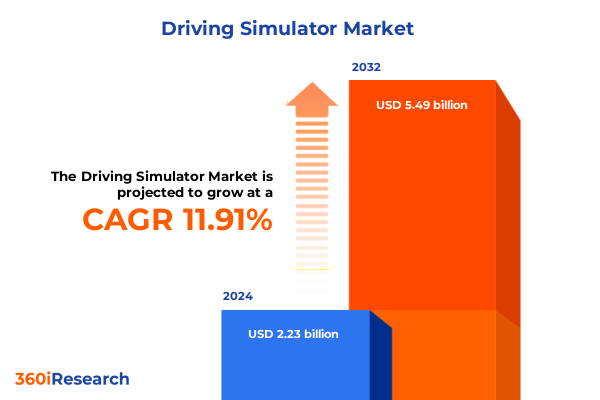

The Driving Simulator Market size was estimated at USD 2.49 billion in 2025 and expected to reach USD 2.79 billion in 2026, at a CAGR of 11.93% to reach USD 5.49 billion by 2032.

Emerging technologies and evolving market demands are reshaping the global driving simulator industry landscape with unprecedented opportunities ahead

The driving simulator industry is experiencing a profound evolution as technological advancements intersect with shifting market demands to redefine what is possible in virtual training and testing environments. What once served primarily as basic training aids has rapidly transformed into sophisticated platforms that support complex research and development initiatives across automotive OEMs, research institutions, and even entertainment providers. This metamorphosis is driven by the convergence of interdisciplinary investments exceeding $50 billion over the past five years, with non-automotive sectors contributing nearly 70% of funding toward autonomous vehicle research and simulation integration.

Key transformative shifts such as AI integration cloud deployment and immersive AR/VR innovations are redefining driving simulation capabilities and business models

Artificial intelligence and machine learning are at the forefront of the sector’s transformative shifts, enabling simulators to adapt scenarios in real time based on user behavior and system performance. The integration of AI-driven analytics not only enhances the realism of training modules but also accelerates iterative development cycles for autonomous driving systems, allowing stakeholders to test edge-case scenarios in repeatable virtual environments with a level of detail previously unattainable.

Analysis of the Cumulative Impact of Recent United States Tariffs on Driving Simulator Manufacturing Supply Chains and Cost Structures in 2025

The cumulative impact of the United States’ 2025 tariff measures on imported electronics, semiconductors, and specialized metals has introduced significant cost pressures across the driving simulator supply chain. Component prices have escalated by double-digit percentages, compelling leading hardware integrators to reassess traditional sourcing strategies and absorb increased duties while negotiating with suppliers for more favorable long-term contracts.

In response to these headwinds, many system integrators have shifted critical assembly processes closer to home by nearshoring operations to Mexico and Southeast Asia. This strategic realignment has been accompanied by long-term procurement agreements with domestic partners, stabilizing pricing and delivery timelines despite persistent tariff volatility. Additionally, automotive OEMs have allocated incremental R&D budgets toward the development of homegrown simulation software platforms, fostering deeper collaboration with U.S.-based technology firms to mitigate reliance on imported hardware.

Deep segmentation insights reveal how different simulator types vehicle categories applications deployment modes and end-user profiles influence market dynamics

A nuanced understanding of market segmentation reveals how specific simulator types, from immersive AR-based and VR-based platforms to full-scale and desktop-based systems, are being deployed to address distinct training and testing objectives. AR-based and VR-based simulators are increasingly leveraged for high-fidelity immersion in autonomous vehicle testing and driver education, while mobile simulators provide cost-effective flexibility for decentralized training programs. Full-scale driving simulators, with their comprehensive motion cueing systems, serve as the cornerstone for mission-critical R&D projects, whereas desktop-based and mobile solutions cater to entry-level training needs and rapid prototyping exercises.

Vehicle type segmentation further underscores diverse adoption patterns, with passenger cars and trucks securing dominant usage in commercial driver training and fleet operator safety programs. Construction vehicles and agricultural vehicles employ specialized simulator modules that replicate unique operational environments, optimizing skill development in industries where equipment downtime can generate significant costs. Buses and heavy-duty vehicles benefit from tailored scenarios that prepare drivers for complex passenger transport and logistics challenges, ensuring both regulatory compliance and operational efficiency.

The application dimension highlights the driving simulator’s versatility, extending beyond autonomous vehicle testing to encompass research and development, military and defense exercises, and entertainment and gaming experiences. Simulator deployments for traffic safety research are instrumental in shaping data-driven policy frameworks, while driver training and education modules serve as a critical link between academic institutions, driving schools, and government regulatory initiatives. Cloud-based simulators facilitate scalable deployment modes for software licensing and collaborative R&D, whereas on-premise solutions are preferred by organizations with stringent data security and latency requirements.

End-user segmentation illustrates the broad stakeholder base that relies on driving simulators for strategic outcomes. Automotive OEMs and Tier 1 suppliers are at the forefront of integrating simulators into vehicle validation programs, while fleet operators and logistics companies leverage these tools to enhance driver performance and reduce incident rates. Educational institutions, driving schools, and government bodies are increasingly adopting simulator solutions to elevate curriculum standards and enforce safety mandates. Entertainment companies and gaming studios exploit the immersive qualities of advanced simulators to captivate audiences, and research organizations depend on customizable simulation platforms for specialized experimental protocols.

This comprehensive research report categorizes the Driving Simulator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type of Simulator

- Vehicle Type

- Application

- End-User

- Deployment Mode

Compelling regional dynamics across the Americas Europe Middle East and Africa and Asia-Pacific underpin unique growth trajectories for driving simulator adoption worldwide

The Americas region continues to drive innovation and adoption through robust government support for driver safety initiatives and substantial automotive R&D spending. North America, in particular, has witnessed accelerated investments in simulator technology, underpinned by a strong emphasis on regulatory compliance and the presence of leading automotive manufacturers. Driver training centers and research labs across the United States and Canada are leveraging high-fidelity simulators to validate autonomous systems under varied weather and traffic conditions, reinforcing the region’s status as a global testing hub.

Europe, the Middle East & Africa present a diverse landscape characterized by stringent road safety regulations and a legacy of advanced simulation research. European nations are integrating simulators into national driver licensing frameworks and defense training programs, while collaborative initiatives between industry consortia and academic institutions are pushing the boundaries of mixed reality and digital twin technologies. The Middle East has begun investing in simulator-based infrastructure for urban mobility planning, and Africa’s nascent market is showing promise through government-funded road safety campaigns that utilize portable and cloud-enabled solutions.

Asia-Pacific leads global market share, driven by rapid urbanization, infrastructure expansion, and aggressive investments in autonomous driving research. China’s intelligent vehicle research institutes are deploying cable-driven dynamic systems with advanced motion cueing to support next-generation ADAS development. India’s growing driver training ecosystem and Japan’s focus on connected mobility solutions further amplify regional demand. Governments across Asia-Pacific are mandating simulator-based curriculum enhancements for commercial driver certification, while private sector players invest in hybrid cloud deployments to bridge resource gaps and scale operations efficiently.

This comprehensive research report examines key regions that drive the evolution of the Driving Simulator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key industry players are spearheading innovation through strategic collaborations and technological advancements within the driving simulator ecosystem

Leading equipment manufacturers and system integrators are spearheading the development of innovative simulator platforms that cater to both specialized research applications and high-volume training programs. John Deere’s virtual reality driving solutions support agricultural vehicle operator training, while AVSimulation’s SCANeR Studio platform is widely recognized for its integration capabilities in autonomous vehicle validation. Ansible Motion’s Delta Series DIL simulators and Moog Inc.’s driver-in-the-loop systems provide dynamic motion feedback that replicates real-world driving forces. ECA Group’s advanced driving simulators and Cruden B.V.’s modular Cruden Simulator Platform are designed for seamless expansion, enabling clients to upgrade visual and motion subsystems over time. MTS Systems Corporation continues to offer Flat-Trac simulators optimized for multidisciplinary research and endurance testing.

Software providers and service leaders are likewise enhancing ecosystem interoperability and scalability through strategic partnerships and R&D investments. VI-grade’s driving simulator hardware and software solutions deliver high-fidelity vehicle dynamics and motion cueing, as demonstrated by the installation of the DiM400 system at key research institutes in Beijing. IPG Automotive’s CarMaker environment is renowned for its closed-loop testing capabilities, while OKTAL’s Virtual Reality Driving Training System integrates with defense applications for crew training. AB Dynamics focuses on fully automated vehicle testing scenarios that enable repeatable validation cycles, and CAE’s simulation platforms offer extensive instructor toolboxes and scenario creation functionalities that support both aviation and ground vehicle training.

This comprehensive research report delivers an in-depth overview of the principal market players in the Driving Simulator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Dynamics plc

- Ansible Motion Ltd.

- AVSimulation

- Bosch Rexroth AG

- CAE Inc.

- Cruden B.V.

- Dallara Automobili S.p.A.

- ECA Group

- FAAC Incorporated

- IPG Automotive GmbH

- Mechanical Simulation Corporation

- Moog Inc.

- Tecknotrove Simulator System Pvt. Ltd.

- Thales Group

- VI-grade GmbH

Actionable recommendations for industry leaders to enhance competitive positioning drive innovation and navigate emerging challenges in the driving simulator sector

Industry leaders should invest in enhancing AI and machine learning capabilities within simulator platforms to deliver hyper-personalized training scenarios and predictive performance analytics. By embedding adaptive algorithms that respond to individual driver behaviors and system variables, stakeholders can reduce training cycle times and accelerate autonomous system validation protocols. Collaboration with AI research labs and technology vendors will be crucial to unlock advanced features and maintain competitive differentiation in the marketplace.

To mitigate ongoing tariff pressures, organizations must diversify their supply chains through nearshoring strategies and partnerships with regional component manufacturers. Engaging in proactive procurement planning and establishing long-term agreements with domestic foundries can stabilize input costs and enhance production agility. Concurrently, expanding R&D investments in software development and localization efforts will diminish reliance on imported hardware modules and foster a more resilient value chain.

Adoption of hybrid deployment models that combine cloud-based simulation services with on-premise hardware solutions will enable greater scalability and cost efficiency. Cloud architectures provide seamless software updates, collaborative data sharing, and elastic compute resources for large-scale scenario rendering, while on-premise systems ensure low-latency performance for mission-critical applications. Industry leaders should evaluate platform-as-a-service offerings and consider tiered licensing frameworks that align with diverse end-user requirements.

Finally, strengthening regional partnerships with academic institutions, government agencies, and end-user communities will facilitate targeted pilot programs and curriculum integration. By co-developing certification standards and simulation-based training modules, stakeholders can foster regulatory alignment, promote safety best practices, and accelerate market penetration across key geographies.

Comprehensive research methodology combining primary interviews secondary data sourcing and rigorous analytical frameworks to ensure robust market insights

This research framework commenced with an exhaustive secondary research phase, mining proprietary databases, industry publications, and peer-reviewed journals to establish a foundational understanding of driving simulator technologies and market dynamics. Key industry associations, regulatory filings, and company financial disclosures were examined to trace investment patterns and strategic developments.

Complementing the secondary analysis, a series of structured primary interviews were conducted with a cross-section of stakeholders, including technology providers, automotive OEM executives, research institution leads, and regulatory policy experts. Insights gleaned from these dialogues were instrumental in validating market drivers, identifying emerging use cases, and uncovering regional nuances.

Data triangulation techniques were employed to reconcile disparate information streams, ensuring consistency across quantitative metrics and qualitative observations. The analytical process integrated trend extrapolation, impact assessment of tariff measures, and segmentation performance analysis to deliver a holistic perspective on market dynamics without extrapolating or forecasting market size or share.

Finally, the research adhered to a rigorous segmentation methodology that dissected the market by simulator type, vehicle category, application, deployment mode, and end-user. Regional frameworks were applied to capture the Americas, Europe, Middle East & Africa, and Asia-Pacific, enabling a comprehensive assessment of geographic drivers and competitive landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Driving Simulator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Driving Simulator Market, by Type of Simulator

- Driving Simulator Market, by Vehicle Type

- Driving Simulator Market, by Application

- Driving Simulator Market, by End-User

- Driving Simulator Market, by Deployment Mode

- Driving Simulator Market, by Region

- Driving Simulator Market, by Group

- Driving Simulator Market, by Country

- United States Driving Simulator Market

- China Driving Simulator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusive perspectives on the driving simulator market highlight strategic priorities future outlook and imperative next steps for stakeholders across the ecosystem

The driving simulator landscape is poised for sustained transformation as advances in artificial intelligence, immersive technologies, and cloud deployment continue to converge. Organizations that strategically align their product development roadmaps with these evolving capabilities will gain a decisive advantage in autonomous vehicle testing, driver training, and simulation-based research.

Navigating the complexities of tariff-induced cost pressures will require proactive supply-chain realignment and strategic investments in domestic manufacturing and software development. Companies that embrace nearshoring, diversify procurement networks, and foster local R&D ecosystems will build the resilience needed to thrive amid regulatory and economic shifts.

Targeted segmentation strategies and regional focus enable stakeholders to tailor solutions for specific end-user groups, from educational institutions to defense agencies, amplifying market impact and adoption rates. Collaborative partnerships with government bodies and academic entities will further enhance credibility and drive standardized certifications across geographies.

With a robust understanding of technological trajectories and actionable recommendations, industry participants are well positioned to capitalize on the unprecedented opportunities shaping the driving simulator sector. By integrating advanced analytics, immersive platforms, and flexible deployment models, organizations can future-proof their operations and lead the market into its next phase of innovation.

Engage with Ketan Rohom to secure in-depth insights customized data and strategic guidance by purchasing the full driving simulator market report today

To access the most comprehensive and actionable insights on the driving simulator market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for a seamless purchasing experience and tailored guidance on how this report can support your strategic objectives. Engage with Ketan to explore bespoke data solutions, in-depth analyses, and one-on-one consultations designed to meet the unique needs of your organization. Don’t miss the opportunity to leverage this essential resource to make informed decisions and stay ahead in the rapidly evolving driving simulator sector.

- How big is the Driving Simulator Market?

- What is the Driving Simulator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?