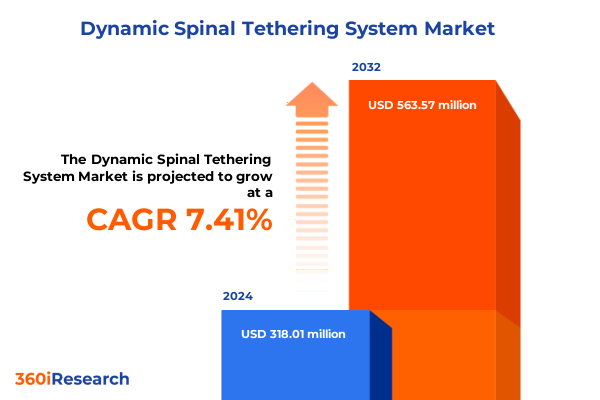

The Dynamic Spinal Tethering System Market size was estimated at USD 340.62 million in 2025 and expected to reach USD 364.97 million in 2026, at a CAGR of 7.45% to reach USD 563.57 million by 2032.

Establishing the Dynamic Spinal Tethering System Overview Emphasizing Technological Innovation, Clinical Benefits, and Strategic Imperatives for Stakeholders

The dynamic spinal tethering system represents a paradigm shift in spinal care, merging biomechanical innovation with patient-centric design to address complex spinal pathologies. At its core, this approach diverges from traditional rigid fixation by introducing flexible tethers that preserve natural spinal motion while providing corrective force. As the healthcare industry grapples with escalating demands for minimally invasive solutions and improved long-term outcomes, dynamic tethering technologies have emerged as a promising alternative to fusion-based treatments.

In this context, stakeholders across the value chain-from device manufacturers to surgeons and payers-are recalibrating their strategies to align with these emerging clinical preferences. The integration of advanced materials such as shape-memory alloys and high-performance polymers is enabling a new generation of implants that adapt to patient biomechanics, thereby reducing recovery times and enhancing overall quality of life. Consequently, the dynamic spinal tethering system is poised to play a pivotal role in reshaping therapeutic pathways and redefining standards of care.

Furthermore, the broader emphasis on personalized medicine underscores the importance of modular and adaptable device architectures. As clinical evidence continues to validate the benefits of motion-preserving interventions, market participants are investing in research and development to refine tether configurations, expand indications, and optimize surgical workflows. Thus, understanding the foundational dynamics of this evolving segment is essential for decision-makers seeking to capitalize on innovation and deliver superior patient outcomes.

Examining Transformative Shifts Reshaping the Spinal Tethering Landscape Including Technological Advancements, Patient Demographics, and Regulatory Evolution

Over recent years, the dynamic spinal tethering landscape has been reshaped by several transformative forces that are redefining industry dynamics. Technological advancement sits at the forefront, with next-generation materials and sensor-integrated devices enabling real-time intraoperative feedback and postoperative monitoring. These developments are enhancing surgical precision and promoting adaptive healing processes, thereby elevating the standard of care.

Simultaneously, demographic shifts are exerting considerable influence on market trajectories. The aging population in developed economies is driving greater demand for motion-preserving spinal solutions, while pediatric and adolescent segments are embracing dynamic tethering systems for early intervention in idiopathic and congenital scoliosis. In response, manufacturers are innovating design platforms to cater to diverse anatomical profiles and life stages, emphasizing versatility and customized treatment planning.

Moreover, evolving regulatory frameworks are catalyzing a reexamination of approval pathways, encouraging collaborative research between device makers and regulatory agencies. Harmonized clinical trial requirements and expedited review processes provide fertile ground for accelerating market entry, though they also necessitate rigorous safety and performance validation. As reimbursement policies shift toward value-based care, cost-effectiveness analyses and long-term outcome data become critical success factors.

Thus, these convergent trends-technological innovation, shifting patient demographics, regulatory evolution, and reimbursement reform-are collectively steering the dynamic spinal tethering system sector toward a more agile, patient-focused future.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Dynamic Spinal Tethering System Supply Chains, Cost Structures, and Competitive Dynamics

The imposition and evolution of United States tariffs in 2025 have introduced a complex layer of cost considerations and supply chain recalibrations for dynamic spinal tethering system providers. Tariff adjustments targeting key components such as nitinol and advanced polymers have prompted companies to reassess their sourcing strategies, seeking alternative suppliers or nearshoring options to mitigate escalating import duties. Consequently, supply networks are being redesigned for resilience and flexibility, balancing cost containment with the imperative to maintain material quality.

In parallel, manufacturers are negotiating with logistics partners to explore consolidated freight solutions and flexible shipping windows that reduce exposure to sudden tariff spikes. This operational pivot is fostering closer collaboration across the procurement function, engineering teams, and finance departments to develop scenario-based models that anticipate policy shifts. As a result, product cost structures are adapting in real time, which underscores the importance of transparent supplier agreements and proactive tariff management protocols.

Furthermore, these trade measures have influenced competitive dynamics, elevating the strategic importance of domestic production capabilities. Investment in local manufacturing facilities is accelerating, driven by the desire to insulate critical production processes from international tariff volatility. While this localization trend entails upfront capital commitments, it also offers enhanced control over quality, lead times, and regulatory compliance.

In essence, the cumulative impact of 2025 tariffs is catalyzing a strategic transformation in supply chain design, cost management, and geographic footprint optimization for companies operating in the dynamic spinal tethering system domain.

Uncovering Key Segmentation Insights Based on Material Composition, Tether Type Variations, Age Group Demographics, Application Categories, and End User Channels

The market’s segmentation landscape for dynamic spinal tethering systems reveals nuanced insights when examined through multiple analytical lenses. Based on material composition, platforms incorporating nitinol deliver superior shape-memory performance, while high-density polyethylene options offer cost efficiency and biocompatibility, and titanium configurations ensure structural robustness. Each material category addresses distinct clinical priorities, guiding design trade-offs between flexibility, durability, and imaging compatibility.

Shifting attention to tether type, dynamic constructs are engineered to support both single-level corrections and multi-level applications, affording surgeons a spectrum of therapeutic precision. Static tethering remains relevant for scenarios demanding rigid stabilization, yet dynamic variants are gaining traction due to their capacity to mimic physiological motion. This duality underscores the importance of product portfolios that accommodate diverse surgical philosophies and patient anatomies.

Age group segmentation further refines market understanding, as adult populations often prioritize minimized invasiveness and accelerated recovery timelines, whereas geriatric cohorts emphasize stability and long-term durability. Pediatric and adolescent cases present unique biomechanical challenges, particularly in managing progressive idiopathic and congenital scoliosis, which in turn drives demand for adjustable tether configurations that grow with the patient.

Application-focused analysis highlights distinct pathways for degenerative disc disease, scoliosis subtypes-ranging from congenital to neuromuscular forms-and adjunctive support in spinal fusion procedures. These clinical indications delineate varying device performance requirements, from curvature modulation to fusion load sharing. Finally, end user channels, including ambulatory surgical centers, hospitals, and specialty clinics, define distribution strategies and service models, shaping how products are marketed and supported across care settings.

This comprehensive research report categorizes the Dynamic Spinal Tethering System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Tether Type

- Age Group

- Application

- End User

Analyzing Key Regional Insights Across the Americas, Europe Middle East and Africa, and Asia Pacific to Understand Divergent Market Dynamics and Opportunities

Regional performance within the dynamic spinal tethering market reflects the interplay of healthcare infrastructure, regulatory environments, and demographic imperatives. In the Americas, robust private sector investment and a favorable reimbursement climate drive early adoption of advanced tethering technologies. North American centers of excellence are catalysts for clinical research, fostering key opinion leader engagement and facilitating surgeon training programs. In Latin America, gradual expansion of healthcare access and targeted government initiatives are creating new growth corridors, although pricing sensitivity remains a critical factor.

Turning to Europe, Middle East & Africa, heterogeneous healthcare systems present both opportunities and challenges. Western European nations benefit from well-established reimbursement pathways and high procedural volumes, whereas emerging markets in the Middle East and Africa exhibit nascent adoption curves tempered by infrastructure constraints. Yet, growing urbanization and increased focus on musculoskeletal health underscore the long-term potential of these regions. Harmonized regulatory frameworks in the European Union streamline device approval, while collaborative funding mechanisms in Gulf Cooperation Council countries are accelerating capital deployment.

Lastly, in Asia Pacific, rapid expansion of the private healthcare sector, coupled with rising disposable incomes and aging populations, fuels demand for minimally invasive spinal solutions. Markets such as Japan and Australia demonstrate sophisticated clinical uptake, whereas emerging economies in Southeast Asia and India are characterized by progressive hospital investments and volume-driven procurement. Moreover, regional manufacturing hubs are maturing, enabling localized production that alleviates import dependencies and supports competitive pricing.

Collectively, these regional dynamics shape differentiated go-to-market strategies and partnership models for stakeholders seeking to maximize reach and impact across diverse healthcare landscapes.

This comprehensive research report examines key regions that drive the evolution of the Dynamic Spinal Tethering System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Companies Shaping the Spinal Tethering System Market Through Innovation, Strategic Collaborations, and Differentiated Technology Portfolios

Several leading companies are driving innovation and shaping competitive trajectories within the dynamic spinal tethering arena. Pioneers in shape-memory alloys are collaborating with biomedical engineers to refine nitinol-based constructs that offer improved elasticity and fatigue resistance. Simultaneously, polymer specialists are formulating advanced polyethylene composites designed to enhance biostability and reduce wear, positioning themselves as strategic partners for modular device platforms.

In parallel, established orthopedic conglomerates are leveraging their global distribution networks to accelerate market penetration and surgeon education initiatives. Through strategic collaborations with academic centers and real-world evidence studies, these organizations are generating robust clinical data that reinforce product differentiation and inform reimbursement dossiers. Additionally, emerging medtech entrants are securing venture capital funding to scale minimally invasive tethering systems, focusing on user-friendly instrumentation and integrated imaging solutions that streamline procedural workflows.

Furthermore, key alliances between device manufacturers and service providers are fostering comprehensive care models that extend beyond the implant. Digital health integrations, such as remote patient monitoring and postoperative compliance tracking, are being embedded into device ecosystems to optimize outcomes and generate longitudinal insights. These multifaceted partnerships are enabling holistic value propositions that align with payers’ emphasis on total cost of care.

As competitive intensity mounts, the landscape is witnessing a convergence of material science, data-driven clinical validation, and strategic channel management. Companies that can seamlessly integrate these dimensions are poised to secure leadership positions in the dynamic spinal tethering system market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Dynamic Spinal Tethering System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Auctus Surgical, Inc

- Globus Medical, Inc

- HIGHRIDGE Inc

- Medtronic plc

- Orthofix Medical Inc.

- OrthoPediatrics Corp.

- Premia Spine, Inc.

- SpineSave AG

- Zimmer Biomet Holdings, Inc.

- ZimVie, Inc.

Actionable Recommendations to Guide Industry Leaders in Optimizing Product Development, Supply Chain Resilience, Strategic Partnerships, Regulatory Compliance

To thrive in the evolving dynamic spinal tethering system landscape, industry leaders should prioritize a multi-pronged strategic agenda that spans product innovation, operational resilience, partnerships, and compliance. First, R&D investments must be channeled toward modular designs that accommodate both single-level and multi-level applications while leveraging advanced materials for enhanced biomechanical performance. By integrating sensor-enabled feedback and digital health components, companies can deliver differentiated clinical value and strengthen their competitive moat.

Operationally, supply chain resilience is paramount. Establishing diversified sourcing strategies, including nearshore manufacturing and dual-sourcing agreements, will shield organizations from tariff-induced cost pressures and logistical disruptions. Moreover, adopting agile procurement protocols-such as dynamic inventory management and collaborative planning with key suppliers-will enhance responsiveness to policy shifts and market fluctuations.

Strategic partnerships with clinical centers of excellence and thought leaders are indispensable for generating high-quality outcome data. Engaging healthcare providers in co-development initiatives and real-world evidence generation not only accelerates product validation but also fosters trust and advocacy within the surgical community. Concurrently, alliance-building with digital health vendors can facilitate seamless integration of telemonitoring and patient engagement tools, reinforcing the value-based care proposition.

Finally, proactive regulatory engagement and comprehensive compliance frameworks will expedite approvals and mitigate downstream risks. By collaborating with regulatory bodies on harmonized protocols and leveraging standardized submission templates, companies can streamline review timelines and ensure alignment with evolving safety standards. Collectively, these recommendations provide a roadmap for market participants to fortify their strategic positioning and drive sustainable growth.

Detailing the Comprehensive Research Methodology Employed Including Data Collection Techniques, Rigorous Validation Processes, and Analytical Frameworks

This research initiative employed a rigorous methodology that combined both primary and secondary research techniques to ensure robust and reliable insights. Initially, an extensive review of scientific literature, regulatory filings, and corporate disclosures provided the foundational context for understanding material innovations, device classifications, and clinical applications. Concurrently, proprietary databases and industry publications were consulted to map the competitive landscape and identify key corporate partnerships.

Primary research was conducted through in-depth interviews with orthopedic surgeons, procurement executives, and regulatory specialists across major markets. These engagements yielded qualitative insights into clinical preferences, reimbursement challenges, and device adoption barriers. Survey instruments were designed to capture practitioner sentiment on emerging technologies, fostering a nuanced understanding of surgeon decision-making criteria.

To validate and triangulate findings, a structured data triangulation process was implemented, juxtaposing insights from expert interviews with real-world procedural data and secondary market reports. Analytical models were then applied to dissect segmentation dimensions-material, tether type, age group, application, and end user-to surface actionable insights. A cross-functional panel of advisors reviewed interim results, ensuring alignment with clinical realities and industry best practices.

Finally, the research adhered to established quality benchmarks, including transparency, reproducibility, and ethical compliance, thereby delivering a comprehensive and credible resource for stakeholders seeking to navigate the dynamic spinal tethering system market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Dynamic Spinal Tethering System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Dynamic Spinal Tethering System Market, by Material

- Dynamic Spinal Tethering System Market, by Tether Type

- Dynamic Spinal Tethering System Market, by Age Group

- Dynamic Spinal Tethering System Market, by Application

- Dynamic Spinal Tethering System Market, by End User

- Dynamic Spinal Tethering System Market, by Region

- Dynamic Spinal Tethering System Market, by Group

- Dynamic Spinal Tethering System Market, by Country

- United States Dynamic Spinal Tethering System Market

- China Dynamic Spinal Tethering System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Dynamic Spinal Tethering System Evolution Emphasizing Strategic Imperatives and Future Pathways for Stakeholders

Dynamic spinal tethering systems are redefining the paradigm of spinal care by marrying flexibility with corrective force, thus catering to diverse clinical indications and patient demographics. The interplay of advanced material technologies, evolving reimbursement landscapes, and shifting regulatory environments underscores a market at the cusp of accelerated innovation. As tariffs reshape supply chain strategies and regional disparities delineate unique growth pathways, stakeholders must remain agile and collaborative to capitalize on emerging opportunities.

In conclusion, the dynamic spinal tethering system market demands an integrated approach that aligns technological differentiation, robust clinical validation, and strategic operational agility. Decision-makers who embrace modular device platforms, pursue resilient sourcing strategies, and cultivate data-driven partnerships will be best positioned to drive meaningful advancements in patient care. Looking forward, continued investment in personalized treatment solutions, digital health integration, and harmonized regulatory engagements will shape the next frontier of spinal therapeutics.

Thus, this executive summary sets the stage for a deeper exploration of market intricacies, equipping readers with the strategic context necessary to inform critical business decisions and foster sustained competitive advantage across the dynamic spinal tethering ecosystem.

Prompting Engagement with Ketan Rohom for Further Insights and Access to the Comprehensive Market Research Report on Dynamic Spinal Tethering Systems

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth insights can empower your strategic decisions in the dynamic spinal tethering space. By connecting with Ketan, you’ll gain personalized guidance on navigating the report’s rich analysis, ensuring you extract the precise intelligence needed to stay ahead of evolving market dynamics and clinical innovations.

Take advantage of this opportunity to secure a comprehensive research asset that consolidates critical intelligence on tariffs, segmentation, regional performance, and competitive strategies. Ketan Rohom is ready to assist you in tailoring the content to your unique business needs and facilitating access to the full report. Reach out today to begin your journey toward enhanced market visibility, informed product development, and sustained competitive advantage.

- How big is the Dynamic Spinal Tethering System Market?

- What is the Dynamic Spinal Tethering System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?