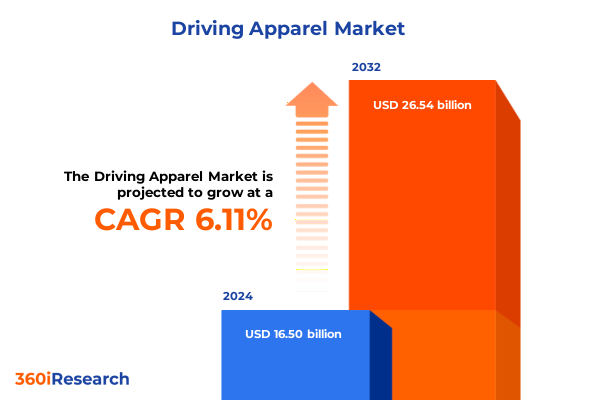

The Driving Apparel Market size was estimated at USD 17.22 billion in 2025 and expected to reach USD 17.96 billion in 2026, at a CAGR of 6.37% to reach USD 26.54 billion by 2032.

Unveiling the Strategic Foundations of the Driving Apparel Market to Guide Stakeholders through Emerging Opportunities and Complex Challenges

Entering the realm of driving apparel demands a clear understanding of emerging dynamics that shape consumer preferences, supply chain considerations, and competitive landscapes. This introduction sets the stage by outlining the core purpose of the executive summary: to provide strategic clarity for decision makers navigating a rapidly evolving market. By positioning driving apparel at the intersection of performance, safety, and fashion, stakeholders gain insight into how this specialized segment is gaining prominence as both a functional necessity and a lifestyle statement.

In the following sections, readers will explore transformative factors that redefine industry contours-from shifting tariff regimes to segmentation nuances and regional demands. The emphasis is on delivering a concise yet comprehensive overview that bridges granular analysis with high-level strategic implications. Consequently, the introduction not only frames the core themes but also underscores the value of an integrated perspective, ensuring that executives focusing on product development, market entry, or distribution optimization can derive actionable guidance.

Ultimately, this foundational narrative guides stakeholders toward the questions that matter most: how to adapt product portfolios to evolving material innovations, align distribution channels with consumer behaviors, and leverage regional strengths. By setting clear expectations for the insights ahead, the introduction fosters a shared understanding of both the challenges and opportunities inherent to the driving apparel landscape.

Identifying the Transformative Shifts That Are Reshaping the Driving Apparel Industry with Technology Integration Sustainability and Consumer Expectations

The driving apparel sector is undergoing fundamental shifts as advanced textile technologies, digital commerce, and sustainability criteria converge to redefine market assumptions. Major brands are integrating smart fabrics and wearable sensors into jackets and suits, elevating comfort, protection, and connectivity. This evolution reflects a broader consumer demand for gear that seamlessly blends performance with lifestyle. Moreover, online platforms are reshaping purchasing behaviors, enabling smaller heritage labels and new entrants to gain rapid visibility alongside established players.

Concurrently, sustainability imperatives are accelerating adoption of eco-friendly leather alternatives and recycled textile blends. Governments and advocacy groups are driving transparency, prompting manufacturers to trace material origins and reduce carbon footprints. In addition, the emergence of modular apparel formats that allow for interchangeable protective layers is challenging traditional product cycles and encouraging brands to explore subscription models to retain customer loyalty.

Furthermore, digital supply chain innovations-ranging from blockchain-based tracking to predictive demand analytics-are enhancing operational agility and minimizing stock imbalances. These interconnected trends signal that success in driving apparel will increasingly depend on an organization’s ability to orchestrate cross-functional initiatives, marrying design ingenuity with logistical excellence. As the landscape transforms, companies that embrace a holistic strategy will be best positioned to capture value in both mature and emerging markets.

Analyzing the Far Reaching Consequences of United States 2025 Tariff Adjustments on Sourcing Manufacturing and Pricing Dynamics for Driving Apparel

The imposition of new tariffs on driving apparel imports as of early 2025 has catalyzed significant recalibrations across sourcing, manufacturing, and pricing strategies. Elevated duties on leather and synthetic components have prompted global brands to reassess their production geographies, shifting certain operations closer to end markets to mitigate added costs. This realignment is particularly evident in North America, where regional manufacturing hubs have gained traction as companies seek to preserve margins and ensure supply continuity.

Suppliers are responding by diversifying material portfolios, leaning more heavily on domestic production of textile blends and seeking alternative feedstocks to fill gaps left by reduced leather imports. In parallel, distribution partners are renegotiating contracts to reflect revised landed costs, leading to dynamic pricing adjustments that have altered the competitive landscape. Retailers operating on thin margins are prioritizing high-value-added products that can better absorb tariff-related expenses while maintaining consumer affordability.

In the broader context, these tariff-driven shifts underscore vulnerabilities inherent in long-established global supply chains. Industry leaders are now evaluating proactive hedging strategies, including forming strategic alliances with downstream suppliers and investing in manufacturing automation to offset labor cost differences. As tariffs continue to shape cost structures, market participants with the foresight to adapt their sourcing architecture and value propositions will secure a decisive advantage in controlling price volatility and safeguarding profitability.

Revealing Deep Insights into Market Segmentation Based on Product Type Material End User Distribution Channels and Application Use Cases

A nuanced understanding of market segmentation reveals critical paths for portfolio differentiation and targeted growth. When examining products by type, the driving apparel ecosystem spans jackets, pants, shirts, and suits, each catering to distinct usage scenarios and performance requirements. Jackets themselves bifurcate into leather, synthetic, and textile categories, with leather jackets prized for premium durability, synthetic options delivering lightweight resilience, and textile versions offering breathability for variable driving conditions. Similarly, pants are subcategorized across leather, synthetic, and textile iterations, underscoring the importance of material innovations in defining product positioning.

Looking deeper at material-based segmentation, leather emerges in cowhide, goat leather, and sheep leather grades, each contributing unique tactile and protective attributes. Synthetic materials encompass high-performance fibers such as Kevlar and elastic spandex blends that optimize abrasion resistance and fit. Textile fabrics like cotton, nylon, and polyester rounds out the material spectrum, enabling brands to balance cost, comfort, and protective performance.

Distribution channels shape how consumers engage with driving apparel, whether through offline specialty stores and motorsports outlets or online brand websites and e-commerce platforms. Within offline environments, motorcycle shops and sports retail chains function as critical touchpoints for product trial and expert consultation. Online channels, meanwhile, offer direct-to-consumer experiences that leverage personalized digital interfaces and data-driven recommendations. End user segmentation into men’s and women’s collections guides design aesthetics and fit standards, while application-specific categories such as casual everyday wear, off-road enduro and motocross, and high-speed road and track racing reflect evolving consumer preferences for versatility and performance. This layered segmentation framework equips stakeholders with the granularity needed to tailor offerings and marketing approaches to diverse customer cohorts.

This comprehensive research report categorizes the Driving Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Distribution Channel

- Application

- End User

Examining Regional Dynamics across the Americas Europe Middle East Africa and Asia Pacific to Illuminate Distinctive Drivers and Growth Catalysts

Regional dynamics in driving apparel markets display marked contrasts driven by consumer tastes, regulatory environments, and infrastructure sophistication. In the Americas, particularly the United States and Canada, emphasis on motorsports heritage and car culture sustains strong demand for premium leather jackets and performance suits. This region’s maturing e-commerce frameworks also facilitate rapid expansion of direct-to-consumer strategies, enabling brands to engage niche enthusiast segments and cultivate brand loyalty through targeted digital campaigns.

Turning to Europe, Middle East, and Africa, a diverse mosaic of preferences emerges. Western European markets prioritize high-end craftsmanship and sustainability credentials, spurring the integration of recycled textile blends and certified leather sourcing. In contrast, emerging economies within EMEA present growth potential for entry-level and mid-tier synthetic and textile apparel, where price sensitivity intersects with rising disposable incomes. Gulf states show particular interest in luxury driving garments tailored for endurance driving in high-temperature environments, reflecting climatic and cultural nuances.

Across Asia-Pacific, rapid urbanization and expanding automotive ownership in markets such as China and India are driving heightened demand for both functional and fashion-oriented driving gear. Localized manufacturing nodes in Southeast Asia and South Asia are enabling competitive cost structures, while e-commerce penetration fuels omnichannel strategies. Consumers in this region are increasingly drawn to customization and brand collaborations that blend heritage motifs with cutting-edge materials. Overall, understanding these regional subtleties enables OEMs and aftermarket brands to align their go-to-market models with distinct market drivers.

This comprehensive research report examines key regions that drive the evolution of the Driving Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players in the Driving Apparel Space to Showcase Competitive Strategies Innovations and Market Positioning Approaches

The driving apparel domain is anchored by a diverse range of companies that have established leadership through differentiated expertise in design, technology, or heritage craftsmanship. Legacy European motorcycle gear specialists are distinguished by their mastery of leatherworking techniques and deep engagement with motorsports associations, lending their products an aspirational appeal among performance-oriented enthusiasts. Conversely, North American firms are forging new paths by embedding advanced textiles and digital safety features into their core lines, emphasizing innovation in impact absorption and rider connectivity.

Asia-based manufacturers are rapidly scaling production capabilities to meet both regional and global demand, leveraging competitive labor markets and robust supply infrastructure. These players often collaborate with global brands to co-develop next-generation materials, unlocking economies of scale for high-performance synthetic blends. At the same time, nimble direct-to-consumer startups are carving out niches by offering custom-fit solutions, leveraging 3D scanning technologies and on-demand manufacturing to reduce lead times and minimize inventory risks.

Across the ecosystem, strategic partnerships between apparel producers, material scientists, and technology vendors are reshaping competitive dynamics. Companies that integrate proprietary fabric treatments, advanced impact liners, or integrated telematics modules into their offerings are differentiating on the basis of both safety and user experience. This interplay of tradition and innovation underscores a competitive landscape where those who successfully blend design heritage with forward-looking technologies are setting new benchmarks for market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Driving Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Alpinestars S.p.A.

- Christian Dior SE

- Dainese S.p.A.

- H & M Hennes & Mauritz AB

- Industria de Diseño Textil, S.A.

- Lululemon Athletica Inc.

- LVMH Moët Hennessy Louis Vuitton SE

- NIKE, Inc.

- Puma SE

- Ralph Lauren Corporation

- Scott Sports SA

- The TJX Companies, Inc.

- ThorMX Inc.

- Under Armour, Inc.

- VF Corporation

- Zalando SE

Providing Actionable Strategic Recommendations to Empower Industry Leaders in Driving Apparel to Navigate Market Disruptions and Capitalize on Emerging Trends

To thrive in a landscape marked by regulatory shifts, evolving consumer expectations, and technological disruption, industry leaders must adopt a multifaceted approach. First, diversifying supply chains by establishing regional manufacturing partnerships and nearshoring critical components can mitigate the impact of fluctuating tariffs and transportation costs. In parallel, forging strategic alliances with material innovators-particularly those specializing in sustainable leather alternatives and advanced synthetic fibers-will enable rapid product iteration and reinforce brand credibility in an eco-conscious marketplace.

Marketing strategies should leverage omnichannel engagement, blending immersive in-person experiences at motorsports events and retail showrooms with personalized digital touchpoints. Customization platforms and virtual try-on capabilities can deepen consumer relationships, driving loyalty and repeat purchases. Additionally, brands should invest in data analytics to refine demand forecasting, optimize inventory levels, and tailor product assortments to regional preferences and end-use applications.

Finally, embedding a culture of continuous innovation is paramount. Cross-functional R&D teams that include designers, engineers, and user experience experts should collaborate to develop modular apparel systems that adapt to diverse driving conditions. By combining agile product development methodologies with strategic foresight, companies can anticipate market trends, react swiftly to regulatory changes, and maintain a resilient competitive edge.

Describing a Robust Research Methodology Combining Rigorous Primary Interviews Secondary Data Sources and Advanced Analytical Frameworks for Market Insights

Our analysis employs a rigorous mixed-methods approach, commencing with extensive primary interviews across stakeholders encompassing brand executives, supply chain managers, technical textile experts, and key distribution partners. These qualitative insights are complemented by secondary research drawing from reputable industry publications, public financial disclosures, trade associations, and patent databases. Data triangulation techniques ensure alignment between qualitative observations and quantitative indicators, bolstering the robustness of our insights.

Segment definitions and frameworks were refined through iterative workshops with domain specialists, validating the categorization of product types, materials, distribution channels, end users, and applications. Geographical analyses combine macroeconomic data, regulatory reviews, and consumer sentiment studies to map regional demand drivers. Scenario modeling was applied to assess the potential ramifications of tariff adjustments, simulating cost impacts under various sourcing and pricing conditions.

Quality assurance protocols included consistency checks, peer reviews by senior analysts, and cross-validation against publicly available case studies and pilot implementations. This comprehensive research methodology underpins the accuracy and relevance of the executive summary, providing stakeholders with confidence in the strategic recommendations and insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Driving Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Driving Apparel Market, by Product Type

- Driving Apparel Market, by Material

- Driving Apparel Market, by Distribution Channel

- Driving Apparel Market, by Application

- Driving Apparel Market, by End User

- Driving Apparel Market, by Region

- Driving Apparel Market, by Group

- Driving Apparel Market, by Country

- United States Driving Apparel Market

- China Driving Apparel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing Core Executive Insights and Critical Takeaways to Reinforce Strategic Direction and Support Informed Decision Making in Driving Apparel

Drawing together the key discoveries and strategic implications, this executive summary illuminates the pathways forward for driving apparel stakeholders. By synthesizing market dynamics, segmentation intelligence, tariff impacts, and regional nuances, the document offers a cohesive narrative that equips decision makers to make informed choices. The convergence of advanced materials, digital engagement models, and sustainability criteria underscores the imperative for integrated strategies that transcend traditional product silos.

Furthermore, the analysis spotlighted critical inflection points, including the rising influence of online channels in shaping brand perceptions, the potential for domestic production hubs to offset tariff pressures, and the competitive differentiation offered by modular design systems. These themes interlink to form a strategic playbook for balancing innovation with operational resilience.

Ultimately, the conclusions drawn emphasize that success in driving apparel rests on an organization’s ability to adapt proactively, leveraging data-driven insights to tailor offerings, optimize supply architecture, and engage consumers across diverse markets. This holistic perspective sets the stage for sustained growth and establishes a benchmark for excellence in the evolving global driving apparel industry.

Inviting Engagement with Ketan Rohom Associate Director to Secure Comprehensive Driving Apparel Market Research Support and Propel Business Growth Forward

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, opens the door to unparalleled expertise and tailored support. Through an initial consultation, prospective clients can explore how the driving apparel market research aligns with their strategic goals, gaining clarity on how the report’s incisive analyses and forward-looking perspectives can be applied to their specific business context. In this session, Ketan will walk you through the most salient findings, address any questions about methodology or industry implications, and outline how the insights can drive tangible value from product innovation to supply chain optimization.

Beyond the consultation, partnership opportunities are designed to meet diverse organizational needs. Whether your focus is on refining product portfolios, exploring new regional expansion, or mitigating tariff-driven risks, Ketan offers guidance on integrating our research outcomes into your broader growth roadmap. This one-on-one engagement ensures that stakeholders receive personalized recommendations and actionable strategies that resonate with corporate objectives and market realities. By choosing to collaborate with Ketan Rohom, companies gain a dedicated ally committed to facilitating data-driven decisions and sustainable competitive advantages.

To begin this transformative journey, schedule a meeting with Ketan Rohom. Discover how comprehensive, expert-curated insights can accelerate your path to market leadership in driving apparel. Connect now and equip your team with the knowledge and support necessary to chart a course toward unprecedented growth and resilience in an evolving global landscape.

- How big is the Driving Apparel Market?

- What is the Driving Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?