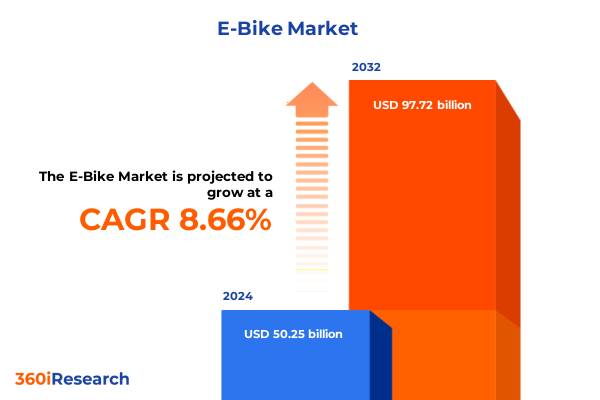

The E-Bike Market size was estimated at USD 54.28 billion in 2025 and expected to reach USD 58.64 billion in 2026, at a CAGR of 8.76% to reach USD 97.72 billion by 2032.

Exploring the Rising Momentum of the Global E-Bike Revolution Fueled by Sustainability Demands and Urban Mobility Innovations

The electric bicycle sector is charting an unprecedented course as consumers and policymakers alike pivot toward sustainable and efficient modes of urban transportation. Over the past decade, heightened environmental awareness and congestion challenges have propelled e-bike adoption from a niche recreational category into a mainstream mobility solution embraced by commuters, delivery services, and leisure riders. This introduction lays the groundwork for understanding how and why e-bikes have become integral to the future of transportation, emphasizing the broad societal and technological shifts accelerating this momentum.

As cities worldwide grapple with air quality concerns and the demands of last-mile logistics, e-bikes have emerged as a versatile answer-combining the agility of traditional bicycles with the extended range and speed afforded by electric assistance. Concurrently, innovations in battery technology and digital connectivity have enhanced both the user experience and operational efficiency for fleet operators. These converging dynamics have set the stage for robust market innovation and investment, making the e-bike industry one of the most dynamic segments in the mobility space today.

Unveiling the Key Transformative Forces Shaping the E-Bike Ecosystem Through Technological Breakthroughs and Evolving Consumer Preferences

The e-bike industry is not merely riding a wave of consumer interest; it is being reshaped by transformative forces that span technological breakthroughs, evolving regulatory frameworks, and novel business models. Breakthroughs in lithium-ion battery chemistry have dramatically reduced weight and charging times, while regenerative braking and smart power management systems have extended real-world range. These innovations have redefined performance expectations and opened new use cases beyond traditional urban commuting, including cargo delivery and mixed-terrain recreation.

Simultaneously, digitalization has permeated every facet of the value chain. Integrated mobile applications now provide real-time diagnostics, route optimization, and remote firmware updates, fostering deeper engagement and loyalty through connected services. At the same time, partnerships between e-bike manufacturers and ride-sharing platforms have demonstrated the model’s viability for scalable, rental-based applications in dense urban environments. These business model experiments, coupled with incentive programs and infrastructure investments from municipal governments, are fundamentally altering consumer behavior and market dynamics.

As these forces converge, they are creating an environment ripe for innovation. Traditional bicycle brands are accelerating their electrification roadmaps, while new entrants are capitalizing on modular designs and direct-to-consumer strategies. In this evolving landscape, agility and technological leadership will be critical differentiators for companies seeking to capture value and drive sustained growth.

Assessing How United States Tariffs Implemented in 2025 Are Redefining Supply Chains Pricing Structures and Domestic Manufacturing Initiatives

The introduction of United States tariffs on imported electric bicycles and components in early 2025 has reverberated across the global supply chain, reshaping procurement strategies and cost structures. By imposing levies on key inputs-ranging from battery cells to complete bike assemblies-the new trade measures have increased landed costs for import-dependent brands, prompting many stakeholders to reevaluate their sourcing footprints. Consequently, manufacturers and assemblers have accelerated initiatives to localize production and secure domestic partnerships that mitigate tariff exposure.

Pass-through effects have varied across the value spectrum. Premium brands have largely absorbed incremental costs to preserve positioning, while entry-level product segments have seen retail prices rise modestly, potentially dampening demand among price-sensitive consumers. Meanwhile, aftermarket and replacement parts have also faced cost pressures, leading to emerging opportunities for third-party suppliers to offer alternative components that balance performance and affordability. In response, some established brands have reconfigured their product roadmaps to emphasize modular, tariff-neutral designs that leverage standardized frames and detachable, locally sourced batteries.

Beyond cost impacts, the tariff regime has spurred a broader reassessment of resilience within the e-bike ecosystem. Companies are increasingly diversifying their supplier networks, investing in near-shoring strategies, and exploring vertical integration to secure critical inputs. These shifts, driven by trade policy uncertainty, are reinforcing long-term structural changes that will influence competitive dynamics and market access for years to come.

Delving into Comprehensive Segmentation Perspectives to Uncover Critical Variations Across Product Types Classes Battery and Motor Technologies and Sales Channels

A nuanced understanding of product type distinctions illuminates how consumer preferences and use cases are diversifying the market. From urban commuters seeking nimble city e-bikes to logistics firms deploying cargo models for last-mile delivery, the product landscape has fragmented into specialized categories. Folding and retro/classic designs are carving out dedicated followings among urban dwellers and style-driven enthusiasts, while hybrid and mountain variants appeal to multi-terrain adventurers. Each segment demands tailored feature sets, such as reinforced frames for cargo or suspension systems for off-road excursions.

Class delineations-spanning entry-level pedal-assist models to throttle-enabled machines-further stratify the market. Class-I bikes, limited to 20 miles per hour with pedal assist, remain popular among regulatory-sensitive jurisdictions, whereas Class-II and Class-III variants attract riders seeking higher speeds and versatility. Battery technology preferences align closely with these applications: lead-acid batteries persist in cost-constrained fleets, nickel-metal hydride serves mid-tier budgets, and lithium-ion dominates premium offerings with superior energy density and charge cycles.

Motor types also play a pivotal role in performance differentiation. Hub motor systems are prized for simplicity and cost-effectiveness, while mid-drive configurations deliver balanced weight distribution and torque performance favored by recreational and cargo riders. Power capacity ranges from sub-250 watt models for urban compliance to above-500 watt systems engineered for heavy-load duties and steep terrain. Frame materials-from aluminum’s balance of strength and affordability to titanium’s lightness and longevity-cater to distinct user priorities. Component integration is evolving, with fully integrated systems blending batteries and motors seamlessly into frame architectures, while semi-integrated designs retain modularity for repairability.

Application-driven demand spans personal use among eco-conscious commuters to commercial deployments in delivery services and shared mobility schemes. Sales channels reflect these use cases, with offline specialty retailers providing hands-on experiences and after-sales support, while online platforms emphasize convenience and direct value propositions. By weaving these segmentation lenses together, stakeholders can identify high-potential niches and align product development roadmaps with specific customer needs.

This comprehensive research report categorizes the E-Bike market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Class

- Battery Type

- Motor Type

- Power Capacity

- Frame Material

- Application

- Sales Channel

Comparative Regional Analysis Illuminates Distinct Adoption Drivers Manufacturing Hubs and Regulatory Frameworks Spurring Growth Across Key Global Markets

The Americas region has emerged as a leading adopter of e-bikes, driven by a confluence of supportive policies, private investment, and shifting consumer attitudes around sustainable mobility. Major metropolitan areas have expanded bike lane networks and introduced incentive programs, spurring growth in both personal and commercial applications. Meanwhile, domestic manufacturing initiatives-fueled by renewable energy commitments-are strengthening local supply chains, creating an ecosystem that prioritizes resilience and innovation.

Europe, Middle East & Africa presents a mosaic of mature and emergent markets, each shaped by unique regulatory landscapes and cultural factors. Western European countries continue to lead in per-capita adoption, supported by robust cycling infrastructure and public transit integration. In the Middle East, pilot projects in urban centers are exploring e-bike sharing as a last-mile complement to metro systems, while select African cities are evaluating cargo-e-bike solutions to streamline logistics and reduce carbon footprints.

Asia-Pacific remains the world’s largest manufacturing hub for electric bicycles, with several economies combining cost-competitive production with rapidly expanding domestic demand. China’s export-oriented clusters and Taiwan’s R&D capabilities have positioned the region as a global powerhouse in battery innovation and motor engineering. Meanwhile, markets such as Japan and Australia are witnessing accelerated consumer uptake, backed by government grants and increasing environmental consciousness. As regional ecosystems evolve, cross-border partnerships and technology transfers are expected to drive the next wave of growth and product differentiation.

This comprehensive research report examines key regions that drive the evolution of the E-Bike market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Titans and Agile New Entrants Demonstrating Strategic Investments in Product Innovation Partnerships and Market Expansion to Dominate the E-Bike Sector

Leading e-bike manufacturers are differentiating themselves through a blend of technology leadership, strategic partnerships, and brand positioning. Established bicycle brands with legacy manufacturing expertise are leveraging their distribution networks to scale electric models rapidly, while emerging pure-play e-bike companies are securing venture capital funding to accelerate R&D in battery management and lightweight materials.

Global OEMs are forging alliances with battery specialists and software providers to deliver integrated powertrain solutions and over-the-air update capabilities. These collaborations are enhancing performance consistency and enabling new revenue streams from subscription services for features such as advanced ride analytics and preventive maintenance alerts. At the same time, a handful of nimble startups are making inroads with direct-to-consumer platforms that emphasize customization and build-to-order models, effectively bypassing traditional dealership networks.

In parallel, shared mobility operators and logistics enterprises are forging vendor relationships with manufacturers to deploy large-scale fleets. Such partnerships often involve co-development agreements focused on durability testing and fleet management software, underscoring the value of an end-to-end approach. As competition intensifies, differentiation through brand authenticity, localized service networks, and value-added digital services has become increasingly critical for market leaders seeking to protect margins and cultivate customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Bike market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addmotor Tech.

- AIMA Technology Group Co., Ltd.

- Ampler Bikes OÜ

- Beistegui Hermanos S.A.

- Brompton Bicycle Limited

- Cowboy SA

- ENERMAX Technology Corporation

- Giant Manufacturing Co., Ltd.

- Gocycle by Karbon Kinetics Ltd.

- Hero Cycles Limited

- HeyBike, Inc.

- Juiced Riders, Inc.

- Keego Mobility

- Lectric eBikes, LLC

- Lyft, Inc.

- Merida Industry Co., Ltd.

- Mondraker by Blue Factory Team S.L.U.

- PEDEGO INC.

- PIERER Mobility AG

- Pon Holdings B.V.

- Porsche eBike Performance GmbH

- Rad Power Bikes Inc.

- Ride Aventon, Inc.

- Ride1Up, Inc.

- Riese & Müller GmbH

- SCOTT Sports SA

- Shimano Inc.

- Smalo by Darad Innovation Corporation

- Specialized Bicycle Components, Inc.

- Trek Bicycle Corporation

- VOLT E BYK

- Yadea Technology Group Co., Ltd.

- Yamaha Motor Co., Ltd.

Strategic Roadmap for E-Bike Industry Leaders Outlining Priority Actions to Enhance Innovation Strengthen Supply Resilience and Elevate Customer Engagement Experiences

Industry leaders seeking to maintain and expand their leadership positions should prioritize strategic diversification of their supply chains while accelerating investments in advanced battery and motor technologies. By fostering multi-supplier partnerships and near-shoring key components, companies can mitigate exposure to trade policy fluctuations and currency volatility. Simultaneously, embedding energy-dense battery cells and efficient thermal management systems will be imperative for enhancing product differentiation and consumer appeal.

Furthermore, the integration of IoT-enabled platforms and predictive analytics can drive new service offerings, including preventive maintenance subscriptions and usage-based insurance models. Executives should also explore direct partnerships with urban municipalities and logistics firms to pilot e-bike deployments in targeted corridors, leveraging real-world data to refine operational efficiency and build case studies for broader adoption. Cultivating brand loyalty through seamless omnichannel experiences-blending offline showroom engagement with digital content and virtual test rides-can create a competitive moat in an increasingly crowded marketplace.

Finally, leaders must embed sustainability and circular economy principles into their product roadmaps, emphasizing modular designs that facilitate component upgrades and end-of-life recycling. By championing responsible manufacturing practices and transparent material sourcing, companies will not only meet evolving regulatory requirements but also resonate with environmentally conscious consumers who view e-bikes as an extension of their eco-friendly lifestyles.

Transparent Research Methodology Integrating Primary Insights Secondary Data and Analytical Frameworks to Deliver a Robust Foundation for Market Intelligence and Decision Making

This research draws upon a hybrid methodology combining extensive primary interviews with industry executives and domain experts alongside rigorous analysis of publicly available data sources. Primary engagements included structured consultations with manufacturing partners, fleet operators, and regulatory bodies to contextualize the impact of recent tariff changes and infrastructure investments. These insights were triangulated against secondary data derived from authoritative industry databases, transportation authorities, and battery technology consortia.

Quantitative segmentation analyses were performed to map consumer preferences across product types and geographic regions, while qualitative case studies illuminated successful business model innovations in shared mobility and last-mile logistics. To ensure methodological rigor, data underwent multiple validation cycles, including cross-referencing shipment records and market announcements. Additionally, thematic workshops were conducted to test emerging hypotheses around segment growth drivers and to identify potential inflection points in technology adoption.

The resulting framework integrates both macroeconomic trends and micro-level operational considerations, offering a comprehensive view of the e-bike landscape. By blending statistical modeling with expert judgment, this methodology provides stakeholders with actionable intelligence that balances empirical robustness with strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Bike market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Bike Market, by Product Type

- E-Bike Market, by Class

- E-Bike Market, by Battery Type

- E-Bike Market, by Motor Type

- E-Bike Market, by Power Capacity

- E-Bike Market, by Frame Material

- E-Bike Market, by Application

- E-Bike Market, by Sales Channel

- E-Bike Market, by Region

- E-Bike Market, by Group

- E-Bike Market, by Country

- United States E-Bike Market

- China E-Bike Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Concluding Insights Emphasizing the Future Outlook for the E-Bike Market Highlighting Critical Success Factors Driving Sustainable Urban Mobility Transformation

The e-bike market stands at the cusp of a transformational phase driven by technological advancements, evolving consumer expectations, and dynamic policy landscapes. As the industry matures, success will hinge on the ability of stakeholders to navigate supply chain complexities, capitalize on segmentation opportunities, and forge strategic partnerships that unlock new applications. The interplay between tariffs, regional priorities, and product innovation will continue to shape competitive dynamics, demanding agile responses and proactive investment.

Looking ahead, the most successful companies will be those that embrace holistic strategies-combining sustainable manufacturing practices, integrated digital platforms, and customer-centric business models. By continuously monitoring regulatory shifts and fostering collaborative ecosystems with governments and logistics partners, industry participants can turn potential disruptions into catalyst for differentiation. Ultimately, the e-bike revolution transcends mere product sales; it represents a broader movement toward cleaner, more efficient urban mobility that stands to redefine how people live, work, and move.

Engage with Our Associate Director of Sales and Marketing to Access In-Depth E-Bike Market Research Tailored for Strategic Growth and Competitive Advantage

The path to unlocking comprehensive insights into the e-bike market begins with a simple step: engaging directly with Ketan Rohom, our Associate Director of Sales & Marketing. His deep understanding of strategic growth challenges and opportunities within the electric bicycle landscape ensures that you will receive a tailored consultation that aligns with your specific goals and competitive context. By partnering with him, you gain privileged access to our full market research report, featuring in-depth analyses, granular segmentation insights, and forward-looking strategic recommendations designed to shape your decision-making roadmap and accelerate success.

Whether you are seeking to refine your product portfolio, shore up your supply chain in light of evolving tariffs, or explore emerging consumer segments, a conversation with Ketan will guide you to the precise data sets and expert perspectives that matter most. Reach out today to transform raw data into actionable intelligence, leveraging our comprehensive methodologies and specialized expertise to drive innovation, revenue growth, and sustainable market leadership in the rapidly evolving e-bike sector.

- How big is the E-Bike Market?

- What is the E-Bike Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?