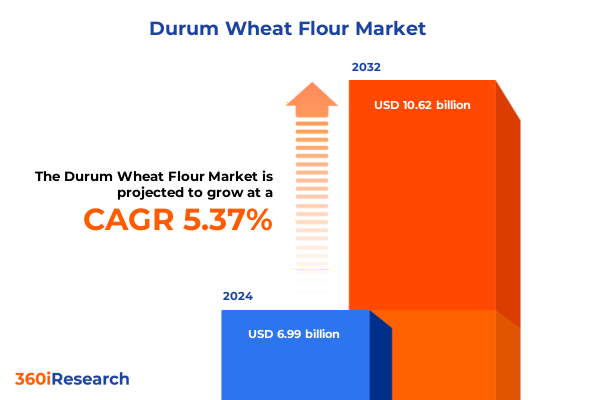

The Durum Wheat Flour Market size was estimated at USD 7.33 billion in 2025 and expected to reach USD 7.71 billion in 2026, at a CAGR of 5.43% to reach USD 10.62 billion by 2032.

Setting the Stage for Durum Wheat Flour Evolution Amid Rising Consumer Demand, Premium Culinary Trends, and Sustainability in Global Supply Chains

Durum wheat flour stands at the intersection of tradition and innovation, serving as both a culinary cornerstone and a driver of value-added products in global food industries. This fine-tuned ingredient, prized for its high protein content and robust gluten profile, has underpinned staple foods such as pasta, bread, and semolina-based delicacies for centuries. Recent years have witnessed a resurgence of interest in durum wheat flour, propelled by consumer appetites for artisanal bakery products and clean-label goods. As dietary preferences continue to evolve, consumers are seeking ingredients that deliver authentic texture and taste while aligning with health and sustainability commitments.

Concurrently, the supply chain for durum wheat flour has become increasingly complex, reflecting geopolitical developments and trade policy adaptations. Importers and distributors in major markets are navigating fluctuating freight costs and regulatory frameworks to maintain consistent availability and preserve quality. Innovations in milling technologies, sustainable farming practices, and logistics optimization are reshaping the landscape from field to fork. Against this backdrop of dynamic consumer demand and operational challenges, industry stakeholders require a clear understanding of emerging drivers, potential bottlenecks, and strategic levers to capitalize on growth opportunities. This report provides a concise yet comprehensive foundation, delivering a panoramic view of the key forces that will influence the trajectory of the durum wheat flour market in the near term and beyond.

Exploring Breakthrough Agricultural Technologies, Sustainable Practices, and Evolving Consumer Preferences that Are Redefining Durum Wheat Flour Market Dynamics

The durum wheat flour market is undergoing transformative shifts driven by agricultural innovation, consumer sensibilities, and operational agility. Advances in plant breeding have yielded high-yield, disease-resistant cultivars that deliver consistent protein quality and wrist-friendly gluten strength. These developments are complemented by precision farming techniques, where data-driven irrigation, soil nutrient monitoring, and drone-based crop assessments enhance yield predictability and resource efficiency. Together, such innovations are poised to reduce production costs, elevate grain quality, and bolster supply chain resilience.

Alongside agricultural breakthroughs, milling operations are embracing digitalization. Automated sorting systems now ensure tighter granulation control, while real-time moisture and ash monitoring guarantee batch consistency. Roller and stone milling facilities are increasingly integrating renewable energy sources, reflecting a broader industry commitment to sustainable footprint reduction. Meanwhile, consumer expectations are steering product portfolios toward specialty variants, including organic and non-GMO durum wheat flour. This divergence underscores how health, wellness, and traceability are shaping purchasing behaviors.

Furthermore, the rising tide of ready-to-cook fresh pasta solutions and artisanal bakery innovations is amplifying demand for premium flour grades. Food service operators and commercial bakers are forging closer collaborations with millers, co-developing blends tailored to textural and processing requirements. As the industry navigates a convergence of technological prowess and evolving consumer ethos, stakeholders who harness these transformative shifts will be best positioned to secure market leadership and profitability.

Assessing How 2025 United States Tariff Measures Are Reshaping Supply Chains, Pricing Models, and Competitive Dynamics in the Durum Wheat Flour Industry

In 2025, the United States implemented targeted tariff measures on imported durum wheat and resulting flour products, triggering a cascading impact across the value chain. These duties have exerted upward pressure on raw material costs for flour producers, compelling many to renegotiate supplier contracts or identify alternate sourcing regions. As a consequence, some manufacturers have recalibrated their pricing models to preserve margin integrity, while others have pursued cost-optimization strategies, such as consolidating shipments and leveraging bonded warehouses to mitigate tariff liabilities.

The tariff environment has also awakened interest in domestic milling capacity, prompting investments in local grain cultivation and processing infrastructure. Millers in key wheat-growing states have accelerated expansion projects, aiming to capture market share from traditional exporters. In parallel, food service companies and bakeries have revisited their ingredient procurement policies, seeking to balance cost stability with product consistency. For niche brand owners, the immediate challenge has been to maintain the premium positioning of organic and specialty durum flours without compromising on affordability for end-consumers.

Longer-term, the tariff landscape continues to influence supply chain diversification, as industry participants explore partnerships with North American and non-US mills. Strategic alliances and toll-milling agreements are on the rise, reflecting a broader intent to sidestep trade barriers while ensuring uninterrupted access to high-quality durum flour. Ultimately, the cumulative effect of the 2025 tariff regime underscores the importance of agility, strategic sourcing, and cross-border collaboration for sustaining competitiveness in the evolving durum wheat flour ecosystem.

Illuminating Market Diversification through Analysis of Quality Grades, Processing Techniques, Flour Types, End-User Categories, Distribution Channels, and Application Trends

A nuanced examination of the durum wheat flour market reveals that quality grade distinctions between organic and standard offerings play a pivotal role in catering to divergent customer segments. Organic variants command heightened interest among health-conscious consumers and premium foodservice operators, while standard grades satisfy broader commercial applications with cost-effective solutions. Beyond quality definition, the choice of processing technique-whether heat-treated for enhanced shelf stability, roller milling for fine granulation, or stone milling for heritage-style texture-serves as a critical differentiator, influencing both functional performance and brand narrative.

Flour type segmentation further refines product positioning, with coarse grinds favored by artisanal bakers seeking rustic crumb structures and fine flours driving elasticity in pasta production. In the commercial versus residential end-user divide, bakeries, hotels, and restaurants & cafés each demand consistent supply levels and tailored flour blends, whereas home cooks prioritize packaging size and ease of preparation. Distribution channels likewise diverge, as offline networks spanning convenience outlets, specialty stores, and large-format supermarkets accommodate in-store discovery, while online direct-to-consumer platforms and e-commerce websites offer convenience and subscription models that appeal to digital-native shoppers.

Application insights add another layer of complexity; bakery products continue to absorb a substantial share of durum flour consumption, driven by the artisanal bread renaissance, whereas pasta and noodle manufacturers require strict gluten and protein specifications to meet process and texture benchmarks. By synthesizing these segmentation dimensions, stakeholders can develop targeted product innovation roadmaps, optimize distribution strategies, and craft marketing communications that resonate with each distinct customer cohort.

This comprehensive research report categorizes the Durum Wheat Flour market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Flour Type

- Grade

- Processing Technology

- Composition

- Packaging Format

- Application

- Distribution Channel

- Customer Type

Highlighting Regional Drivers and Consumption Patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Durum Wheat Flour Market

Regional consumption patterns in the Americas remain robust, underpinned by strong heritage associations with pasta and layered pastry products. In North America, surging demand for clean-label ingredients is propelling millers to secure organic durum wheat contracts, while Latin American markets are responding to urbanization trends and changing dietary habits. Cross-regional trade within the Americas illustrates the strategic importance of proximity, with mid-continent milling hubs supplying coastal distribution centers and minimizing logistics costs.

Across Europe, the Middle East, and Africa, cultural affinity for durum-based staples such as semolina couscous, beyond pasta, sustains elevated per capita consumption levels. In Europe, premiumization is driving adoption of single-origin, traceable flour varieties, whereas in EMEA’s emerging markets, affordability and supply chain reliability are the primary purchase triggers. Millers in the region are leveraging consolidation to achieve scale and negotiate favorable grain procurement terms, thus reinforcing their market positions.

In the Asia-Pacific arena, burgeoning middle-class populations and expanding foodservice channels are creating new avenues for durum flour penetration. Retailers and restaurant chains are incorporating pasta and baked goods into mainstream offerings, necessitating consistent product quality and localized flavor adaptations. Strategic investments in cold-chain logistics and regional milling facilities are enabling suppliers to reduce lead times and preserve functional attributes of durum flour. As each region navigates its unique socio-economic drivers and infrastructure landscapes, the capacity to align production footprints, distribution networks, and marketing narratives accordingly will determine the ultimate course of market expansion.

This comprehensive research report examines key regions that drive the evolution of the Durum Wheat Flour market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players, Strategic Collaborations, and Innovation Initiatives Driving Growth in the Durum Wheat Flour Sector

The competitive arena for durum wheat flour features both global milling conglomerates and niche, specialty producers. Leading players have differentiated themselves through integrated supply chain models, spanning agricultural inputs, milling operations, and branded product lines. These enterprises continuously invest in state-of-the-art facilities equipped with advanced process controls, enabling them to deliver consistent protein and gluten levels at scale.

Conversely, smaller mills are carving out market space by focusing on heritage processes, organic certification, and traceable sourcing. Their strategic collaborations with boutique bakeries and artisanal pasta makers underscore the value of agility and close customer engagement. Some firms have introduced collaborative innovation platforms, inviting chefs and food scientists to co-develop bespoke flour blends that address emerging texture and nutritional trends.

Partnerships between millers and logistics providers have also emerged as a critical enabler of market responsiveness. By deploying temperature-controlled warehousing and synchronized shipment scheduling, companies can uphold product integrity and reduce lead times. In parallel, technology partnerships are facilitating the rollout of digital quality passports, which allow end-users to access real-time data on protein content, particle size distribution, and moisture measurements. Such collaborative initiatives underscore the industry’s shift toward transparency, premiumization, and customer-centric innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Durum Wheat Flour market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Antimo Caputo Srl

- Archer Daniels Midland Company

- Ardent Mills

- Bob's Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- Casillo SpA

- Damati Foods Private Limited

- FWP Matthews Ltd

- General Mills, Inc.

- Giusto's Specialty Foods, LLC

- GoodMills Group GmbH

- Grain Craft

- Italco Food Products, Inc.

- J.M. Smucker Co.

- Kambeitz Farms

- Khandesh Roller Flour Mills Pvt. Ltd.

- King Arthur Baking Company, Inc.

- La Molisana S.p.A

- Manildra Flour Mills Pty. Ltd.

- Modern Mountain Baking Company

- Molino Grassi SpA

- Mühlenchemie GmbH & Co. KG

- Nisshin Seifun Group

- Orlando Food Sales, Inc.

- Parrish and Heimbecker, Limited

- Philadelphia Macaroni Company

- Rettenmeier Mühle

- Richardson International Limited

- RUSTICHELLA D'ABRUZZO SpA

- Smucker Foods of Canada Corp.

- Taru Naturals

- Trupti Enterprises Inc.

- TWF Technologies Pvt Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends, Enhance Supply Chain Resilience, and Drive Sustainable Growth in Durum Wheat Flour Market

To thrive amid intensifying competition and regulatory headwinds, industry leaders should prioritize end-to-end supply chain visibility and agility. Implementing digital traceability solutions will not only shore up food safety compliance but also empower marketing narratives around provenance and quality. Concurrently, forging strategic alliances with grain growers and co-packers can secure stable raw material availability and unlock cost synergies through shared infrastructure.

Innovation investments must be channeled toward high-value product segments, such as organic and specialty flours, where margin potential remains robust. Pilot programs that integrate alternative processing techniques and climate-resilient winter durum cultivars can provide first-mover advantages. In tandem, sales and marketing teams should deploy segmented communication strategies, tailoring messaging to the distinct requirements of commercial bakers, foodservice operators, and retail consumers. Emphasis on functional benefits-such as dough elasticity or extended shelf life-will resonate with technical purchasing specifications, while culinary storytelling will appeal to end users seeking authentic experiences.

Moreover, adopting flexible distribution models that balance offline retail partnerships with direct-to-consumer digital platforms can expand market reach and fortify customer relationships. By leveraging subscription services, private-label collaborations, and value-added packaging innovations, companies can drive incremental revenue streams. Ultimately, the successful integration of operational excellence, customer-centric innovation, and targeted marketing will ensure sustained profitability and leadership in the evolving durum wheat flour landscape.

Detailing a Comprehensive Research Framework Combining Primary Stakeholder Engagement, Secondary Data Analysis, and Rigorous Validation Techniques

The research underpinning this report employed a rigorous methodology, combining primary insights from key industry stakeholders with extensive secondary data analysis. Primary engagement included in-depth interviews with senior executives across milling operations, grain suppliers, and major end-users, ensuring firsthand perspectives on supply chain dynamics, tariff impacts, and product innovation priorities. These qualitative inputs were complemented by structured surveys deployed to a representative sample of commercial bakers, foodservice professionals, and retail buyers, yielding quantitative validation of preference drivers and purchasing criteria.

Secondary research drew upon reputable public filings, trade association publications, and specialist agricultural databases to map out production capacities, milling technologies, and regulatory frameworks. Cross-referencing multiple data sources enabled triangulation of trends, while iterative consultations with subject-matter experts ensured that insights remained current and actionable. Data integrity was further reinforced through consistency checks and peer reviews, guaranteeing that conclusions accurately reflect real-world market conditions.

This blended research approach provides a holistic understanding of the durum wheat flour ecosystem, capturing both the macro-level shifts-such as trade policy adjustments-and the micro-level innovations shaping product differentiation. The result is a robust, multi-dimensional perspective that equips decision-makers with the clarity and confidence needed to formulate effective strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Durum Wheat Flour market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Durum Wheat Flour Market, by Flour Type

- Durum Wheat Flour Market, by Grade

- Durum Wheat Flour Market, by Processing Technology

- Durum Wheat Flour Market, by Composition

- Durum Wheat Flour Market, by Packaging Format

- Durum Wheat Flour Market, by Application

- Durum Wheat Flour Market, by Distribution Channel

- Durum Wheat Flour Market, by Customer Type

- Durum Wheat Flour Market, by Region

- Durum Wheat Flour Market, by Group

- Durum Wheat Flour Market, by Country

- United States Durum Wheat Flour Market

- China Durum Wheat Flour Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2703 ]

Synthesizing Key Insights and Strategic Outlook to Navigate the Future Landscape of the Durum Wheat Flour Industry with Confidence

In an environment marked by shifting consumer preferences, regulatory complexities, and technological advancements, the durum wheat flour market presents both challenges and opportunities. The interplay between tariff measures and domestic capacity expansions underscores the need for strategic sourcing and agile supply chain management. Simultaneously, segmentation insights reveal that success hinges on meeting diverse end-user requirements, whether through organic certification, specialized milling processes, or tailored flour textures.

Regional dynamics further highlight the importance of adapting to localized consumption patterns and infrastructure realities, from the heritage-driven markets of EMEA to the growth trajectories unfolding in Asia-Pacific. Against this multifaceted backdrop, leading companies have demonstrated that innovation partnerships, digital traceability, and customer-centric product development are critical differentiators.

Looking ahead, stakeholders who can seamlessly integrate operational excellence with market-driven innovation will be best positioned to navigate volatility and capture share. By leveraging the insights in this report, decision-makers can formulate targeted strategies that balance short-term resilience with long-term growth, ensuring that their businesses remain at the vanguard of the evolving durum wheat flour sector.

Unlock Exclusive Durum Wheat Flour Market Intelligence by Connecting with Ketan Rohom for Tailored Research and Strategic Insights

To gain a competitive edge and secure comprehensive insights into the evolving durum wheat flour market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan opens the door to a tailored discussion that addresses your specific business needs, explores bespoke data segments, and ensures you obtain the actionable intelligence required to drive strategic decision-making. His expertise in translating complex market findings into operational roadmaps will provide you with the clarity and confidence to navigate regulatory shifts, optimize supply chains, and capitalize on emerging consumer trends.

Partnering with Ketan also grants you exclusive access to in-depth analyses, including granular segmentation breakdowns, regional trend assessments, and risk mitigation strategies. Whether your organization is seeking to refine its product portfolio, expand into new territories, or strengthen its market positioning, Ketan can arrange a customized briefing or a full research package. Take the next step toward securing a robust competitive advantage and unlocking growth opportunities in the durum wheat flour sector by contacting Ketan Rohom today.

- How big is the Durum Wheat Flour Market?

- What is the Durum Wheat Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?