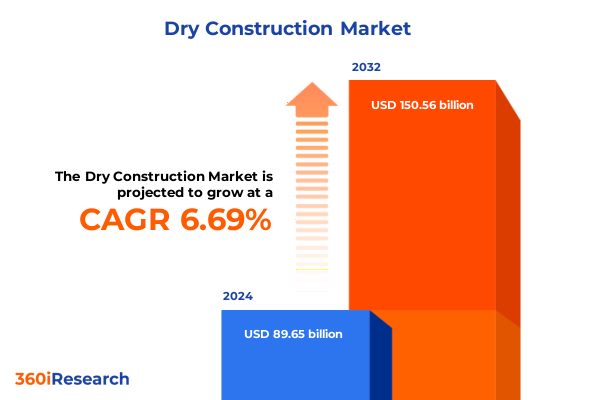

The Dry Construction Market size was estimated at USD 95.55 billion in 2025 and expected to reach USD 101.59 billion in 2026, at a CAGR of 6.71% to reach USD 150.56 billion by 2032.

Revolutionizing Modern Construction Through Innovative Dry Building Technologies That Enhance Project Efficiency Quality and Environmental Responsibility

Dry construction methods have rapidly emerged as the backbone of modern building practices, driven by the need for speed, precision, and sustainability. By eliminating reliance on traditional wet trades and heavy curing processes, these systems streamline on-site workflows and reduce weather dependencies, offering project teams greater control over timelines and budgets. Moreover, as urban environments demand efficient space utilization and minimal disruption, lightweight panels and modular assemblies have shown their value in accelerating delivery schedules while maintaining structural integrity.

As environmental imperatives reshape regulatory landscapes, the move toward lower-carbon materials has further underscored the importance of dry construction. Engineered boards composed of cementitious or gypsum cores combined with specialized facings now rival traditional masonry in fire resistance and acoustic performance. In this context, the fusion of advanced manufacturing techniques and digital design tools has enabled greater customization, allowing architects and contractors to tailor wall and ceiling systems to exacting performance criteria. Consequently, stakeholders from project inception to handover are experiencing enhanced predictability and enhanced quality controls.

Transitioning from conventional building approaches, companies are increasingly leveraging digital platforms and automated fabrication to reduce material waste and labor costs. This evolution not only addresses the rising demands for sustainability but also empowers decision-makers to adopt more agile and cost-effective construction strategies. In turn, this shift catalyzes further innovation across the industry value chain, setting the stage for unprecedented growth and transformative potential.

Emerging Paradigms in Dry Construction That Are Reshaping Industry Standards Through Sustainability Digitization and Modular Prefabrication Advances

The landscape of dry construction is undergoing a profound metamorphosis as sustainability criteria, digital integration, and modular techniques converge to redefine industry standards. Material advancements, such as fiber-reinforced cement boards with improved durability and moisture resistance, are replacing legacy products that once dominated partitions and exterior cladding. Likewise, the proliferation of digital design workflows and building information modeling has made it possible to optimize panel layouts for seamless installation, dramatically reducing on-site adjustments and waste.

In parallel, the drive for decarbonization has accelerated the adoption of low-carbon binders and recycled content, reshaping procurement strategies and supplier collaborations. As regulatory frameworks tighten, manufacturers are investing in greener production facilities and circular supply chains to meet evolving emission targets. This alignment of environmental objectives with commercial imperatives has inspired partnerships that push the envelope of material science, yielding new formulations that balance performance with ecological stewardship.

Moreover, the rise of off-site prefabrication and modular assembly is streamlining complex projects across healthcare, education, and multifamily housing. By producing wall and ceiling modules in controlled factory settings, stakeholders achieve higher precision and faster assembly, which translates into predictable costs and reliable quality. These transformative shifts, propelled by technological synergy and regulatory drivers, are forging a new era in which dry construction is not merely an alternative but a primary approach for forward-looking developers and contractors.

Comprehensive Assessment of 2025 United States Tariff Measures on Dry Construction Supply Chains Cost Structures and Competitive Positioning

In 2025, a series of tariff measures have reverberated through the dry construction supply chain, reshaping cost structures and sourcing strategies. The reinstatement of Section 232 duties on steel and aluminum imports has added at least 25 percent to the cost of metal framing and suspension systems, placing upward pressure on partition wall and ceiling budgets. Meanwhile, softwood lumber levies have climbed beyond traditional thresholds, prompting contractors to explore alternative stud materials such as cold-formed steel and composite systems to mitigate price volatility.

Simultaneously, the United States Government announced targeted tariffs on cementitious imports from major exporters. Key cement shipments from Canada, Türkiye, and Vietnam now face duties ranging between 10 and 46 percent, translating into higher landed costs for fiber cement board manufacturers who depend on imported clinker and raw materials. These cumulative duties have compelled board producers to reassess supply corridors, leading to a resurgence of domestic grinding operations and increased investments in local quarrying to reduce foreign exposure.

Moreover, tariffs on ancillary inputs - including paper facings for gypsum boards sourced from Asia - have amplified material expenses across drywall product lines. Combined with transportation surcharges and port congestion, these elevated duties have extended lead times and constrained inventory buffers. As a result, many stakeholders are negotiating long-term agreements to lock in prices and secure capacity, while forward-thinking firms are strategically diversifying sourcing to encompass lower-tariff origins and bolstered supply chain resilience.

Multidimensional Market Dissection of Dry Construction Through Detailed Material Application End Use Distribution Channel and Construction Type Perspectives

Analyzing the market through multiple dimensions reveals nuanced opportunities and challenges that demand precision. Material considerations span from cement board variants-where fiber-reinforced and standard formulations each cater to differing durability and cost requirements-to a spectrum of gypsum boards, encompassing fire-resistant, moisture-blocking, and acoustic-tuned offerings alongside traditional panels. These material distinctions inform installation protocols and lifecycle attributes in ceiling, wall and flooring applications.

Functionality demands traverse a wide array of installations. Ceiling solutions range from exposed grid drywall systems to suspended acoustic tiles, each optimized for structural integration and ambient control. In the realm of partition walls, the choice between exterior and interior barrier assemblies influences thermal performance, weatherproofing and load-bearing capabilities. Flooring underlayment products intersect with moisture mitigation and sound-deadening criteria, further diversifying the application matrix.

Market participants serve diverse end-use sectors. Commercial projects within hospitality, office and retail segments prioritize aesthetics, fire codes and maintainability, whereas industrial facilities require robust mechanical resilience for manufacturing or warehousing operations. Residential developers balance multi-family sound insulation needs with single-family customization demands. Distribution networks bifurcate into offline outlets-spanning direct sales, traditional distributors and big-box retailers-and online channels, which include manufacturer portals and e-commerce marketplaces. Finally, the dichotomy between new construction and renovation underscores strategic product positioning, with renovation projects leaning into remodeling and repair kits that address retrofits and maintenance in occupied spaces.

This comprehensive research report categorizes the Dry Construction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Construction Type

- Application

- End Use

- Distribution Channel

Strategic Regional Dynamics Shaping Dry Construction Markets with Differentiated Trends Across Americas Europe Middle East Africa and Asia Pacific Zones

Regional dynamics exhibit striking diversity in adoption rates and growth vectors for dry construction methodologies. In the Americas, the United States and Canada continue to spearhead innovation, driven by stringent energy codes and a rebound in multifamily and commercial developments. Domestic board producers leverage localized supply to offset import duties, while distributors expand warehousing footprints to streamline just-in-time deliveries. Latin American markets, by contrast, are incrementally embracing prefabricated wall systems, supported by partnerships between global manufacturers and regional fabricators seeking to address infrastructure backlogs and rapid urbanization.

Europe, the Middle East and Africa present a mosaic of regulatory landscapes and industrial capabilities. Western European nations adhere to robust fire and acoustic standards, resulting in high demand for specialty gypsum and fiber cement boards. Meanwhile, Middle Eastern economies are channeling mega-project investments into lightweight modular systems to accelerate hospitality and mixed-use construction. In Africa, urban growth corridors are catalyzing pilot programs that integrate dry construction with affordable housing initiatives, often in collaboration with international development agencies prioritizing resource efficiency and resilience against extreme weather events.

The Asia-Pacific region exhibits unparalleled scale and variance. Mature markets such as Japan and Australia deploy high-precision automated manufacturing lines to produce complex panel geometries, while Southeast Asian hubs are rapidly adopting low-cost fiber cement boards to meet surging residential needs. China’s vast domestic capacity continues to shape export flows, although rising transport costs and trade tensions have incentivized regional capacity expansions in Vietnam and India. Across the region, the interplay of local content requirements and digital fabrication services is crafting a competitive landscape where agility and localization are paramount.

This comprehensive research report examines key regions that drive the evolution of the Dry Construction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Strategies and Innovation Insights from Leading Dry Construction Manufacturers Driving Product Development Agility and Market Differentiation

Leading dry construction manufacturers are charting diverse strategic pathways to reinforce their market positions and drive growth. One major producer has invested heavily in high-throughput automated board lines, enabling rapid scale-up of fiber-reinforced cement offerings and seamless integration of recycled aggregates. This approach not only reduces per-unit production costs but also aligns with corporate sustainability goals by slashing carbon footprints and minimizing waste.

Another global entity has broadened its portfolio by acquiring regional gypsum plants and co-investing in state-of-the-art paper facing operations. This vertical integration secures consistency in raw material supply, insulating downstream panel production from external price fluctuations. Simultaneously, it fosters research collaborations that yield enhanced fire-resistant and moisture-tolerant board variants tailored for challenging climates.

A regional innovator in Europe has distinguished itself through modular panel systems equipped with embedded acoustic damping and integrated conduit pathways. By offering pre-finished surfaces and plug-and-play mechanical channels, the company reduces installation labor and compresses schedules, winning contracts in institutional and commercial projects. Meanwhile, emerging players in the Asia Pacific are pursuing joint ventures to localize manufacturing near demand centers, countering long lead times and heavy logistics costs that have historically hindered export-driven growth in the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dry Construction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Gypsum Company

- Armstrong World Industries, Inc.

- BlueLinx Holdings Inc.

- BMC Stock Holdings, Inc.

- Boral Limited

- Builders FirstSource, Inc.

- Cemex, S.A.B. de C.V.

- CertainTeed Corporation

- Continental Building Products LLC

- Etex Group

- Fletcher Building Limited

- Gebr. Knauf KG

- Georgia-Pacific LLC

- Headwaters Inc.

- James Hardie Industries plc

- Knauf Gips KG

- LafargeHolcim Ltd.

- National Gypsum Company

- PABCO Building Products, LLC

- Saint-Gobain S.A.

- Temple-Inland Inc.

- USG Corporation

Supply Chain Optimization Investment in Sustainable Manufacturing and Technological Integration to Elevate Competitiveness in the Dry Construction Sector

To navigate this evolving environment, industry leaders should prioritize resilience through strategic supply chain diversification. By developing parallel sourcing networks for critical raw materials, firms can swiftly shift production in response to tariff adjustments or geopolitical disruptions. Concurrently, establishing collaborative forecasting platforms with key suppliers will enhance visibility and reduce the risk of stockouts or cost spikes.

Investment in sustainable manufacturing must also remain front and center. Embracing alternative binders, low-impact paper facings and renewable energy in production facilities not only addresses tightening regulatory demands but also lowers long-term operational costs. Integrating circular economy principles, such as recycling offcuts and reclaiming gypsum from decommissioned panels, can further minimize waste and strengthen corporate environmental credentials.

Technological integration offers a parallel advantage. Deploying advanced analytics and digital twins for production planning can optimize yield and reduce downtime, while building information modeling coupled with automated fabrication drives design-to-assembly accuracy. Finally, fostering cross-sector partnerships-bridging material scientists, digital solution providers and logistics specialists-will catalyze holistic innovation, enabling companies to transform cost pressures into new service offerings and market differentiation.

Robust Research Methodology Employing Integrated Qualitative and Quantitative Approaches for Comprehensive Analysis of the Dry Construction Market Dynamics

This research synthesizes insights from a robust methodology combining both quantitative and qualitative techniques. Secondary data was gathered from government trade reports, regulatory filings and industry associations to establish baseline tariff impacts, material flows and regional demand patterns. Primary interviews were conducted with executives, project managers and supply chain directors across materials manufacturing, distribution and contracting operations to validate market drivers and uncover emerging opportunities.

Market segmentation was developed through a dual top-down and bottom-up approach, where aggregate industry metrics were reconciled with company-level shipments and product line revenues. Triangulation across multiple data sources ensured consistency, while sensitivity analyses stressed key variables such as material costs and regulatory shifts to assess their influence on market trajectories. Scenario planning exercises were also incorporated to model the effects of evolving trade policies and sustainable sourcing mandates.

Finally, iterative review sessions with subject-matter experts refined the insights, ensuring that the analysis accurately captures competitive dynamics and technological inflection points. By adhering to these rigorous steps, the study provides a transparent and replicable framework that stakeholders can leverage to inform strategic decision-making and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dry Construction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dry Construction Market, by Material Type

- Dry Construction Market, by Construction Type

- Dry Construction Market, by Application

- Dry Construction Market, by End Use

- Dry Construction Market, by Distribution Channel

- Dry Construction Market, by Region

- Dry Construction Market, by Group

- Dry Construction Market, by Country

- United States Dry Construction Market

- China Dry Construction Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Perspectives on the Future of Dry Construction Emphasizing Strategic Adaptation Technological Innovation and Sustainability Imperatives

In summary, the dry construction sector stands at a pivotal juncture defined by escalating sustainability imperatives, rapid digitalization and shifting trade landscapes. Innovations in material compositions and off-site manufacturing are unlocking new efficiencies, yet tariff pressures underscore the need for agile sourcing and localized production. As demand intensifies across commercial, industrial and residential segments, stakeholders must align product portfolios with precise performance requirements and evolving regulatory mandates.

Looking ahead, the most successful organizations will be those that integrate end-to-end digital platforms to forecast demand, optimize supply chains and streamline project delivery. Simultaneously, embedding circular economy principles within manufacturing operations will become a competitive imperative, as clients and regulators alike place greater emphasis on embodied carbon and resource conservation. By embracing collaborative ecosystems-spanning material scientists, technology partners and logistics providers-the industry can unlock value beyond traditional boundaries, delivering differentiated solutions that meet tomorrow’s challenges.

Ultimately, strategic alignment between innovation, sustainability and operational resilience will define market leaders in the evolving dry construction landscape. Companies that proactively adapt to tariff oscillations, regulatory shifts and technological breakthroughs will secure stronger margins and foster enduring customer partnerships, laying the groundwork for long-term success.

Empower Your Strategic Decisions with a Comprehensive Dry Construction Market Report Gain Exclusive Insights by Engaging Directly with Our Associate Director

To explore the depths of the dry construction landscape and equip your organization with data-driven intelligence, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating market insights into strategic action can help you unlock new opportunities, mitigate emerging risks, and optimize your competitive stance. By engaging directly, you gain access to a comprehensive report that synthesizes current trends, tariff impacts, segmentation nuances, regional dynamics, and industry best practices. Secure your copy today and transform uncertainty into strategic advantage through tailored guidance and actionable recommendations.

- How big is the Dry Construction Market?

- What is the Dry Construction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?