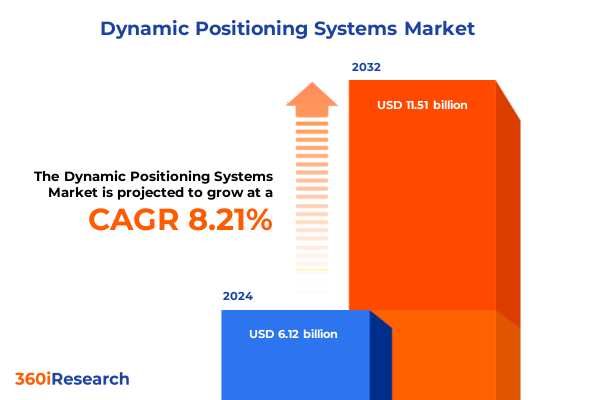

The Dynamic Positioning Systems Market size was estimated at USD 6.61 billion in 2025 and expected to reach USD 7.14 billion in 2026, at a CAGR of 8.24% to reach USD 11.51 billion by 2032.

Unveiling the Strategic Importance of Dynamic Positioning Systems in Modern Offshore Operations and Emerging Maritime Ventures

In an era defined by increasingly complex offshore operations and stringent regulatory scrutiny, dynamic positioning systems have emerged as a pivotal technology enabling vessels to maintain precise station-keeping without reliance on traditional anchoring. The convergence of deeper water exploration, renewable energy installations, and specialized subsea construction has propelled dynamic positioning beyond its initial applications in deepwater drilling into a broad spectrum of maritime ventures. As platforms extend into harsher environments and undertake delicate tasks such as cable-laying and pipeline maintenance, the ability to stabilize vessels with centimeter-level accuracy under varying sea states has become a fundamental operational requirement.

Moreover, the maturation of sensor fusion, advanced control algorithms, and real-time data analytics has significantly enhanced the reliability and performance of dynamic positioning architectures. These advances have catalyzed a shift toward more autonomous operations, reducing human error and enabling efficient mission planning. Concurrently, evolving environmental mandates are driving demand for lower emissions, prompting manufacturers and end users alike to reevaluate power and propulsion configurations within dynamic positioning frameworks. Against this backdrop, the strategic importance of this technology extends across offshore oil and gas, renewable energy sectors spearheaded by offshore wind and tidal power initiatives, and specialized research missions seeking to navigate deep-sea mining and oceanographic studies with minimal footprint.

Consequently, a nuanced understanding of dynamic positioning systems is indispensable for stakeholders navigating capital-intensive projects and supply chain complexities. This executive summary distills the essential trends, tariff implications, segmentation insights, regional dynamics, and competitive maneuvers shaping the industry, equipping decision makers with the clarity required to harness the full potential of dynamic positioning in their strategic roadmaps.

Examining the Disruptive Forces and Technological Innovations Reshaping the Dynamic Positioning Systems Landscape Across Global Maritime Sectors

The dynamic positioning systems landscape is undergoing transformative shifts driven by the rapid integration of digital technologies and the imperative of sustainability. From the advent of cloud-based control solutions to the application of artificial intelligence in predictive maintenance, these technological innovations are redefining performance benchmarks. As vessels increasingly rely on advanced positioning sensors-encompassing GPS receivers, gyrocompass modules, and motion reference units-the ability to process and interpret high-frequency data streams in real time has become a competitive differentiator. Such sensor fusion frameworks are now complemented by sophisticated software suites that manage redundancy, fault tolerance, and adaptive control algorithms, which collectively elevate system resilience in dynamic marine environments.

In parallel, the convergence of green energy mandates and offshore wind farm developments is reshaping platform requirements. Research vessels, once predominantly dedicated to scientific exploration, are now at the forefront of deploying and servicing tidal power arrays, while cable-laying vessels adapting dynamic positioning functionality ensure uninterrupted installation of subsea electrical grids. Similarly, the oil and gas sector continues to demand DP architectures with enhanced power modules and reference systems capable of sustaining drilling vessels-ranging from drill ships to jack-up rigs-with uninterrupted station keeping during high-precision operations. This dual evolution toward cleaner energy integration and deeper water exploration underscores a critical inflection point for industry participants.

Furthermore, mounting regulatory pressures on emissions and the imperative to enhance safety protocols have catalyzed the adoption of battery-augmented and diesel-electric hybrid power configurations. These trends are amplified by growing investor scrutiny on environmental, social, and governance criteria, compelling manufacturers and operators to innovate around energy-efficient thrusters, retractable and tunnel variants, while ensuring compliance with the latest class certifications. In essence, the dynamic positioning sphere is in the midst of a radical redefinition, where technological prowess, sustainability, and regulation coalesce to form the cornerstones of future competitiveness.

Assessing the Compound Effects of 2025 United States Tariff Measures on Supply Chains and Operational Costs of Dynamic Positioning Systems

The introduction of escalated United States tariffs in early 2025 has precipitated a complex ripple effect across global supply chains supporting dynamic positioning systems. With steel, specialized electronics, and precision components now subject to higher duties, component manufacturers have faced cost pressures that have, in turn, been transmitted to system integrators and end-user operators. In response, several leading suppliers have pursued localized sourcing strategies, establishing assembly lines within North American free trade zones to mitigate the margin erosion caused by import levies. This realignment, while capital intensive initially, has yielded greater supply chain resilience, reducing exposure to transpacific logistical disruptions and fostering closer collaboration with regional engineering partners.

Simultaneously, operators of cable-laying vessels and offshore support vessels have restructured procurement cycles to factor in longer lead times and contingency buffers. The drilling vessel segment, with its acute dependency on high-specification thrusters and control computers, has been particularly sensitive to tariff-induced cost escalations. Consequently, end users have accelerated maintenance schedules and sought extended service contracts to defer capital expenditure on replacement assets. These strategic responses have not only cushioned immediate financial impacts but have also underscored the strategic value of asset lifecycle management within dynamic positioning frameworks.

Looking ahead, industry leaders are increasingly advocating for collaborative engagement with policymakers to calibrate tariff regimes that recognize the specialized nature of dynamic positioning components. By quantifying domestic manufacturing capacity shortfalls and highlighting the national security imperatives underpinning offshore infrastructure, stakeholders aim to secure exemptions or preferential treatment for mission-critical elements. Such advocacy efforts, when coupled with targeted R&D tax incentives, can expedite the development of indigenous capacity for GPS receivers, thrusters, and power modules, thereby fostering a more robust and self-sufficient dynamic positioning ecosystem within the United States.

Deriving Actionable Insights from Type Platform End User Component and Power Type Segmentation within the Dynamic Positioning Systems Market

A granular evaluation of market segmentation reveals distinct adoption patterns and performance imperatives across multiple dimensions. Based on type classifications, the market delineates into DP1 systems offering fundamental station keeping, DP2 architectures delivering redundant control for moderate risk operations, and DP3 platforms engineered for the highest criticality missions where dual redundant systems ensure uninterrupted functionality. While DP1 remains prevalent in research vessels, DP2 and DP3 have become indispensable for drilling vessels and offshore support vessels tasked with complex subsea construction and well intervention activities.

Platform segmentation further illustrates that cable-laying vessels rely on mid-tier DP2 configurations for precise trenching and burial tasks, whereas drill ships and semi-submersibles demand DP3 systems to manage the intricate dynamics of deepwater drilling. Jack-up rigs integrate specialized reference systems and power modules to maintain stability during load transfers, and FPSOs deploy dynamic positioning controls to counteract mooring line fatigue under volatile sea states. Meanwhile, anchor handling tug supply vessels, well intervention vessels, and seismic carriers employ tailored thruster arrays-ranging from azimuth to tunnel variants-to optimize maneuverability and minimize environmental footprint.

End-user segmentation underscores the diversified utility of dynamic positioning technology. Deep-sea mining operations leverage state-of-the-art positioning sensors in conjunction with battery-augmented hybrid power configurations to support autonomous subsea vehicles with reduced emissions. In the oil and gas domain, exploration and production platforms invest heavily in gyrocompass and motion reference units, whereas pipeline installation and maintenance contractors prioritize electric DP systems with AC/DC flexibility for prolonged station-keeping during tie-in campaigns. The renewable energy sector, particularly offshore wind arrays, integrates DP2 solutions to align turbine foundation installations, while nascent tidal power initiatives are experimenting with electro-hydraulic systems to enhance turbine alignment accuracy.

Component-level analysis highlights the growing significance of DP control computers and software, which orchestrate real-time adjustments across sensor networks. GPS receivers, gyroscopic instrumentation, and motion reference units feed critical data into power module management systems that regulate energy distribution across thruster banks. Reference systems now incorporate inertial navigation back-ups, and thruster innovations span retractable and azimuth designs to deliver precise lateral and longitudinal control. Lastly, the evolution of power type preferences-from traditional electro-hydraulic architectures to fully electric and hybrid diesel-electric platforms-reflects end-user demand for modular, energy-efficient solutions that align with decarbonization targets.

This comprehensive research report categorizes the Dynamic Positioning Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Platform

- Components

- Power Type

- End User

Identifying Regional Nuances and Growth Drivers across the Americas Europe Middle East and Africa and Asia-Pacific in Dynamic Positioning Systems Adoption

Regional dynamics in the dynamic positioning systems arena manifest in differentiated growth catalysts and technology adoption curves. Within the Americas, robust offshore oil and gas exploration frameworks, particularly in the Gulf of Mexico and Brazilian deepwater fields, have historically underpinned investment in advanced DP3 solutions. Recent expansions of offshore wind projects along the Atlantic seaboard and Pacific rim, coupled with emerging deep-sea mining initiatives off the coast of Canada, are diversifying the regional demand profile. This multifaceted momentum encourages domestic fabrication of positioning sensors and thrusters, while fostering collaborative pilot programs between vessel operators and technology developers to tailor systems for extreme sea states.

In Europe, the Middle East and Africa, the confluence of mature North Sea wind enterprises, Gulf of Mexico analogues in the Middle East’s offshore gas operations, and nascent exploration projects off the African continental shelf presents a complex mosaic of requirements. European regulators’ stringent emissions mandates have accelerated the transition to battery-augmented hybrid power types on drilling vessels, and several EMEA-based research institutions are collaborating on tidal power pilot sites that employ DP2 systems for turbine deployment. Furthermore, localized manufacturing clusters in Norway and the United Kingdom have emerged as hubs for control computer and reference system innovation, reinforcing the EMEA region’s leadership in high-reliability system production.

Across the Asia-Pacific, a confluence of renewable energy policy shifts and strategic resource exploration is redefining the DP landscape. Chinese offshore wind installations demand scalable DP2 platforms capable of extended station-keeping, while Australian deep-sea mining and research expeditions require DP3 configurations to support autonomous subsea vehicles. Japan’s emphasis on ocean science has spurred upgrades to research vessels, integrating modern navigation sensors and software suites. Meanwhile, Southeast Asian naval and offshore support fleets are investing in retrofit programs to replace legacy electro-hydraulic systems with more efficient electric and hybrid power modules, underscoring the region’s holistic approach to modernizing maritime capabilities.

This comprehensive research report examines key regions that drive the evolution of the Dynamic Positioning Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Strategies and Innovation Portfolios of Leading Manufacturers Shaping the Dynamic Positioning Systems Ecosystem

Leading manufacturers in the dynamic positioning ecosystem are deploying multifaceted strategies to consolidate market share and accelerate innovation cycles. Several incumbents have scaled research and development investments toward next-generation control software platforms that integrate machine learning for anomaly detection and autonomous decision-making. Concurrently, collaborative partnerships between sensor specialists and thruster producers are yielding integrated packages that simplify vessel retrofits and newbuild installations. This move toward turnkey dynamic positioning offerings aligns with operators’ preferences for reduced vendor complexity and streamlined support footprints.

Moreover, merger and acquisition activity continues to shape competitive dynamics. Strategic acquisitions of boutique software houses by larger conglomerates have bolstered product portfolios, enabling end-to-end solutions encompassing hardware, software, and lifecycle services. The emergence of joint ventures with regional system integrators has improved local market access, particularly in geographies where regulatory compliance and certification requirements demand intimate collaboration with classification societies. In parallel, service-oriented business models-comprising predictive maintenance subscriptions, remote diagnostics, and capacity-upgrading modules-are gaining traction, providing continuous revenue streams beyond initial equipment sales.

Finally, sustainable performance has become a core differentiator. Manufacturers introducing thrusters with lower acoustic signatures and reduced fuel consumption are capturing the attention of operators in sensitive marine environments. Similarly, vendors emphasizing modular power modules that can transition between AC, DC, and hybrid configurations are well positioned to address fluctuating energy cost structures and emission control objectives. Collectively, these strategies underscore a dynamic competitive landscape where technological leadership, strategic alliances, and comprehensive service ecosystems define market standing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dynamic Positioning Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo Penta

- ABB Ltd.

- Brunvoll AS

- GE Vernova

- Japan Radio Co., Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Marine Technologies, LLC

- Navis Engineering Oy

- Praxis Automation Technology B.V.

- Rolls-Royce Holdings plc

- Sirehna SAS

- Sonardyne Group Ltd.

- Twin Disc, Inc.

- Wärtsilä Corporation

Formulating Strategic Initiatives and Operational Best Practices to Enhance Competitiveness in the Dynamic Positioning Systems Industry

To thrive in the evolving dynamic positioning domain, industry leaders must adopt a proactive blueprint that balances technological depth with operational agility. It is imperative to prioritize the deployment of software-defined control architectures, enabling rapid updates and customization without overhauling hardware layers. Simultaneously, investing in sensor fusion frameworks that harmonize GPS receivers, gyrocompass data, and motion reference inputs will deliver granular situational awareness, reducing downtime and enhancing safety margins during complex subsea operations.

Equally important is the diversification of supply chain networks to mitigate exposure to geopolitical and tariff-driven disruptions. Cultivating partnerships with regional component fabricators, establishing dual-sourcing strategies for critical modules, and leveraging free trade zones can substantially bolster resilience. In parallel, operators should explore performance contracting models with equipment suppliers, aligning maintenance incentives with uptime performance to optimize total cost of ownership.

Sustainability must be woven into every strategic initiative. Embracing battery-augmented and diesel-electric hybrid power configurations can drastically lower emissions while offering operational flexibility for vessels with intermittent station-keeping demands. Furthermore, integrating digital twins of dynamic positioning systems will facilitate scenario testing, predictive maintenance scheduling, and continuous performance optimization. By combining these technological, operational, and sustainability-driven guidelines, stakeholders can position themselves at the forefront of a competitive and rapidly maturing market landscape.

Elucidating the Rigorous Research Framework Data Collection Techniques and Analytical Approaches Underpinning the Dynamic Positioning Systems Study

The methodology underpinning this analysis is rooted in a multi-tiered research framework that synthesizes primary and secondary data through rigorous validation processes. Initially, an extensive literature review was conducted, drawing on industry publications, regulatory filings, and academic research to establish foundational knowledge of dynamic positioning technologies and market dynamics. This was complemented by in-depth interviews with vessel operators, equipment manufacturers, and regulatory experts to capture firsthand perspectives on evolving performance requirements and compliance regimes.

Subsequently, a structured survey was administered across a representative cross-section of stakeholders, including deep-sea mining contractors, offshore wind developers, and marine research institutions. The resulting quantitative data were triangulated against proprietary shipment records, service contract databases, and supply chain analytics to identify convergence points and outliers. A series of expert workshops and peer reviews then subjected the preliminary findings to critical scrutiny, ensuring methodological rigor and mitigating potential biases.

Finally, advanced analytical techniques-including cluster analysis on segmentation dimensions and scenario modeling to assess tariff impact trajectories-were employed to generate holistic insights. Throughout the process, transparency was maintained via an audit trail of data sources and decision rationales, while confidentiality protocols safeguarded sensitive participant information. This layered approach ensures that the conclusions and recommendations articulated herein rest on a robust evidence base and offer actionable clarity for strategic decisionmakers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dynamic Positioning Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dynamic Positioning Systems Market, by Type

- Dynamic Positioning Systems Market, by Platform

- Dynamic Positioning Systems Market, by Components

- Dynamic Positioning Systems Market, by Power Type

- Dynamic Positioning Systems Market, by End User

- Dynamic Positioning Systems Market, by Region

- Dynamic Positioning Systems Market, by Group

- Dynamic Positioning Systems Market, by Country

- United States Dynamic Positioning Systems Market

- China Dynamic Positioning Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Consolidating Key Findings and Strategic Implications to Guide Decision Makers in Leveraging Dynamic Positioning Systems for Future Maritime Excellence

The comprehensive examination of dynamic positioning systems underscores the technology’s indispensable role in modern maritime operations and its trajectory toward greater automation, energy efficiency, and environmental stewardship. Across segmentations by type, platform, end user, component, and power configurations, clear patterns emerge: advanced DP3 architectures are increasingly paramount for high-risk offshore tasks, while hybrid power models and sensor fusion software are driving efficiency and compliance.

Regional analysis highlights the Americas’ diversified offshore portfolio, EMEA’s regulatory-driven innovation hubs, and Asia-Pacific’s aggressive renewable and resource exploration mandates. Competitive insights reveal that manufacturers embracing turnkey solutions, sustainable performance metrics, and service-oriented business models are best positioned to capture market leadership. Crucially, the compound effects of 2025 tariff measures have galvanized supply chain realignment and underscored the strategic necessity of localized sourcing and policy advocacy.

Taken together, these findings provide a coherent blueprint for stakeholders seeking to harness dynamic positioning systems as a catalyst for operational excellence and strategic differentiation. By calibrating technology investments, supply chain strategies, and sustainability initiatives against the evolving regulatory and competitive landscape, industry participants can chart resilient paths forward in a dynamic and increasingly contested maritime environment.

Empowering Stakeholders to Secure Comprehensive Market Intelligence on Dynamic Positioning Systems in Partnership with Ketan Rohom for Informed Strategic Decisions

Unlock unparalleled insights with the authoritative dynamic positioning systems market research report guided by Ketan Rohom, Associate Director of Sales & Marketing. Engage directly with an expert who can tailor a consultation to your organization’s unique operational context and strategic objectives. Whether you are a vessel operator seeking to optimize control architectures, a component supplier aiming to anticipate emerging sensor demands, or an investor evaluating regional growth trajectories, this comprehensive analysis empowers you with the clarity and confidence to make informed decisions. Partnering with Ketan Rohom ensures streamlined access to proprietary data, in-depth competitive benchmarking, and actionable intelligence. Take the next decisive step toward securing your competitive advantage in the rapidly evolving dynamic positioning systems landscape by reaching out to Ketan Rohom today to discuss customized licensing options, supplementary deep-dive modules, or enterprise-wide deployments of the full market intelligence suite.

- How big is the Dynamic Positioning Systems Market?

- What is the Dynamic Positioning Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?