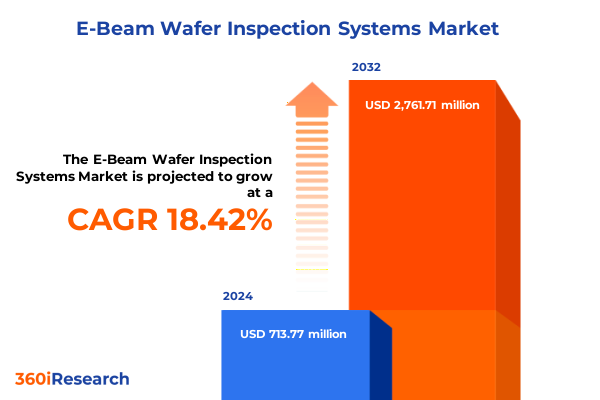

The E-Beam Wafer Inspection Systems Market size was estimated at USD 844.34 million in 2025 and expected to reach USD 1,001.49 million in 2026, at a CAGR of 18.44% to reach USD 2,761.71 million by 2032.

Discovering How Advanced Electron Beam Wafer Inspection Technologies are Revolutionizing Semiconductor Quality Assurance and Production Precision

Electron beam wafer inspection systems represent the pinnacle of defect detection and quality control in semiconductor manufacturing. By harnessing focused electron probes, these systems identify sub-nanometer anomalies that optical inspection tools cannot resolve. As feature sizes shrink and complexity escalates, manufacturers face unprecedented challenges in maintaining yield and reliability. Electron beam inspection delivers the precision needed to address defects arising from advanced lithography, novel materials, and intricate 3D architectures.

The evolution of inspection technologies has paralleled the progression of semiconductor nodes. Early optical review platforms gave way to high-resolution scanning electron microscopy for critical layer analysis. Today’s electron beam wafer inspection solutions integrate multi-beam configurations, machine learning–driven defect classification, and in-line process compatibility. This seamless orchestration of hardware and software elevates throughput while preserving the fidelity required for leading-edge nodes.

In this executive summary, we explore recent paradigm shifts, policy impacts, segmentation insights, and regional nuances shaping the electron beam inspection market. We also highlight the strategic initiatives of industry leaders, offer actionable recommendations for manufacturers, and outline the rigorous methodology behind our analysis. Ultimately, this report serves as a comprehensive guide for decision-makers seeking to enhance yield, optimize production workflows, and sustain technological leadership.

Exploring the Next Generation of Electron Beam Inspection as Emerging Technologies and Industry Forces Reshape Semiconductor Manufacturing

The landscape of wafer inspection has undergone transformative shifts driven by technological innovation, integration demands, and escalating defect control requirements. Semiconductor manufacturers are transitioning from standalone metrology islands to interconnected process control ecosystems. Electron beam systems now interface directly with lithography and etch tools, enabling real-time feedback loops that adapt exposure parameters to reduce defect introduction at each step. This heightened connectivity accelerates cycle times and supports adaptive process recipes critical for sub-5nm nodes.

Simultaneously, the rise of multi-beam architectures marks a pivotal advancement in throughput enhancement. By deploying dozens to hundreds of miniaturized electron probes in parallel, these systems achieve inspection rates once considered infeasible for high-volume production. Coupled with automated wafer handling and advanced signal processing algorithms, multi-beam tools are setting new benchmarks for efficiency without sacrificing resolution.

Artificial intelligence and big data analytics have also become integral to defect management. Machine learning models sift through vast volumes of inspection data to classify defect types, predict yield erosion, and pinpoint root-cause correlations across process inputs. These capabilities transform raw electron images into actionable intelligence, empowering fabs to preemptively fine-tune equipment settings and reduce scrap rates. As a result, the semiconductor industry is witnessing a convergence of hardware innovation and data-driven insight that is redefining the economics of yield optimization.

Analyzing the Far-Reaching Consequences of Recent United States Tariffs on Electron Beam Wafer Inspection Equipment Supply and Adoption

In 2025, the imposition of new tariffs on advanced semiconductor equipment by the United States has reverberated throughout the electron beam wafer inspection supply chain. These levies, affecting imports of specialized metrology tools, have increased acquisition costs for domestic fabs, creating a ripple effect across capital expenditure budgets. As original equipment manufacturers reassess pricing structures, some end users have postponed planned deployments, deferring throughput gains and precision improvements.

Moreover, the tariff adjustments have catalyzed shifts in sourcing strategies. Equipment vendors are exploring alternative manufacturing bases and local assembly operations to mitigate duty impacts. Partnerships with regional component suppliers have strengthened, enabling partial localization of critical subsystems such as electron optics modules and high-speed detectors. While these initiatives deliver longer-term resilience, the transition introduces lead-time variability and integration challenges amid ongoing node migrations.

On the flip side, tariff-induced pressures have spurred innovation in rental and subscription models for inspection systems. Vendors now offer flexible financing options, aligning payment milestones with tool performance milestones and yield improvement targets. This approach eases upfront financial burdens and fosters closer collaboration between fabs and metrology providers. Ultimately, while the 2025 tariff measures have introduced short-term cost headwinds, they are also prompting strategic realignments that may accelerate technological diffusion and supply chain robustness over the longer term.

Unveiling Critical Insights Across Wafer Size, Integrated Circuit Types, MEMS Structures, and Photonics Categories Driving Market Differentiation

Understanding the market through multiple segmentation lenses reveals nuanced opportunities and challenges. When examining wafer size, tools optimized for the 201–300 mm category have commanded significant interest, especially for high-volume logic and memory fabs. Within this band, systems tailored to 201–250 mm workflows excel in defect coverage for mature logic nodes, whereas those designed for 251–300 mm support advanced DRAM and 3D NAND processes. Inspection platforms for wafers above 300 mm, subdivided into 301–450 mm and larger variants, are emerging to accommodate pilot lines exploring next-generation substrates. Meanwhile, tools compatible with up to 200 mm wafers-spanning 50–100 mm, 101–150 mm, and 151–200 mm-remain critical for specialized MEMS and sensor device manufacturers.

From the perspective of integrated circuit types, inspection demands differ markedly. Logic devices drive high-resolution overlay and CD variance analysis, with microcontrollers benefiting from fewer inspection cycles and microprocessors necessitating exhaustive defect screening. Memory segments exhibit distinct requirements as DRAM producers prioritize buried contact defect detection while NAND foundries focus on subsurface void identification. Mixed-signal devices such as ADCs and DACs introduce further complexity, requiring tailored electron beam energies and imaging modes to evaluate analog-digital interfaces with precision.

Segmentation by MEMS structures underscores divergent performance criteria for actuators and sensors. Electrostatic and microfluidic actuator manufacturers rely on voltage contrast imaging to validate electrode integrity, while capacitive and piezoresistive sensor producers demand wafer-level uniformity checks. Photonics segmentation, covering laser and waveguide components, calls for specialized modules: distributed feedback lasers and VCSELs require sub-0.5 nm overlay accuracy, whereas photonic crystal and silicon waveguides benefit from phase-contrast inspection to detect subtle etch irregularities. By aligning inspection tool capabilities with these segmented needs, stakeholders can optimize resource allocation and process control efficacy.

This comprehensive research report categorizes the E-Beam Wafer Inspection Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Integrated Circuits

- Photonics

- Inspection Technology

- Wafer Size

- Application

- End-Use Industry

Highlighting Regional Variations in Demand, Innovation, and Adoption Trends Across the Americas, EMEA, and Asia-Pacific Semiconductor Markets

Regional dynamics play a decisive role in the adoption and evolution of electron beam inspection technologies. In the Americas, strong R&D investment and domestic incentives under the CHIPS and Science Act have propelled rapid uptake of advanced metrology systems. U.S. facilities have prioritized deployment for sub-3nm logic development and high-density memory pilot lines, leveraging local integration expertise and university partnerships to refine defect detection methodologies.

Europe, Middle East & Africa presents a heterogeneous landscape characterized by robust research collaborations and incremental capacity expansions. Leading semiconductor clusters in Germany, the Netherlands, and France focus on EUV layer review and photonics device inspection, while emerging hubs in Israel and Eastern Europe explore customized solutions for automotive and industrial sensor applications. Funding mechanisms through Horizon Europe and national initiatives have strengthened cross-border tool qualification programs, fostering a cohesive innovation network.

Asia-Pacific remains the largest demand center, driven by expansive foundry and IDM ecosystems in Taiwan, South Korea, and Japan. Manufacturers here prioritize high-throughput multi-beam systems to maintain cost efficiencies at scale, particularly for DRAM, logic, and advanced packaging segments. China’s accelerating domestic fabs are also investing in electron beam platforms for hybrid optical-electron metrology, aiming to close the gap with established leaders. Across APAC, the confluence of government support, industry consortiums, and agile supply chains continues to accelerate tool development and deployment.

This comprehensive research report examines key regions that drive the evolution of the E-Beam Wafer Inspection Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading E-Beam Wafer Inspection Innovators and Their Strategic Initiatives That Are Shaping Global Semiconductor Yield Improvement

Leading technology providers each bring distinctive strengths to electron beam inspection, shaping market direction and customer expectations. KLA Corporation has fortified its position through the eDR7xxx series, which integrates AI-powered signal processing to enhance defect sensitivity. Its unified metrology ecosystem bridges optical and electron channels, delivering correlated insights that many advanced node fabs require for yield ramp acceleration.

Applied Materials complements this with a hybrid inspection approach, merging optical review and electron beam precision within a single 300 mm platform. The eVision series targets mixed workloads, enabling logic and memory producers to switch inspection modes seamlessly without sacrificing throughput. Continuous enhancements in beam stability and classifier algorithms underscore its commitment to adaptive process control.

Hitachi High-Technologies has differentiated itself through multi-column beam architectures that conduct simultaneous scans across wafer quadrants, achieving twice the throughput of single-beam competitors while sustaining sub-2 nm resolution. This innovation resonates strongly with high-volume DRAM and NAND manufacturers striving to balance throughput and sensitivity.

ASML Holding N.V., while best known for lithography systems, has leveraged its expertise in EUV metrology to introduce proprietary e-beam review tools tailored for next-generation nodes. These platforms deliver sub-0.1 nm measurement repeatability critical for edge placement error verification in 2 nm and beyond.

JEOL Ltd. rounds out the leading cohort with modular electron beam kits that retrofit onto existing scanning electron microscopes. This flexible approach serves university labs and R&D centers, expanding the inspection ecosystem beyond traditional fab settings.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Beam Wafer Inspection Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantest Corporation

- Aerotech, Inc.

- Applied Materials, Inc.

- ASML Holding N.V.

- C&D Semiconductor Services, Inc.

- Camtek Ltd.

- Carl Zeiss SMT GmbH

- Cognex Corporation

- Evident Corporation

- Hitachi High-Technologies Corporation

- HOLON CO.,LTD.

- JEOL Ltd.

- KLA Corporation

- MKS Instruments, Inc.

- Nanometrics Incorporated

- Nanotronics Imaging

- Nova Ltd.

- Onto Innovation Inc.

- PDF Solutions, Inc.

- Photo electron Soul Inc.

- Raith GmbH

- TASMIT, Inc.

- Telemark, Inc.

- TESCAN Group, a.s.

- Thermo Fisher Scientific Inc.

Implementing Tactical Recommendations for Manufacturers to Leverage E-Beam Inspection Capabilities and Defect Reduction Across Semiconductor Production Lines

Manufacturers seeking to maximize yield and throughput must adopt a strategic, phased approach to electron beam inspection integration. Begin by conducting a detailed process audit to identify critical defect types and layers where optical methods have reached their resolution limits. By mapping defect dwell points, fabs can prioritize electron beam deployment for high-impact applications such as EUV resist inspection or critical metallization layers.

Next, invest in versatile, multi-beam platforms that support dynamic reallocation of beam modules in response to evolving node requirements. Such flexibility mitigates the risk of tool obsolescence and ensures alignment with future process roadmaps. Integrating machine learning–based defect classifiers from the outset will further accelerate time-to-insight and enhance classification accuracy as inspection volumes grow.

Operationally, cultivate cross-functional teams that blend metrology specialists with process engineers. This collaborative framework fosters rapid root-cause analysis and continuous improvement cycles. Establish clear performance metrics tied to yield improvement targets and incorporate inspection data directly into advanced process control loops for real-time adjustments.

Finally, leverage flexible financing and subscription models to manage capital outlays and align costs with performance milestones. Vendors now offer outcome-based agreements that link payment schedules to defect reduction achievements, fostering shared accountability and accelerating ROI. By following these actionable steps, industry leaders can harness the full potential of electron beam inspection technologies to drive next-generation manufacturing excellence.

Detailing Rigorous Research Methodologies and Analytical Frameworks Underpinning High-Accuracy Electron Beam Wafer Inspection Market Studies

The analysis underpinning this report combines primary interviews with semiconductor metrology experts, in-plant visits to leading fabs, and rigorous secondary research. Our methodology begins with a comprehensive landscape assessment, identifying key tool architectures, emerging multi-beam configurations, and the latest AI-driven inspection software developments. We engage with equipment vendors, process engineers, and defect analysis specialists to capture firsthand perspectives on performance, integration challenges, and future trajectories.

Quantitative data is validated through technical data sheets, patent filings, and regulatory filings where applicable. We also review industry consortium publications, white papers, and academic research to ensure a holistic understanding of evolving inspection requirements, particularly for advanced nodes and novel device architectures. To contextualize regional dynamics, we analyze government policy documents, incentive programs, and public funding initiatives shaping equipment procurement strategies.

Our segmentation framework dissects the market by wafer size categories, IC types, MEMS structures, and photonics applications, aligning tool capabilities with application-specific requirements. Further, we examine tariff and trade policy impacts through import/export statistics, customs data, and vendor strategy disclosures. Company profiles synthesize product roadmaps, partnership announcements, and patent portfolios to articulate strategic positioning. This triangulated approach ensures robust, actionable insights free from speculative forecasting.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Beam Wafer Inspection Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Beam Wafer Inspection Systems Market, by Integrated Circuits

- E-Beam Wafer Inspection Systems Market, by Photonics

- E-Beam Wafer Inspection Systems Market, by Inspection Technology

- E-Beam Wafer Inspection Systems Market, by Wafer Size

- E-Beam Wafer Inspection Systems Market, by Application

- E-Beam Wafer Inspection Systems Market, by End-Use Industry

- E-Beam Wafer Inspection Systems Market, by Region

- E-Beam Wafer Inspection Systems Market, by Group

- E-Beam Wafer Inspection Systems Market, by Country

- United States E-Beam Wafer Inspection Systems Market

- China E-Beam Wafer Inspection Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Summarizing the Critical Role of E-Beam Wafer Inspection in Enabling Next-Generation Semiconductor Manufacturing Excellence and Reliability

Electron beam wafer inspection has emerged as an indispensable pillar of modern semiconductor manufacturing, enabling the detection and classification of defects at resolutions beyond optical limits. As device nodes advance and novel materials proliferate, the precision and adaptability of electron beam systems will determine yield trajectories and time-to-market performance.

Innovations in multi-beam architectures, AI-augmented defect analytics, and hybrid optical-electron platforms are collectively redefining what is achievable in high-volume production. The ability to correlate defect data across sequential process steps fosters proactive control strategies that reduce scrap and enhance uniformity. Geopolitical factors and evolving trade policies have introduced supply chain complexities, yet they have also catalyzed local manufacturing engagements and flexible financing models that mitigate short-term disruptions.

Segmentation insights reveal that wafer size, IC type, MEMS applications, and photonics integration each impose unique metrology demands. Tailoring inspection strategies to these nuances ensures optimal resource allocation and process control. Regional dynamics-from CHIPS Act–driven expansions in the Americas to consortium-backed collaborations in EMEA and scale economies in Asia-Pacific-underscore the importance of localized approaches within a global supply chain.

Collectively, the strategic actions of leading technology providers and the adoption guidance outlined here equip decision-makers to navigate complexity, seize emerging opportunities, and unlock the full potential of electron beam inspection to sustain semiconductor leadership.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Electron Beam Wafer Inspection Systems Market Research Report

Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the complexities of the Electron Beam Wafer Inspection Systems landscape. His deep expertise and industry insight ensure you’ll gain unparalleled clarity on the technologies, market dynamics, and strategic opportunities that matter most for your organization’s success. Engage directly with Ketan to discuss customized solutions, address specific technical queries, and explore how this comprehensive research report can empower your decision-making.

To secure full access to detailed analyses, proprietary data, and forward-looking perspectives, reach out to Ketan and acquire your copy of the Electron Beam Wafer Inspection Systems Market Research Report. Benefit from his personalized recommendations on how to leverage the insights within to strengthen your competitive position, optimize process control, and accelerate innovation across your wafer inspection workflows. Don’t miss the chance to transform your approach with authoritative guidance-connect with Ketan Rohom today and take the next step toward industry leadership.

- How big is the E-Beam Wafer Inspection Systems Market?

- What is the E-Beam Wafer Inspection Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?