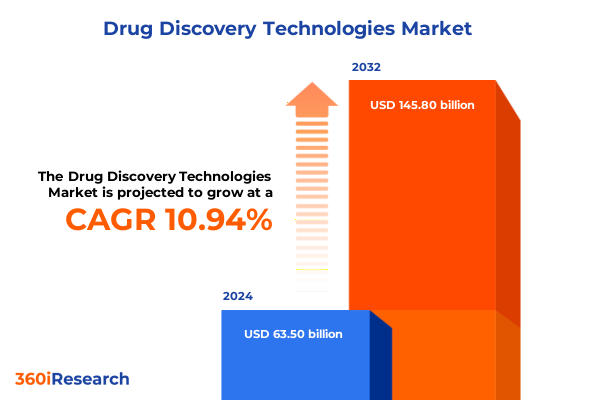

The Drug Discovery Technologies Market size was estimated at USD 70.19 billion in 2025 and expected to reach USD 77.59 billion in 2026, at a CAGR of 11.00% to reach USD 145.80 billion by 2032.

Revolutionizing Drug Discovery Through Convergent Advancements in Technology, Collaboration, and Data-Driven Innovation to Accelerate Therapeutic Breakthroughs

The accelerating pace of scientific innovation and technological integration has transformed drug discovery into a highly dynamic and interconnected field. Advances in computational modeling, high-throughput screening, and nanotechnology now converge with traditional biochemical and cell based assays to create a landscape where speed and precision are paramount. Concurrently, the rise of biologic drugs alongside established small-molecule therapeutics has reshaped target identification, validation, and lead optimization processes. This introduction outlines the foundational concepts and contextual drivers that underpin modern drug discovery technologies and frames the subsequent analysis of market dynamics and strategic imperatives.

In recent years, the proliferation of pharmacogenomics and structure based design has enabled researchers to leverage genomic insights and three dimensional target conformations with unprecedented resolution. This fusion of molecular biology and computational power facilitates the rapid triaging of candidate molecules, reduces reliance on trial and error, and enhances the likelihood of clinical success. Additionally, novel assay techniques-ranging from binding assays that elucidate direct receptor interactions to reporter gene assays that monitor functional outcomes-further refine hit discovery and characterization.

As the industry pivots toward more integrated and collaborative models, partnerships between academic institutions, biotechnology firms, and pharmaceutical companies have become indispensable. These alliances mobilize complementary expertise, enable access to specialized platforms, and distribute risk across the innovation value chain. This convergence of players and platforms lays the groundwork for the transformative shifts examined in the next section.

Uncovering the Pivotal Shifts Reshaping Drug Discovery Landscapes Through Integration of AI, High-Throughput Platforms, and Collaborative Research Ecosystems

Drug discovery is experiencing a paradigm shift driven by the integration of artificial intelligence, machine learning, and automated high-throughput platforms. Computational modeling has evolved from a theoretical tool into a central component of early stage screening, enabling the in silico evaluation of compound libraries with speed and accuracy. These digital frameworks not only predict binding affinities but also anticipate off-target interactions and metabolic liabilities, thereby reducing downstream attrition.

Simultaneously, advancements in assay techniques have redefined how biological activity is measured. Binding assays, once limited to radioligand displacement, now employ fluorescence resonance energy transfer and surface plasmon resonance to detect interactions in real time. Biochemical assays, traditionally confined to enzyme kinetics, have expanded to cover complex multi-enzyme pathways. Cell based assays have moved beyond static culture models to incorporate three dimensional organoids and microfluidic systems that better replicate physiological environments. Reporter gene assays have similarly matured to provide multiplexed readouts of gene expression patterns, enabling more nuanced insights into compound efficacy and mechanism of action.

The convergence of these assay innovations with structure based design and pharmacogenomics has created a feedback loop where experimental data continuously inform computational predictions. This interconnected ecosystem accelerates hit identification, optimizes lead compounds, and supports iterative design cycles. As a result, pipelines have become more resilient to failure, and strategic collaborations between academia, biotech, and large pharmaceutical organizations have become critical for harnessing these transformative technologies.

Evaluating the Far-Reaching Consequences of United States Tariffs Implemented in 2025 on Supply Chains, Research Costs, and Innovation Pipelines in Drug Discovery

The introduction of new tariff measures by the United States in early 2025 has reverberated across the drug discovery ecosystem, impacting the cost and availability of key research materials and equipment. Tariffs levied on imported reagents and specialized instrumentation have prompted organizations to reexamine supply chain strategies and consider alternative sourcing options. This adjustment period has highlighted vulnerabilities in global procurement networks and underscored the importance of local manufacturing capacity for critical assay components.

In response to increased import costs, many research organizations have accelerated investments in domestic production of small molecules and antibody reagents. This shift not only mitigates exposure to tariff fluctuations but also strengthens regional resilience. However, the ramp-up of local manufacturing requires capital expenditure and validation timelines, affecting short-term program budgets. The cumulative effect has been a strategic reallocation of R&D resources toward platforms and workflows less reliant on imported goods, such as in silico screening and computational design.

Despite these challenges, the tariffs have catalyzed a renewed focus on supply chain transparency and collaboration among stakeholders. Cross sector alliances are forging agreements to share production facilities, co-develop reagent quality standards, and optimize logistics. These cooperative models are reducing cost inefficiencies and establishing more agile procurement frameworks, ensuring that innovation pipelines remain robust even in the face of evolving trade policies.

Harnessing Multi-Dimensional Segmentation Insights to Illuminate Diverse Drug Types, Assay Techniques, Technology Platforms, Applications, and End User Dynamics

A nuanced understanding of market segmentation is essential for stakeholders seeking to navigate the complexities of drug discovery technologies. When examining drug type, the dichotomy between biologic drugs and small-molecule drugs reflects divergent discovery pathways, with biologics often requiring cell based and reporter gene assays for characterization, while small molecules leverage high throughput biochemical and binding assays to accelerate hit generation. The parallel growth of both categories necessitates tailored platform investments and expertise development.

Considering assay techniques provides further clarity on methodological specialization. Binding assays deliver precise interaction kinetics and are widely adopted in early target validation stages. Biochemical assays remain the workhorse for enzyme inhibition studies and pathway elucidation. Cell based assays offer context-rich insights into cellular responses but demand more complex infrastructure and analytical capabilities. Reporter gene assays complement these approaches by enabling multiplexed functional analysis, facilitating deeper mechanistic exploration.

Technology platforms further differentiate the market landscape. Computational modeling stands out for its ability to process vast chemical spaces with minimal consumable costs, while high throughput screening platforms generate empirical datasets across thousands of compounds. Nanotechnology introduces novel delivery vehicles and nanoscale biosensors, whereas pharmacogenomics uncovers patient-specific responses and informs personalized medicine initiatives. Structure based design closes the loop by integrating three dimensional target structures into both virtual and physical screening workflows.

Applications of these platforms span from biomarker discovery to toxicology testing. Biomarker discovery leverages high content assays to identify actionable disease indicators. Lead discovery combines computational and empirical screening to isolate promising candidates. Preclinical and clinical development integrates advanced analytics to de-risk safety and efficacy profiles. Target identification and validation proceed through rigorous assay cascades. Toxicology testing applies both in vitro and computational methods to predict adverse effects, ensuring candidate compounds meet stringent regulatory standards.

Finally, end user dynamics shape the trajectory of technology adoption. Academic institutions drive early innovation but often lack scale for late-stage validation. Biotechnology firms balance agility and specialized expertise, targeting niche therapeutic areas. Pharmaceutical companies deploy integrated pipelines and global resources, emphasizing cross-disciplinary collaboration for large scale program execution. The interplay among these end users defines adoption curves, partnership strategies, and investment priorities.

This comprehensive research report categorizes the Drug Discovery Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Assay Techniques

- Technology Platforms

- Application

- End User

Examining Regional Nuances Across Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Growth Drivers and Collaborative Opportunities in Drug Discovery

Regional nuances exert a powerful influence on the evolution and adoption of drug discovery technologies across the global landscape. In the Americas, particularly within the United States, robust R&D tax incentives, established biopharma clusters, and deep venture capital markets have fostered a culture of rapid innovation in computational design and assay miniaturization. Leading academic centers and biotech hubs collaborate seamlessly with contract research organizations, collectively driving the development of novel high throughput and pharmacogenomic platforms.

Across Europe, the Middle East and Africa (EMEA), a more regulated environment has incentivized harmonized standards for assay validation and quality control. European Union research initiatives support cross-border consortia that integrate nanotechnology and structure based design to address complex diseases. Meanwhile, growing investment in personalized medicine within the Middle East leverages regional genomics initiatives. Africa showcases emerging opportunities for leapfrog technologies, where cost-effective computational screening and mobile diagnostic platforms offer scalable solutions to infrastructure constraints.

In the Asia-Pacific region, expansive public-private partnerships and government funding programs have catalyzed adoption of automated screening and artificial intelligence tools. Nations such as China, Japan, and South Korea are investing heavily in domestic manufacturing of biologic reagents and assay kits, reducing reliance on imports and fostering localized innovation ecosystems. Rapid digitalization and deployment of cloud-based analytical platforms have democratized access to advanced computational modeling, enabling both established pharmaceutical firms and emerging biotech startups to accelerate discovery timelines.

This comprehensive research report examines key regions that drive the evolution of the Drug Discovery Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Shaping Drug Discovery Technologies Through Cutting Edge Research, Partnerships, and Commercial Strategies

The competitive landscape of drug discovery technologies is defined by the strategic actions of leading innovators and their alliances. Major instrument and software providers have expanded their portfolios through targeted acquisitions of niche assay developers and computational biology startups. These strategic mergers enable integrated end-to-end platforms that seamlessly transition from in silico screening to high throughput empirical validation, thereby reducing handoff inefficiencies and data fragmentation.

Biotechnology firms specializing in nanotechnology and pharmacogenomics have secured venture funding to scale proprietary platforms, forming collaborative agreements with larger pharmaceutical companies seeking to diversify their discovery pipelines. These partnerships often include co-development clauses and shared intellectual property arrangements, reflecting a shift toward more equitable risk-and-reward structures. Additionally, consortium models have emerged, where multiple companies pool resources to build advanced precompetitive platforms, such as shared biomarker libraries and open access computational frameworks.

Contract research organizations have evolved beyond service provision into strategic partners, investing in proprietary assay modules and modular automation systems. By offering flexible, scalable services, these organizations enable clients to access cutting edge technologies without heavy upfront capital commitments. This dynamic interplay of acquisitions, alliances, and co-development agreements underscores the importance of agility and partnership in maintaining competitive advantage within the drug discovery arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drug Discovery Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories, Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer Healthcare AG

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Bristol-Myers Squibb Company

- Covaris, LLC

- Curia Global, Inc.

- Elucidata Corporation

- Eurofins Advinus Private Limited

- Evotec SE

- F. Hoffmann-La Roche Ltd.

- GE Healthcare Ltd.

- Gilead Sciences, Inc.

- Horiba, Ltd.

- Illumina, Inc.

- IQVIA Inc.

- Luminex Corporation by DiaSorin Group

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- PIRAMAL PHARMA LIMITED

- Randox Laboratories Ltd.

- Revolution Medicines, Inc.

- Sanofi S.A.

- Sygnature Discovery Limited

- Syngene International Limited

- Thermo FIsher Scientific Inc.

- VWR International LLC

- WuXi AppTec Co., Ltd.

Translating Industry Insights into Actionable Strategies for Stakeholders to Optimize Investment, Foster Innovation, and Enhance Competitive Positioning in Drug Discovery

To capitalize on emerging opportunities, industry leaders must align investment priorities with platform scalability and cross-disciplinary collaboration. Allocating resources to integrate computational modeling with empirical assay data can significantly reduce cycle times and increase confidence in lead optimization. Establishing joint innovation centers that co-locate computational scientists, chemists, and biologists fosters continuous feedback loops, accelerating the translation of predictive insights into actionable experimental designs.

Organizations should also develop flexible procurement strategies that balance cost efficiencies with supply chain resilience. Diversifying reagent and equipment sources, while investing in domestic manufacturing partnerships, can buffer the impact of external policy shifts. Concurrently, engaging in precompetitive consortia for reagent standardization and quality assurance reduces duplication of effort and creates industry-wide benchmarks for assay performance.

Finally, cultivating talent through cross-functional training programs ensures that teams can navigate the intersection of data science, automation, and molecular biology. Embedding continuous learning frameworks and rotational assignments between discovery, translational, and clinical research groups enhances organizational agility. By adopting these actionable strategies, stakeholders can position themselves to lead in an environment defined by rapid technological change and increasingly complex therapeutic targets.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Validated Analytical Frameworks for Comprehensive Market Insights

This analysis is grounded in a multi-tiered methodology designed to deliver comprehensive insights into drug discovery technologies. Primary research comprised in-depth interviews with senior R&D executives, academic researchers, and technology providers, enabling the capture of first-hand perspectives on emerging trends, adoption challenges, and strategic priorities. These qualitative inputs were complemented by structured surveys to quantify adoption rates of key platforms and assess investment intentions across different end user segments.

Secondary research involved systematic review of peer-reviewed journals, patent filings, regulatory submissions, and industry white papers. Proprietary databases were leveraged to track merger and acquisition activity, funding rounds, and publication metrics within the areas of computational modeling, high throughput screening, nanotechnology, pharmacogenomics, and structure based design. Market intelligence tools provided anonymized benchmarking data on equipment installation trends and reagent consumption patterns.

Analytical frameworks were applied to synthesize primary and secondary findings. Segmentation matrices aligned technology platforms with application areas and end user profiles. Regional mapping techniques integrated macroeconomic indicators, policy landscapes, and infrastructure capacities. A cross-validation process ensured data integrity and consistency, with iterative reviews by subject matter experts to resolve discrepancies and refine key insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drug Discovery Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drug Discovery Technologies Market, by Drug Type

- Drug Discovery Technologies Market, by Assay Techniques

- Drug Discovery Technologies Market, by Technology Platforms

- Drug Discovery Technologies Market, by Application

- Drug Discovery Technologies Market, by End User

- Drug Discovery Technologies Market, by Region

- Drug Discovery Technologies Market, by Group

- Drug Discovery Technologies Market, by Country

- United States Drug Discovery Technologies Market

- China Drug Discovery Technologies Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Critical Findings and Strategic Implications to Guide Decision Makers Through the Evolving Drug Discovery Horizon with Confidence and Clarity

The evolution of drug discovery technologies reflects a broader shift toward integrated, data-driven, and collaborative innovation models. Advances in computational modeling and automated high-throughput screening have redefined early discovery stages, while novel assay techniques and platform synergies accelerate lead validation. These developments are further influenced by external factors such as tariff policies, regional funding initiatives, and strategic alliances among academic, biotech, and pharmaceutical stakeholders.

Key segmentation insights illuminate how diverse drug types, assay methodologies, and technology platforms intersect with distinct end user needs and application requirements. Regional analysis highlights varied adoption trajectories shaped by policy incentives, infrastructure maturity, and local manufacturing capabilities. Competitive profiling underscores the critical role of strategic partnerships, mergers, and consortium models in driving platform integration and market differentiation.

By synthesizing these findings, decision makers gain a cohesive understanding of the strategic imperatives needed to navigate the evolving drug discovery landscape. The actionable recommendations provide a blueprint for aligning investments, fostering cross-disciplinary collaboration, and enhancing supply chain resilience. This comprehensive executive summary serves as a guiding document for stakeholders seeking to leverage cutting edge technologies and maintain a competitive advantage in the pursuit of therapeutic breakthroughs.

Empowering Stakeholders to Propel Breakthrough Developments by Partnering with Ketan Rohom to Acquire the Definitive Drug Discovery Technologies Market Intelligence Report

Engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, enables stakeholders to access the definitive market research report on drug discovery technologies. The comprehensive insights within this report empower decision makers to navigate the complexities of evolving assay techniques, technology platforms, and emerging therapeutic modalities with confidence. By initiating a dialogue with Ketan, organizations can tailor their data needs, secure timely delivery of customized analyses, and gain early visibility into upcoming industry trends.

Partnering with an experienced liaison like Ketan streamlines the process of obtaining critical market intelligence. His expertise ensures that each inquiry is addressed efficiently, and that the final deliverable aligns with strategic objectives-from R&D prioritization to investment planning and commercialization strategies. The actionable frameworks and data-rich narratives contained within the report serve as a catalyst for innovation and competitive differentiation.

Reach out today to explore subscription options, secure exclusive briefings, and integrate this essential resource into your organizational toolkit. Whether you seek to refine pipeline decisions, benchmark against peer activities, or identify high-potential collaboration opportunities, this market research report will serve as your foundational guide to drug discovery technologies.

- How big is the Drug Discovery Technologies Market?

- What is the Drug Discovery Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?