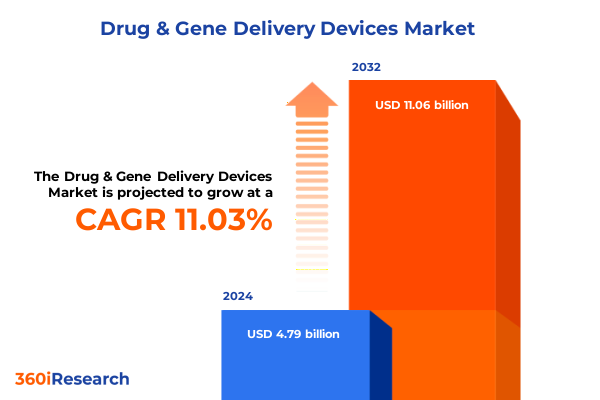

The Drug & Gene Delivery Devices Market size was estimated at USD 5.32 billion in 2025 and expected to reach USD 5.92 billion in 2026, at a CAGR of 11.01% to reach USD 11.06 billion by 2032.

Setting the Stage for Innovation in Drug and Gene Delivery Devices with an Overview of Market Dynamics and Emerging Opportunities

The global landscape for drug and gene delivery devices is experiencing a period of rapid transformation driven by breakthroughs in materials science, digital health integration, and patient-centric innovation. This introduction provides an essential overview of how evolving therapeutic demands and technological capabilities are converging to reshape delivery device design and adoption. As populations age and chronic conditions proliferate, there is growing emphasis on devices that enable precise, minimally invasive administration while ensuring patient adherence and comfort. Concurrently, advances in biomaterials and nanotechnology are enabling novel delivery modalities that extend release profiles, enhance stability, and target specific tissues or cellular pathways.

Transitioning from traditional syringe and vial approaches, the industry is embracing smart systems that integrate sensors, connectivity, and data analytics to support real-time dosing adjustments and remote monitoring. This paradigm shift not only empowers healthcare providers with actionable insights but also fosters patient engagement through intuitive device interfaces and digital coaching. To frame these developments within a cohesive context, this introduction will outline key drivers, barriers, and opportunity areas, setting the stage for a deeper examination of transformative market dynamics and strategic implications.

Uncovering the Transformative Shifts Redefining Drug and Gene Delivery Device Development and Adoption Across Therapeutic Landscapes

Emerging trends are redefining the drug and gene delivery device landscape, ushering in transformative shifts that span materials innovation to regulatory frameworks. At the core, hydrogels, liposomal carriers, nanoparticles, and advanced polymers are driving a resurgence in tailored release profiles and targeted administration. These materials facilitate enhanced bioavailability and reduce systemic exposure, enabling therapies that were previously constrained by stability or toxicity concerns.

Parallel to materials advancements, device architectures are evolving from passive injectors to sophisticated platforms that integrate digital intelligence. Auto injectors, pen injectors, and infusion pumps now incorporate connected features that collect and transmit adherence data, thereby enabling personalized therapy optimization. Needle-free injectors are gaining traction in immunization and insulin delivery, as they minimize patient discomfort and risk of needlestick injuries. These innovations reflect an underlying shift: the convergence of device engineering and digital health to create holistic, patient-centric delivery ecosystems.

Regulatory bodies are also adapting, issuing guidance that acknowledges the unique challenges of combination products. Frameworks for gene therapy vectors, whether viral or nonviral, are becoming more standardized, reducing time to market and fostering investment. As regulatory clarity improves, companies are reallocating R&D resources toward next-generation delivery solutions, catalyzing a virtuous cycle of innovation and collaboration across the value chain.

Examining the Complex Ripple Effects of 2025 United States Tariffs on Supply Chains Development and Cost Structures in Delivery Devices

The imposition of new United States tariffs in 2025 has reshaped the supply chain economics for drug and gene delivery devices, prompting companies to reassess sourcing strategies and manufacturing footprints. Components such as specialty polymers and precision machined device parts, often imported under prior tariff schedules, now incur higher duties, squeezing margins and potentially delaying product launches. In response, leading organisations are diversifying supply bases and establishing regional manufacturing hubs to mitigate exposure to trade policy fluctuations.

Meanwhile, pricing pressures have intensified downstream as payers and providers seek to absorb increased costs without compromising patient access. Strategic partnerships between device manufacturers and raw material suppliers are emerging to negotiate volume discounts and implement just-in-time inventory models. These collaborative arrangements not only distribute risk but also reinforce supply chain resilience against future policy shifts. Simultaneously, some innovators are accelerating the adoption of alternative materials-such as biocompatible hydrogels produced domestically-to bypass tariff-impacted imports.

As the industry evolves under this new trade regime, forward-looking companies are embedding tariff impact assessments into early-stage development processes. By integrating trade policy considerations with product design and sourcing decisions, they are positioning themselves to maintain competitiveness while preserving the innovation velocity essential for advancing drug and gene delivery solutions.

Revealing Critical Insights from Technology Device Molecule Type End User Application and Therapeutic Area Segmentation Perspectives

A nuanced understanding of market segmentation reveals how technology, device type, molecule type, end-user settings, application modalities, and therapeutic focus collectively shape the competitive environment. Within each segment, distinct value propositions emerge: hydrogel-based carriers offering tunable release kinetics sit alongside liposomal formulations prized for enhanced drug solubility, while polymer-based devices enable robust structural integrity for sustained deployments. Nanoparticles further differentiate by facilitating tissue-specific targeting across diverse indications.

In terms of device typologies, auto injectors and pen injectors optimize self-administration, needle-free injectors improve patient comfort, and infusion pumps deliver continuous dosing within both clinical and home healthcare settings. Syringes remain indispensable for small-volume injections, but their role is evolving as integrated digital modules enrich user experiences. The molecule landscape underscores the ascent of biologics-spanning monoclonal antibodies, peptides, and recombinant proteins-and the rapid maturation of gene therapies, which deploy both viral vectors (adenoviral, lentiviral, retroviral) and nonviral lipid or polymer systems.

Clinics and hospitals continue to anchor high-intensity therapeutic regimens, while home healthcare adoption accelerates, driven by patient empowerment and cost-efficiency imperatives. Research laboratories fuel early-stage innovation, partnering with device developers to validate proof-of-concept applications. From controlled release through smart delivery, sustained release, and targeted delivery, each application niche warrants bespoke solutions, ultimately converging to address critical therapeutic areas such as cardiovascular disease, diabetes management, infectious diseases, and oncology.

This comprehensive research report categorizes the Drug & Gene Delivery Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Device Type

- Molecule Type

- End User

- Application

- Therapeutic Area

Deriving Strategic Perspectives from Key Regional Landscapes Spanning Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics are shaping the future of drug and gene delivery devices as competitive advantages crystallize across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, established infrastructure, robust R&D investment, and a favorable regulatory climate underpin rapid adoption of innovative delivery systems. The United States serves as a global hub for combination product approvals, while Canada and Latin American markets are experiencing increasing demand for self-administrable devices driven by home healthcare expansion.

Across Europe, the Middle East, and Africa, harmonized regulatory frameworks are fostering cross-border commercialization, yet market maturity varies significantly. Western Europe leads in digital integration and smart device utilization, supported by strong health data interoperability mandates. In contrast, emerging EMEA markets show promising growth in basic device adoption, buoyed by rising healthcare expenditure and initiatives aimed at expanding access to biologics.

Asia-Pacific represents another frontier of growth, with markets such as China, Japan, and Australia demonstrating high receptivity to advanced delivery technologies. Local manufacturing capabilities are being reinforced by joint ventures and licensing agreements, reducing dependency on imports. At the same time, regulatory authorities in the region are aligning guidelines for gene therapies and combination products, accelerating approval timelines and stimulating domestic innovation ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Drug & Gene Delivery Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Dynamics Shaping Leading Players Innovation Partnerships and Strategic Positioning in Delivery Device Markets

Competitive intensity in the drug and gene delivery device market is escalating as both established players and nimble innovators converge on high-value opportunities. Traditional device manufacturers are expanding portfolios through acquisitions of biopolymers specialists and digital health start-ups, thereby integrating materials expertise with connected device capabilities. Concurrently, emerging biotech firms are partnering with contract development and manufacturing organisations to co-develop tailor-made delivery platforms for advanced therapeutics.

Strategic alliances are emerging around shared challenges, such as ensuring stable viral vector integration within injectors or refining nanocarrier formulations to optimize payload release. Companies are forging cross-sector collaborations, drawing upon academic research in hydrogels and polymer science to enhance device safety and functionality. Moreover, investments in automated assembly lines and predictive maintenance technologies are driving operational excellence, enabling manufacturers to scale rapidly while maintaining stringent quality controls.

Innovation pipelines reflect this collaborative ethos, featuring modular platforms that can accommodate a spectrum of therapeutic molecules. This agility empowers stakeholders to pivot across indications, from oncology immunotherapies to cardiovascular peptide analogues. The resulting competitive landscape rewards those organisations capable of orchestrating end-to-end solutions, from material synthesis through device assembly to post-market data analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drug & Gene Delivery Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca plc

- B. Braun Melsungen AG

- Baxter International Inc.

- Bayer AG

- Becton, Dickinson & Company

- Catalent, Inc.

- Epeius Biotechnologies Corporation

- F. Hoffmann-La Roche Ltd.

- Fresenius Kabi AG

- Gerresheimer AG

- Johnson & Johnson Services, Inc.

- Lonza Group AG

- Medtronic plc

- Nipro Corporation

- Novartis AG

- Sartorius AG

- Shanghai Sunway Biotech Co., Ltd.

- SHL Medical AG

- SiBiono GeneTech Co., Ltd.

- Stevanato Group S.p.A.

- Terumo Corporation

- UniQure N.V.

- West Pharmaceutical Services, Inc.

- Ypsomed Holding AG

Presenting Actionable Strategic Recommendations to Propel Competitive Advantage and Drive Growth for Stakeholders in Delivery Device Technology

Industry leaders must adopt a multifaceted strategy that balances material innovation, regulatory agility, and digital integration to secure sustainable growth. First, prioritizing the development of adaptable platforms that support both small molecules and complex biologics will enhance portfolio resilience. By designing modular delivery systems, companies can accelerate time to market for novel therapeutics while managing R&D risk across multiple segments.

Second, forging strategic partnerships with raw material innovators and digital health providers will optimize supply chain efficiency and enrich device functionality. Joint development agreements can provide early access to cutting-edge biomaterials and enable seamless integration of sensors and connectivity features. This approach not only mitigates tariff-induced cost pressures but also ensures that next-generation devices deliver actionable patient data.

Third, engaging with regulatory agencies through proactive dialogues will streamline approval pathways, particularly for gene therapy combination products. By aligning study designs with evolving guidance, organisations can reduce time to market and safeguard patient safety. Finally, organisations should invest in advanced manufacturing techniques-such as continuous processing and additive manufacturing-to enhance production scalability and quality assurance. Collectively, these recommendations provide a roadmap for capturing emerging opportunities while navigating complex market dynamics.

Illuminating the Robust Research Methodology Employed Including Primary Secondary and Analytical Techniques for Comprehensive Market Analysis

This report’s findings are underpinned by a robust research methodology combining comprehensive primary and secondary data collection with rigorous analytical techniques. Primary research encompassed in-depth interviews with key opinion leaders, including device engineers, regulatory experts, and industry executives. These conversations provided nuanced perspectives on technology adoption, patient requirements, and supply chain dynamics.

Complementing these insights, secondary research sources spanned peer-reviewed journals, regulatory filings, patent databases, and trade publications. This breadth ensured a holistic understanding of materials science breakthroughs, device patent landscapes, and emerging application paradigms. Data triangulation techniques were applied to reconcile divergent information streams, enhancing the reliability of qualitative observations.

Quantitative analysis included mapping of adoption trajectories across segmentation variables such as technology, device type, molecule class, end-user setting, application modality, and therapeutic area. Regional dynamics were assessed through import-export data, regulatory approval rates, and investment flow analyses. Finally, thematic synthesis distilled the strategic imperatives and growth enablers, providing a coherent narrative framework to guide decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drug & Gene Delivery Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drug & Gene Delivery Devices Market, by Technology

- Drug & Gene Delivery Devices Market, by Device Type

- Drug & Gene Delivery Devices Market, by Molecule Type

- Drug & Gene Delivery Devices Market, by End User

- Drug & Gene Delivery Devices Market, by Application

- Drug & Gene Delivery Devices Market, by Therapeutic Area

- Drug & Gene Delivery Devices Market, by Region

- Drug & Gene Delivery Devices Market, by Group

- Drug & Gene Delivery Devices Market, by Country

- United States Drug & Gene Delivery Devices Market

- China Drug & Gene Delivery Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Decision Makers Toward Sustainable Innovation in Drug and Gene Delivery Devices

In synthesizing the analysis of drug and gene delivery devices, several core themes emerge that will shape the sector’s trajectory. Material diversity-spanning hydrogels, liposomal systems, nanoparticle carriers, and advanced polymers-is unlocking new frontiers in targeted and sustained release. Device evolution toward smart, connected platforms is enhancing patient engagement, adherence, and real-time clinical decision making. Simultaneously, regulatory progression and tariff considerations are driving strategic supply chain realignments and collaborative sourcing approaches.

As segmentation insights highlight distinct value pools across therapeutic areas and delivery pathways, industry participants must remain agile to capitalize on shifting market demands. Regional dynamics underscore the importance of localized manufacturing, regulatory harmonization, and digital health infrastructure. Competitive analysis reveals that organisations capable of orchestrating cross-sector partnerships and digitized production will command leadership positions.

Ultimately, the interplay of these factors suggests a transformative era in which delivery devices become integral components of holistic therapeutic solutions. Decision makers who integrate these insights into strategic roadmaps will be best positioned to navigate complexity, drive innovation, and deliver superior patient outcomes.

Connect with Ketan Rohom Associate Director Sales and Marketing to Access the Comprehensive Market Research Report and Elevate Strategic Planning

To explore this comprehensive market research report and unlock the full spectrum of strategic insights tailored to drug and gene delivery devices, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through the report’s depth, highlight customised findings, and support your organisation’s strategic decision-making. Secure your access today and harness critical intelligence that can shape the future of delivery device innovation.

- How big is the Drug & Gene Delivery Devices Market?

- What is the Drug & Gene Delivery Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?