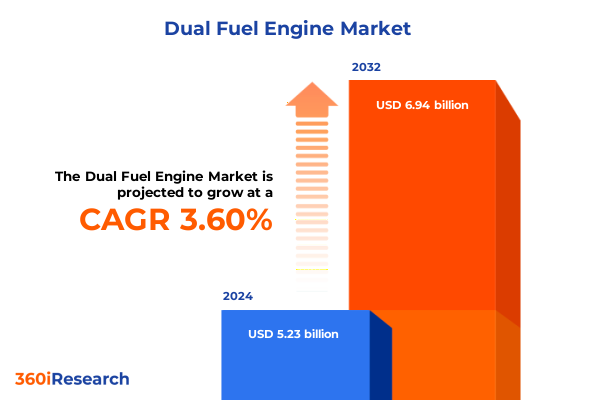

The Dual Fuel Engine Market size was estimated at USD 5.40 billion in 2025 and expected to reach USD 5.59 billion in 2026, at a CAGR of 3.65% to reach USD 6.94 billion by 2032.

Unveiling the Strategic Significance of Dual Fuel Engine Technology in Driving Operational Efficiency and Sustainability Across Industries

Dual fuel engines have emerged as a pivotal technology for balancing operational performance with environmental responsibility. By integrating dual fuel systems, operators can switch seamlessly between conventional hydrocarbon-based fuels and alternative energy sources, resulting in enhanced fuel flexibility and lower emissions profiles. This capability addresses the shifting regulatory and stakeholder demands for cleaner energy utilization while ensuring reliability in critical industrial, marine, and power generation applications.

Over the past decade, breakthroughs in combustion chamber optimization and electronic control modules have significantly improved the efficiency and responsiveness of dual fuel powertrains. These advances have reduced barriers to adoption by simplifying retrofit processes and minimizing downtime. Consequently, leading OEMs and end users are now prioritizing dual fuel solutions to align with decarbonization targets and secure access to affordable fuel sources.

Moreover, strategic drivers such as volatile oil prices, tightening emission standards, and expanding fuel infrastructure networks are accelerating market momentum. As organizations pursue net-zero ambitions, the dual fuel engine has become a cornerstone of transitional energy strategies, bridging the gap between traditional fossil fuels and emerging low-carbon alternatives.

Exploring the Transformative Shifts in Energy Landscapes That Are Accelerating Adoption of Cleaner Dual Fuel Engine Solutions Worldwide

The landscape of propulsion and power generation is undergoing rapid transformation, driven by a convergence of technological innovation and stringent environmental mandates. Governments worldwide are implementing progressive emission standards, compelling operators to adopt cleaner engine architectures. In marine sectors, sulfur oxides and greenhouse gas regulations have compelled a shift toward fuels and engine solutions capable of compliance without sacrificing performance. Concurrently, industrial stakeholders are exploring dual fuel configurations to mitigate carbon footprints and leverage cost-efficient fuel blends.

Technological innovation has played a critical role in facilitating this transition. Enhanced electronic control units, advanced injection systems, and predictive maintenance platforms are redefining engine lifecycle management and operational transparency. These digital enablers permit real-time optimization of fuel ratios and combustion parameters, thereby maximizing efficiency while maintaining emission compliance. At the same time, hybrid powertrain concepts are emerging, combining battery storage with dual fuel combustion to further reduce carbon intensity during peak load conditions.

Furthermore, the global proliferation of LNG bunkering terminals and refined fuel distribution networks is underpinning the feasibility of dual fuel deployments at scale. As new fuel corridors develop, operators gain greater assurance of fuel availability and cost predictability, reinforcing confidence in dual fuel strategies as a viable long-term investment.

Assessing the Cumulative Impact of United States Commerce Measures on Cost Structures and Supply Chains for Dual Fuel Engine Manufacturers through 2025

United States trade policies enacted in early 2025 have introduced new tariffs on imported engine components and assemblies, reshaping cost structures and strategic sourcing decisions. These measures, designed to bolster domestic manufacturing and protect critical supply chains, have prompted manufacturers to reassess global procurement strategies. As a result, component prices for international OEM partners have increased, leading to modest adjustments in capital expenditure plans for marine, industrial, and power generation operators.

In response to these tariff pressures, many stakeholders have accelerated efforts to localize production capabilities. Collaborative ventures between domestic fabricators and established engine technology providers have emerged to mitigate cost escalations. This shift toward nearshoring not only cushions the impact of external tariffs but also enhances supply chain resilience by reducing transit times and exposure to geopolitical disruptions.

Despite initial cost pressures, the cumulative effect of these measures is expected to strengthen the domestic ecosystem for dual fuel engine manufacturing. By fostering partnerships with local equipment suppliers and investing in regional assembly hubs, industry participants are positioning themselves for sustained competitiveness, even as global trade dynamics continue to evolve.

Delivering Key Segmentation Insights to Illuminate Diverse Engine Configurations, Fuel Blends, and End Use Scenarios Shaping Dual Fuel Engine Market Dynamics

A nuanced understanding of market segmentation reveals critical insights into how dual fuel engine solutions are tailored to distinct operational requirements. Based on engine speed, high speed configurations are favored for applications demanding compact footprint and rapid load response; low speed variants deliver robust torque and exceptional fuel efficiency for heavy-duty marine propulsion, while medium speed designs strike a balance between performance and operational versatility.

When viewed through the lens of engine cycle, two-stroke dual fuel engines stand out for continuous, high-torque operations in large vessels and stationary power plants, whereas four-stroke alternatives offer enhanced flexibility and lower maintenance demands, making them suitable for onshore industrial and smaller marine applications. Transitioning between these cycles enables operators to align engine architecture with their specific duty profiles and fueling strategies.

Fuel blend segmentation further defines market opportunity, with diesel dual fuel systems providing operators a seamless switch between liquid hydrocarbons and compressed gases, heavy fuel oil dual fuel units leveraging existing bunker infrastructure, liquefied natural gas dual fuel engines capitalizing on low-carbon fuel sources, and naphtha dual fuel variants enabling niche specialty applications where feedstock proximity is a priority.

End user segmentation underscores how industrial operations rely on high reliability and predictable maintenance intervals, marine customers prioritize optimized fuel consumption and emission compliance across commercial vessels, cruise ships, and offshore support vessels, and power generation stakeholders deploy backup units for resilience, cogeneration systems for maximized energy efficiency, and utility-scale solutions for grid stability.

This comprehensive research report categorizes the Dual Fuel Engine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Speed

- Engine Cycle

- Fuel Blend

- End User

Uncovering Strategic Regional Insights That Highlight Growth Drivers, Regulatory Influences, and Infrastructure Readiness across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the evolution of dual fuel engine adoption, reflecting differing regulatory frameworks, infrastructure maturity, and commercial priorities. In the Americas, robust LNG distribution networks and supportive federal and state policies have driven significant uptake of dual fuel engines in maritime and power generation applications. Operators in North America are leveraging indigenous natural gas reserves to achieve cost-competitive fueling options while advancing decarbonization objectives.

Across Europe, the Middle East, and Africa, stringent carbon reduction targets and evolving maritime emission norms have created compelling incentives for engine upgrades. The European Union’s carbon pricing mechanisms and the Gulf Cooperation Council’s focus on cleaner shipping fuels have spurred investment in dual fuel propulsion, supported by expanding bunkering capabilities along key trade routes. Simultaneously, infrastructure investments in North Sea terminals and Mediterranean bunkering hubs are reinforcing supply reliability.

In the Asia-Pacific region, accelerating industrialization and energy demand growth have intensified the need for flexible, low-emission power solutions. Dual fuel engines are increasingly integrated into utility-scale and distributed generation projects, where fuel availability ranges from LNG and naphtha to heavy fuel oil. Government incentives in major markets such as China, Japan, and Australia are fostering partnerships between energy companies and engine manufacturers to deploy dual fuel assets that align with national decarbonization roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Dual Fuel Engine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Providers and Pioneering Collaborators Shaping Innovation, Partnerships, and Competitive Strategies in Dual Fuel Engine Industry

The competitive landscape of dual fuel engine technology is defined by a blend of established OEMs and emerging innovation leaders. Key providers have differentiated themselves through robust R&D investments aimed at optimizing combustion processes, reducing lifecycle emissions, and enhancing the fuel flexibility of their engine portfolios. Strategic alliances between engine manufacturers and global shipbuilders have accelerated the deployment of large-scale dual fuel propulsion systems in commercial and offshore applications.

In parallel, several companies have expanded their service footprints to offer turnkey solutions encompassing fuel infrastructure integration, digital monitoring platforms, and remote diagnostic capabilities. By embedding predictive analytics into their maintenance offerings, these organizations are helping end users minimize operational disruptions and maximize asset uptime. Furthermore, cross-industry partnerships with energy suppliers are enabling bundled fuel supply contracts that improve cost transparency and reduce administrative burdens.

Leadership in the dual fuel space also extends to thought leadership initiatives, where firms engage with regulatory bodies and industry associations to shape standards for fuel quality, emission measurement, and interoperability. This holistic approach to market engagement ensures that technology roadmaps are aligned with evolving policy landscapes and customer expectations, reinforcing the competitive positioning of pioneering companies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dual Fuel Engine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anglo Belgian Corporation NV

- Caterpillar Inc.

- Cummins Inc.

- Deutz AG

- Doosan Engine Co., Ltd.

- Fairbanks Morse Defense LLC

- Heinzmann GmbH & Co. KG

- Hyundai Heavy Industries Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Kubota Corporation

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- MTU Friedrichshafen GmbH

- Niigata Power Systems Co., Ltd.

- Rolls-Royce Holdings plc

- Scania AB

- Volvo Penta (AB)

- WinGD (Switzerland) SA

- Woodward Inc.

- Wärtsilä Corporation

- Yanmar Holdings Co., Ltd.

Formulating Actionable Strategic Recommendations to Optimize Operational Efficiency, Risk Management, and Sustainable Growth for Dual Fuel Engine Industry Leaders

Industry leaders should prioritize a modular engine architecture strategy to enhance adaptability across diverse fuel blends and evolving emission requirements. By standardizing core component interfaces, engine manufacturers and end users can accelerate retrofit cycles and reduce total cost of ownership. Concurrently, investments in advanced control systems and digital twin models will extend predictive maintenance capabilities, delivering measurable gains in reliability and lifecycle performance.

To mitigate supply chain vulnerabilities, organizations must cultivate strategic partnerships with component suppliers and logistics providers, focusing on nearshoring opportunities that align with shifting tariff landscapes and geopolitical considerations. Strengthening supplier diversity and implementing dual-sourcing frameworks will ensure continuity of critical spares and assemblies, even amid global disruptions.

Moreover, fostering collaboration among engine OEMs, fuel infrastructure developers, and regulatory agencies can accelerate the expansion of LNG and alternative fuel bunkering networks. Stakeholders should jointly advocate for standardized fueling protocols and streamlined permitting processes to reduce infrastructure deployment timelines. Lastly, aligning R&D roadmaps with decarbonization targets will enable the rapid scaling of next-generation dual fuel technologies, reinforcing competitive differentiation and delivering sustainable value for stakeholders.

Outlining Rigorous Research Methodology Integrating Primary Interviews, Data Triangulation, and Robust Validation Frameworks for Market Intelligence

The research methodology underpinning this analysis is rooted in a comprehensive multi-stage approach that integrates both primary and secondary research techniques. Initially, in-depth interviews were conducted with a diverse set of stakeholders, including engine OEM executives, shipyard managers, energy utility planners, and regulatory authorities, to capture firsthand perspectives on market drivers and emerging challenges.

Secondary research encompassed a systematic review of industry white papers, regulatory publications, and peer-reviewed academic studies, ensuring that the insights reflect the most current technological developments and policy frameworks. Data triangulation across multiple sources was employed to validate qualitative findings and enhance the robustness of strategic conclusions.

Quantitative analyses were performed using a combination of bottom-up and top-down approaches, examining historical deployment data, fuel price trends, and infrastructure capacity metrics without estimating market size or share. Expert validation sessions were held to refine assumptions and test the practical applicability of recommendations, while an iterative internal peer review process guaranteed consistency, accuracy, and alignment with best practices in market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dual Fuel Engine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dual Fuel Engine Market, by Engine Speed

- Dual Fuel Engine Market, by Engine Cycle

- Dual Fuel Engine Market, by Fuel Blend

- Dual Fuel Engine Market, by End User

- Dual Fuel Engine Market, by Region

- Dual Fuel Engine Market, by Group

- Dual Fuel Engine Market, by Country

- United States Dual Fuel Engine Market

- China Dual Fuel Engine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Imperatives to Reinforce the Critical Role of Dual Fuel Engines in Transforming Energy Utilization and Decarbonization Efforts

The explosion of dual fuel engine adoption reflects a deeper industry commitment to reconciling operational imperatives with environmental stewardship. As demonstrated throughout this analysis, technological advancements in combustion control, digital integration, and infrastructure development have coalesced to create a compelling value proposition for dual fuel deployments. These engines are no longer niche solutions; they have become foundational components of transition strategies across marine, industrial, and power generation sectors.

Strategic imperatives for industry participants include embracing interoperability standards, fostering cross-sector collaboration, and continuously enhancing the digital and functional capabilities of engine platforms. By internalizing these principles, organizations can secure a competitive edge, mitigate regulatory exposures, and meet the accelerated timelines of global decarbonization agendas.

Ultimately, the sustained growth of dual fuel engines will hinge on the industry’s ability to harmonize cost efficiency, regulatory compliance, and technological innovation. Stakeholders that adapt swiftly to evolving market conditions and proactively engage in shaping the regulatory discourse will be best positioned to lead the market forward.

Connect with Ketan Rohom to Access Comprehensive Market Intelligence and Drive Strategic Decisions for Dual Fuel Engine Investments and Operational Excellence

Engaging with an expert partner can accelerate your strategic decision making and ensure you capitalize on emerging opportunities in the dual fuel engine arena. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, you can unlock a wealth of insights tailored to your organization’s unique needs. His expertise will guide you through the complexities of fuel blend strategies, engine cycle innovations, and regional market nuances to optimize your investment roadmap. This personalized collaboration offers direct access to detailed intelligence on competitive positioning, supply chain dynamics, and regulatory landscapes, empowering you to navigate the rapidly evolving energy transition. Reach out to schedule a consultation and discover how this market research report can become your blueprint for achieving operational excellence and sustainable growth in the dual fuel engine sector. Let Ketan Rohom partner with you in transforming data into actionable strategies that drive long-term value and resilient performance.

- How big is the Dual Fuel Engine Market?

- What is the Dual Fuel Engine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?