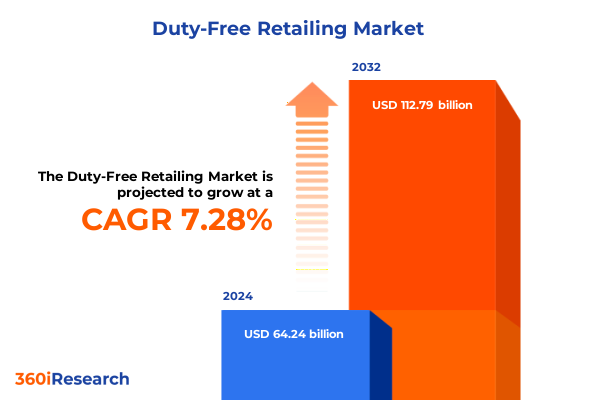

The Duty-Free Retailing Market size was estimated at USD 69.03 billion in 2025 and expected to reach USD 73.55 billion in 2026, at a CAGR of 7.26% to reach USD 112.79 billion by 2032.

How Duty-Free Retailing Is Adapting to Post-Pandemic Travel Resurgence and Shifting Consumer Behaviors Across the Global Marketplace

Over the past few years, duty-free retailing has undergone a remarkable transformation driven by the resurgence of global travel and the evolution of consumer expectations. As borders reopened and flight schedules returned to pre-pandemic levels, retailers swiftly adapted to shifting traffic flows, capitalizing on pent-up demand for experiential shopping. Travelers today seek convenience alongside curated experiences, expecting seamless integration between physical stores and digital touchpoints during their journey. In response, duty-free operators have reimagined storefronts with interactive elements, personalized service offerings, and frictionless payment systems that cater to a new era of connected travelers.

Moreover, the industry’s renewed focus on premiumization and experiential engagement has elevated duty-free from a transactional channel to a strategic brand engagement platform. Luxury beauty and fragrance brands collaborate with retailers to launch exclusive product lines, while gourmet food purveyors create live cooking demonstrations to engage both business and leisure travelers. These initiatives underscore a broader shift toward differentiated in-store experiences that forge emotional connections and drive loyalty beyond the checkout counter.

In addition, data analytics and customer insights have become indispensable tools for optimizing assortments and tailoring promotions in real time. By harnessing traveler profiles, purchase histories, and footfall patterns, retailers can align inventory with demand, reduce stockouts, and anticipate emerging preferences. Collectively, these innovations set the stage for a dynamic duty-free landscape that balances heritage retail practices with cutting-edge customer engagement strategies.

Unveiling the Key Transformations Shaping Duty-Free Retail as Technology Integration and Consumer Personalization Drive Industry Innovation

The duty-free retail sector is witnessing a wave of transformative innovations that are fundamentally reshaping the traveler experience and operational models. Foremost among these shifts is the rapid adoption of omnichannel capabilities, enabling consumers to research products online, reserve items via mobile applications, and complete seamless collection at airport lounges or border shops. This integration of digital and physical channels not only enhances convenience but also extends the retailer’s reach beyond traditional brick-and-mortar footprints, fostering continuous engagement throughout the travel cycle.

Simultaneously, advancements in personalization technologies, such as AI-driven recommendation engines and facial recognition payment systems, are enabling more relevant promotions and faster transactions. Travelers now receive customized offers based on their profiles, loyalty status, and real-time contextual data, which heightens satisfaction and increases conversion rates. In parallel, retailers are experimenting with virtual try-ons, augmented reality product demonstrations, and interactive kiosks that cater to the tech-savvy consumer and differentiate store environments from conventional retail outlets.

Furthermore, sustainability has emerged as a critical driver of innovation, prompting duty-free operators to implement eco-friendly packaging, source ethically produced goods, and collaborate with brands on carbon-neutral logistics. These strategic initiatives resonate strongly with environmentally conscious travelers and reinforce the sector’s commitment to responsible retailing. Collectively, these technology and sustainability-led transformations underscore how duty-free retail is evolving into a sophisticated, customer-centric ecosystem.

Analyzing the Growing Influence of United States Tariff Measures on Duty-Free Retail Channels and Global Supply Chain Dynamics in 2025

The cumulative effects of United States tariff policies through 2025 are exerting considerable influence on duty-free retail, particularly in categories reliant on cross-border supply chains. Escalating duties under Section 301 have elevated costs for electronics and select luxury fashion accessories, prompting retailers to reassess sourcing strategies and negotiate new agreements with suppliers outside affected jurisdictions. Consequently, some operators are reallocating product allocations toward categories less exposed to onerous tariffs, while others are exploring near-shoring options to mitigate cost pressures and preserve margins.

In addition, tariffs on imported wines and spirits have impacted the wines & spirits category, resulting in subtle adjustments to pricing structures for premium bottles. Retailers have responded by refining promotional calendars, bundling exclusive regional offerings with tariff-insulated spirits, and engaging more directly with suppliers to secure favorable terms. These measures have helped cushion the pass-through of duties to end consumers and sustain competitive positioning against domestic outlets.

Moreover, fluctuations in tariff rates have introduced complexity into inventory management and forecasting, as retailers balance the risk of sudden duty increases with the need to maintain sufficient stock levels for travelers. To navigate this uncertainty, operators are leveraging advanced analytics and scenario-planning frameworks to model duty impact across product categories and optimize lead times. This proactive stance is essential for sustaining supply chain resilience and safeguarding the shopper experience amid evolving trade dynamics.

Dissecting the Multifaceted Segmentation of Duty-Free Retail through Product Categories Travel Preferences and Distribution Channels

A nuanced understanding of duty-free market segmentation is vital for crafting differentiated strategies that resonate with diverse traveler cohorts and optimize retail performance. Within the product category segmentation, beauty and cosmetics dominate through fragrances imbued with exclusive aromas, haircare treatments tailored to jet-lagged consumers, makeup launches previewed in flagship stores, and skincare innovations that speak to on-the-go rejuvenation. Meanwhile, confectionery offerings span artisanal candies, luxury chocolates, gourmet cookies and biscuits, and colorful gummies, all curated to evoke a sense of indulgence during transit.

The electronics category remains a high-velocity segment, driven by noise-cancellation headphones, compact camera systems, and portable charging solutions. Fashion and accessories encompass a spectrum from luxury apparel and designer footwear to premium handbags and wallets, artisanal jewelry, and statement timepieces, each reflecting the traveler’s desire for both style and functionality. Gourmet foods capture specialty cheeses, premium olive oils, unique brewed teas, and exotic spices and herbs, enriching the culinary narrative of cross-border commerce.

In addition, tobacco products such as cigarettes and cigars continue to command attention among specific traveler demographics, while wines and spirits showcase an array of cocktail mixers, aged rums, premium vodkas, refined whiskeys, and celebrated wine selections. When segmentation is applied by travel type, business travelers value streamlined service, compact gifting sets, and high-end electronics, whereas leisure travelers gravitate toward experiential purchases and collectible souvenirs. Location-based segmentation highlights the distinction between curbside border shops, bustling international airports, scenic sea ports, and regional train stations, each presenting unique traffic patterns and shopper mindsets that inform assortment and promotional planning.

This comprehensive research report categorizes the Duty-Free Retailing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Categories

- Travel Type

- Location

Illuminating Regional Trends in Duty-Free Retail across the Americas Europe Middle East Africa and the Asia-Pacific Travel Corridors

Regional distinctions in duty-free retail underscore the importance of tailoring strategies to local market characteristics, traveler profiles, and regulatory frameworks. In the Americas, cross-border shopping along the US-Mexico frontier remains a staple of the category, with border shops offering competitively priced tobacco and spirits, while Caribbean cruise ports integrate duty-free boutiques that cater to multi-national itinerants seeking luxury goods. Additionally, North American international hubs have ramped up investment in premium beauty and tech stores to serve a mix of business and leisure segments transiting through gateway cities.

Across Europe, the Middle East, and Africa, airport conglomerates have leveraged duty-free as a core revenue driver, blending high-value fashion concessions with expansive spirit and fragrance boutiques. Middle Eastern transit hubs in Dubai and Doha showcase immersive brand pavilions and experiential pop-ups that reinforce regional hospitality standards. Meanwhile, African border corridors are witnessing growth in locally curated gourmet food assortments and artisanal crafts, aligning with a burgeoning trend toward heritage branding.

In the Asia-Pacific region, gateway airports in Hong Kong, Singapore, and Tokyo lead with expansive duty-free precincts that blend global luxury houses with emerging regional labels. Southeast Asian sea ports and train stations complement this growth by introducing micro-duty-free formats that address shorter dwell times and domestic tourism flows. Collectively, these regional insights highlight the dynamic interplay between local culture, traveler behavior, and retail execution.

This comprehensive research report examines key regions that drive the evolution of the Duty-Free Retailing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Duty-Free Retail Players and Strategic Collaborations Forging Competitive Advantages in the Global Travel Retail Arena

Leading players in duty-free retail continue to expand their footprints and diversify offerings through strategic partnerships and technological investments. Integrated travel retailers such as major airport concession operators have established alliances with luxury conglomerates to secure exclusive distribution rights for premium beauty and fashion brands, thereby enhancing their brand portfolios and elevating in-store experiences. Concurrently, specialist operators in the gourmet and beverage categories collaborate directly with distillers and artisans to launch limited-edition collections that cater to discerning travelers seeking unique provenance stories.

Global beauty and cosmetics manufacturers drive category growth by unveiling traveler-exclusive product lines and leveraging brand ambassadors to host in-person activations at key terminals and checkpoints. Chocolate and confectionery brands capitalize on festive calendars and local customs by creating regionally themed gift packs that resonate with cross-border shoppers. Electronics giants partner with airport authorities to install dedicated tech lounges, offering hands-on demos and fast-track pick-up services to business travelers and digital nomads.

Moreover, aviation industry alliances and duty-free consortiums share best practices on sustainability, customer engagement, and digital innovation, accelerating sector-wide progress. These collaborative efforts underscore the importance of end-to-end ecosystem integration, from procurement through omnichannel fulfillment, ensuring that retailers and brands maintain a competitive edge in a complex global marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Duty-Free Retailing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3Sixty Duty Free

- Adani Digital Labs Private Limited

- Aer Rianta International cpt

- AirAsia Group

- ALFA Brands Inc.

- Avolta AG

- China Duty Free Group Co., Ltd.

- Dubai Duty Free

- Duty Free Americas, Inc.

- Duty Free International Limited

- Ferrero International

- Flemingo International Ltd.

- Gebr. Heinemann SE & Co. KG

- Hanwha Corporation

- Hyundai Department Store Group Co., Ltd.

- Inflyter SAS

- JDC duty free

- King Power Group

- Lagardère Travel Retail SAS

- Le Bridge Corporation Limited

- Lotte Corporation

- LVMH Moët Hennessy Louis Vuitton

- NAA Retailing Corporation

- Przedsiębiorstwo Handlu Zagranicznego Baltona S.A.

- Qatar Duty Free Company W.L.L.

- Shilla Travel Retail Pte Ltd.

- Shinsegae DF by Shinsegae Co., Ltd.

- The James Richardson Group

- Tobacco Plains Duty Free Shop

- Unifree

- WH Smith PLC

Strategic Recommendations for Duty-Free Retail Leaders to Navigate Market Disruptions and Capitalize on Emerging Consumer Trends

To thrive amid ongoing disruptions and evolving consumer expectations, duty-free retail leaders must adopt a proactive, data-driven approach to portfolio management, customer engagement, and operational efficiency. First, leveraging advanced analytics platforms to segment travelers by purchasing patterns and lifestyle indicators will enable more targeted assortment decisions and personalized promotions, thereby boosting conversion rates and average transaction values. In parallel, investing in digital touchpoints such as mobile pre-order portals and contactless checkout systems will streamline the shopper journey and reinforce brand loyalty.

Furthermore, cultivating strategic partnerships with airlines, local tourism boards, and logistics providers can create synergistic opportunities for joint marketing campaigns and seamless cross-channel fulfillment solutions. Leaders should also explore alternative sourcing arrangements, including near-shoring and direct trade agreements, to mitigate tariff volatility and enhance supply chain agility. Sustainability initiatives-ranging from eco-friendly packaging to carbon-offset programs-should be embedded into core business practices, reflecting traveler preferences for responsibly produced goods.

Finally, empowering frontline staff through continuous training on product storytelling, cultural sensitivity, and digital tools will elevate in-store experiences and drive deeper emotional connections with shoppers. By implementing these recommendations in an integrated manner, industry stakeholders can navigate uncertainty, capitalize on emerging trends, and secure long-term resilience in the competitive duty-free retail landscape.

Detailing the Robust Research Framework Employed to Analyze Duty-Free Retail Markets Including Data Sources Analytical Approaches and Validation Methods

This analysis is underpinned by a robust research framework designed to yield comprehensive, actionable insights into the duty-free retail sector. Primary research involved in-depth interviews with senior executives from airport authorities, travel retailers, brand licensors, and logistics providers, enabling nuanced perspectives on emerging challenges and innovation imperatives. These candid discussions provided firsthand accounts of tariff impacts, consumer preferences, and operational best practices, directly informing our thematic analysis.

Secondary research encompassed a thorough review of industry publications, regulatory announcements, trade association reports, and financial disclosures, ensuring alignment with the latest policy developments and market narratives. To enhance data validity, we triangulated findings across multiple sources and conducted field observations at major international airports and border shops, capturing real-time shopper behaviors and store executions. Comparative benchmarking against adjacent retail channels further contextualized duty-free trends within the broader retail ecosystem.

Analytical methodologies included qualitative content analysis to identify recurring themes, scenario-planning simulations to assess tariff risk exposure, and customer journey mapping to pinpoint critical touchpoints. Throughout the process, rigorous quality controls and peer reviews were employed to guarantee the reliability and relevance of our conclusions. This systematic approach provides stakeholders with a clear understanding of current dynamics and strategic pathways forward.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Duty-Free Retailing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Duty-Free Retailing Market, by Product Categories

- Duty-Free Retailing Market, by Travel Type

- Duty-Free Retailing Market, by Location

- Duty-Free Retailing Market, by Region

- Duty-Free Retailing Market, by Group

- Duty-Free Retailing Market, by Country

- United States Duty-Free Retailing Market

- China Duty-Free Retailing Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Insights on Duty-Free Retail Dynamics to Guide Stakeholder Decisions and Foster Sustainable Growth within the Travel Retail Sector

In conclusion, the duty-free retail landscape is at an inflection point characterized by heightened traveler expectations, evolving tariff regimes, and intensified competitive dynamics. Retailers and brand partners who embrace digital integration, experiential engagement, and resilient sourcing practices will be best positioned to capitalize on growth opportunities. Moreover, a nuanced appreciation of segmentation and regional nuances will enable tailored strategies that resonate with diverse traveler cohorts and operating environments.

The cumulative impact of United States tariff measures in 2025 underscores the need for agile supply chain management and proactive scenario planning to mitigate cost pressures. Meanwhile, ongoing investments in sustainability and personalized retail experiences will continue to differentiate leading operators in an increasingly crowded field. By grounding decisions in rigorous research, leveraging real-time analytics, and fostering cross-industry collaboration, stakeholders can navigate disruptions and foster long-term value creation.

Ultimately, the future of duty-free retail hinges on the ability to anticipate shifts in consumer behavior, adapt to regulatory changes, and innovate through partnership. As the sector continues to evolve, maintaining a strategic focus on customer centricity and operational excellence will serve as the cornerstone for sustainable success in the global travel retail arena.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Duty-Free Retail Insights and Propel Strategic Decision Making

I encourage you to connect with Associate Director Ketan Rohom to explore how these insights can be tailored to your unique strategic objectives. Ketan’s extensive background in travel retail sales and marketing will ensure you gain a deeper understanding of the duty-free landscape and unlock actionable intelligence for your organization. By engaging directly, you can discuss bespoke research extensions, clarify any specific analytical needs, and secure priority access to proprietary data and expert briefings. Take this opportunity to leverage specialized guidance that will accelerate your decision-making process and strengthen your competitive position in the dynamic duty-free retail environment.

- How big is the Duty-Free Retailing Market?

- What is the Duty-Free Retailing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?