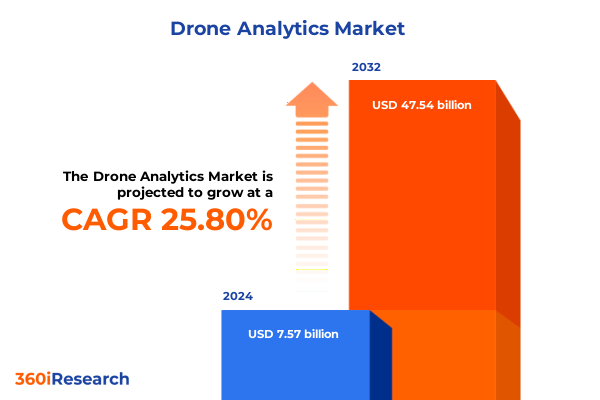

The Drone Analytics Market size was estimated at USD 9.49 billion in 2025 and expected to reach USD 11.73 billion in 2026, at a CAGR of 25.87% to reach USD 47.54 billion by 2032.

Unveiling the Power of Drone Analytics in Modern Industry Operations to Drive Strategic Decisions and Enhance Operational Efficiency

Drone analytics has rapidly evolved from a niche research tool into a cornerstone of data-driven decision-making across diverse industries. By coupling advanced unmanned aerial systems with sophisticated data processing algorithms, organizations can unlock rich geospatial, thermal, and temporal insights that were previously inaccessible. These capabilities empower stakeholders to optimize resource allocation, monitor critical infrastructure with unprecedented precision, and automate complex inspection workflows. In essence, drone analytics bridges the gap between raw aerial imagery and actionable intelligence, catalyzing operational efficiencies and strategic differentiation.

Building on recent enhancements in sensor miniaturization, battery performance, and real-time communication networks, drone analytics now supports both near-real-time and archival analysis at scale. Integration with cloud-native platforms enables seamless data ingestion, storage, and collaboration, allowing cross-functional teams to harness 3D modeling, volumetric analysis, and predictive algorithms. Moreover, the convergence of artificial intelligence and edge computing has driven down latency, making it feasible to process high-resolution imagery in the field. Consequently, organizations that adopt these end-to-end solutions can pivot more nimbly, anticipate maintenance needs, and respond proactively to evolving operational challenges.

Furthermore, the democratization of drone technology, underpinned by evolving regulatory frameworks and standardized safety protocols, has broadened the spectrum of end-users. From environmental organizations conducting habitat surveys to government agencies mapping critical infrastructure, the versatility of drone analytics has been instrumental in addressing both commercial and societal use cases. As the landscape advances, understanding these transformative dynamics is crucial for executives seeking to harness drone analytics as a strategic asset and competitive differentiator.

Exploring the Transformative Technological Advances and Regulatory Evolutions That Are Reshaping the Drone Analytics Ecosystem Across Global Markets

In recent years, the drone analytics ecosystem has undergone profound transformational shifts, driven by breakthroughs in artificial intelligence, machine learning, and sensor integration. Advanced neural networks now facilitate complex image classification tasks, while new photogrammetry techniques produce highly accurate 3D reconstructions. These technological innovations have expanded the utility of unmanned aerial systems beyond visual inspection, enabling them to generate volumetric surveys, estimate material stockpiles, and conduct thermal anomaly detection. Consequently, organizations can move from reactive assessment to proactive decision-making, leveraging automated anomaly alerts and prescriptive maintenance recommendations.

Simultaneously, regulatory landscapes have matured to accommodate the increasing adoption of drone operations. In the United States, incremental updates to remote identification requirements and airspace authorizations have streamlined beyond-visual-line-of-sight (BVLOS) deployments. Globally, harmonized standards from aviation authorities have reduced certification barriers, enabling multinational projects to proceed with fewer administrative delays. This regulatory evolution has coincided with the emergence of industry consortiums focused on safety, data privacy, and interoperability, fostering a collaborative environment that accelerates technology adoption.

Moreover, the rollout of next-generation connectivity-5G networks and low Earth orbit (LEO) satellite constellations-has significantly enhanced the bandwidth and reliability of data transmission. This high-speed infrastructure supports continuous high-definition video streaming, real-time analytics feeds, and remote operator control in challenging environments. As these transformative forces converge, enterprises can harness a new era of scalable, secure, and intelligent drone analytics workflows to optimize operational performance and unlock untapped efficiencies.

Assessing the Multifaceted Impacts of 2025 United States Tariff Policies on Drone Analytics Component Supply Chains and Service Delivery

The introduction of targeted United States tariffs on imported drone components and analytics hardware in early 2025 has exerted multifaceted impacts across the supply chain and service delivery models. These measures, aimed at boosting domestic manufacturing, have resulted in upward pressure on component costs, particularly for high-precision sensors and specialized processors. Consequently, original equipment manufacturers have been compelled to reevaluate sourcing strategies, balancing the need for cost mitigation with the imperative to maintain performance standards.

In response, several service providers have initiated nearshoring and regional diversification initiatives. By establishing partnerships with North American suppliers and leveraging incentive programs for domestic production, organizations are gradually reducing dependency on single-source imports. This strategic pivot has also stimulated innovation in alternative sensor design and open-architecture analytics platforms, enabling more modular and interoperable end-to-end solutions. As a result, service delivery models are evolving to emphasize flexibility, with scalable subscription-based offerings that mitigate the impact of tariff-driven cost fluctuations.

Furthermore, the tariff environment has accelerated investment in software-centric capabilities, where value creation can be decoupled from hardware cost pressures. Cloud-hosted analytics suites, advanced predictive algorithms, and customizable prescriptive modules have emerged as competitive differentiators. By pivoting toward software-first strategies, companies can preserve margin integrity while delivering enhanced insights through continuous feature updates and data integration services. Collectively, these adaptations underscore the resilience and agility of the drone analytics sector amid shifting trade policies.

Deriving Deep Insights from Component, Analytic Type, Data Output, Application, and End-User Segments in Drone Analytics

A nuanced understanding of drone analytics requires careful examination of five core segments, each driving unique value propositions and adoption dynamics. Component analysis reveals two primary offerings: services and software. Within software, the divide between cloud-based and on-premise deployments shapes how organizations handle data sovereignty, scalability, and integration with existing enterprise resource planning systems. Meanwhile, service providers differentiate through turnkey offerings versus custom analytics engagements, tailoring outputs from raw imagery to fully contextualized operational insights.

Analytic type further delineates the market into predictive and prescriptive capabilities. Predictive analytics focuses on identifying trends and forecasting potential failures through historical data patterns, while prescriptive analytics advances this by recommending actionable interventions to optimize outcomes. On the dimension of data output, organizations leverage either 3D models or thermal imaging, selecting the former for spatial reconstruction and volumetric assessments, and the latter for heat signature analysis in energy inspections or search and rescue operations.

Applications span a wide array of industries. In agriculture, drone analytics is applied to crop monitoring and soil analysis to optimize yields and resource usage. Construction and mining firms depend on site surveying and structural inspection for project planning and safety compliance. Energy and utilities entities employ aerial thermal surveys for pipeline leak detection, whereas government and defense agencies utilize high-resolution mapping for border security and disaster response. Media and entertainment companies harness aerial cinematography and immersive 3D modeling to enhance storytelling, while logistics operators use fleet tracking and route optimization to improve delivery efficiency.

Lastly, end-user segmentation highlights enterprises, environmental organizations, government agencies, and research institutes. Enterprises prioritize operational cost reductions and uptime maximization, environmental organizations focus on habitat monitoring and conservation analytics, government agencies require compliance and security oversight, and research institutes pursue experimental applications and algorithmic innovation. Together, these segments underscore the diverse market drivers and adoption patterns that shape the strategic trajectory of drone analytics.

This comprehensive research report categorizes the Drone Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Analytic Type

- Data Output

- Application

- End-User

Analyzing Regional Nuances in the Drone Analytics Landscape Across the Americas, Europe Middle East Africa, and Asia-Pacific

Regional dynamics significantly influence how drone analytics solutions are adopted and utilized. In the Americas, the United States leads with robust infrastructure for unmanned aerial testing corridors, favorable regulatory reforms, and a thriving ecosystem of technology incubators. Canada’s focus on precision agriculture and forestry management has driven specialized applications, while Latin American nations are increasingly deploying drones for mining oversight and environmental monitoring as remote regions demand cost-effective survey methods.

The Europe, Middle East & Africa region presents a heterogeneous landscape. Western Europe’s stringent data privacy regulations and well-established industrial base encourage adoption of cloud-compliant analytics platforms and industrial inspection use cases. In the Middle East, strategic investments in smart city initiatives and energy infrastructure have spurred demand for large-scale aerial surveys and predictive maintenance solutions. Across Africa, infrastructure constraints and expansive terrains have elevated drone analytics as a critical enabler for asset mapping, wildlife conservation, and disaster response, with numerous pilot programs bridging government, NGO, and private sector collaborations.

In Asia-Pacific, China’s concerted push for indigenous drone manufacturing and domestic analytics innovation has created a highly competitive market, particularly in smart agriculture and infrastructure inspection. Japan’s stringent safety standards and focus on precision engineering have driven adoption in energy sector inspections, while South Korea’s integration of drone analytics with advanced robotics is reshaping maintenance operations. In India, the agricultural sector harnesses soil nutrient mapping and crop health monitoring to address food security challenges, supported by government-led trials and subsidy programs. These diverse regional insights demonstrate how geopolitical priorities, infrastructure maturity, and regulatory environments collectively shape the trajectory of drone analytics adoption.

This comprehensive research report examines key regions that drive the evolution of the Drone Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Moves and Core Competencies of Leading Drone Analytics Providers Driving Innovation and Market Differentiation

Leading companies in the drone analytics domain are distinguished by their comprehensive solution portfolios, strategic partnerships, and relentless innovation pipelines. One prominent provider has carved out a leadership position through seamless integration of cloud infrastructure with edge computing modules, enabling end-to-end workflows that span data capture, processing, and visualization on unified platforms. Another key player emphasizes a hardware-agnostic software approach, collaborating with multiple unmanned aerial system manufacturers to broaden its addressable customer base and foster interoperability.

Emerging vendors are carving niches with specialized analytics applications. Some focus on prescriptive maintenance for energy utilities, embedding machine learning models that detect thermal anomalies and predict equipment failures with high accuracy. Others excel in large-area agricultural analytics, delivering custom soil nutrient indices and crop stress models that integrate multispectral imagery with ground-truth sensor data. These players often differentiate through open APIs and developer ecosystems that facilitate custom algorithm deployment and third-party integration.

Strategic partnerships and ecosystem alliances have become hallmarks of competitive differentiation. Several industry leaders have forged ties with telecommunications providers to leverage low-latency connectivity, while alliances with mapping service specialists enhance high-resolution base map accuracy. Additionally, acquisitions of niche analytics startups bolster core capabilities and accelerate time-to-market for advanced modules. This collaborative model underscores a broader industry trend toward platform-based offerings that unite diverse competencies under a cohesive user experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drone Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarav Unmanned Systems Private Limited

- AeroVironment, Inc.

- AgEagle Aerial Systems Inc.

- Asteria Aerospace Limited

- Cyberhawk Innovations Limited

- Delair SAS

- DroneDeploy, Inc.

- Environmental Systems Research Institute, Inc.

- FlyPix AI Ltd.

- Garuda Aerospace Private Limited

- Kespry, Inc.

- Optelos, LLC

- PDRL Private Limited

- Pix4D S.A.

- PrecisionHawk, Inc.

- Propeller Aerobotics Pty Ltd

- Sentera, Inc.

- Sitemark NV

- Skycatch, Inc.

- Skylark Drones Private Limited

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Drone Analytics Growth Trajectories

To capitalize on the momentum in drone analytics, industry leaders should prioritize integration of artificial intelligence and machine learning capabilities directly into edge devices. By embedding lightweight inference engines on drones, organizations can reduce data transfer costs and enable real-time anomaly detection in constrained network environments. Subsequently, optimizing analytics pipelines for hybrid cloud architectures will ensure that on-premise deployments maintain compliance with data sovereignty requirements while still benefiting from scalable processing power.

Diversifying supply chain sources is equally critical. Establishing relationships with regional component manufacturers and participating in government incentive programs can mitigate tariff risks and enhance production agility. Furthermore, proactive engagement with regulatory bodies to shape evolving policies will serve as a catalyst for broader beyond-visual-line-of-sight operations, unlocking high-value use cases in logistics and infrastructure inspection.

From a go-to-market perspective, tailoring solutions to industry-specific pain points will drive adoption. For example, constructing bundled service offerings that combine aerial data acquisition, proprietary analytics modules, and actionable reporting will resonate with enterprises seeking end-to-end accountability. Finally, investing in user training and certification programs can build customer loyalty, reduce operational risk, and establish a community of certified professionals to drive recurring revenue streams. This strategic blueprint provides a clear roadmap for organizations aiming to secure a dominant position in the evolving drone analytics landscape.

Outlining Rigorous Research Methodologies and Analytical Frameworks Underpinning the Drone Analytics Market Study

This study employs a rigorous mixed-methods research methodology to ensure comprehensive and unbiased insights into the drone analytics sector. Primary research components include structured interviews with C-level executives from leading drone service providers, technology strategists, and end-user organizations across key industries. In parallel, quantitative surveys capture adoption patterns, pricing sensitivities, and deployment challenges across disparate geographic regions.

Secondary research sources encompass a thorough review of peer-reviewed journals, whitepapers from regulatory authorities, and published technical standards. Industry consortium reports and public domain filings are systematically analyzed to triangulate technology roadmaps and regulatory trajectories. Data from sensor manufacturers, cloud service providers, and telecommunication entities inform the infrastructure context and highlight key partnership ecosystems.

Analytical frameworks underpinning the report feature SWOT assessments, growth-driver matrices, and value chain analyses to elucidate competitive positioning and market dynamics. Validation workshops with subject-matter experts ensure that findings resonate with real-world experiences and strategic imperatives. This multilayered approach yields a robust, fact-based foundation for the strategic recommendations and insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drone Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drone Analytics Market, by Component

- Drone Analytics Market, by Analytic Type

- Drone Analytics Market, by Data Output

- Drone Analytics Market, by Application

- Drone Analytics Market, by End-User

- Drone Analytics Market, by Region

- Drone Analytics Market, by Group

- Drone Analytics Market, by Country

- United States Drone Analytics Market

- China Drone Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Discoveries and Envisioning Future Directions From the Comprehensive Drone Analytics Market Analysis for Strategic Planning

The comprehensive analysis presented here synthesizes the defining trends, challenges, and opportunities shaping the drone analytics ecosystem. Technological advancements in AI-driven imaging and evolving regulatory landscapes have collectively broadening the scope of viable applications, from precision agriculture to critical infrastructure inspection. Meanwhile, the 2025 tariff environment has reinforced the need for supply chain resilience, catalyzing a shift toward domestic sourcing and software-centric business models.

Segmentation insights reveal the nuanced interplay between components, analytic types, data outputs, applications, and end-users. The balance between cloud-based and on-premise software, coupled with the strategic adoption of predictive versus prescribing algorithms, underscores the importance of tailoring solutions to specific operational requirements. Regional analyses highlight how infrastructure maturity, policy frameworks, and strategic national priorities drive divergent adoption pathways across the Americas, EMEA, and Asia-Pacific.

Leading organizations have differentiated through integrated platforms, strategic partnerships, and relentless innovation pipelines. By embracing best practices-such as embedding analytics at the network edge, diversifying sourcing strategies, and collaborating with regulatory bodies-industry participants can maximize value capture. These insights form the cornerstone for strategic decision-making, equipping stakeholders to navigate the rapidly evolving drone analytics landscape with confidence and clarity.

Seize the Strategic Advantage in Drone Analytics: Engage with Ketan Rohom to Access the Comprehensive Market Research Report Today

To explore the full breadth of insights, proprietary datasets, and strategic frameworks covered in the comprehensive Drone Analytics market research report, readers are encouraged to contact Ketan Rohom, Associate Director, Sales & Marketing, for a personalized consultation. Connecting with this expert will provide tailored guidance on leveraging granular competitive intelligence, regulatory analysis, and region-specific deep dives to inform high-impact decisions. Engage directly to secure access to customizable data modules, executive briefings, and hands-on implementation roadmaps that can fuel immediate competitive advantage.

By partnering with Ketan Rohom, organizations will gain the clarity needed to navigate complex supply chain dynamics, integrate advanced analytics capabilities, and align investment strategies with emerging use cases across agriculture, infrastructure, defense, and logistics. Reach out today to initiate a conversation on how this detailed research can accelerate technological adoption, de-risk strategic initiatives, and unlock new value pools. Your organization’s next breakthrough in operational excellence and data-driven innovation begins with this critical call to action.

- How big is the Drone Analytics Market?

- What is the Drone Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?