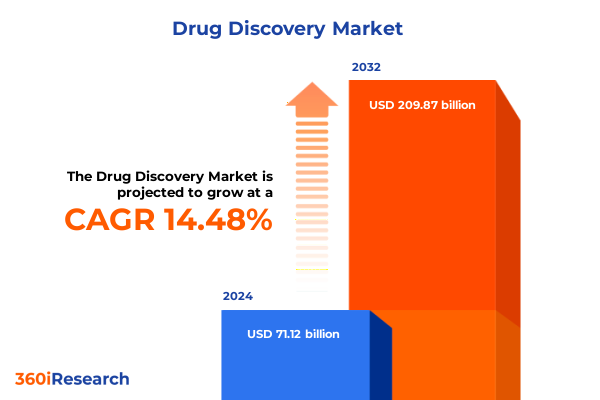

The Drug Discovery Market size was estimated at USD 81.11 billion in 2025 and expected to reach USD 92.53 billion in 2026, at a CAGR of 14.54% to reach USD 209.87 billion by 2032.

Understanding How Rapid Scientific Advances and Collaborative Ecosystems Are Revolutionizing the Drug Discovery Process for Future Therapeutic Breakthroughs

In recent years, the drug discovery ecosystem has experienced an unparalleled acceleration driven by the confluence of scientific breakthroughs and cross-industry collaborations. From the elucidation of complex biological pathways to the integration of cutting-edge computational tools, the traditional paradigm of screening thousands of compounds in laborious laboratory workflows is being replaced by agile, data-driven processes that emphasize precision and speed. Modern drug discovery initiatives leverage multiplexed assay platforms, advanced imaging techniques, and high-content data analytics to sift through vast chemical libraries, pinpointing high-value leads with unprecedented accuracy. This shift reflects a broader trend toward convergence science, where molecular biology intersects with systems biology, bioengineering, and digital informatics to reveal novel targets and therapeutic strategies.

Against a backdrop of shifting regulatory frameworks and heightened stakeholder expectations for safety, efficacy, and cost efficiency, this executive summary provides a synthesized view of the critical forces shaping the field. It distills key developments in technology adoption, supply chain evolution, policy impacts, and competitive dynamics, offering decision-makers a clear vantage on where opportunities and risks are most acute. By framing these insights alongside strategic recommendations, this summary equips executives and investors with the contextual understanding needed to navigate an increasingly complex environment and to seize the transformative potential of next-generation drug discovery.

Examining the Pivotal Integration of Artificial Intelligence Automation and Open Innovation Models Transforming the Modern Drug Discovery Industry

The drug discovery landscape has been redrafted by three interlocking trends: the rise of artificial intelligence, the advent of automated laboratory platforms, and the growth of open innovation networks. Machine learning algorithms trained on expansive chemical and biological datasets are now capable of predicting compound-target interactions, optimizing molecular structures for drug-like properties, and accelerating lead identification. These capabilities have been augmented by automated liquid handling systems that enable unattended, round-the-clock experimentation, driving unprecedented throughput in hit-to-lead campaigns. Concurrently, open innovation models-fueled by pre-competitive consortia, academic partnerships, and collaborative data-sharing initiatives-have democratized access to valuable assay data, reducing redundancy and catalyzing discovery across organizational boundaries.

In regulatory spheres, realigning approval pathways such as adaptive clinical trial designs and real-time safety monitoring have further incentivized innovation, shortening timelines from discovery to market authorization. Stakeholders are embracing modular, stage-gated frameworks that emphasize go/no-go decision points, enabling resources to be focused on the most promising candidates. Together, these shifts redefine success metrics in drug discovery, rewarding agility, predictive accuracy, and cross-sector collaboration over traditional high-volume screening approaches. As a result, organizations that strategically align R&D investments to capitalize on these transformative trends stand to gain a sustainable competitive advantage in a landscape defined by both opportunity and disruption.

Analyzing the Compounded Effects of 2025 United States Tariffs on Global Supply Chains Research Costs and Collaborative Drug Discovery Initiatives

The 2025 alterations to the United States tariff regime have introduced a new layer of complexity to global drug discovery operations. With increased duties imposed on key raw materials, reagents, and lab equipment imported from major manufacturing hubs, biopharmaceutical companies now face elevated input costs that stress R&D budgets and may extend project timelines. Small and midsize organizations, in particular, are contending with the ramifications of higher capital expenditure requirements for critical instrumentation, leading many to reevaluate supplier partnerships and consider nearshoring or onshoring alternatives to mitigate risk.

Moreover, the tariffs have disrupted established supply chain flows, prompting firms to diversify their procurement strategies and to accelerate qualification processes for secondary vendors. While this adjustment enhances long-term resilience, it also introduces short-term operational friction and potential compliance considerations in quality management. On the innovation front, cross-border collaborations have encountered increased logistical burdens, as customs clearances and tariff-related documentation add administrative overhead to joint research agreements. Consequently, industry leaders are prioritizing strategic alliances with domestic manufacturers and exploring consortium-based sourcing models that can distribute tariff impacts across multiple stakeholders. This proactive stance is crucial for maintaining momentum in high-priority research programs and safeguarding the pipeline against avoidable delays and cost escalations.

Unveiling Critical Insights Derived from Drug Type Technology and Therapeutic Area Segmentations That Drive Strategic Decision Making

In assessing market dynamics through the lens of drug type segmentation, the dichotomy between biologic drugs and small molecule compounds reveals distinct developmental pathways and resource allocations. Biologic modalities, driven by complex protein engineering and cell-based production processes, demand specialized infrastructure for upstream fermentation and downstream purification. Conversely, small molecule pipelines benefit from synthetic chemistry platforms and well-established regulatory precedents, streamlining formulation and scale-up activities.

Evaluating the landscape based on technology segmentation underscores how each innovation domain contributes uniquely to R&D productivity. Bioanalytical instruments and biochips furnish the granular data needed for high-resolution target validation, while bioinformatics platforms integrate multi-omic datasets to generate actionable hypotheses. Combinatorial chemistry and high throughput screening accelerate the identification of novel scaffolds, and advances in nanotechnology deliver precision delivery vehicles that can enhance therapeutic index. Parallel progress in pharmacogenomics is driving personalized medicine initiatives, enabling developers to stratify patient populations and refine clinical trial design.

When segmenting by therapeutic area, distinct patterns emerge in prioritization and funding flows. Cardiovascular disease and oncology continue to attract substantial investment due to persistent unmet needs and large patient populations. In parallel, neurology and infectious disease programs are experiencing a resurgence of interest, fueled by breakthroughs in blood-brain barrier models and the urgency of emerging pathogen threats. Digestive system diseases and immune system disorders also command strategic focus, with developers integrating insights from the gut microbiome and immune-oncology cross-talk to unlock new therapeutic frontiers.

This comprehensive research report categorizes the Drug Discovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Technology

- Therapeutic Area

Regional Dynamics in Global Drug Discovery Identifying Strategic Opportunities and Addressing Complex Challenges Across the Americas EMEA and Asia Pacific Markets

Across the Americas, the drug discovery sector thrives on robust venture capital inflows, a supportive regulatory environment, and a dense network of research institutions. North America’s emphasis on translational research and early-phase clinical development has fostered a vibrant startup ecosystem, while Latin American initiatives increasingly leverage regional strengths in bioprocessing and biologics manufacturing to carve out niche capabilities.

The Europe, Middle East & Africa region presents a rich tapestry of innovation clusters, where collaborative research consortia have succeeded in harmonizing regulatory requirements across national borders. European Union frameworks for data sharing and streamlined clinical trial approvals are complemented by targeted government incentives in several Middle Eastern countries aiming to position themselves as life sciences hubs. However, variability in infrastructure and market maturity across EMEA necessitates a calibrated approach to partnership selection and investment prioritization.

Asia-Pacific, propelled by government-led biotech strategies in China, Japan, and India, stands out for its large-scale manufacturing capacity and rapidly growing R&D budgets. The region’s cost-competitive service models, combined with an increasing focus on digital health platforms and artificial intelligence applications, are attracting both local ventures and multinational players. In this dynamic environment, success hinges on balancing global best practices with nuanced understanding of local regulatory landscapes and patient access pathways.

This comprehensive research report examines key regions that drive the evolution of the Drug Discovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical and Technology Innovators Shaping the Competitive Landscape of Drug Discovery Through Strategic Collaborations and Investments

Leading pharmaceutical corporations continue to dominate late-stage pipelines by investing heavily in novel modalities and forging strategic alliances with biotech innovators. These legacy players leverage their global commercialization networks and regulatory expertise to expedite market entry while pursuing acquisitions that bolster their portfolios in high-growth therapeutic areas. Simultaneously, emerging biotechnology firms are disrupting conventional models with agile research frameworks and niche focus areas, often targeting rare diseases or leveraging proprietary platform technologies to differentiate their value proposition.

Instrument and reagent suppliers have also intensified their focus on end-to-end solutions, offering integrated platforms that combine hardware, software, and data analytics under a unified interface. Digital technology companies are entering the life sciences space, providing cloud-based collaboration tools and AI-driven insight engines that enhance cross-functional visibility and decision-making. Contract research and manufacturing organizations have expanded their footprint through mergers and investments in advanced capabilities such as continuous manufacturing and cell therapy production, aligning with industry demand for flexibility and scalability.

Collectively, these diverse cohorts of stakeholders are reshaping competitive dynamics by blurring traditional boundaries between discovery, development, and commercialization. Organizations that cultivate symbiotic partnerships-connecting established industry players, agile biotechs, technology providers, and service specialists-are best positioned to accelerate timelines, optimize resource utilization, and deliver differentiated therapies to patients worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drug Discovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Alacrita Holdings Limited

- Amgen Inc.

- Astex Pharmaceuticals by Otsuka Pharmaceutical Co., Ltd.

- Astrazeneca PLC

- Atomwise, Inc.

- BenevolentAI

- Bio-Rad Laboratories, Inc.

- Merck & Co., Inc.

Strategic Imperatives for Industry Leaders to Navigate Disruption Harness Emerging Technologies and Strengthen Resilience in Drug Discovery

To thrive in an environment marked by rapid technological change and evolving policy landscapes, industry leaders must adopt a multi-pronged strategy that balances innovation with operational resilience. Prioritizing the deployment of artificial intelligence and machine learning platforms will streamline target identification and predictive toxicology, while investments in laboratory automation can drive consistent, high-throughput experimentation. At the same time, diversifying supply chains and forging domestic sourcing partnerships will mitigate the financial exposure introduced by shifting tariff regimes.

Leaders should also cultivate an open innovation mindset by participating in pre-competitive consortia and forging academic-industry alliances that enable access to specialized expertise and shared infrastructure. Embedding pharmacogenomic insights into early development stages can accelerate the design of adaptive clinical trials and reduce attrition rates by improving patient stratification. Furthermore, executives must engage proactively with regulatory authorities to shape policy frameworks that support flexible approval pathways and harmonized standards, ensuring that promising therapies reach market efficiently.

Finally, integrating scenario planning and dynamic risk assessment into strategic roadmaps will equip organizations to anticipate macroeconomic and geopolitical shifts. By aligning cross-functional teams around clear milestones and leveraging real-time data analytics for rapid course correction, industry leaders can maintain momentum even amidst uncertainty, safeguarding innovation pipelines and fostering sustainable growth.

Methodological Framework Employed to Ensure Rigorous Data Collection Comprehensive Analysis and Unbiased Insights in Drug Discovery Research

This analysis draws upon a structured, multi-stage research framework designed to ensure depth, rigor, and impartiality. The process began with comprehensive secondary research, encompassing peer-reviewed journals, patent filings, regulatory announcements, and public financial disclosures. These sources provided the foundational understanding of technological trends, tariff policies, and competitive activities across the global landscape.

Primary insights were obtained through in-depth interviews with key opinion leaders, including senior R&D executives, regulatory experts, procurement specialists, and academic researchers. These discussions validated emerging themes and uncovered nuanced perspectives on operational challenges, collaborative models, and strategic priorities. Data triangulation was applied systematically to reconcile divergences between secondary findings and expert input, ensuring that conclusions represent a balanced synthesis of quantitative metrics and qualitative observations.

Finally, advanced analytical techniques-such as cross-segmentation mapping, thematic trend analysis, and comparative regional benchmarking-were employed to distill actionable insights. Throughout the research process, methodological safeguards, including transparency protocols and audit trails, were maintained to uphold the highest standards of accuracy and objectivity. This robust framework underpins the credibility of the report’s findings and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drug Discovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drug Discovery Market, by Drug Type

- Drug Discovery Market, by Technology

- Drug Discovery Market, by Therapeutic Area

- Drug Discovery Market, by Region

- Drug Discovery Market, by Group

- Drug Discovery Market, by Country

- United States Drug Discovery Market

- China Drug Discovery Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Critical Findings and Charting a Forward Looking Vision for Stakeholders in the Evolving Drug Discovery Ecosystem

In synthesizing these findings, it is clear that drug discovery is undergoing a period of profound transformation. Technological breakthroughs, evolving regulatory environments, and geopolitical influences are converging to redefine how therapies are conceived, developed, and delivered. Companies that optimize their R&D portfolios by harnessing advanced analytics, embracing collaborative networks, and proactively managing external risks will emerge as leaders in the next wave of therapeutic innovation.

The strategic insights and recommendations presented here offer a roadmap for decision-makers to allocate resources effectively, navigate uncertainties, and capitalize on emerging opportunities. As the industry continues to evolve, maintaining agility-both at the organizational and operational levels-will be the defining factor in sustaining competitive advantage and ultimately driving patient-centric outcomes.

Empowering Your Strategic Planning with In-Depth Drug Discovery Insights Connect with Ketan Rohom to Acquire the Full Research Report Today

For direct access to comprehensive insights that can inform your strategic planning and investment decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can provide details on how this in-depth report can be tailored to your organization’s needs and outline subscription options that deliver the robust analytical framework and forward-looking perspectives essential for staying ahead in the competitive drug discovery landscape. Engage with an expert who understands the nuances of market dynamics and can facilitate immediate access to the full suite of data and recommendations.

- How big is the Drug Discovery Market?

- What is the Drug Discovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?