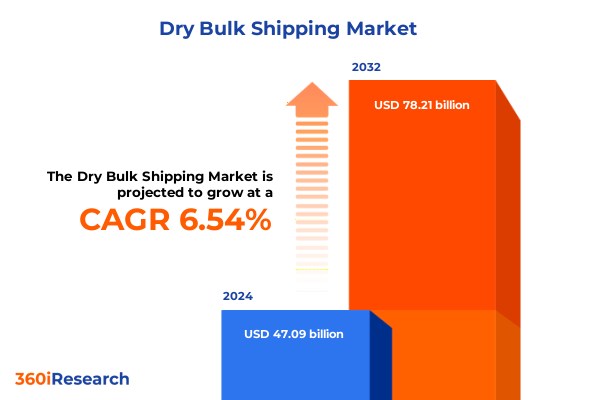

The Dry Bulk Shipping Market size was estimated at USD 49.99 billion in 2025 and expected to reach USD 53.08 billion in 2026, at a CAGR of 6.60% to reach USD 78.21 billion by 2032.

Comprehensive Overview of Global Dry Bulk Shipping Dynamics Driving Trade Efficiencies and Competitive Positioning in Maritime Logistics

The dry bulk shipping industry constitutes a critical pillar of global trade infrastructure, handling the transport of unrefined commodities such as iron ore, coal, grains, bauxite, and fertilizer. Evolving trade routes and commodity flows challenge stakeholders to optimize fleet allocation and enhance port connectivity. Furthermore, the interplay between economic cycles and cargo demand necessitates agile operational strategies to mitigate volatility and maintain service reliability. Strategic stakeholders, including shipowners, charterers, and port operators, must align investments with shifting market dynamics to secure competitive positioning and drive long-term value.

Recent advancements in vessel design and fuel technologies have spurred momentum toward sustainability, compelling market participants to adopt eco-friendly propulsion systems and digital monitoring tools. As environmental compliance standards tighten, analytics-driven decision-making emerges as a cornerstone for maximizing vessel utilization and streamlining supply chain processes. Moreover, the integration of real-time visibility platforms strengthens risk management capabilities, enabling rapid response to geopolitical and economic disruptions. This introduction lays the groundwork for a thorough analysis of transformational shifts, tariff implications, segmentation insights, and strategic recommendations shaping the trajectory of the dry bulk shipping sector.

Evolutionary Disruptions Transforming Dry Bulk Shipping Value Chains Through Technological Innovation, Regulatory Changes, and Environmental Imperatives

The dry bulk shipping landscape is undergoing profound transformation as technological innovation, regulatory frameworks, and environmental mandates converge to redefine value chains. Automation in cargo handling and digital twins for vessel performance are swiftly gaining traction, enabling operators to forecast maintenance needs and optimize route planning with heightened precision. Simultaneously, emission control areas and upcoming carbon levies drive the adoption of alternative fuels, compelling fleet renewals and retrofitting initiatives across major shipping lines.

In parallel, geopolitical developments, including shifting trade alliances and supply chain diversification efforts, are reshaping traditional cargo corridors and spawning new demand centers. Notably, evolving bilateral agreements have stimulated increased grain shipments to emerging markets in Southeast Asia, while iron ore flows are realigning toward South American ports due to capacity expansion projects. Consequently, stakeholders face a dual imperative: to harness cutting-edge technologies for operational excellence and to navigate an intricate web of policy changes that directly impact freight economics and asset deployment strategies.

Assessing the Broad Economic and Operational Consequences of Newly Imposed United States Tariffs on Dry Bulk Shipping Routes in 2025

The introduction of revised United States tariff measures in early 2025 has exerted a material influence on dry bulk shipping economics and route structures. Tariffs reaffirmed under Section 232 for steel and aluminum, alongside levies targeting specific fertilizer imports, have prompted shippers to reroute iron ore and bauxite shipments to alternative ports in Canada and Mexico. This diversion has led to incremental voyage distances and scheduling complexities, compelling carriers to recalibrate fleet deployment and voyage planning.

Moreover, higher import duties on grain and coal commodities under Section 301 review have increased landed costs for U.S. buyers, resulting in fluctuating demand patterns and compressed freight rate negotiations. Subsequent to these policy shifts, trade lanes between the Gulf Coast and Asia-Pacific have experienced diminished cargo volumes for U.S. exporters, while transatlantic grain flows have surged as European suppliers capture incremental market share. In light of these dynamics, industry participants must adopt multifaceted strategies to mitigate tariff-induced headwinds, leveraging network flexibility and strategic alliances to sustain efficient service delivery.

Deep Dive into Cargo, Vessel, Charter, and End User Segmentation Revealing Niche Opportunities and Operational Efficiencies

A nuanced assessment of the dry bulk shipping space reveals significant variations when analyzed through cargo type, vessel class, charter structure, and end user industry lenses. Cargo classification spans bauxite and alumina, coal (including coking coal and thermal coal), fertilizer, grain (encompassing corn, soybeans, and wheat), and iron ore. Each commodity segment exhibits unique handling requirements, trade seasonality, and demand drivers influenced by manufacturing cycles or agricultural harvest schedules.

Vessel typology ranges from the largest Capesize vessels suited to transoceanic iron ore voyages to Handymax and Handysize ships that service regional terminals with draft constraints. Panamax vessels have bifurcated into classic Panamax designs and neo Panamax variants tailored for expanded canal locks, while Supramax carriers now include standard Supramax and Ultramax classes that blend capacity with port accessibility. Charter arrangements further delineate market strategies, encompassing bareboat charter agreements, contracts of affreightment, time charter deals, and voyage charters. In parallel, end user industries, from agriculture and construction to power generation and steel manufacturing, drive cargo origination and align carrier capabilities with shifting consumption patterns across global supply chains.

This comprehensive research report categorizes the Dry Bulk Shipping market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cargo Type

- Vessel Type

- Charter Type

- End User Industry

Analyzing Regional Variances Impacting Dry Bulk Shipping Capacities and Trade Flows across Americas, Europe Middle East Africa, and Asia Pacific

Regional analysis underscores distinct trends shaping dry bulk shipping trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust grain exports from North and South America to Asia have bolstered demand for Capesize and Panamax tonnage, while intra-regional flows of coal and fertilizer support burgeoning biofuel and agricultural sectors. Moreover, infrastructure upgrades along the U.S. Gulf Coast and Brazilian terminals have enhanced throughput capabilities, reinforcing trade competitiveness.

Europe, the Middle East & Africa exhibit mixed demand signals as North African iron ore imports to European steel mills offset Atlantic coal exports to the Middle East. Port capacity investments in the Mediterranean and Red Sea regions have catalyzed new trade corridors, yet political instability poses intermittent operational risks. Across the Asia-Pacific, expanding steel production in India and China sustains high volumes of iron ore and coking coal trade, simultaneously driving interest in modern ultramodern Supramax and Ultramax vessels. Infrastructure growth in Southeast Asia opens secondary discharge points, creating opportunities for smaller Handysize and Handymax ships to capitalize on niche routes.

This comprehensive research report examines key regions that drive the evolution of the Dry Bulk Shipping market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Dry Bulk Shipping Enterprises Highlighting Competitive Strengths, Fleet Innovations, and Collaborative Ventures

Leading stakeholders in the dry bulk shipping arena have demonstrated differentiated approaches to fleet renewal, digitalization, and strategic partnerships. Major shipowning enterprises have pursued dual strategies of newbuild acquisitions and selective retrofits, emphasizing green fuel compatibility and enhanced hull designs to reduce energy consumption. Collaborative joint ventures between shipping lines and terminal operators have increased berth efficiency and facilitated investments in automated cargo handling.

Technology alliances between carriers and fintech platforms are refining freight payment solutions and credit management, enhancing cash flow certainty for charterers and owners alike. Furthermore, emerging players from Asia have expanded chartering portfolios through mergers and minority equity stakes in established Western shipping groups, reinforcing access to global cargo pools. Such multifaceted corporate maneuvers underscore the importance of agility in fleet management, the strategic integration of digital tools, and the pursuit of symbiotic partnerships to navigate an increasingly complex marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dry Bulk Shipping market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CMB NV

- Diana Shipping Inc.

- Eagle Bulk Shipping Inc.

- Golden Ocean Group Limited

- Grindrod Shipping Holdings Ltd

- Oldendorff Carriers GmbH & Co. KG

- Pacific Basin Shipping Limited

- Safe Bulkers Inc.

- Scorpio Bulkers Inc.

- Star Bulk Carriers Corp.

Targeted Strategic Recommendations to Enhance Operational Resilience, Sustainability Practices, and Market Positioning for Dry Bulk Shipping Leaders

Industry leaders should prioritize the acceleration of fleet decarbonization by investing in dual-fuel engines, hull air lubrication systems, and onshore power connections at major terminals to comply with tightening emission regulations. Simultaneously, diversifying charter portfolios to include contracts of affreightment can provide flexibility against rate volatility, while leveraging time charter arrangements enhances network predictability during cyclical downturns.

Moreover, forging strategic alliances with terminal operators and commodity traders can secure preferred berth slots and backhaul cargo opportunities, thereby reducing ballast distances and lowering cost per ton delivered. Integrating advanced analytics for demand forecasting and dynamic routing will empower decision-makers to anticipate supply chain disruptions and optimize vessel utilization. Finally, adopting digital documentation through blockchain-based platforms will streamline trade finance processes and mitigate administrative bottlenecks, positioning organizations for resilient growth in an era of heightened regulatory and market complexity.

Rigorous Research Methodology Combining Qualitative Interviews, Secondary Data Analysis, and Validation for Comprehensive Market Understanding

This research synthesis is grounded in a robust, multi-tiered methodology combining expert interviews, exhaustive secondary research, and rigorous data triangulation. Initially, in-depth discussions with shipowners, charterers, port authorities, and regulatory specialists provided qualitative insights into operational challenges and strategic priorities. These primary inputs were complemented by comprehensive analysis of industry publications, maritime databases, and trade reports to contextualize emerging trends and regulatory developments.

Subsequently, findings underwent cross-validation through comparative studies of vessel tracking data and freight rate movements, ensuring alignment between qualitative perspectives and quantitative patterns. Iterative feedback loops with industry experts refined the narrative, enhancing analytical precision and relevance. Throughout, ethical research protocols and confidentiality agreements preserved the integrity of proprietary information, culminating in a disciplined approach that delivers actionable intelligence and authoritative perspectives on the dry bulk shipping domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dry Bulk Shipping market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dry Bulk Shipping Market, by Cargo Type

- Dry Bulk Shipping Market, by Vessel Type

- Dry Bulk Shipping Market, by Charter Type

- Dry Bulk Shipping Market, by End User Industry

- Dry Bulk Shipping Market, by Region

- Dry Bulk Shipping Market, by Group

- Dry Bulk Shipping Market, by Country

- United States Dry Bulk Shipping Market

- China Dry Bulk Shipping Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Conclusive Insights Summarizing Strategic Imperatives, Industry Evolution, and Future Prospects for Dry Bulk Shipping Stakeholders

The preceding analysis synthesizes the complex forces shaping the dry bulk shipping industry into cohesive strategic imperatives for stakeholders at all levels. Technological innovation, environmental regulation, and evolving tariff regimes collectively redefine operational paradigms, while granular segmentation by cargo, vessel, charter type, and end user industry illuminates niche opportunities. Regional variances underscore the need for adaptive strategies tailored to distinct trade corridors and infrastructure dynamics.

Looking ahead, the integration of sustainability initiatives, digital platforms, and collaborative partnerships will distinguish market leaders in an increasingly competitive environment. By harnessing data-driven insights and aligning investment decisions with evolving regulatory and geopolitical contexts, organizations can fortify their market positioning and drive enduring value creation. This report crystallizes the key themes and actionable recommendations that will guide dry bulk shipping participants toward resilient growth and strategic excellence.

Exclusive Opportunity to Secure the In-Depth Dry Bulk Shipping Market Report by Engaging with our Associate Director for Tailored Insights

Engaging with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, ensures tailored guidance and seamless access to the comprehensive dry bulk shipping market research report. By initiating a direct conversation, decision-makers can clarify specific areas of interest and receive bespoke data extracts aligned with organizational objectives. Personalized consultations facilitate an in-depth understanding of the report’s chapters, highlighting insights most relevant to unique operational and strategic needs. Reach out to explore exclusive purchasing options and accelerate your competitive readiness with a definitive industry resource.

- How big is the Dry Bulk Shipping Market?

- What is the Dry Bulk Shipping Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?