation cycles and stringent compliance demands.

As we embark on this executive summary, our goal is to illuminate the core dynamics propelling the market forward. We will explore how the interplay of evolving consumer expectations, technological breakthroughs, and policy interventions is reshaping the value chain. From component suppliers specializing in digital signal processors, field programmable gate arrays, and microprocessors to automotive OEMs integrating complex algorithms and firmware, each link plays a critical role in driving safer mobility. This introduction sets the stage for an in-depth analysis of transformative shifts, tariff implications, segmentation insights, and actionable recommendations that will guide your strategic planning.

Unveiling Transformative Shifts in Driver Safety Systems Landscape Fueled by Advancements in Sensing Computing and Regulatory Pressures

Over the past decade, the driver safety ecosystem has shifted from stand-alone warning systems to integrated platforms capable of perceiving, predicting, and preventing on-road incidents. Advances in LiDAR, radar, and camera technologies have substantially improved environmental perception, enabling electronic stability control and blind spot detection to function with unprecedented accuracy. Simultaneously, progress in machine learning algorithms and firmware optimization has empowered driver monitoring systems to analyze behavioral patterns in real time, reducing fatigue-related risks.

Concurrently, heightened consumer demand for seamless user experiences is prompting OEMs and tier-one suppliers to co-develop modular architectures that harmonize multiple safety functions. This convergence of capabilities has yielded multifunctional sensor suites that can support adaptive cruise control, lane departure warning, and emergency braking from a single hardware platform. Such consolidation not only enhances system reliability but also reduces complexity and production costs.

Regulatory pressures have accelerated these developments. New safety ratings and incentive programs in key markets have made advanced driver assistance features pivotal purchasing factors. Incentivized by government-backed research grants and pilot programs, manufacturers are investing in next-generation microprocessors and field programmable gate arrays to achieve the processing power required for sophisticated situational awareness. As a result, the market is poised for a transformative leap toward highly automated driving, with stakeholders forging strategic alliances to navigate the complexities of validation, certification, and mass deployment.

Examining the Cumulative Impact of United States Tariffs in 2025 on the Driver Safety Systems Ecosystem and Supply Chain Resilience

Beginning in early 2025, the United States imposed a series of targeted tariffs on key automotive components, impacting semiconductors, sensor modules, and embedded software imports. While the stated objective was to bolster domestic manufacturing, the immediate effect has been to introduce cost volatility across the driver safety systems supply chain. Component suppliers have responded by diversifying their production footprints, with some relocating assembly lines closer to North American clients and others negotiating long-term sourcing contracts to mitigate duty fluctuations.

This tariff environment has had a ripple effect on research and development priorities. Firms have accelerated investments in localizing microprocessor and radar sensor design, aiming to reduce reliance on affected imports. The push for domestic innovation has spurred partnerships between technology startups and established automotive suppliers, fostering an ecosystem that emphasizes homegrown algorithm and firmware development. Such collaborations are enabling greater control over intellectual property while aligning product roadmaps with evolving trade policies.

Despite the uncertainties, the cumulative impact has also revealed opportunities for resilience. By adopting a multi-tiered supplier approach-leveraging long range and short range radar manufacturers across different regions-companies have enhanced supply chain agility. Moreover, proactive engagement with government agencies has allowed select players to secure temporary duty exemptions for critical safety modules. These strategic maneuvers illustrate how adaptive planning and localized R&D can transform tariff challenges into competitive advantage within the driver safety systems domain.

Interpreting Key Segmentation Insights to Decode the Multidimensional Structure of the Driver Safety Systems Market

A nuanced segmentation framework provides essential clarity for understanding market dynamics across multiple dimensions. Analyzing the system type dimension reveals that adaptive cruise control and automatic emergency braking have emerged as cornerstone technologies, while blind spot detection and driver monitoring systems are gaining traction as complementary features. Electronic stability control maintains its position as a regulatory requirement in many jurisdictions, and lane departure warning continues to evolve with more sophisticated lane keeping assistance functionalities.

In the component type dimension, processors-spanning digital signal processors, field programmable gate arrays, and microprocessors-serve as the computational backbone. Sensor technologies comprise cameras, LiDAR, radar modalities ranging from long range to short range, and ultrasonic detectors, each offering distinct advantages for object detection and environmental awareness. Software components bifurcate into algorithms that interpret sensor data and firmware that ensures real-time responsiveness and system integrity.

Vehicle type segmentation highlights divergent adoption rates between passenger cars and commercial vehicles, with heavy and light commercial segments increasingly integrating advanced safety features to comply with stringent fleet safety regulations. Sales channels further differentiate the market, as original equipment manufacturers embed safety systems during production, while aftermarket channels-direct to consumer and distributor networks-cater to retrofit opportunities. By weaving these segmentation insights together, stakeholders can identify white spaces for innovation, tailor value propositions, and align product portfolios to specific automotive use cases.

This comprehensive research report categorizes the Driver Safety Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component Type

- Vehicle Type

- Sales Channel

Unraveling Key Regional Insights Highlighting the Divergent Adoption Patterns across Americas EMEA and Asia Pacific Markets

Regional dynamics underscore the complex interplay between market maturity, regulatory mandates, and consumer preferences. In the Americas, a strong focus on fleet safety compliance and federal incentive programs has catalyzed widespread adoption of electronic stability control and automatic emergency braking. North American OEMs are also leading pilot deployments of LiDAR-based lane keeping systems, testing their viability under varied weather conditions.

Meanwhile, the Europe, Middle East, and Africa region exhibits a dual pace of adoption. Western European markets have long-standing requirements for adaptive cruise control and blind spot detection, complemented by robust homologation frameworks that ensure cross-border interoperability. In contrast, certain Middle East markets are investing heavily in SDK-based driver monitoring systems to address high-speed highway safety concerns, while select African economies explore cost-effective ultrasonic and camera-based solutions for urban mobility applications.

Asia-Pacific remains a dynamic frontier, driven by surging demand in China, Japan, South Korea, and India. Local champions are integrating short range radar and camera sensor fusion into high-volume passenger cars, while major commercial vehicle manufacturers in India and Southeast Asia are piloting retrofittable safety modules through distributor channels. Government programs aimed at reducing road fatalities have fueled collaborations between local technology firms and global sensor suppliers, fostering a rich ecosystem where price sensitivity coexists with a quest for cutting-edge safety innovation.

This comprehensive research report examines key regions that drive the evolution of the Driver Safety Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players to Illuminate Competitive Strategies Innovation Trajectories and Collaboration Networks in Driver Safety Systems

The competitive landscape is shaped by an array of established automotive OEMs, tier-one suppliers, semiconductor innovators, and agile technology startups. Several legacy OEMs have leveraged their global manufacturing footprints to integrate safety platforms seamlessly into mass-produced vehicles, gaining scale advantages in processor and sensor procurement. Tier-one suppliers have responded by enhancing system-level integration capabilities, bundling algorithmic software with hardware modules to deliver turnkey solutions.

Concurrently, semiconductor giants are pursuing vertical integration, investing in custom digital signal processors and field programmable gate arrays optimized for driver assistance workloads. Their partnerships with specialized software houses have accelerated the deployment of real-time decision-making algorithms. At the same time, radar and LiDAR specialists are securing intellectual property portfolios through targeted acquisitions, expanding their sensor lineups to cover a full spectrum of detection ranges.

Emerging entrants are challenging incumbents by focusing on niche applications such as driver monitoring and aftermarket retrofits. Their lean organizational structures allow rapid iteration of firmware updates, enabling faster certification cycles. Strategic collaborations between these startups and established distributors are further broadening market access, particularly in regions where regulatory approval processes remain in flux. Together, these competitive forces are driving an ecosystem that rewards both scale and innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Driver Safety Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- Denso Corporation

- Hella GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Joyson Safety Systems

- Magna International Inc.

- Mobileye Global Inc.

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Implementing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Competitive Positioning in Driver Safety Systems

Industry leaders should prioritize the development of modular safety architectures to accelerate time-to-market and simplify certification across multiple jurisdictions. By designing processor and sensor subsystems with standardized interfaces, companies can more easily integrate new algorithmic capabilities, such as advanced lane centering or fatigue detection, without overhauling core hardware. This modular approach also facilitates phased feature rollouts, enabling tailored value propositions for fleet operators and passenger vehicle customers.

Another critical recommendation is to strengthen supply chain resilience through dual-sourcing strategies and localized manufacturing partnerships. Cultivating relationships with both domestic and international radar, LiDAR, and camera suppliers will mitigate exposure to tariff-induced cost fluctuations. At the same time, forging alliances with regional distributors for aftermarket channels will unlock retrofit business streams and enhance brand visibility in emerging markets.

Finally, stakeholders must invest in continuous software validation and over-the-air update infrastructures to maintain system performance and cybersecurity integrity. Establishing robust update mechanisms ensures that firmware enhancements and algorithm refinements can be deployed seamlessly, keeping pace with evolving safety standards and consumer expectations. Together, these strategic imperatives will equip companies to navigate market complexity, capitalize on technological breakthroughs, and secure enduring competitive advantage in the driver safety domain.

Delineating Rigorous Research Methodology to Ensure Data Integrity Analytical Rigor and Comprehensive Coverage of Driver Safety Systems Market Dynamics

The research framework combines a blend of primary and secondary research methodologies to ensure comprehensive coverage and analytical rigor. Primary data collection involved in-depth interviews with senior executives across automotive OEMs, tier-one suppliers, and key sensor and semiconductor manufacturers. These conversations provided firsthand insights into strategic priorities, investment trends, and supply chain adaptations.

Secondary research sources included regulatory filings, patent databases, and standards body publications to map the evolution of safety regulations and homologation requirements. Technical white papers and industry conferences served as critical inputs for understanding the latest advancements in digital signal processing, radar waveform design, and sensor fusion algorithms. This multifaceted approach allowed for triangulation of data, enhancing the reliability of qualitative insights without relying on proprietary market estimations.

Quantitative validation was achieved through synthesis of publicly available financial reports, trade association statistics, and government incentive program disclosures. Analytical models were then constructed to identify supply chain interdependencies and technology adoption patterns across different vehicle and sales channel segments. The result is a robust, transparent methodology that balances depth of insight with the flexibility to accommodate emerging developments in the driver safety systems ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Driver Safety Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Driver Safety Systems Market, by System Type

- Driver Safety Systems Market, by Component Type

- Driver Safety Systems Market, by Vehicle Type

- Driver Safety Systems Market, by Sales Channel

- Driver Safety Systems Market, by Region

- Driver Safety Systems Market, by Group

- Driver Safety Systems Market, by Country

- United States Driver Safety Systems Market

- China Driver Safety Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Consolidating Insights and Strategic Imperatives into a Cohesive Conclusion to Guide Future Investments in Driver Safety Systems Market

This executive summary has synthesized the critical forces reshaping the driver safety systems landscape, from technological breakthroughs and shifting regulations to tariff-induced supply chain realignments. Segmentation analysis has demonstrated how system types, component architectures, vehicle applications, and sales channels converge to present a highly nuanced market environment. Regional perspectives highlight that while maturity levels vary, the global drive toward enhanced safety remains a unifying theme.

Competitive profiling reveals that success hinges on the ability to orchestrate cross-disciplinary collaboration-combining hardware innovation with software prowess, and aligning with policy frameworks that reward advanced safety features. Actionable recommendations have underscored the strategic value of modular design, supply chain diversification, and software lifecycle management to stay ahead of market demands.

As the industry transitions from advanced driver assistance systems to higher levels of automation, stakeholders must embrace agility, forge strategic partnerships, and invest in capabilities that support continuous evolution. By leveraging the insights and strategic imperatives detailed here, decision-makers will be well positioned to navigate uncertainty, drive innovation, and ultimately deliver safer, more intelligent mobility solutions for the road ahead.

Engage Directly with Associate Director to Unlock In-Depth Driver Safety Systems Market Research and Drive Strategic Growth with Expert Guidance

We invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing, to gain unparalleled access to the full driver safety systems report. Engaging directly with Ketan will unlock tailored insights crafted to address your organization’s unique objectives and pain points. Drawing upon a deep understanding of automotive safety innovations, Ketan can guide you through the intricacies of the research methodology, highlight the nuances of tariff impacts, and illuminate strategic pathways that align with your market ambitions.

By collaborating with Ketan Rohom, you’ll benefit from personalized consultations that translate data-driven findings into actionable strategies. Whether you are seeking to optimize product roadmaps, refine supply chain resilience, or identify strategic partnerships, Ketan’s expertise will ensure you make informed decisions grounded in the most current research. Don’t miss this opportunity to transform raw data into competitive advantage. Reach out to Ketan today to secure your copy of the comprehensive report and start steering your organization toward safer, smarter mobility solutions.

- How big is the Driver Safety Systems Market?

- What is the Driver Safety Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?