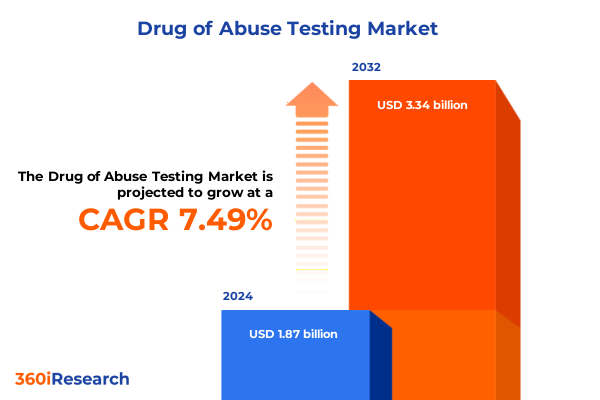

The Drug of Abuse Testing Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 7.58% to reach USD 3.34 billion by 2032.

Comprehensive Overview Highlighting Core Drivers, Stakeholder Priorities, and Technological Foundations Shaping the Drug Abuse Testing Industry Today

The evolving world of drug abuse testing is underpinned by complex regulatory, technological, and clinical dynamics that directly influence stakeholder decisions and market trajectories. As law enforcement agencies, healthcare providers, and corporate employers continue to prioritize accurate detection of illicit substances, understanding the multifaceted drivers of this field becomes essential. Rapid technological advancements, heightened regulatory scrutiny, and the push for more comprehensive testing panels have all converged to define the current landscape, shaping how laboratories and end users approach specimen collection and analysis.

Moreover, the imperative to balance speed, accuracy, and cost-efficiency adds layers of complexity. Traditional immunoassay screens remain invaluable for rapid preliminary results, while chromatographic techniques offer the specificity required for confirmatory analysis. Concurrently, regulatory bodies are tightening guidelines around sample integrity and reporting standards, reinforcing the need for robust quality management systems. The convergence of these factors compels organizations across the ecosystem-from clinical and forensic laboratories to correctional and hospital settings-to reimagine testing protocols and investment strategies.

Transitioning from historical paradigms, today’s market demands not only technical excellence but also agility in responding to emerging drug classes and shifting legal frameworks. This introduction sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, and regional variances that collectively paint a comprehensive view of the drug abuse testing industry.

Dynamic Transformations Driving the Drug Abuse Testing Landscape Through Advanced Detection Methods, Regulatory Reforms, and Market Disruptions

In recent years, the drug abuse testing market has witnessed unprecedented transformations driven by breakthroughs in analytical instrumentation, shifts in regulatory frameworks, and changing patterns of substance use. Innovations in chromatographic techniques, particularly the evolution of liquid chromatography coupled with high-resolution mass spectrometry, have elevated detection capabilities, enabling laboratories to identify emerging psychoactive substances at trace levels. These advancements have simultaneously prompted regulatory agencies to update validation guidelines, ensuring that laboratories maintain rigorous performance standards.

Furthermore, the shift toward decentralized and point-of-care testing models is reshaping service delivery. Compact immunoassay analyzers and portable mass spectrometers are empowering workplace testing facilities and clinical practitioners to obtain rapid, actionable results without the need for central laboratory workflows. This decentralization is complemented by data integration platforms that streamline result reporting, enhance chain-of-custody management, and support compliance with evolving accreditation requirements.

Market consolidation and strategic collaborations also underscore this transformative era. Diagnostic developers are aligning with software providers to offer end-to-end solutions that not only deliver analytical accuracy but also leverage digital technologies for real-time monitoring and predictive analytics. As the industry continues to embrace these transformative shifts, stakeholders are positioned to respond more effectively to public health challenges and the evolving landscape of controlled substances.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on Drug Abuse Testing Supplies, Technologies, and Global Supply Chains

The implementation of new tariff measures by the United States in 2025 has introduced significant variables affecting the procurement of critical reagents, instruments, and consumables for drug abuse testing. With increased import duties on testing kits, mass spectrometry components, and auxiliary laboratory equipment, organizations are navigating cost pressures that cascade through supply chains. Vendors sourcing chromatography columns or immunoassay reagents from overseas suppliers have had to reassess pricing models to maintain margins without compromising accessibility.

These tariff-related cost escalations have incentivized laboratories and distributors to explore alternative sourcing strategies. Some end users are prioritizing domestic manufacturers of consumables, while others are negotiating value-added service agreements with original equipment manufacturers to offset increased landed costs. At the same time, forward-looking enterprises are implementing advanced demand forecasting and inventory optimization protocols to mitigate supply disruptions and manage working capital more effectively.

On the strategic front, tariff dynamics are stimulating greater investment in local manufacturing capabilities. Diagnostic firms are evaluating the feasibility of in-country assembly and reagent compounding, seeking to shorten lead times while avoiding punitive duties. In parallel, industry associations are engaging with policymakers to advocate for tariff exemptions on essential testing supplies deemed critical to public health. The cumulative impact of these efforts is reshaping procurement landscapes and driving a more resilient testing infrastructure across the United States.

Unveiling Critical Segmentation Insights Across Sample Types, Testing Technologies, End Users, and Drug Panel Configurations Shaping Market Dynamics

A nuanced understanding of market segmentation reveals how diverse variables influence product adoption and innovation trajectories. Based on sample type, laboratories weigh the merits of hair analysis, oral fluid collection, and urine sampling, each offering distinct detection windows, preparation protocols, and user acceptability considerations. Hair analysis’s extended detection window enhances long-term monitoring, whereas oral fluid testing is prized for its minimally invasive collection and near-real-time results. Urine sampling remains the industry workhorse for its blend of cost-effectiveness and broad analyte coverage.

Based on test technology, organizations differentiate between chromatography and immunoassay platforms. Chromatography’s high resolution and selectivity, particularly through GC-MS and LC-MS methods, have become indispensable for confirmatory testing. Delving deeper, LC-MS techniques such as tandem mass spectrometry and quadrupole time-of-flight enable laboratories to expand panels and detect novel psychoactive compounds. In contrast, immunoassay solutions serve as rapid screening tools, offering streamlined workflows and immediate decision support at high throughput.

Based on end user, the market’s diverse demands are reflected in distinct purchasing patterns among clinical laboratories, correctional facilities, forensic laboratories, and hospitals. Each segment prioritizes attributes such as throughput capacity, regulatory compliance features, and cost per test differently. Finally, based on drug panel, the choice between customized panels and standardized configurations-be it five-panel, ten-panel, or expanded formats-allows users to align testing protocols with risk profiles, patient demographics, and use-case requirements. Recognizing these segmentation insights is key to tailoring product development and market strategies to specific stakeholder needs.

This comprehensive research report categorizes the Drug of Abuse Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sample Type

- Test Technology

- Drug Panel

- End User

Decoding Regional Market Variations in Drug Abuse Testing Across the Americas, Europe Middle East and Africa, and Asia Pacific Regions

Regional dynamics profoundly shape how drug abuse testing solutions are adopted and reimbursed. In the Americas, well-established regulatory frameworks and comprehensive insurance coverage underpin a mature market environment. Laboratories benefit from clear guidelines governing specimen collection and result reporting, while advanced economies such as the United States and Canada emphasize integration with electronic health records and national safety programs. Meanwhile, emerging markets across Latin America are investing in laboratory infrastructure, supported by international partnerships aimed at combating substance misuse.

Europe, the Middle East, and Africa collectively present a spectrum of opportunity and challenge. The European Union’s stringent In Vitro Diagnostic Regulation enforcements demand rigorous compliance and conformity assessments, driving vendors to secure CE marking for diagnostic platforms. In the Middle East, the rapid expansion of healthcare facilities and penal systems is accelerating adoption of forensic and workplace testing programs. Conversely, parts of Africa are prioritizing scale-up of basic immunoassay screening capabilities, often facilitated by public-private collaborations to enhance community health outcomes.

Within Asia Pacific, dynamic growth is underpinned by growing awareness of substance abuse issues and government-led initiatives to strengthen forensic and clinical testing networks. Advanced economies like Japan and Australia are early adopters of high-resolution chromatographic and mass spectrometric techniques, whereas markets such as China and India are balancing cost imperatives with rising demand for diversified drug panels. These regional nuances underscore the critical need for adaptable go-to-market approaches and localized support frameworks.

This comprehensive research report examines key regions that drive the evolution of the Drug of Abuse Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants Driving Innovation, Strategic Partnerships, and Competitive Positioning in the Drug Abuse Testing Industry

Leading companies in drug abuse testing are distinguishing themselves through technology leadership, strategic collaborations, and service integration. One multinational organization has leveraged its expertise in liquid chromatography instruments to launch modular mass spectrometry platforms, enabling laboratories to scale panel sizes while maintaining consistent throughput. Another global diagnostics provider has recently expanded its immunoassay portfolio, offering rapid test strips tailored for point-of-care applications in correctional facilities and emergency departments.

Major industry players have also entered partnerships with software developers to enhance result management, compliance tracking, and data analytics. By integrating digital dashboards and cloud-based quality control modules, these firms are addressing laboratories’ demands for unified platforms that streamline workflows from sample accessioning to result delivery. Simultaneously, specialized forensic equipment manufacturers are focusing on high-resolution mass spectrometry systems designed to detect novel psychoactive substances, reflecting growing market interest in next-generation analytical capabilities.

Competitive positioning is further defined by after-sales support networks and reagent supply agreements. The most influential companies offer comprehensive service contracts, on-site training programs, and rapid-response calibration services. By aligning their commercial strategies with end users’ operational needs, these market leaders are strengthening long-term customer relationships and driving portfolio diversification across clinical, forensic, correctional, and hospital segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drug of Abuse Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AccuBioTech Co., Ltd.

- American Bio Medica Corporation

- Bio‑Rad Laboratories, Inc.

- Clinical Reference Laboratory, LLC

- Cordant Health Solutions Inc.

- Danaher Corporation

- Drägerwerk AG & Co. KGaA

- Express Diagnostics International Inc.

- F. Hoffmann‑La Roche Ltd.

- Laboratory Corporation of America Holdings (LabCorp)

- LGC Group Holdings Ltd.

- LifeLoc Technologies, Inc.

- MP Biomedicals, LLC

- Omega Laboratories, Inc.

- OraSure Technologies, Inc.

- Precision Diagnostics Inc.

- Premier Biotech, Inc.

- Psychemedics Corporation

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd.

- Siemens Healthineers AG

- SureScreen Diagnostics Ltd.

- Thermo Fisher Scientific Inc.

- Wondfo Biotech Co., Ltd.

Strategic Recommendations Empowering Industry Leaders to Navigate Emerging Trends, Strengthen Supply Chains, and Enhance Testing Capabilities Effectively

Industry leaders looking to solidify their market presence should prioritize investments in advanced chromatographic and mass spectrometric technologies that deliver unparalleled specificity and panel flexibility. Strengthening supply chain resilience through dual sourcing of key reagents and collaborating with domestic manufacturers will mitigate tariff pressures and safeguard continuity of service. Additionally, fostering partnerships with software providers to integrate laboratory information management systems and compliance tracking tools can elevate operational efficiency and reduce turnaround times.

Organizations must also expand training initiatives focused on emerging analytical methods and quality assurance protocols. By equipping laboratory staff with the skills to validate new drug targets and maintain accreditation standards, companies can differentiate themselves through superior service quality. Exploring decentralized testing models-such as portable immunoassay analyzers for field deployment-will open untapped opportunities in correctional and remote clinical settings.

Finally, engaging proactively with regulatory bodies to advocate for harmonized standards and tariff exemptions on critical testing supplies can yield strategic advantages. By championing public-private initiatives that underscore the public health importance of reliable drug abuse testing, companies can strengthen their industry leadership and contribute to broader community safety objectives.

Robust Research Methodology Leveraging Primary Interviews, Secondary Data Sources, and Rigorous Analytical Frameworks for Comprehensive Insights

This research effort relied on a systematic approach combining both primary and secondary data sources to ensure comprehensive and reliable insights. Initially, a broad spectrum of secondary data was collected from peer-reviewed journals, regulatory clearance databases, and industry white papers. This body of evidence was critical for establishing baseline knowledge of technological advancements, regulatory requirements, and tariff developments in 2025.

Complementing the secondary research, a series of structured interviews was conducted with key opinion leaders, including clinical laboratory directors, forensic toxicologists, procurement officers, and regulatory specialists. These conversations provided granular context around sample type preferences, instrumentation adoption rationales, and regional variances. Interview feedback was triangulated against import-export data and published standards to validate emerging themes.

Analytical frameworks such as SWOT analysis, value chain mapping, and segmentation modeling were then applied to synthesize findings. Segmentation was structured around sample type, test technology, end user, and drug panel configurations, enabling targeted insights into each market dimension. Regional assessments were informed by data on regulatory frameworks, reimbursement policies, and laboratory infrastructure development.

Finally, iterative validation workshops with industry experts ensured that key takeaways and recommendations were actionable and reflective of real-world constraints. This rigorous methodology underpins the credibility and depth of the insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drug of Abuse Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drug of Abuse Testing Market, by Sample Type

- Drug of Abuse Testing Market, by Test Technology

- Drug of Abuse Testing Market, by Drug Panel

- Drug of Abuse Testing Market, by End User

- Drug of Abuse Testing Market, by Region

- Drug of Abuse Testing Market, by Group

- Drug of Abuse Testing Market, by Country

- United States Drug of Abuse Testing Market

- China Drug of Abuse Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusive Perspectives Emphasizing Critical Takeaways, Strategic Imperatives, and Future Directions in the Evolving Drug Abuse Testing Environment

This executive summary has highlighted the imperative role of cutting-edge analytical platforms, from immunoassay screens to high-resolution chromatographic systems, in meeting evolving demands for accurate drug abuse testing. The transformative shifts observed-namely decentralization of testing, integration of digital compliance tools, and expansion of forensic capabilities-underscore an industry in flux, responding to both technological breakthroughs and changing substance abuse trends.

The 2025 tariff landscape has introduced new complexities, prompting stakeholders to reassess sourcing strategies and pursue localized manufacturing partnerships. Coupled with insights into sample type preferences and test technology adoption, these developments illuminate pathways for differentiation and resilience. Regional analyses within the Americas, Europe Middle East and Africa, and Asia Pacific reveal nuanced market drivers, regulatory imperatives, and investment priorities, underscoring the importance of adaptive go-to-market tactics.

Leading companies are capitalizing on these trends through strategic alliances, integrated software offerings, and comprehensive after-sales support, setting benchmarks for innovation and customer engagement. To maintain competitive advantage, industry leaders should adopt actionable recommendations focused on technological investment, supply chain fortification, and proactive regulatory engagement. The methodologies employed in this research-grounded in primary interviews and robust segmentation analysis-provide a reliable foundation for informed decision-making.

As the drug abuse testing environment continues to evolve, organizations that embrace data-driven strategies and collaborative partnerships will be best positioned to navigate future challenges and opportunities.

Compelling Call To Action Connecting Stakeholders with Ketan Rohom to Unlock In-Depth Market Research Insights and Drive Strategic Growth in Drug Abuse Testing

To explore deeper insights or secure full access to the comprehensive market research report, stakeholders are encouraged to reach out to Ketan Rohom, Associate Director of Sales & Marketing. By connecting directly, organizations can benefit from tailored consultations, receive sneak-peek summaries, and discuss customized research solutions aligned with their strategic priorities. Engaging with an expert at this level ensures a clear understanding of the methodologies, key findings, and actionable recommendations presented in the study.

Taking advantage of this opportunity provides decision-makers with the confidence and clarity needed to navigate a highly dynamic drug abuse testing environment. Whether seeking to refine product development strategies, optimize supply chain resilience, or expand into new regions, a direct conversation with Ketan unlocks the path to data-driven growth. Reach out today to transform insights into strategic action and gain a competitive edge in the rapidly evolving market.

- How big is the Drug of Abuse Testing Market?

- What is the Drug of Abuse Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?