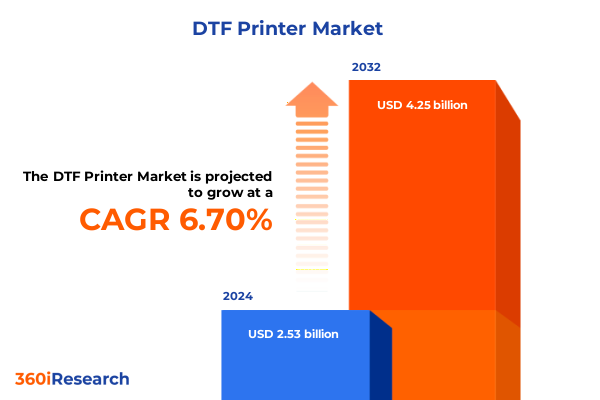

The DTF Printer Market size was estimated at USD 2.68 billion in 2025 and expected to reach USD 2.85 billion in 2026, at a CAGR of 6.77% to reach USD 4.25 billion by 2032.

Unlocking the Direct-to-Film Printing Revolution: A Comprehensive Overview of Emerging Trends, Strategic Drivers, and Market Dynamics

Direct-to-Film (DTF) printing represents a significant paradigm shift in digital textile decoration, enabling vibrant, full-color designs to be transferred onto a wide range of fabrics with unprecedented versatility and durability. Leveraging precision inkjet and specialized transfer films, DTF technology allows garment decorators to reproduce complex graphics without the pre-treatment steps required by traditional direct-to-garment systems, reducing setup times and enabling on-demand customization at scale. This evolution in print methodology has been further propelled by the integration of artificial intelligence–driven color correction and optimization features that eliminate manual calibration errors and ensure consistent color fidelity across diverse substrates. In parallel, advancements in pigment formulations have yielded inks that balance environmental considerations with performance requirements, offering wash-resistant prints that maintain vibrancy through repeated cycles, aligning the industry with broader sustainability imperatives.

The growing appetite for streamlined workflows and remote management has catalyzed the adoption of cloud-based print management platforms that provide real-time production monitoring, predictive maintenance alerts, and seamless integration with e-commerce and order management systems. These platforms are instrumental in optimizing throughput and reducing downtime, allowing print service providers to scale operations efficiently. Moreover, the emergence of hybrid printing solutions that combine DTF with technologies such as direct-to-garment and thermal sublimation has expanded the scope of printable materials and applications, enabling providers to diversify their service offerings and address evolving customer demands for personalization and niche products.

Embracing Technological Breakthroughs and Sustainability Imperatives Driving the Future of Direct-to-Film Printing Technology

As the DTF printing landscape matures, the infusion of artificial intelligence and machine learning algorithms has reshaped print workflows. Smart color-matching algorithms now analyze artwork and substrate properties to automatically adjust print parameters, ensuring precise color reproduction without manual intervention, significantly reducing waste and rework. Concurrently, automation in equipment design has introduced dual and quad printhead architectures that elevate print speeds, enabling high-volume runs without compromising on quality, which addresses the escalating demand for rapid turnaround in on-demand production models.

On the material science front, the next generation of ink formulations blends UV-curable chemistries with conventional pigment inks, offering an optimal balance of durability and environmental performance. UV-curable DTF inks cure instantaneously under UV exposure, resulting in scratch-resistant, fade-proof prints that stand up to rigorous use cases ranging from industrial workwear to outdoor signage. Alongside ink innovation, film technologies have evolved to include both hot peel and cold peel variants with proprietary adhesive layers that enhance transfer consistency and expand compatibility with challenging substrates, from performance sportswear to hard surfaces.

Assessing the Far-Reaching Consequences of Recent United States Trade Policies on the Direct-to-Film Printing Supply Chain and Cost Structures

The United States' trade policy environment in 2025 has introduced a complex web of tariffs that cumulatively affect the direct-to-film printing ecosystem at multiple stages of the value chain. Following the imposition of baseline 10 percent tariffs on all imports and reciprocal levies targeting specific countries, the effective duty on certain equipment and consumables has fluctuated widely. At its peak, stacked tariffs on Chinese-origin printing equipment can approach rates north of 50 percent, amplifying landed costs for machinery and driving end users to reevaluate sourcing strategies.

The enactment of Section 301 duties, initially established in 2018, continues to impose a 25 percent duty on critical components ranging from printheads and electronics to specialized polymers utilized in transfer films. Moreover, Section 232 measures, levying up to a 50 percent rate on steel, aluminum, and related products, indirectly influence production economics by elevating the cost base of hardware frameworks that rely on metal components for structural and mechanical assembly.

Most notably, the administration’s so-called ‘Liberation Day’ reciprocal tariffs introduced in April 2025 have oscillated between 34 percent and 125 percent on Chinese goods before a provisional truce reduced them to a 10 percent rate for a 90-day window, illustrating the volatility that manufacturers and print shops must manage.

These trade tensions and tariff layers have tangible downstream effects. The price inflation of imported inks, films, and spare parts has pressured profit margins for printing service providers, prompting a recalibration of pricing models. Some market players have accelerated investment in domestic assembly operations or North American distribution partnerships to offset the unpredictability of cross-border trade barriers, illustrating a strategic pivot towards supply chain resilience.

Unveiling Key Market Segmentation Dimensions Illuminating Distinct User Preferences and Technical Requirements in Direct-to-Film Printing

Detailed market dissection across multiple dimensions provides clarity on how different stakeholders approach DTF printing. By printer type, operators choose between roll-based systems that offer uninterrupted continuous printing for high-volume orders and sheet-based devices that deliver precise, on-demand transfers suited for smaller runs. Ink preferences span a spectrum from traditional solvent-based and textile-specific formulations to advanced UV-curable chemistries and eco-friendly water-based pigments, each tailored to balance color vibrancy, substrate compatibility, and environmental compliance. The selection of transfer film further refines end-product characteristics, with cold peel variants enabling immediate handling post-press and hot peel films facilitating smoother release and finish control, impacting workflow efficiency and product aesthetics.

Application-specific insights reveal that segments such as advertising and signage leverage DTF for digital billboards, indoor displays, and robust outdoor installations, while industrial printing demands inline integration with automated assembly lines. Packaging uses DTF transfers on cartons, corrugated boxes, flexible formats, and labels to imbue graphic-rich presentations, and textile printing encompasses fashion apparel, home textiles, and technical fabrics requiring tailored performance attributes. Sale channels bifurcate between traditional offline networks, including distributors, wholesalers, and OEM partnerships, and online platforms encompassing direct brand websites and e-commerce marketplaces. Finally, end users range from creative advertising agencies and garment manufacturers to specialized printing service providers, each driving distinct requirements in throughput, customization, and service levels.

This comprehensive research report categorizes the DTF Printer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Ink Type

- Film Type

- Application

- Sales Channels

- End User

Exploring Critical Regional Nuances and Growth Drivers Shaping the Global Direct-to-Film Printing Landscape Across Major World Markets

In the Americas, North America serves as a strategic hub for DTF adoption, underpinned by robust consumer demand for personalized apparel and promotional materials. The United States, buoyed by a mature printing infrastructure and proximity to OEM partnerships, hosts major trade events such as the Impressions Expo in Long Beach, which continues to spotlight breakthroughs from both established Japanese manufacturers and emerging domestic innovators. Mexico and Canada are emerging as production and distribution nodes, with lower labor costs and favorable trade agreements such as the USMCA fostering cross-border collaboration.

Europe, Middle East, and Africa present a heterogeneous landscape characterized by stringent environmental regulations and a proliferation of textile centers in regions like Turkey and North Africa. European print service providers are at the forefront of integrating eco-conscious ink chemistries and energy-efficient equipment to comply with EU directives on VOC emissions. Trade expos such as FESPA Global Print Expo in Berlin serve as critical platforms for showcasing hybrid DTF solutions that address the diverse signage, garment, and decorative printing demands across the region. Meanwhile, the Gulf Cooperation Council has shown growing interest in on-demand customization for retail and corporate branding, leveraging DTF’s rapid turnaround capabilities.

Asia-Pacific remains the epicenter of DTF manufacturing innovation, with Japan’s leading OEMs and a burgeoning base of component suppliers in China driving cost competitiveness and rapid product development cycles. Chinese manufacturers focus on expanding UV-curable ink lines and modular hardware designs that simplify maintenance and scalability, while markets like India and Southeast Asia prioritize affordability and after-sales support. Partnerships between local distributors and production centers facilitate access to both roll and sheet systems, fueling adoption among small-to-medium enterprises seeking regional supply chain resilience.

This comprehensive research report examines key regions that drive the evolution of the DTF Printer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Industry Heavyweights Steering Innovation and Competitive Dynamics in Direct-to-Film Printing

Industry leadership in the direct-to-film printing sector is concentrated among a handful of global OEMs recognized for their deep engineering expertise and expansive service networks. Seiko Epson Corporation, headquartered in Nagano, has leveraged its PrecisionCore inkjet technology to deliver the SureColor G-Series and G6000 models, distinguished by automated maintenance functions and OEKO-TEX® certified UltraChrome DTF inks that underscore the emphasis on both productivity and eco-compliance. Mimaki Engineering Co., Ltd., also based in Japan, continues to innovate with platforms such as the TxF150-75 and the UJV300DTF-75, introducing UV-curable pigment systems that expand material compatibility and accelerate curing processes for industrial-scale applications. Kornit Digital Ltd. brings its core competency in integrated printing workflows to the DTF arena, while Brother International Corporation has gained traction with the high-speed DTRX roll-to-roll series, optimizing throughput for bulk printing environments. Roland DG Corporation’s TY-300 transfer printer and Ricoh Company Ltd.’s D1600 series serve specialized niches within the decorated apparel segment, emphasizing reliability and scalability. Additional competitive players such as ColDesi, aeoon Technologies GmbH, and Axiom America contribute by developing niche solutions-from entry-level photo-quality printers to modular industrial systems-broadening the market’s equipment spectrum and driving continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the DTF Printer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeoon Technologies GmbH

- AUDLEY LIMITED

- Brother International Corporation

- Cobra Flex Printers DTF

- Creative Graphics Solutions India Limited

- Dream Vista Technologies

- DTF PRINTER USA LLC

- DTF Solutions Group

- DTG Pro

- Guangzhou Xin Flying Digital TechnologyCo.,Ltd.

- InkTec Europe Ltd.

- Kornit Digital Ltd.

- MeiTu Digital Industry Co.,Ltd.

- Mimaki Engineering Co., Ltd.

- MUTOH INDUSTRIES LTD.

- ORIC Digtial Technology Co.,Ltd.

- Polyprint Inc. by HP Inc.

- PrintBig Digital Technology Co., Ltd.

- Procolored

- RESOLUTE LEGAL LTD.

- Ricoh Imaging Company, Ltd.

- Roland DG Corporation

- Seiko Epson Corporation

- Shanghai orink co.,ltd.

- Shenzhen Giftec Technology Co., Ltd.

- STS Refill Technology

- SUBLISTAR by Feiyue Digital Inc.

- Zhengzhou New Century Digital Technology Co., Ltd.

Strategic Action Plans for Industry Visionaries to Capitalize on Emerging Opportunities in the Direct-to-Film Printing Sector

To maintain a competitive edge within this dynamic market, industry leaders should prioritize diversification of supply chain sources, combining established East Asian OEM partnerships with emerging regional assemblies to offset tariff volatility and logistic bottlenecks. Strategic investments in cloud-based print management and AI-driven workflow tools will streamline operations, reduce downtime, and enable data-informed decision-making on maintenance and capacity planning.

Embracing sustainability initiatives through the deployment of water-based pigment inks and energy-efficient peripherals not only addresses regulatory mandates but also resonates with increasingly eco-conscious end users, fostering brand differentiation. Furthermore, adopting hybrid printing configurations that integrate DTF with complementary technologies can expand service portfolios, opening new revenue streams in non-textile applications such as custom décor and industrial labeling.

Finally, stakeholders should actively engage in industry consortiums and trade events to remain at the forefront of technological advancements and policy developments. Participation in forums addressing international trade agreements and tariff mitigation strategies, coupled with agile pricing models that reflect real-time duty fluctuations, will facilitate proactive risk management and support sustainable growth in an evolving global trade environment.

Transparent Methodological Framework Combining Proprietary Data Collection and Rigorous Analytical Protocols Guiding the Direct-to-Film Printing Study

This report synthesizes insights derived from a comprehensive research framework that integrates both primary and secondary data sources. Primary research consisted of in-depth interviews with key executives and technical experts from leading OEMs, print service providers, and distribution partners, ensuring direct capture of strategic priorities, operational challenges, and technology roadmaps. Secondary research involved systematic analysis of industry publications, trade journals, and regulatory databases to contextualize tariff regimes, environmental standards, and regional market behaviors. Data triangulation methods were applied to validate findings, cross-referencing supplier disclosures with independent trade statistics and event reports. Analytical processes included thematic coding of qualitative inputs, competitive benchmarking, and scenario-based impact assessments to evaluate trade policy volatility and segmentation dynamics. This methodological rigor ensures that the conclusions and recommendations presented herein are robust, actionable, and reflective of both current market conditions and emerging trends. Confidential stakeholder data was anonymized and aggregated to maintain proprietary integrity, while adherence to ethical research standards and quality control protocols underpins the credibility of this study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our DTF Printer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- DTF Printer Market, by Type

- DTF Printer Market, by Ink Type

- DTF Printer Market, by Film Type

- DTF Printer Market, by Application

- DTF Printer Market, by Sales Channels

- DTF Printer Market, by End User

- DTF Printer Market, by Region

- DTF Printer Market, by Group

- DTF Printer Market, by Country

- United States DTF Printer Market

- China DTF Printer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Consolidating Insights and Forward-Looking Perspectives on the Evolution and Strategic Imperatives of the Direct-to-Film Printing Industry

In conclusion, the direct-to-film printing sector is undergoing accelerated transformation driven by technological innovation, sustainability imperatives, and shifting trade policies. The integration of AI and automation is enhancing process efficiency and print quality, while material and film advancements are broadening application horizons across textiles, packaging, and specialty graphics. Concurrently, the intricate matrix of U.S. tariffs and reciprocal duties underscores the importance of supply chain resilience and strategic sourcing. Segmentation analysis reveals differentiated needs across printer types, ink chemistries, film variants, application domains, sales channels, and end-user profiles, underscoring the necessity for tailored go-to-market strategies. Regional insights highlight the significance of localized partnerships in the Americas, stringent environmental dynamics in EMEA, and manufacturing prowess in the Asia-Pacific region. Leading OEMs and service providers are well-positioned to capitalize on these developments, provided they adopt agile operational models and embrace cross-functional collaboration. As the industry charts its course, those who blend innovation with adaptability will define the next chapter of the DTF market’s evolution.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Direct-to-Film Printing Market Research Report Today

To gain unparalleled strategic insights and a comprehensive understanding of the direct-to-film printing landscape, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise and tailored guidance will ensure you navigate technological advancements, policy fluctuations, and market segmentation intricacies with confidence. Secure your market research report today to inform investment decisions, optimize operations, and accelerate growth in this dynamic industry.

- How big is the DTF Printer Market?

- What is the DTF Printer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?