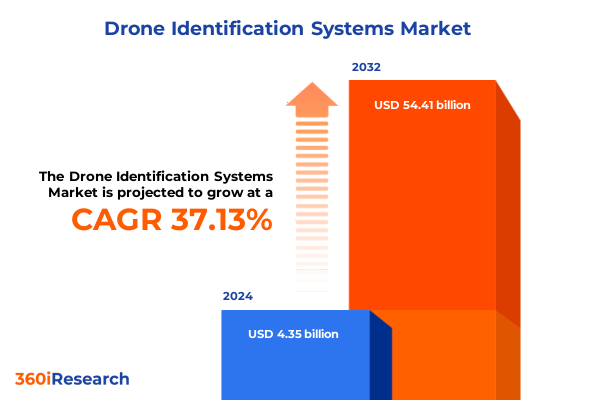

The Drone Identification Systems Market size was estimated at USD 5.95 billion in 2025 and expected to reach USD 8.15 billion in 2026, at a CAGR of 37.16% to reach USD 54.41 billion by 2032.

Setting the Stage for a New Era of Aerial Surveillance Through Advanced Drone Detection and Identification Capabilities Unveiled

The expanding complexity of aerial domains has thrust drone identification systems into the spotlight as an essential layer in modern security and surveillance frameworks. As unmanned aircraft systems proliferate across commercial, defense, and critical infrastructure sectors, the ability to accurately detect and distinguish legitimate from illicit drones has never been more critical. Over the past decade, the convergence of sensor fusion, machine learning, and networked communications has redefined the capabilities of counter-unmanned aerial vehicles (C-UAS), transforming them from nascent proof-of-concept tools into mission-critical defenses.

This introduction underscores how emerging threats-from illicit surveillance at border zones to incursions around airports and mass events-are driving unprecedented demand for robust drone detection, classification, and identification solutions. Incidents of drones near U.S. airports have surged, with more than 3,000 flights violating restricted airspace since 2021 and recent evasive maneuvers by commercial aircraft highlighting the urgency of resilient detection systems. Concurrently, federal officials are seeking expanded authority to track and disable rogue drones across sensitive locations, reflecting a consensus that countermeasures must evolve to meet increasingly sophisticated adversarial tactics.

In turn, industry stakeholders are racing to integrate artificial intelligence, electro-optical sensors, radar, and RF telemetry into unified platforms capable of real-time threat assessment. This melding of technologies paves the way for automated alerts, intelligent fusion of sensor data, and seamless coordination with existing air traffic and unmanned traffic management infrastructures. As this report will demonstrate, understanding the multi-dimensional drivers of this market-and the intricate interplay of technology, regulation, and global security concerns-is foundational to capitalizing on the next generation of drone identification innovations.

Uncovering the Transformative Technological and Regulatory Shifts That Are Redrawing the Drone Identification Landscape Globally

In recent years, the drone identification landscape has undergone seismic shifts propelled by both technological breakthroughs and evolving policy mandates. The integration of AI-driven sensor fusion has emerged as a cornerstone, enabling systems to correlate radar, RF signatures, and electro-optical feeds to reduce false positives and enhance classification accuracy. For example, leading operators now leverage intelligent open fusion architectures that integrate data across multiple modalities-radar arrays, camera networks, and cyber sensors-to create a unified situational picture, a trend which civil aviation hubs like Heathrow and Gatwick have showcased as benchmarks for reliability and performance.

Simultaneously, regulatory frameworks are recalibrating to accommodate the dual imperatives of commercial drone innovation and national security. Proposed FAA rulemakings aim to expand beyond-visual-line-of-sight permissions for delivery services and industrial inspections, while federal amendments seek to enforce no-drone zones along border corridors to thwart smuggling networks. These policy shifts reflect a broader consensus that uniform airspace governance and counter-UAS protocols must align to ensure both safety and operational flexibility for authorized drone actors.

Moreover, the ubiquity of autonomous and fixed-wing UAV threats in conflict zones has catalyzed investment in long-range detection arrays and AI-enhanced decision-support tools. As adversarial use of drones to conduct reconnaissance, supply chain disruption, and even direct attacks intensifies, the industry is pivoting towards modular, interoperable solutions capable of rapid deployment across maritime, urban, and remote frontline environments. The cumulative effect of these transformative shifts underscores an inflection point: drone identification is no longer a niche capability but a fundamental pillar of contemporary defense and security architectures.

Evaluating the Layered Consequences of United States Tariff Regimes on Drone Identification Systems Through 2025 and Their Operational Implications

United States trade policy has exerted a layered influence on the drone identification ecosystem, particularly through the continuation and adjustment of Section 301 tariffs targeting Chinese-origin components. Initiated in 2018 and maintained by successive administrations, these duties cover a broad swath of electronic materials, including semiconductors, batteries, and specialized sensors. As of January 1, 2025, the duty on semiconductor devices rose to 50% while tariffs on related electronic components remained at 25%, imposing additional cost pressures on system integrators and board-level manufacturers alike.

The cumulative effect of these tariff layers has precipitated a strategic realignment of supply chains, driving major vendors to seek alternative sources of lidar optics, electro-optical modules, and RF transceivers outside the People’s Republic of China. To mitigate tariff exposure, some organizations are investing in near-shore manufacturing facilities or qualifying domestic suppliers under accelerated accreditation programs. This recalibration not only hedges against tariff volatility but also addresses national security imperatives by strengthening visibility and control over critical hardware pipelines.

In response to the heightened import costs, design teams are innovating around modular architectures that allow degraded reliance on heavily taxed components, opting for open-architecture firmware solutions and swap-in sensor modules sourced from allied nations. While short-term margins may absorb elevated duties, the persistent impact of these tariffs underscores the need for ongoing policy engagement and strategic procurement adjustments to maintain competitive positioning.

Deciphering Market Segmentation Nuances to Reveal Critical Technology, Component, Application, End User, and Platform Insights Driving Adoption

Market segmentation within the drone identification domain reveals nuanced demand patterns driven by divergent technology modalities, component functions, application use cases, end-user profiles, and platform configurations. Insights across technology categories show that electro-optical infrared and radar systems tend to dominate in military and critical infrastructure scenarios due to their proven detection range and classification fidelity, whereas RF signal analysis and computer vision solutions deliver complementary capabilities in spectrum-based signature recognition and visual identification tasks. This interplay of sensing technologies informs both pricing strategies and platform integration roadmaps.

When exploring component-based segmentation, hardware investments in processors and sensor assemblies account for the bulk of up-front capital expenditure, yet the recurring revenue potential resides in services-particularly integration, maintenance, and operator training. Software, spanning analytics platforms, firmware enhancements, and middleware frameworks, is emerging as the primary locus for differentiation, enabling AI-driven analytics, over-the-air updates, and streamlined user interfaces that accelerate operational readiness.

Across applications, border security, surveillance of critical infrastructure, and emergency response scenarios such as search and rescue all demand rapid detection-to-identification turnarounds, heightening the importance of real-time analytics and low-latency communication channels. Traffic management and wildlife monitoring, in contrast, often prioritize affordability and ease of deployment, leading to wider adoption of UAV-mounted identification payloads and subscription-based airspace oversight services.

End-user segmentation illustrates that defense agencies and law enforcement continue to be the most intensive users of advanced C-UAS systems, leveraging comprehensive sensor suites for perimeter defense and high-profile event protection. Commercial enterprises and infrastructure operators, however, are increasingly embracing tiered solutions that balance detection range with cost-often opting for modular kits that can be scaled up for temporary high-threat conditions.

Finally, platform considerations underscore that ground-based radar installations and manned aerial systems are typically deployed in fixed or semi-permanent roles, whereas UAV-mounted modules offer the flexibility required for dynamic threat landscapes, including rapid response and ad hoc perimeter scans. Understanding how these platform vectors intersect with technology and component selections is pivotal for tailoring go-to-market approaches and channel partnerships.

This comprehensive research report categorizes the Drone Identification Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Platform

- Application

- End User

Examining Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Unveil Geographical Drivers in Drone Identification Systems

Regional market dynamics for drone identification systems reflect distinct strategic priorities and regulatory frameworks across the Americas, Europe, Middle East & Africa, and Asia-Pacific. The Americas remain a high-growth zone fueled by robust defense budgets, expansive border control initiatives, and the U.S. government’s emphasis on securing critical infrastructure through advanced C-UAS deployments. National programs and federal grants are channeling resources into airport perimeter security and pilot projects for integrated unmanned traffic management, anchoring the region’s leadership position.

Conversely, Europe, the Middle East & Africa have coalesced around collective security frameworks and industrial sovereignty goals. The European Defence Fund and the ReArm Europe Plan are driving investments in homegrown sensor fusion and electronic warfare capabilities, while Middle Eastern states leverage sovereign wealth funds to acquire turnkey airspace security solutions. Africa’s market, although nascent, demonstrates growing interest in counter-drone systems for both VIP protection and anti-poaching efforts, often facilitated through public-private partnerships.

In Asia-Pacific, the competition to bolster domestic manufacturing and reduce reliance on external suppliers has intensified, especially under the AUKUS export framework that enables seamless trade of dual-use C-UAS technologies between Australia, the United States, and the United Kingdom. Regional governments are also mandating drone restrictions near strategic assets, catalyzing procurement of RF jamming systems and AI-enabled identification platforms. These distinct regional drivers shape the competitive landscape, forging opportunities for vendors to align their solutions with local policy objectives and security doctrines.

This comprehensive research report examines key regions that drive the evolution of the Drone Identification Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Future of Drone Identification Solutions Through Strategic Alliances and Technological Differentiation

The competitive arena of drone identification systems is defined by a blend of legacy defense contractors, specialized C-UAS providers, and ambitious entrants harnessing AI and advanced sensor fusion. Dedrone by Axon has solidified its position through strategic acquisitions and recognition as a growth and innovation leader by Frost & Sullivan in 2025, leveraging its artificial intelligence-driven analytics and modular effectors across over 900 global sites. Partnerships with Thales to integrate mobile, vehicle-mounted detection capabilities further exemplify the company’s push to embed industry-leading DTI-M solutions into broader public safety platforms.

Australia’s DroneShield has emerged as a formidable competitor, expanding manufacturing capacity with a new Sydney production facility and securing multiple high-value contracts in the Asia-Pacific and Europe. Its registration under the AUKUS export framework has unlocked preferential supply channels, while recent A$32.2 million APAC deals underscore the company’s traction with military end-users. The firm’s heavy focus on RF sensing, AI-driven analytics, and in-house electronics manufacturing positions it strongly amid supply chain realignments.

In the defense technology realm, Anduril Industries continues to push the envelope with its Lattice software platform and autonomous interceptor family, securing a significant Pentagon award of $250 million for Roadrunner interceptors and a $642 million IDIQ contract to defend Marine Corps bases worldwide. Collaborations with OpenAI further enhance its AI-driven detection and response capabilities, reflecting the critical role of advanced software ecosystems in next-generation C-UAS deployments.

Meanwhile, HENSOLDT is carving a niche with its software-defined defence approach, showcasing its TRML-4D AESA radars and Elysion C-UAS command-and-control suite at major defense exhibitions. Recent commissioning to upgrade the German Armed Forces’ ASUL modular counter-UAS system underscores the company’s prowess in sensor-effector integration and mission-tailored software throughput. These profiles illustrate a competitive landscape where innovation, strategic partnerships, and supply chain sovereignty are decisive.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drone Identification Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aaronia AG

- AirMap Inc.

- AIRmarket Inc.

- AIRVIS LTD

- Aloft Technologies, Inc.

- ANRA Technologies

- Auterion Ltd.

- CERBAIR

- CONTROP Precision Technologies Ltd.

- COPTRZ

- D-Fend Solutions AD Ltd.

- Dedrone Holdings, Inc.

- DeTect, Inc.

- Dronavia

- DroneShield Ltd

- Dronetag

- Dronetag DRI

- Elbit Systems Ltd.

- HENSOLDT AG

- INVOLI SA

- Kittyhawk.io, Inc.

- RelmaTech

- Rheinmetall AG

- Rinicom Ltd.

- Thales Group

Articulating Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities in the Drone Identification Ecosystem

To seize emerging opportunities in the drone identification sector, industry leaders should pursue a multi-pronged strategic approach. First, fostering close collaboration with regulatory authorities and standards bodies can accelerate certification processes and inform adaptive product roadmaps. By engaging in pilot initiatives and public–private task forces, vendors can ensure that evolving FAA, EU, and defense agency mandates are anticipated and incorporated into system design early in the development cycle.

Second, investing in modular, open-architecture platforms that support rapid sensor swaps and over-the-air firmware updates will provide a competitive edge. This flexibility not only future-proofs deployments against shifting threat vectors but also reduces total cost of ownership by enabling incremental upgrades rather than complete hardware replacements.

Third, strengthening supply chain resilience through diversification and local partnerships is crucial to mitigate tariff impacts and geopolitical risks. Establishing assembly facilities or joint ventures in key markets such as North America, Europe, and Australia can buffer against Section 301 tariff exposure while aligning with sovereign procurement preferences.

Fourth, expanding customer-centric service portfolios-including integration, continuous maintenance, and operator training-will cultivate recurring revenue streams and deepen client relationships. Customized training programs that upskill end users in AI-enhanced analytics and C2 software operation will differentiate offerings in both commercial and defense segments.

Finally, forging alliances with AI leaders and cybersecurity firms can enhance detection algorithms and harden C-UAS systems against cyber intrusion attempts. As automation and autonomous countermeasures become more prevalent, ensuring robust cybersecurity protocols and transparent AI governance frameworks will build trust with both public and private sector customers.

Elucidating a Rigorous Research Methodology that Blends Primary Insights with Secondary Analysis and Data Triangulation for Credibility

This analysis combined rigorous primary research with extensive secondary data collection and expert validation to ensure robust conclusions. Initially, a detailed review of government publications, trade press, and tariff notices was conducted to map the regulatory environment and quantify the cumulative impact of U.S. tariffs on critical components. This was augmented by insights from U.S. Trade Representative releases and trade law briefings to frame the Section 301 landscape through 2025.

Primary research involved structured interviews and surveys with C-suite executives, R&D managers, and technical specialists across leading C-UAS vendors, end-user organizations, and systems integrators. These engagements provided granular perspectives on technology adoption challenges, procurement cycles, and field performance feedback.

Secondary research comprised a systematic examination of company filings, press releases, patent databases, and technical white papers to track strategic partnerships, product roadmaps, and innovation pipelines. Financial analyses of key providers were triangulated with contract awards and market expansion announcements to validate growth trajectories.

Data triangulation techniques were applied to cross-verify insights, ensuring consistency between qualitative interviews, quantitative tariff data, and competitive intelligence. This multi-source approach underpins the credibility of the segmentation framework, regional profiles, and strategic recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drone Identification Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drone Identification Systems Market, by Technology

- Drone Identification Systems Market, by Component

- Drone Identification Systems Market, by Platform

- Drone Identification Systems Market, by Application

- Drone Identification Systems Market, by End User

- Drone Identification Systems Market, by Region

- Drone Identification Systems Market, by Group

- Drone Identification Systems Market, by Country

- United States Drone Identification Systems Market

- China Drone Identification Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Underscoring the Strategic Imperatives for Stakeholders in the Evolving Drone Identification Market

The convergent forces of advanced sensor fusion, AI-driven analytics, and recalibrated trade policies have fundamentally reshaped the drone identification systems market. As outlined, evolving Section 301 tariffs are prompting supply chain realignments, while regulatory initiatives are expanding both the permissive and restrictive frameworks governing drone operations. Against this backdrop, segmentation insights emphasize the importance of tailoring solutions across technology modalities, service offerings, application domains, end-user needs, and platform architectures.

Regional dynamics underscore that no single approach satisfies all market conditions: the Americas capitalize on federal funding and border security mandates, Europe Middle East & Africa prioritize sovereign manufacturing and interoperability, and Asia-Pacific harnesses export frameworks to strengthen domestic capabilities. Competitive analysis reveals that success hinges on forging strategic alliances, innovating around platform modularity, and embedding advanced software ecosystems into core offerings.

Going forward, industry stakeholders who integrate forward-looking AI capabilities, adhere to transparent cybersecurity and AI governance standards, and foster resilient local partnerships will be best positioned to navigate the complexities of this dynamic landscape. The insights compiled here form a strategic blueprint for decision-makers to align investment, technology development, and policy engagement, ensuring readiness for the next wave of unmanned threats and opportunities in the aerial domain.

Take the Next Step to Empower Your Organization with Comprehensive Drone Identification Market Intelligence by Engaging with Ketan Rohom Today

Are you ready to elevate your strategic decision-making with in-depth insights into the drone identification systems market? Reach out today to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the comprehensive market research report. By partnering directly with Ketan, you’ll gain customized guidance on which sections of the analysis align with your organization’s priorities, ensuring you can rapidly act on the most critical opportunities and challenges. Don’t miss the chance to arm your team with the foresight needed to stay ahead in this fast-evolving landscape-connect with Ketan Rohom now to transform insights into action and drive your competitive advantage.

- How big is the Drone Identification Systems Market?

- What is the Drone Identification Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?