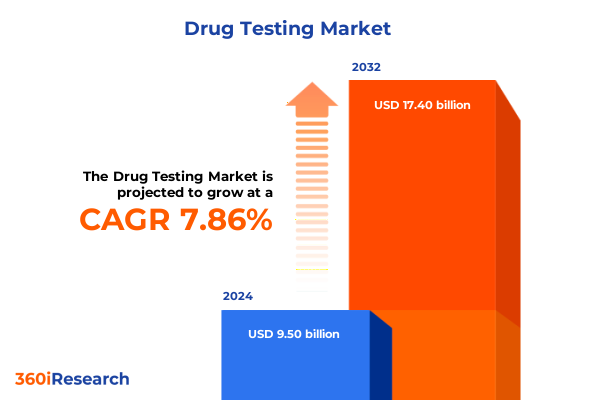

The Drug Testing Market size was estimated at USD 13.69 billion in 2025 and expected to reach USD 14.40 billion in 2026, at a CAGR of 5.43% to reach USD 19.83 billion by 2032.

Unveiling the Shifting Dynamics in Drug Testing with a Panorama of Market Drivers, Regulatory Landscapes, and Emerging Technological Horizons

In recent years, the imperative for drug testing has intensified in response to escalating substance use challenges across the United States. According to the Substance Abuse and Mental Health Services Administration’s 2023 National Survey on Drug Use and Health, 17.1 percent of Americans aged 12 or older-equating to approximately 48.5 million individuals-met criteria for a substance use disorder, highlighting the critical need for comprehensive screening measures to safeguard public health and workplace safety.

Regulatory frameworks have concurrently evolved to support more diversified testing methodologies and enhance detection accuracy. Notably, the Department of Transportation’s final rule, effective December 5, 2024, authorizes employers and enforcement agencies to utilize oral fluid testing alongside traditional urine screens, enabling more precise detection of recent substance use in safety-sensitive roles and roadside applications.

Furthermore, the residual effects of the COVID-19 pandemic catalyzed the integration of point-of-care testing and telehealth-enabled collection protocols, empowering organizations to implement rapid, decentralized screening solutions. This shift has not only reduced turnaround times but also fostered resilience in continuity of operations and compliance with evolving health guidelines

Harnessing Advanced Analytical Innovations and Regulatory Reforms to Define the Future of Drug Testing Precision and Accessibility

The drug testing landscape is undergoing a transformative wave driven by advanced analytical technologies and integrated digital solutions. Digital microfluidic platforms, leveraging electrowetting-on-dielectric and surface acoustic wave techniques, have redefined immunoassay workflows for point-of-care applications. By automating sample preparation, reaction control, and detection within a single lab-on-a-chip device, these systems enable multiplexed biomarker analysis with minimal reagent consumption and rapid turnaround, addressing the urgent needs of decentralized clinical and field testing environments.

Simultaneously, liquid chromatography-tandem mass spectrometry (LC-MS/MS) continues to serve as the gold standard for confirmatory testing, with laboratories increasingly integrating AI-driven data analysis to enhance throughput and reproducibility. Machine learning algorithms now facilitate automated peak detection and deconvolution, while miniaturized, portable MS systems are emerging to support on-site sweat and oral fluid testing, thereby expanding the scope of non-invasive, high-accuracy detection protocols beyond centralized laboratory settings.

Complementing these core techniques, chromatography and spectroscopy platforms are experiencing renewed emphasis on automation and integration. Gas and liquid chromatography systems are being paired with immunoaffinity and high-resolution mass analyzers to improve selectivity and lower limits of detection, while Fourier-transform infrared and ultraviolet spectroscopies are enhancing rapid screening capabilities for preliminary substance identification. These converging innovations are reshaping analytical pipelines, enabling stakeholders to achieve both speed and analytical depth in drug screening processes

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Drug Testing Supply Chains and Operational Budgets

The implementation of enhanced U.S. tariff measures in 2025 is imposing significant cost pressures on drug testing supply chains, particularly for consumables imported from China. Section 301 increases have levied a 100 percent duty on syringes and needles and a 50 percent duty on rubber gloves, while surgical masks and respirators face 25 percent tariffs, directly affecting the production and distribution of sample collection kits and personal protective equipment used in testing protocols.

In response, leading diagnostic and medtech firms are recalibrating manufacturing footprints to mitigate tariff exposure. Companies such as Intuitive Surgical and Boston Scientific are optimizing production costs through regionalized supply chain strategies and investing in U.S. facilities to absorb the financial impact. Abbott has committed hundreds of millions in 2025 to expand its domestic manufacturing of blood screening devices, anticipating that these investments will cushion the immediate effects of import duties while supporting long-term operational stability.

Despite these efforts, smaller testing service providers and startup innovators face heightened challenges as input costs rise and supply chain complexity grows. To navigate this volatile landscape, many are pursuing dual-sourcing strategies, forging partnerships with domestic manufacturers, and exploring alternative materials and formats to ensure uninterrupted access to critical testing kits and consumables

Deep Dive into Diverse Drug Testing Segmentation Revealing Distinct Requirements and Opportunities across Sample, Technology, Test, and End User Criteria

The drug testing market’s heterogeneity is underscored by its multi-dimensional segmentation, each segment presenting distinct requirements and innovation pathways. Sample type considerations range from plasma and serum analyses in blood specimens to nuanced detection windows in body and scalp hair matrices. Oral fluid applications differentiate between stimulated and unstimulated collection protocols to optimize cannabinoid impairment windows, while urine testing strategies must balance the logistical demands of 24-hour collections against the convenience of spot sampling methods.

On the technology front, chromatographic platforms-encompassing gas and liquid systems-continue to excel in multi-analyte separation, while immunoassay formats such as ELISA and point-of-care immunoassays deliver rapid, cost-effective screening. Mass spectrometry techniques, including MALDI and tandem MS, provide the specificity required for confirmatory analyses, and spectroscopy methods like FTIR and UV-visible systems support preliminary qualitative investigations.

Test types further reflect market diversity, spanning health screening protocols, post-accident evaluations, pre-employment clearances, and random testing regimens. Within random testing, alcohol-focused programs co-exist with broader drug screening initiatives, catering to employers’ varying risk profiles. End-user applications range from clinical and forensic laboratories to rehabilitation centers, with commercial laboratory networks subdividing into clinical and reference labs, and forensic facilities split between government and private entities

This comprehensive research report categorizes the Drug Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Sample Type

- Drug Class

- Result Time

- Test Location

- End User

Comparative Regional Perspectives Unraveling Unique Dynamics Shaping Drug Testing Adoption Patterns in the Americas, EMEA, and Asia-Pacific

Regional adoption of drug testing solutions exhibits pronounced variability driven by regulatory frameworks, healthcare infrastructure, and socio-economic factors. In the Americas, stringent workplace safety mandates and high rates of prescription opioid misuse have catalyzed widespread utilization of both laboratory-based and point-of-care testing. The United States remains at the forefront, with comprehensive DOT and SAMHSA guidelines shaping robust testing programs across transportation, construction, and federal agencies.

In Europe, the Middle East and Africa, regulatory diversity presents both challenges and opportunities. GDPR-driven privacy considerations in major EU economies encourage the rise of non-invasive saliva and hair testing modalities, while African and Gulf markets are investing in healthcare modernization to expand access to forensic and clinical toxicology services. Collaborative efforts within the European Medicines Agency and regional public health initiatives are driving standardization, fostering interoperability among cross-border laboratories.

Asia-Pacific stands out as the fastest growing region, propelled by rising government spending on anti-drug campaigns and heightened awareness of workplace safety. China’s expansion of mobile testing units and India’s integration of saliva-based roadside screening illustrate dynamic approaches to decentralized testing. Australia and Japan continue to refine regulatory frameworks, balancing public health objectives with privacy protections to ensure ethical deployment of advanced testing technologies.

This comprehensive research report examines key regions that drive the evolution of the Drug Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Entities Driving Innovation and Service Excellence across the Drug Testing Ecosystem

Market leaders play pivotal roles in shaping the drug testing ecosystem through continuous product innovation and expansive service networks. Thermo Fisher Scientific and Danaher’s SCIEX division remain at the vanguard of analytical instrumentation, benefiting from strong demand for mass spectrometry and chromatography tools that underpin both clinical and forensic confirmation workflows.

Service powerhouse LabCorp has reinforced its diagnostic laboratory and biopharma services units, reporting an 8.9 percent increase in diagnostic lab revenue and an 11 percent rise in contract research business revenue in Q2 2025. This performance underscores the company’s capability to integrate hospital lab management agreements and expand its toxicology test menu, positioning it alongside Quest Diagnostics as a formidable full-service provider.

On the reagent and point-of-care front, Abbott Laboratories continues to diversify its immunoassay portfolio with next-generation HEIA and SEFRIA reagents for urine and oral fluid screening, delivering enhanced sensitivity and streamlined workflows. Meanwhile, OraSure Technologies’ oral fluid collection devices have gained traction following DOT’s endorsement of oral fluid testing for safety-sensitive positions, cementing its role in rapid on-site screening programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Drug Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AccuBioTech Co., Ltd.

- Agilent Technologies, Inc.

- American Screening Corporation

- Assure Tech (Hangzhou) Co., Ltd.

- Bruker Corporation

- Chromsystems Instruments & Chemicals GmbH

- Cordant Health Solutions

- Danaher Corporation

- DrugScan, Inc.

- Drägerwerk AG & Co. KGaA

- Eurofins Scientific SE

- Express Diagnostics International Inc.

- F. Hoffmann-La Roche Ltd

- Guangzhou Wondfo Biotech Co., Ltd.

- Hangzhou Biotest Biotech Co., Ltd.

- Laboratory Corporation of America Holdings

- Legacy Medical Services

- Lifeloc Technologies, Inc.

- Mayo Clinic Laboratories

- Omega Laboratories, Inc.

- Oranoxis Inc.

- Paramedical S.r.l.

- Precision Diagnostics, LLC

- Premier Biotech, Inc.

- Psychemedics Corporation

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd.

- Sciteck, Inc.

- Screen Italia Srl

- Securetec Detektions-Systeme AG

- Siemens Healthineers AG

- Sonic Healthcare Limited

- UCP Biosciences Inc.

- United States Drug Testing Laboratories, Inc.

- Zhejiang Orient Gene Biotech Co., Ltd.

Strategic Imperatives and Evidence-Based Recommendations to Elevate Competitiveness and Resilience in Drug Testing Operations

To thrive amidst evolving regulations and technological shifts, industry leaders should prioritize strategic diversification of manufacturing and sourcing channels. Establishing dual-sourcing agreements for key consumables and leveraging domestic production capacities will mitigate tariff-related risks while ensuring supply continuity.

Investing in modular, AI-enabled analytical platforms can streamline testing workflows and reduce labor dependencies. Organizations should evaluate digital microfluidic immunoassay systems to achieve rapid, multi-analyte screening at the point of need, and explore miniaturized MS solutions to extend confirmatory testing capabilities beyond centralized laboratories.

Collaborative partnerships between diagnostic service providers, device manufacturers, and academic institutions can accelerate validation of emerging technologies and harmonize quality standards. Cross-sector consortia focused on data interoperability and best-practice guidelines will support scalable deployment of saliva and sweat testing in safety-sensitive industries.

Finally, building robust analytics infrastructure to capture and interpret testing data in real time will enable proactive risk management. By integrating testing outcomes with employee health and safety dashboards, stakeholders can derive actionable insights to optimize program design and reinforce organizational resilience

Transparent and Rigorous Research Methodology Ensuring Credibility through Robust Data Collection and Triangulation

Our research methodology combined extensive secondary and primary research to ensure rigorous validation of insights. Secondary research involved a thorough review of regulatory documents, clinical guidelines, technical publications, and reputable news sources to map evolving trends in drug testing technologies and policies.

Primary research comprised in-depth interviews with stakeholders across the drug testing value chain, including laboratory directors, occupational health managers, forensic toxicologists, and equipment manufacturers. These discussions provided qualitative context on adoption drivers, pain points, and innovation priorities.

Data triangulation was employed to reconcile findings across sources, identify discrepancies, and refine key themes. Quantitative data points were cross-checked against industry reports, government databases, and corporate disclosures for consistency.

Finally, iterative validation workshops with subject matter experts ensured that the final analysis accurately reflects current market realities and anticipated trajectories, providing stakeholders with a robust foundation for strategic decision-making

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Drug Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Drug Testing Market, by Component

- Drug Testing Market, by Sample Type

- Drug Testing Market, by Drug Class

- Drug Testing Market, by Result Time

- Drug Testing Market, by Test Location

- Drug Testing Market, by End User

- Drug Testing Market, by Region

- Drug Testing Market, by Group

- Drug Testing Market, by Country

- United States Drug Testing Market

- China Drug Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3975 ]

Concluding Insights Synthesizing Key Findings and Highlighting Imperatives for Stakeholders in Drug Testing

The drug testing market is at a pivotal juncture, shaped by technological innovation, regulatory evolution, and global trade dynamics. Advanced analytical platforms-from digital microfluidics to AI-augmented mass spectrometry-are expanding the frontiers of sensitivity, throughput, and deployment flexibility.

Concurrent policy shifts, including benchmark tariff impacts and the formal endorsement of alternative sample types, are driving supply chain realignments and catalyzing domestic production investments. Meanwhile, regional disparities in regulations and infrastructure continue to create differentiated adoption patterns and localized growth opportunities.

Key players have demonstrated resilience by diversifying offerings, deepening strategic partnerships, and enhancing service integration. However, smaller providers must proactively adapt through supply chain diversification, technological collaborations, and data-driven program design to remain competitive.

As organizations navigate this evolving landscape, embracing a holistic approach that aligns technological capability with regulatory compliance and data analytics will be indispensable for sustained success

Unlock Expert Support from Ketan Rohom to Acquire the Definitive Drug Testing Market Intelligence Report

To explore the full breadth of insights outlined in this executive summary and secure a competitive edge with the most comprehensive drug testing market research available, contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan offers personalized consultations to address your organization’s unique needs, guide you through the report’s key findings, and facilitate access to tailored data and strategic recommendations. Reach out to Ketan today to arrange a briefing and learn how this report can inform your next strategic move in the rapidly evolving drug testing landscape

- How big is the Drug Testing Market?

- What is the Drug Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?