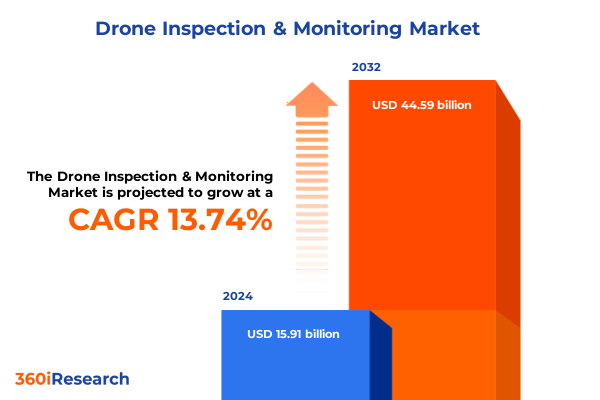

The Drone Inspection & Monitoring Market size was estimated at USD 17.97 billion in 2025 and expected to reach USD 20.35 billion in 2026, at a CAGR of 13.85% to reach USD 44.59 billion by 2032.

Setting the Stage for Unmanned Aerial Innovation in Asset Inspection and Monitoring Across Agriculture, Infrastructure, and Energy Sectors

The integration of unmanned aerial systems into asset inspection and monitoring workflows has transformed operational paradigms across industries, enabling faster, safer, and more cost-effective data collection. As enterprises increasingly embrace drone solutions, the commercial drone market is forecast to expand at a compound annual growth rate of 25.3 percent through 2030, reaching over fifty-three billion dollars in global value by decade’s end.

Regulatory momentum has played a pivotal role in unlocking advanced applications. Between 2020 and 2023, the Federal Aviation Administration approved over twenty-six thousand beyond visual line of sight operations, a twenty-two-fold increase in complex flight authorizations under its BEYOND program. In parallel, the White House’s June 2025 directive to formalize routine BVLOS operations within eight months set the stage for mainstreaming drone integration across infrastructure, logistics, and emergency response sectors.

At the same time, national security considerations have altered supply chain dynamics, as investigations under Section 232 explore additional duties on imported drones and components, reinforcing the drive for domestic manufacturing resilience. This confluence of technological innovation, regulatory facilitation, and strategic policy initiatives underpins the unprecedented transformation of inspection and monitoring processes worldwide.

Revealing the Major Technological and Regulatory Paradigm Shifts Redefining Drone-Based Inspection and Monitoring Operations

Advancements in sensor technology and onboard intelligence are reshaping the capabilities of modern inspection drones, enabling detailed photogrammetry, LiDAR-based terrain modeling, multispectral analysis for crop health, and thermal anomaly detection. Hybrid configurations that integrate LiDAR, RGB imaging, and edge-computing platforms can now process high-resolution point clouds in real time, reducing post-mission processing by more than a third. These convergent technologies have unlocked new use cases in urban planning, environmental compliance, and disaster response, where rapid situational awareness is paramount.

Regulatory frameworks have evolved in tandem, creating a safer, more predictable operating environment. The FAA’s BEYOND program and the forthcoming final BVLOS rule will establish clear performance metrics and risk-based standards, while the European Union’s U-space regulations have harmonized airspace rules to support longer-distance flights and complex missions across member states. These measures reduce bureaucratic barriers and empower operators to scale commercial deployments with confidence.

Simultaneously, service delivery models are shifting toward subscription offerings and LiDAR-as-a-Service platforms, where recurring revenue streams from data analytics, flight planning software, and maintenance-training packages complement hardware sales. This shift reflects a strategic move by providers to capture value throughout the lifecycle of inspection contracts, as enterprises demand end-to-end solutions rather than one-off aircraft purchases.

Examining How Layered Trade Measures in 2025 Are Reshaping Costs and Sourcing Strategies for U.S. Drone Inspection Portfolios

Since 2018, the United States has maintained a twenty-five percent Section 301 tariff on Chinese-made unmanned aerial systems and components, creating a substantial cost baseline for imported drones. In early 2025, an additional ten percent duty was imposed under Executive Order 14195 to address national security and illicit trade concerns, which was subsequently amended in March to raise the rate to twenty percent, effectively bringing cumulative ad valorem duties to forty-five percent for many Chinese imports.

These levies persist despite exemptions granted for consumer electronics; drones were explicitly excluded, reflecting their strategic importance and the desire to bolster domestic production. In parallel, national security investigations under Section 232 of the Trade Expansion Act opened on July 1, 2025, could result in further protective duties or import restrictions for drones, parts, and essential components. Legislative proposals such as the “Drones for America Act” envision adding targeted duties on unmanned aircraft and parts to incentivize U.S. and allied sourcing, with new rates potentially effective within thirty days of enactment.

The combined tariff landscape has altered procurement strategies for public and private buyers alike, prompting many to absorb higher costs or delay fleet refreshes. Simultaneously, it has accelerated the shift toward domestic innovators and expanded efforts to qualify alternative suppliers within allied economies. While consumers face higher retail prices, these policies have also stimulated capital inflows into U.S. manufacturing facilities, partnerships in North America and Europe, and a renewed focus on supply chain resilience.

Unpacking Insightful Dynamics Across End-Use, Platform, Service, Data and Operation Segments Driving Tailored Drone Inspection Solutions

Inspection and monitoring operations span diverse end-use industries, from crop monitoring in precision farming to structural surveys in building and infrastructure projects, from automotive and electronics manufacturing line reviews to pipeline and rig inspections across upstream, midstream, and downstream oil and gas sectors. Energy generation and distribution networks require aerial surveillance for transmission and distribution corridors, while transportation and logistics platforms leverage drones for air, marine, rail, and road asset inspections. These verticals dictate system requirements, mission profiles, and ROI thresholds, guiding customized solution offerings that blend fixed-wing endurance, rotary-wing agility, and hybrid VTOL flexibility with payload configurations optimized for each scenario.

Vehicle platforms exhibit differentiated value propositions: fixed-wing designs with catapult or hand-launch capabilities excel in long-range corridor mapping, while multirotor and single-rotor systems dominate confined-space structural inspections and tactical security patrols. VTOL hybrids offer the operational ceiling and range of fixed wings combined with the precise hover and automatic landing of multirotors, bridging mission gaps and enhancing deployment versatility.

Services encompass hardware sales alongside comprehensive operations and maintenance portfolios that include scheduled maintenance, pilot training, technical support, and safety compliance. Software platforms for data analytics and flight planning integrate AI-driven anomaly detection, automated report generation, and centralized fleet management, enabling end users to extract actionable insights without the need for in-house expertise.

Data types, from high-resolution RGB mapping to LiDAR point clouds, multispectral crop stress analyses, and thermal inspections for hotspot detection, form the basis for asset condition assessments and predictive maintenance models. Imagery segments such as high-resolution mapping and standard RGB capture support progress monitoring and visual documentation, while multispectral sensors reveal vegetation health metrics and thermal payloads detect structural defects or electrical faults.

Operational modes range from manual piloting for ad hoc missions to semi-autonomous workflows and fully autonomous inspection routines that execute preprogrammed flight paths, collect standardized data sets, and return safely with minimal human intervention. This spectrum of operation types enables progressive adoption, allowing operators to pilot manually before scaling to autonomous deployments in controlled environments.

This comprehensive research report categorizes the Drone Inspection & Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Drone Type

- Mode of Operation

- Data Type

- Application

- End Use Industry

Delineating Regional Evolution in Drone Inspection Policies and Adoption Trends Across Americas, EMEA, and Asia-Pacific

In the Americas, robust regulatory support for commercial applications has fostered accelerated adoption. The FAA’s pending BVLOS rule and expanded Part 107 waivers have enabled enterprises to scale drone operations beyond visual sight lines, while U.S. Customs investigations and tariff policies have stimulated growth in domestic manufacturing and services. Canada and Latin American nations are following suit with initiatives to integrate drones into resource mapping, infrastructure maintenance, and public safety programs, leveraging bilateral collaborations to share best practices and training standards.

Europe, the Middle East, and Africa have embraced a harmonized framework through the EU’s U-space package, which standardizes airspace management services and safety protocols across member states. The introduction of EU-wide VTOL airworthiness rules and the expansion of Europe’s Drone Strategy 2.0 have unlocked innovative use cases in urban air mobility, emergency response, and network inspections, while national programs in the Gulf and North Africa are driving infrastructure resilience projects in energy and logistics corridors.

In the Asia-Pacific region, China’s Civil Aviation Administration released provisional regulations in mid-2023, establishing comprehensive rules for drone design, operation, and airworthiness to support large-scale agricultural spraying, smart city mapping, and urban air mobility trials. Mandatory remote identification and real-time tracking standards introduced in early 2025 have enhanced safety, reducing failure rates in complex urban settings by half and boosting mean time between failures by twenty-five percent. Australia and Southeast Asian markets are also expanding regulatory corridors for beyond visual line of sight missions and defining national drone strategies to support mining, forestry, and environmental conservation applications.

This comprehensive research report examines key regions that drive the evolution of the Drone Inspection & Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Edge and Growth Trajectories of Leading UAV Manufacturers and Service Providers

DJI remains the market leader in inspection and monitoring platforms, commanding over fifty percent of global commercial drone shipments. Its integrated payload ecosystem and advanced autonomy systems underpin critical infrastructure and energy sector deployments, although heightened scrutiny and potential import restrictions have prompted the company to expand manufacturing operations in Malaysia and explore localization partnerships.

Skydio has emerged as the fastest-growing domestic innovator, capturing significant defense and enterprise contracts by offering AI-powered obstacle avoidance and fully autonomous inspection routines. Industry estimates place its 2024 revenue at approximately one hundred eighty million dollars, driven by eighty percent year-over-year growth and bolstered by DoD approvals under the “Drone Dominance” initiative.

Autel Robotics and Parrot have gained traction in critical infrastructure and utility monitoring, with Autel’s EVO series and Parrot’s ANAFI models offering high-performance thermal imaging and extended-range mapping capabilities. Market intelligence from insurtech providers indicates both brands have grown market share in North America and Europe through strategic channel partnerships and service integrations.

Teledyne FLIR (formerly FLIR Systems) leverages its thermal imaging heritage to deliver specialized sensor payloads for subsurface infrastructure diagnostics and search-and-rescue operations. Its Prox Dynamics Black Hornet nano-UAV and aerial LiDAR solutions exemplify the integration of precision optics, analytics software, and secure data links for defense and commercial missions. Strategic acquisitions, including Prox Dynamics and Endeavor Robotics, further extend Teledyne FLIR’s capabilities across airborne and ground-based inspection platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drone Inspection & Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerialtronics DV B.V.

- Aerodyne Group

- Aeromat creative labs Pvt. Ltd.

- AeroVironment, Inc.

- AgEagle Aerial Systems Inc.

- Airpix

- Applus+

- Azur Drones SAS

- Censys Technologies Corporation

- DJM Aerial Solutions Limited

- Drone Services Canada Inc.

- DroneDeploy, Inc.

- Dronegenuity, Inc.

- Equinox's Drones Pvt Ltd.

- FEDS Drone-powered Solutions

- Flyability SA

- Force Technology

- GarudaUAV Soft Solutions Pvt. Ltd. by Dorf Ketal Chemicals Pvt. Ltd.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- ideaForge Technology Pvt. Ltd.

- Intertek Group PLC

- Israel Aerospace Industries

- Kespry by Firmatek, LLC

- Lockheed Martin Corporation

- Maverick Inspection Ltd.

- mdGroup

- MISTRAS Group

- Northrop Grumman Corporation

- Parrot Drones SAS

- Sky-Futures by ICR Integrity

- Skydio, Inc.

- SZ DJI Technology Co., Ltd.

- Teledyne Technologies Incorporated

- The Boeing Company

- Wipro Limited

Strategic Imperatives and Collaborative Pathways for Elevating Competitiveness in Drone Inspection and Monitoring

Industry leaders should prioritize diversification of supply chains by partnering with allied manufacturers and developing modular platforms that can integrate domestically sourced components, mitigating the impact of potential tariff increases or import restrictions. By designing open-architecture systems, companies can swiftly swap subsystems and reroute procurement channels without compromising mission readiness.

Regulatory engagement is critical; firms must establish dedicated compliance teams to collaborate proactively with the FAA, EASA, and CAAC on emerging standards for BVLOS, remote identification, and U-space operations. Early participation in public consultations and pilot programs can yield preferential access to favorable rulemaking outcomes and expedite certification timelines.

Investments in autonomous flight software and edge analytics will drive differentiation. By embedding machine learning algorithms directly on the drone, operators can reduce data offload latencies and accelerate anomaly detection, enabling faster decision cycles for high-value asset inspections. Deploying scalable cloud architectures for data management coupled with intuitive dashboards will support enterprise-level fleet management and predictive maintenance.

Cross‐sector partnerships can unlock new revenue streams; for example, collaborations with telecom providers to deploy drone-in-a-box stations on 5G networks can facilitate automated inspections of critical infrastructure, while alliances with software vendors can enhance flight planning and compliance tracking. Industry consortia focused on interoperability will foster ecosystem synergies and reduce integration costs for end users.

Finally, building robust training and certification programs ensures consistent operational excellence. By offering accredited pilot courses and technical support services alongside hardware sales, companies can strengthen client relationships, improve safety outcomes, and create stickier revenue models rooted in ongoing service contracts.

Outlining Our Rigorously Validated Methodology Combining Expert Interviews, Regulatory Analysis, and Market Segmentation

This research integrates primary interviews with executive stakeholders, technical experts, and end users to capture first-hand perspectives on operational challenges and solution requirements. Secondary data was sourced from government publications, regulatory filings, industry journals, and reputable news outlets to validate market dynamics and technology trends.

Market segmentation was defined through a multistage process, mapping end-use industries, platform types, service offerings, data payloads, and operational modalities to develop a comprehensive taxonomy. Quantitative analysis employed data triangulation, combining shipment figures, tariff schedules, and regulatory approval counts to derive qualitative insights without disclosing proprietary estimations.

The study employed scenario analysis to assess the impact of potential policy changes, including tariff adjustments and regulatory reforms, on cost structures and supply chains. Sensitivity analyses were conducted to stress-test key assumptions regarding adoption rates, technological advancements, and regulatory timelines.

Quality assurance measures included peer reviews by independent industry consultants and cross-validation of factual statements against multiple credible sources. All content was vetted for compliance with research ethics, ensuring transparency, data integrity, and the exclusion of speculative forecasts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drone Inspection & Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drone Inspection & Monitoring Market, by Component

- Drone Inspection & Monitoring Market, by Drone Type

- Drone Inspection & Monitoring Market, by Mode of Operation

- Drone Inspection & Monitoring Market, by Data Type

- Drone Inspection & Monitoring Market, by Application

- Drone Inspection & Monitoring Market, by End Use Industry

- Drone Inspection & Monitoring Market, by Region

- Drone Inspection & Monitoring Market, by Group

- Drone Inspection & Monitoring Market, by Country

- United States Drone Inspection & Monitoring Market

- China Drone Inspection & Monitoring Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings on Technology, Policy, Segment Dynamics and Competitive Strategies to Navigate Future Opportunities in Drone Inspection and Monitoring

The confluence of advanced sensing technologies, AI-driven autonomy, and evolving regulatory frameworks is accelerating the integration of drones into inspection and monitoring workflows across industries. Cost pressures from layered tariffs are catalyzing domestic manufacturing investments and supply chain diversification, while Section 232 investigations highlight the strategic importance of unmanned systems.

Segmentation insights reveal that tailored solutions-ranging from fixed-wing corridor mapping to rotary-wing structural inspections, bolstered by comprehensive service portfolios-are essential to address unique operational demands. Regionally, the Americas lead in regulatory support for BVLOS, EMEA is pioneering harmonized airspace management, and Asia-Pacific is scaling nationwide standards to bolster safety and efficiency.

Market leaders such as DJI, Skydio, Autel, Parrot, and Teledyne FLIR are forging distinct competitive positions through platform innovation, strategic partnerships, and targeted acquisitions. Actionable recommendations emphasize modular design, regulatory engagement, ecosystem alliances, and ongoing training services to sustain growth and resilience.

By leveraging these findings, stakeholders can navigate the dynamic landscape, unlock new revenue streams, and drive the safe, scalable deployment of unmanned inspection solutions that redefine asset management and operational risk mitigation.

Empower Your Strategic Vision by Engaging with Our Associate Director to Secure Your Comprehensive Drone Inspection Market Report

To explore the full depth of insights and gain a competitive edge in the rapidly evolving drone inspection and monitoring landscape, take the next step by securing your customized copy of the market research report. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to discuss tailored data options, enterprise licensing, and bespoke consultation packages designed to meet your strategic objectives. Engage now and empower your organization with actionable intelligence that drives innovation, optimizes operations, and positions you at the forefront of unmanned aerial advancements.

- How big is the Drone Inspection & Monitoring Market?

- What is the Drone Inspection & Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?