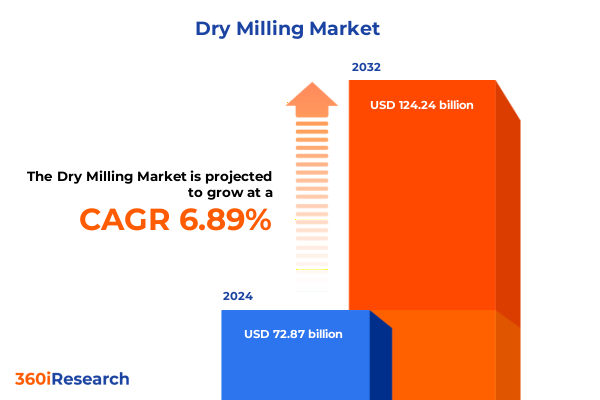

The Dry Milling Market size was estimated at USD 77.13 billion in 2025 and expected to reach USD 81.65 billion in 2026, at a CAGR of 7.04% to reach USD 124.24 billion by 2032.

Unveiling the Dynamics of the Dry Milling Market Landscape: Foundational Overview Defining Scope, Context, and Strategic Imperatives

The dry milling industry has emerged as a pivotal segment within global agricultural processing, distinguished by its capacity to convert harvested grains into a diverse array of high-value ingredients for both human consumption and industrial applications. This report presents an executive summary that unpacks the foundational elements shaping the sector, establishes key thematic pillars, and outlines strategic imperatives that industry leaders must consider. Through a comprehensive overview, readers will gain clarity on how dry milling processes integrate into broader food, feed, and biofuel ecosystems, underscoring the sector’s critical role in value chain optimization.

This introduction defines the scope of analysis, emphasizing the interplay between technological evolution, shifting policy frameworks, and dynamic consumer demands. By contextualizing the industry within historical and contemporary paradigms-from traditional roller milling to cutting-edge sensor-driven platforms-this section sets the stage for an in-depth exploration of transformative trends. It also highlights the report’s objectives: to distill actionable intelligence, evaluate strategic risks and opportunities, and equip stakeholders with a roadmap for enhancing operational resilience and competitive differentiation.

Charting Revolutionary Shifts Reshaping the Dry Milling Sector: Technological Advancements, Sustainability Initiatives, and Evolving Consumer Demands

The dry milling sector is experiencing a renaissance propelled by digitalization, automation, and environmental stewardship. Emerging smart mill architectures leverage real-time monitoring, predictive analytics, and AI-enabled quality control to anticipate equipment maintenance needs and optimize throughput, resulting in demonstrable energy savings and reduced downtime. Major equipment providers have integrated advanced sensors that automatically calibrate roller gaps and adjust process parameters, delivering efficiency gains that translate into lower production costs and consistent product quality.

Concurrently, sustainability initiatives are redefining industry benchmarks. Companies are embracing circular economy principles, repurposing by-products such as bran and hulls into animal feed, biofuel feedstocks, or biodegradable materials. Investment in renewable energy integration-particularly solar and wind systems-alongside water conservation measures has moved from a niche focus to a core operational strategy. According to a recent technology survey, over half of food industry respondents plan to invest in climate-smart and waste-reduction technologies by 2025, driven by consumer demand for sustainable products and mounting regulatory pressure to minimize carbon and water footprints.

Assessing the Aggregate Consequences of 2025 United States Tariff Policies on the Dry Milling Industry Supply Chains, Costs, and Competitive Dynamics

The 2025 tariff landscape initiated by the United States has introduced layered duties that reverberate across dry milling supply chains. A baseline 10 percent tariff on all imports-excluding Canada and Mexico-took effect on April 5, followed by country-specific reciprocal rates on April 9 under a declared national emergency aimed at addressing persistent trade deficits. These measures have elevated input costs, disrupted established material flows, and prompted millers to reevaluate their sourcing strategies while seeking new trade partnerships.

Retaliatory actions and countermeasures by key trading partners have further complicated the market picture. China’s imposition of 10 to 15 percent tariffs on major agricultural inputs-including wheat, corn, sorghum, and soybeans-has effectively reduced the competitiveness of U.S. feed grains in one of its largest export destinations. The cascading impact of these measures has driven processors to accelerate the diversification of supply origins, invest in local storage capacity, and implement hedging strategies to mitigate cost volatility. As a result, the industry is navigating a pivotal inflection point where tariff-driven cost pressures intersect with the imperative for resilient, multi-source procurement models.

Illuminating Strategic Segmentation Perspectives Across Grain Types, Product Variants, End Uses, and Distribution Channels in Dry Milling Markets

An in-depth examination reveals that the grain type classification fundamentally influences process design and product portfolio development. Milling of barley, corn varieties such as dent, flint, and sweet, rice grades spanning long, medium, and short grains, sorghum, and the dual wheat categories of hard and soft requires tailored conditioning, milling regimes, and separation technologies to achieve target particle profiles and functional attributes.

Diversification across product types has unlocked new revenue corridors. Fractionation processes yield bran streams-distinguished as rice or wheat bran-alongside livestock and poultry feed pellets derived from dehulled hulls and low-grade fractions. Refinery lines produce refined flours, specialty blends, and whole wheat variants, while semolina fractions differentiated by coarse and fine granulations cater to pasta, couscous, and bakery segments.

The end-use segmentation underscores the sector’s versatility. Animal nutrition end uses bifurcate into livestock feed and pet food markets, whereas human consumption channels span bakery product bases and confectionery ingredient applications. Industrial lines support biofuel feedstocks and starch extraction trajectories, each demanding specific purity and granulometry.

Distribution architectures further shape market reach, with B2B channels encompassing food service partnerships and institutional procurement, complemented by B2C avenues through e-commerce platforms, specialty store collaborations, and supermarket and hypermarket networks. This layered segmentation underscores the strategic importance of aligning process capabilities with targeted end-market specifications.

This comprehensive research report categorizes the Dry Milling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grain Type

- Product Type

- Distribution Channel

- End Use

Deciphering Regional Nuances and Performance Patterns in the Americas, Europe Middle East & Africa, and Asia Pacific Dry Milling Ecosystem

Regional dynamics continue to redefine competitive positioning within the dry milling domain. In the Americas, maturation of corn and wheat supply chains in North America pairs with expanding barley and sorghum production in South America, supported by robust infrastructure investments and proximity to major ethanol and feed industries. The United States remains a technology incubator, driving process innovation and digital integration.

In Europe, the Middle East, and Africa cluster, regulatory frameworks emphasizing sustainability and circular economy mandates have accelerated mill upgrades and waste valorization efforts. Hard and soft wheat milling capacities are concentrated in Western Europe, while emerging markets in North Africa and the Gulf region are investing in import-oriented facilities to meet rising demand for fortified flours and biofuel feedstocks.

Asia-Pacific’s dynamic landscape is characterized by diverse cereal portfolios, including rice-dominant processing hubs in Southeast Asia and maize-focused operations in China and India. Rapid urbanization, shifting dietary patterns, and government programs supporting domestic food security are fueling expansions of both legacy plants and greenfield investments, solidifying this region’s role as a primary growth engine.

This comprehensive research report examines key regions that drive the evolution of the Dry Milling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Pioneering and Emerging Players Driving Innovation, Collaboration, and Competitive Advantage in the Dry Milling Sector

Industry leadership is marked by a combination of global conglomerates and specialized technology providers. Multinational agribusiness firms leverage integrated supply chains to deliver end-to-end milling solutions, whereas equipment innovators bring cutting-edge grinding, separation, and automation platforms to market. Collaboration between these entities has produced joint ventures scaling next-generation milling systems that reduce energy use, enhance yield consistency, and enable rapid grade transitions.

Simultaneously, a cohort of agile mid-tier companies is capturing niche opportunities through targeted product formulations and regional service excellence. These players emphasize flexible production lines capable of handling small-batch specialty flours and custom formulations, catering to burgeoning demand from health-focused and artisanal bakery sectors. Strategic alliances and licensing agreements with technology developers are further democratizing access to precision milling capabilities, intensifying competitive dynamics across the value chain.

Innovation ecosystems are also emerging around digital traceability and blockchain platforms, where data integrity and provenance certification are central to brand differentiation. Companies that integrate transparent supply chain networks with consumer-facing storytelling are gaining traction among ethically conscious buyers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dry Milling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alapala Makina Sanayi ve Ticaret A.Ş.

- Bühler AG

- DMG MORI Co., Ltd.

- FLSmidth A/S

- Glen Mills, Inc.

- Great Western Manufacturing, Inc.

- Haas Automation, Inc.

- Hebei Pingle Flour Machinery Group Co., Ltd.

- Hosokawa Micron Group

- Metso Outotec Corporation

- NETZSCH Group

- Ocrim S.p.A.

- Satake Corporation

- Schenck Process Holding GmbH

- Sturtevant, Inc.

- The Fitzpatrick Company

- Union Process, Inc.

- Yamazaki Mazak Corporation

Formulating Targeted, Action-Oriented Strategies to Enhance Operational Efficiency, Market Responsiveness, and Sustainable Growth in Dry Milling

Industry leaders must adopt a multifaceted strategy to navigate evolving market complexities. First, embedding advanced analytics and IoT frameworks within existing plant infrastructures can optimize real-time performance metrics and guide proactive maintenance schedules, mitigating unplanned downtime and reducing energy consumption.

Second, establishing regional sourcing hubs and diversifying feedstock origins will insulate operations from tariff-induced cost escalation and logistical bottlenecks. Strategic partnerships with local producers and co-packers can secure committed volumes while minimizing transportation inefficiencies.

Third, developing bespoke product offerings tied to health and wellness trends-such as high-fiber, protein-enriched, and gluten-alternative flours-enables differentiation within saturated commodity markets. Close collaboration with ingredient innovators and research institutions can accelerate the time-to-market for these specialty streams.

Finally, integrating closed-loop systems that valorize milling by-products into renewable energy and bio-based material streams not only reduces waste disposal costs but also generates new revenue, reinforcing commitments to circular economy goals.

Delineating Robust Research Frameworks, Data Acquisition Approaches, and Analytical Techniques Underpinning the Dry Milling Market Study

The research underpinning this analysis combined secondary intelligence gathering with extensive primary engagements to ensure depth and accuracy. Secondary inputs included publicly available trade data, regulatory filings, and technology white papers, which provided a macro-level perspective on feedstock availability, policy shifts, and equipment developments.

Primary research consisted of structured interviews with senior executives, process engineers, and procurement specialists across the value chain. These conversations yielded qualitative insights into operational challenges, investment priorities, and emerging use cases. Data triangulation was applied through cross-referencing expert perspectives with industry association reports and media disclosures, enhancing reliability.

Analytical frameworks incorporated segmentation matrices aligned to grain type, product category, end use, and distribution channel. Regional analyses leveraged geopolitical risk assessments and trade flow models to gauge competitive positioning. The methodology emphasized transparency, reproducibility, and continuous updates to reflect a dynamic external environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dry Milling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dry Milling Market, by Grain Type

- Dry Milling Market, by Product Type

- Dry Milling Market, by Distribution Channel

- Dry Milling Market, by End Use

- Dry Milling Market, by Region

- Dry Milling Market, by Group

- Dry Milling Market, by Country

- United States Dry Milling Market

- China Dry Milling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Insights and Strategic Implications to Chart the Future Trajectory of the Dry Milling Industry Landscape

In summary, the dry milling industry stands at a crossroads shaped by rapid digitalization, intensifying sustainability mandates, and shifting trade policies. Technological integration across milling operations is delivering measurable gains in efficiency and product quality, while circular economy practices are unlocking additional value from by-product streams.

Tariff realignments in 2025 have underscored the need for resilient supply chain networks and proactive procurement strategies. At the same time, segmentation insights reveal abundant opportunities across diverse grain types, product applications, and distribution channels. Regional landscapes offer distinct advantages, from advanced capabilities in North America to burgeoning scale-up investments in Asia-Pacific.

Collectively, these trends signal that stakeholders who embrace adaptive business models, invest in innovation, and align with sustainability objectives will outpace peers. The convergence of operational excellence, market agility, and strategic foresight will define the next era of competitive success in the global dry milling landscape.

Engage with Ketan Rohom to Access Comprehensive Market Intelligence and Propel Your Strategic Positioning in the Dry Milling Sector

Align your strategic planning with Ketan Rohom, Associate Director of Sales & Marketing, to obtain the comprehensive dry milling market research report. Benefit from expert-guided insights tailored to inform your product roadmaps, optimize supply chain strategies, and strengthen competitive positioning. Engage directly with Ketan to explore bespoke data packages, subscription options, and exclusive add-on modules that address your unique challenges and opportunities. Whether you seek deep dives into segmentation nuances or a high-level overview of regional developments, this collaboration ensures you gain the clarity and foresight necessary to navigate a rapidly evolving industry landscape. Reach out now to secure immediate access to actionable intelligence and catalyze your next phase of growth in the dry milling sector.

- How big is the Dry Milling Market?

- What is the Dry Milling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?