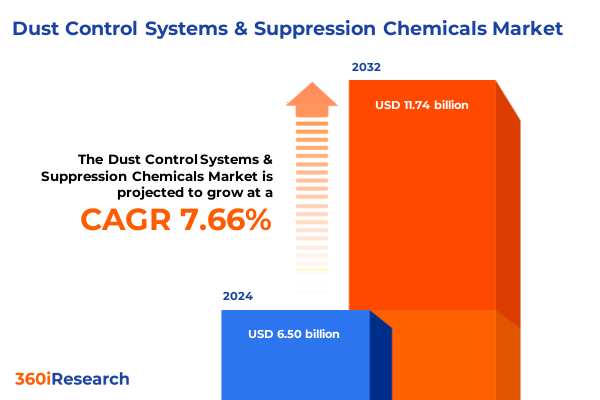

The Dust Control Systems & Suppression Chemicals Market size was estimated at USD 6.99 billion in 2025 and expected to reach USD 7.46 billion in 2026, at a CAGR of 7.68% to reach USD 11.74 billion by 2032.

Comprehensive Introduction to Dust Control Innovations Highlighting the Role of Suppression Chemicals in Enhancing Industrial and Environmental Safety

Dust control systems and suppression chemicals have emerged as critical enablers of safe, compliant, and efficient industrial operations across a wide range of sectors. As environmental regulations tighten and workplace safety standards evolve, companies must deploy advanced solutions to mitigate airborne particulates, reduce health hazards, and prevent costly operational disruptions. Suppression chemicals, from polymer and surfactant additives to sophisticated fogging treatments, offer targeted performance enhancements while minimizing water usage and environmental impact. Meanwhile, mechanical systems such as mist cannons, foggers, and water sprays continue to evolve in response to demands for mobility, precision, and energy efficiency.

In today’s industrial landscape, leaders in mining, construction, manufacturing, and utilities are confronting complex challenges that span regulatory compliance, sustainability goals, and operational excellence. Traditional water-based dust suppression methods are increasingly supplemented or replaced by hybrid approaches that leverage chemical innovation and digital controls. This dual emphasis on chemical efficacy and system intelligence promises to reshape how companies address particulate management. By understanding the multifaceted drivers of this market-from regulatory pressures to technological breakthroughs-stakeholders can devise strategies that protect worker health, safeguard equipment, and preserve community well-being.

Identifying Transformative Shifts Redefining the Dust Management Landscape Through Technology Advancements and Regulatory Evolution

The dust control market is undergoing a period of unprecedented transformation, driven by breakthroughs in smart monitoring, sustainable chemistry, and integrated system design. Over the past two years, the convergence of Internet of Things (IoT) sensors with automated suppression equipment has enabled real-time analysis of particulate levels and dynamic adjustment of chemical delivery. This shift toward data-driven operations reduces downtime and chemical waste while ensuring adherence to stringent air quality regulations. Concurrently, innovators are developing formulations that blend biodegradable surfactants with advanced polymers, achieving superior adhesion to dust particles and extended suppression performance under extreme environmental conditions.

Another pivotal trend is the rise of cross-industry collaborations between equipment manufacturers and chemical providers. Such partnerships accelerate the co-development of turnkey solutions that address both mechanical dispersion and chemical bonding. Regulatory bodies are also influencing product roadmaps by imposing lower emission thresholds and incentivizing low-impact formulations. As a result, new protocols for supply chain traceability, chemical safety data sheets, and environmental impact assessments have become integral to product development cycles. These transformative shifts signal a market that is no longer defined by water sprays alone, but by holistic systems engineered for precision, sustainability, and compliance.

In-Depth Analysis of the Cumulative Effects of 2025 United States Tariffs on Dust Control Equipment Importation and Chemical Suppression Supply Chains

In early 2025, the United States implemented additional import tariffs on key categories of industrial equipment and specialty chemicals, including those integral to dust control and suppression technologies. These measures, designed to bolster domestic manufacturing, have had a cumulative effect on cost structures and supply chain reliability. Equipment import duties have driven several end users to evaluate local fabrication partnerships and inventory strategies, while chemical tariffs have prompted re-negotiations with suppliers and accelerated development of in-country formulation capabilities.

Consequently, organizations relying heavily on imported polymer additives and fogging systems have seen procurement lead times extend by up to 30 percent, necessitating buffer stock strategies and just-in-case inventory models. At the same time, domestic chemical manufacturers have leveraged the tariff environment to expand plant capacity and secure supply agreements with major end-use industries. These shifts are fostering greater resilience but also intensifying competition for raw materials. To mitigate the impact, industry participants are diversifying supplier portfolios, investing in backward integration, and exploring tariff mitigation mechanisms such as free trade zone utilization. This evolving landscape underscores the importance of strategic sourcing and agile operations in maintaining cost efficiency and uninterrupted dust control performance.

Key Segmentation Insights Revealing How Product Types Formulations End Use Industries Applications and Channels Drive Value in Dust Control Markets

A nuanced understanding of market segmentation reveals how product type, formulation, end use industry, application, and distribution channel each influence value creation in dust control solutions. Within product categories, chemical additives dominate thanks to advances in polymer and surfactant technologies, while fogging systems benefit from the precision of both pressurized and ultrasonic delivery methods. Mist cannons have seen differentiated growth between fixed installations for stationary operations and portable units for dynamic work sites. Likewise, high-pressure and low-pressure water sprays continue to play complementary roles, with choice driven by particulate size, site topology, and environmental mandates.

Formulation preferences further delineate market behavior, as aqueous solutions combining surfactant-based and synthetic polymer chemistries gain traction for rapid deployment, whereas dry powder alternatives such as cellulose derivatives and polymer powders appeal to regions with limited water resources. End use industries reflect diverse application imperatives: construction projects emphasize versatility across building and road works, manufacturing facilities require tailored solutions for cement, food, and steel production, mining operations address coal, metal, and mineral extraction, and utilities focus on power generation and wastewater treatment. Mobile systems, whether trailer or truck mounted, satisfy large-scale site requirements, whereas handheld and skid-mounted portable units deliver granularity for confined areas. Finally, distribution channels shape market accessibility, with direct sales offering customization, distributors supplying breadth, online platforms providing convenience, and rental services enabling cost-effective short- or long-term deployments.

This comprehensive research report categorizes the Dust Control Systems & Suppression Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- End Use Industry

- Application

- Distribution Channel

Strategic Regional Insights Demonstrating Distinct Drivers and Opportunities Across Americas Europe Middle East Africa and Asia Pacific for Dust Suppression

Regional dynamics are pivotal in shaping the trajectory of dust control system adoption and suppression chemistry utilization. In the Americas, stringent regulations from agencies such as the U.S. Environmental Protection Agency and provincial authorities in Canada drive demand for compliant, technologically advanced solutions. North American mining and construction sectors prioritize low-emission systems, while Latin American operations weigh cost and reliability amid evolving regulatory frameworks. Investment in mobile and portable systems is particularly robust across remote mining fields where rapid redeployment is essential.

Europe, the Middle East, and Africa display a heterogeneous landscape. The European Union’s Green Deal and industrial emissions directives have compelled manufacturers to integrate real-time monitoring and data reporting into suppression systems. Middle Eastern mining ventures leverage high-pressure sprays and advanced misting solutions to counter arid conditions, while African utilities focus on low-water powder alternatives to manage dust in power generation and wastewater treatment contexts. In Asia-Pacific, rapid urbanization and infrastructure growth are fueling unprecedented construction and mining activity. China and India lead in chemical additive formulation innovation, spurred by domestic environmental targets, while Australia’s mining operators invest heavily in fogging and cannon systems to enhance worker safety and minimize particulate drift across vast open pits.

This comprehensive research report examines key regions that drive the evolution of the Dust Control Systems & Suppression Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Highlighting Leading Innovators Strategic Partnerships and Technological Advancements Shaping Dust Control Solutions

A cadre of market leaders continues to redefine performance standards through targeted innovations and strategic alliances. Equipment manufacturers are integrating digital sensors and predictive analytics into established product lines, while chemical specialists are formulating next-generation additives that achieve longer suppression cycles and lower environmental footprints. Joint ventures between system integrators and research institutions are yielding bespoke solutions for niche applications, such as high-altitude mining sites and urban tunneling projects.

In parallel, mergers and acquisitions have consolidated capabilities, enabling broader geographic reach and end-to-end solution offerings. Strategic partnerships are strengthening supply chain resilience, with leading firms collaborating on raw ingredient sourcing, co-locating production facilities near key industrial regions, and aligning on sustainability certifications. Such collaborations facilitate rapid scalability of new products and reinforce brand credibility in markets governed by rigorous compliance requirements. This ecosystem of innovation and partnership underscores the pivotal role of leading companies in driving market maturation and setting benchmarks for operational excellence in dust suppression.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dust Control Systems & Suppression Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Benetech Inc.

- BossTek Pvt. Ltd.

- Camfil AB

- Cargill, Incorporated

- Chemtex Speciality Limited

- DFW Envirotech India Pvt. Ltd.

- Donaldson Company, Inc.

- Ecolab Inc.

- Integrated Engineering Works Pvt. Ltd.

- Jain Irrigation Systems Ltd.

- Janvik Engineers and Tubes Pvt. Ltd.

- Mist Magic Pvt. Ltd.

- Nederman Holding AB

- Quaker Houghton, Inc.

- Sly Inc.

- SUEZ S.A.

- Symmetrical Engineering Inc.

- The ACT Group, LLC

- Ventilair India Private Limited

- Versatech EPC Pvt. Ltd.

Actionable Recommendations for Industry Leaders to Accelerate Innovation Optimize Operations and Enhance Sustainability in Dust Suppression Ecosystems

Industry leaders seeking to maintain competitive advantage should prioritize investments in research and development for eco-friendly formulations that meet tightening environmental standards while delivering superior performance. Collaborative development agreements with technology providers can accelerate integration of IoT-enabled monitoring platforms into suppression systems, thereby unlocking real-time visibility and predictive maintenance capabilities. Additionally, cultivating partnerships with local chemical producers in tariff-impacted regions will reduce supply chain vulnerability and support responsive formulation customization.

Operational optimization can be achieved by deploying mobile and portable units in a modular fashion, enabling agile site reconfiguration as project parameters evolve. Organizations should also consider subscription-based or rental models to spread capital expenditure and maintain access to the latest equipment. Engaging with regulatory agencies proactively to co-design compliance frameworks and demonstrate pilot outcomes will foster smoother approvals and shape industry standards. Ultimately, a balanced approach that couples technological innovation with strategic alliances and regulatory engagement will position industry leaders to navigate shifting market dynamics and deliver unparalleled dust control solutions.

Robust Research Methodology Ensuring Comprehensive Data Collection Rigorous Analysis and Validated Insights for Dust Control and Suppression Chemicals Study

This market research study employed a multi-tiered methodology combining extensive secondary research with primary insights to produce robust, validated conclusions. The secondary phase involved comprehensive review of industry white papers, regulatory filings, patent databases, and academic journals, ensuring a holistic understanding of technology trends, chemical advancements, and regional policy frameworks. Key data repositories focusing on environmental compliance and industrial safety provided context for evolving regulatory imperatives.

In the primary phase, structured interviews and workshops were conducted with a cross-section of stakeholders, including equipment manufacturers, chemical formulators, end-use customers, and regulatory officials. Qualitative insights from these engagements were triangulated against quantitative findings to validate assumptions and refine segmentation models. A rigorous data triangulation process was applied to reconcile disparate sources, and an expert advisory panel reviewed the draft analysis for factual accuracy and actionability. This methodology ensured that insights reflect real-world applications, emerging innovations, and future market trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dust Control Systems & Suppression Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dust Control Systems & Suppression Chemicals Market, by Product Type

- Dust Control Systems & Suppression Chemicals Market, by Formulation

- Dust Control Systems & Suppression Chemicals Market, by End Use Industry

- Dust Control Systems & Suppression Chemicals Market, by Application

- Dust Control Systems & Suppression Chemicals Market, by Distribution Channel

- Dust Control Systems & Suppression Chemicals Market, by Region

- Dust Control Systems & Suppression Chemicals Market, by Group

- Dust Control Systems & Suppression Chemicals Market, by Country

- United States Dust Control Systems & Suppression Chemicals Market

- China Dust Control Systems & Suppression Chemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Engaging Conclusion Emphasizing Strategic Imperatives and Future Outlook for Advancing Efficient Dust Control Practices and Suppression Chemical Adoption

As industries confront growing regulatory demands and sustainability mandates, the integration of advanced suppression chemicals with intelligent delivery systems will define the next frontier in dust management. Stakeholders equipped with a deep understanding of cumulative tariff implications, segmentation-driven value pools, and regional market dynamics are better positioned to allocate resources effectively and capitalize on emerging opportunities. The convergence of digital monitoring, eco-friendly formulations, and strategic partnerships underscores the importance of an agile, data-driven approach to dust control.

Moving forward, firms that invest in end-to-end solutions capable of real-time performance insight and rapid parameter adjustment will outpace peers and set new standards for environmental stewardship and operational resilience. By aligning innovation agendas with regulatory priorities, organizations can unlock benefits ranging from improved worker health to enhanced equipment lifecycles. This cohesive strategy will not only mitigate particulate hazards but also drive broader organizational objectives related to cost efficiency, sustainability, and brand reputation in a competitive industrial landscape.

Action-Oriented Call To Action Encouraging Engagement with Associate Director Sales And Marketing for Informed Acquisition of Dust Control Market Report

To explore the full breadth of insights on dust control systems and suppression chemicals, including detailed segmentation analysis, regional dynamics, and strategic recommendations, reach out to Ketan Rohom. Engaging with the Associate Director of Sales and Marketing will ensure you receive personalized guidance on how to leverage this market research to drive growth, optimize operations, and outpace industry competitors. He can provide tailored packages, address specific industry challenges, and facilitate a seamless acquisition process for the comprehensive report. Connect today to secure your competitive advantage and stay at the forefront of dust control innovation.

- How big is the Dust Control Systems & Suppression Chemicals Market?

- What is the Dust Control Systems & Suppression Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?