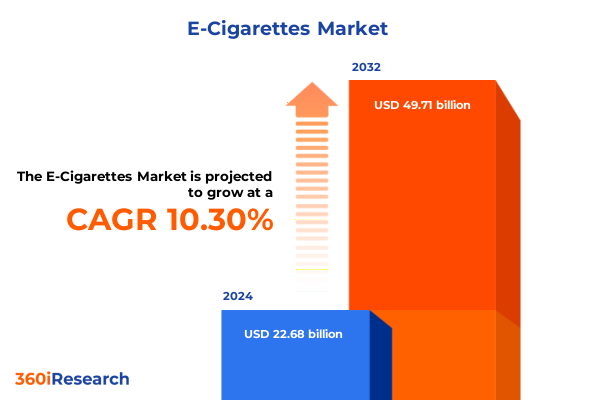

The E-Cigarettes Market size was estimated at USD 24.98 billion in 2025 and expected to reach USD 27.51 billion in 2026, at a CAGR of 10.32% to reach USD 49.71 billion by 2032.

Understanding the Evolution and Crucial Drivers Shaping the Evolving E-Cigarette Ecosystem in a Rapidly Changing Regulatory and Consumer Environment

The modern e-cigarette industry has emerged as a dynamic ecosystem at the intersection of technological innovation, evolving consumer preferences, and stringent policy frameworks. What began over a decade ago as a niche alternative to combustible tobacco has matured into a multifaceted market encompassing a variety of device architectures, nicotine delivery methods, and flavor portfolios. In this context, understanding the historical trajectory offers vital perspective, as early-generation cigalike devices paved the way for more advanced pod systems and high-powered mods. Consequently, each wave of product development has not only influenced consumer adoption patterns but also spurred regulatory debate and public health discourse.

Furthermore, the interplay between public health objectives and commercial ambitions has intensified scrutiny on product safety, youth access, and flavor regulation. Policymakers worldwide are navigating complex trade-offs as they attempt to curb underage use while preserving adult smokers’ access to potentially less harmful alternatives. As such, manufacturers and stakeholders are investing heavily in research and development, aiming to deliver seamless user experiences while demonstrating compliance with emerging quality and safety standards. Moreover, consumer demand for convenience, personalization, and perceived reduced harm continues to shape product roadmaps and marketing strategies.

This executive summary sets the stage for a deeper exploration of transformative shifts, regulatory impacts, segmentation nuances, regional dynamics, competitive landscapes, and strategic recommendations. By synthesizing primary research insights and expert interviews, the subsequent sections provide a holistic overview to support informed decision-making and strategic planning in an industry defined by rapid change and innovation.

Exploring the Technological Advancements and Shifting Regulations Redefining Product Innovation and Consumer Adoption within the E-Cigarette Sector

Technological innovation has been a primary catalyst transforming the e-cigarette landscape. Early cigalike models offered a basic substitute for traditional cigarettes, but advancements in battery chemistry, atomizer design, and sensor integration have given rise to sophisticated mods, pod systems, and vape pens. These emerging platforms enable precise control over vapor production, nicotine dosing, and flavor delivery, thereby enhancing user satisfaction and fostering broader adoption among adult smokers. Additionally, integration of Bluetooth connectivity and smartphone applications has introduced novel opportunities for personalized usage tracking and behavioral interventions.

Concurrently, the regulatory environment has undergone a significant shift, with authorities imposing more rigorous pre-market review processes and product safety requirements. This has prompted manufacturers to invest in compliance infrastructure and scientific substantiation, fundamentally reshaping product pipelines and time-to-market considerations. Moreover, the intensification of flavor restrictions in several jurisdictions has prompted strategic recalibration, leading to the emergence of gourmet and tobacco-centric flavor lines, along with innovative flavor masking techniques.

In parallel, consumer attitudes are evolving as heightened awareness of product safety and social responsibility influences purchase decisions. Younger adult cohorts demonstrate growing interest in discreet and portable systems, while seasoned vapers value customization and high-performance devices. Consequently, manufacturers are aligning research and marketing efforts with distinct consumer segments, ensuring that new offerings resonate with both novice and advanced end-users. Together, these technological, regulatory, and consumer trends are redefining competitive dynamics and laying the groundwork for next-generation products and market expansions.

Analyzing the Far-Reaching Consequences of 2025 Tariff Adjustments on E-Cigarette Supply Chains Distribution Channels and Consumer Pricing Dynamics

In 2025, a series of tariff adjustments enacted by the United States have exerted pronounced effects on the global e-cigarette supply chain and distribution network. As the vast majority of key components and finished devices originate from Asian manufacturing hubs, import duties have increased landed costs, prompting many suppliers to evaluate alternative sourcing strategies. Consequently, several manufacturers have accelerated the establishment of nearshore assembly operations and diversified procurement channels to mitigate tariff exposure and maintain production continuity.

Moreover, higher import levies have reverberated through distribution channels, as wholesalers and retailers grapple with margin compression. The increased cost burden has, in some instances, been passed on to consumers in the form of elevated shelf prices, thereby influencing purchasing patterns, particularly among price-sensitive segments. As a result, discount-oriented and value-driven product tiers have seen renewed emphasis, with brands leveraging lower-cost formulations and streamlined packaging to preserve market competitiveness. Furthermore, online sales platforms have gained greater prominence, as agile e-commerce operations offer dynamic pricing and localized fulfillment to offset traditional retail channel cost pressures.

Transitioning from these operational impacts, industry stakeholders are revisiting strategic roadmaps to ensure resilience and pricing agility. This includes the negotiation of long-term supply contracts with fixed pricing structures, the pursuit of duty drawback programs, and collaboration with trade associations to advocate for tariff relief or exemptions. As such, the 2025 tariff landscape serves as a critical inflection point, challenging established norms while catalyzing more robust, diversified supply chain models and adaptive distribution strategies.

Unearthing Critical Segmentation Insights Showing How Diverse Product Types Components Flavors Charging Modes and Distribution Channels Shape User Experiences

A comprehensive understanding of market segmentation reveals how diverse product and component categories, usage preferences, flavors, charging methods, distribution avenues, and usage frequencies shape the competitive calculus. In terms of product architecture, the market spans entry-level cigalikes that mimic traditional cigarette form factors, advanced mods offering custom power settings for experienced users, versatile pod systems blending convenience and performance, and portable vape pens that cater to on-the-go consumption. Each type addresses distinct user inclinations, from simplicity to personalization.

When examining individual components, the atomizer emerges as the heart of vapor generation, while battery capacity determines session duration and portability. E-liquid formulations dictate nicotine delivery and overall mouthfeel, with mouthpieces and integrated sensors contributing to ergonomic design and safety monitoring. These component-level distinctions inform manufacturing priorities and quality assurance protocols, particularly as innovation targets coil longevity and leak prevention.

In the realm of usage types, disposable options deliver simplicity and zero maintenance for occasional users, whereas reusable platforms appeal to daily consumers seeking cost efficiency over time. Flavor differentiation remains a key driver, encompassing fruity blends that attract lifestyle-oriented users, gourmet options that emphasize artisanal notes, and tobacco variants split between classic tobacco and menthol profiles to satisfy traditional palate preferences. Charging infrastructure notably influences user experience, with wired charging maintaining compatibility with existing USB standards and wireless charging introducing cable-free convenience.

Finally, distribution strategies range from direct-to-consumer e-commerce, including branded websites and leading online marketplaces, to brick-and-mortar channels such as convenience stores, drug stores, specialty e-cigarette boutiques, and tobacconist shops. Overlaying these channels is the factor of usage frequency, differentiating between daily users-who prioritize reliability and device durability-and occasional users seeking novelty and flavor experimentation. Collectively, these segmentation insights illuminate pathways for targeted product development, marketing precision, and channel optimization.

This comprehensive research report categorizes the E-Cigarettes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Components

- Usage Type

- Flavor

- Charging Mode

- Distribution Channel

- Usage Frequency

Revealing Regional Market Dynamics and Usage Patterns Across the Americas Europe Middle East Africa and Asia-Pacific with Strategic Considerations for Growth

Regional market dynamics in the e-cigarette industry are profoundly influenced by distinct consumer behaviors, regulatory frameworks, and distribution infrastructures across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, shifting adult smoking cessation strategies and robust direct-to-consumer channels have spurred widespread adoption of pod systems and vape pens. The United States remains the largest regional market, where heightened scrutiny on youth access has catalyzed investments in age-verification technology and flavor governance. Meanwhile, Latin American markets, though emerging, display growing interest in value-driven product lines and disposable formats to address price-sensitive consumer bases.

Across Europe, Middle East & Africa, a mosaic of regulatory approaches defines the landscape. The European Union’s evolving Tobacco Products Directive demands stringent product notifications and e-liquid ingredient transparency, elevating compliance requirements for manufacturers. At the same time, countries in the Middle East and Africa pursue diverse stances, from permissive frameworks encouraging adult harm reduction to restrictive mandates aligning with broader tobacco control. Consequently, multi-national corporations and regional distributors tailor flavor offerings and nicotine strengths to align with both regulatory limits and localized preferences.

In the Asia-Pacific region, home to major manufacturing hubs, market growth is driven by domestic consumption trends and export-driven production capacity. China, the primary source of device components, has begun consolidating its regulatory environment to ensure quality control and export standards. Meanwhile, markets such as Japan and South Korea exhibit strong demand for advanced mods and premium e-liquids, supported by consumers’ penchant for technology-driven products. Across Southeast Asia, a rising middle class and evolving retail networks are fostering a balanced growth trajectory, though regulatory clarity and cross-border trade considerations remain critical factors. These regional distinctions underscore the necessity for tailored go-to-market strategies and compliance roadmaps that address unique market conditions.

This comprehensive research report examines key regions that drive the evolution of the E-Cigarettes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovators and Partnerships Driving Competitive Edge through Technological Advancements and Growth Strategies in E-Cigarette Market Dynamics

Industry leaders and innovative startups alike are shaping the competitive contours of the e-cigarette ecosystem through strategic partnerships, product launches, and technological breakthroughs. Established manufacturers continue to refine product portfolios, with several deploying next-generation coil technologies to enhance flavor fidelity and prolong device life. At the same time, emerging companies are disrupting traditional models by integrating IoT features for real-time usage monitoring and digital engagement, thereby deepening brand-to-consumer connections.

Collaborations between e-liquid formulators and flavor houses have yielded bespoke taste profiles, catering to increasingly discerning consumers. Similarly, alliances between device makers and battery specialists are advancing fast-charge capabilities and safety protocols. Beyond product innovation, strategic distribution partnerships with major retail chains and online marketplaces are proving pivotal in expanding reach, particularly within regulated markets where authorized channels offer greater assurance of compliance.

Moreover, mergers and acquisitions continue to reshape the landscape as global tobacco conglomerates bolster their alternative nicotine portfolios. These transactions, alongside joint ventures between legacy tobacco firms and nimble independent producers, are facilitating access to capital, regulatory expertise, and international distribution networks. Meanwhile, venture-backed startups leverage agile product iteration cycles to introduce niche offerings-such as nicotine salt pods and botanical extract formulations-targeting specific consumer segments. Collectively, these corporate maneuvers and cooperative ventures are redefining competitive differentiation, accelerating time-to-market, and setting new benchmarks for product performance and regulatory alignment.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Cigarettes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALD Group Limited

- Altria Group, Inc.

- British American Tobacco PLC

- Eleaf Electronics Co., Ltd.

- GD SIGELEI Electronic Tech Co. Ltd.

- GEEKVAPE

- Greenlane Holdings, Inc.

- Innokin Technology Ltd.

- ITC Limited

- J Well Val

- Jac Vapour

- Joyetech (Shenzhen) Electronics Co. Ltd

- JT International SA

- JUUL Labs, Inc.

- JWEI Group

- Kandypens, Inc.

- NicQuid, LLC

- Philip Morris International Inc.

- PhixVapor

- Shenzhen Kanger Technology Co., Ltd.

- Shenzhen Uwell Technology Co., Ltd

- Totally Wicked

- Turning Point Brands, Inc.

- White Cloud Electronic Cigarettes

Formulating Targeted Strategic Actions and Collaborative Initiatives to Propel Sustainable Growth and Regulatory Compliance within the E-Cigarette Industry

To thrive in a complex regulatory environment and capitalize on evolving consumer expectations, industry leaders must adopt targeted strategic actions. First, engaging proactively with regulatory bodies and trade associations can facilitate the development of balanced policies that protect public health while preserving adult access. By participating in stakeholder consultations and sharing empirical safety data, manufacturers can build credibility and influence policy outcomes.

In parallel, streamlining internal compliance processes and investing in quality management systems will ensure adherence to rigorous safety and ingredient standards. Consequently, brands can reduce time-to-market for product innovations and mitigate risk associated with sudden regulatory changes. Additionally, diversifying supply chains by establishing nearshore production or securing multi-sourcing agreements enhances resilience against tariff fluctuations and geopolitical disruptions.

Furthermore, refining product differentiation strategies through the development of premium flavor lines, ergonomic form factors, and digital connectivity features can deepen consumer engagement. Aligning promotional efforts with targeted segmentation insights-such as delivering tailored messaging for daily users or highlighting disposable formats for occasional vapers-will drive marketing efficiency. Finally, forging strategic alliances with retail partners, technology providers, and public health organizations can expand distribution footprints and reinforce brand trust. By integrating these recommendations into corporate roadmaps, industry players can maintain momentum, uphold compliance, and sustain competitive advantage.

Outlining Rigorous Research Approaches and Data Collection Techniques Ensuring Robust Analysis and Credible Insights across Key Market Dimensions

This research employs a mixed-methodology approach, combining primary and secondary data collection to generate comprehensive, validated insights. Primary research involved in-depth interviews with senior executives from leading manufacturers, distributors, and regulatory authorities, as well as surveys targeting adult e-cigarette users across key geographic markets. These engagements yielded nuanced perspectives on product preferences, channel dynamics, and regulatory priorities, enriching the contextual analysis.

Simultaneously, a structured secondary research phase reviewed publicly available regulatory documents, patent filings, and industry reports to map historical trends and policy evolution. Proprietary databases provided intelligence on product launches, merger and acquisition activity, and technological patents, facilitating competitive benchmarking. Data triangulation techniques were applied to cross-verify qualitative insights with quantitative indicators, ensuring analytical rigor.

Additionally, segmentation analysis was conducted using an exhaustive framework covering product types, components, usage modalities, flavor profiles, charging modes, distribution channels, and usage frequency. Regional insights were synthesized through localized research teams and expert networks, enabling precise delineation of market conditions across the Americas, Europe Middle East & Africa, and Asia-Pacific. Throughout the process, validation workshops with subject-matter experts were held to refine assumptions and confirm key findings, ultimately delivering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Cigarettes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Cigarettes Market, by Product

- E-Cigarettes Market, by Components

- E-Cigarettes Market, by Usage Type

- E-Cigarettes Market, by Flavor

- E-Cigarettes Market, by Charging Mode

- E-Cigarettes Market, by Distribution Channel

- E-Cigarettes Market, by Usage Frequency

- E-Cigarettes Market, by Region

- E-Cigarettes Market, by Group

- E-Cigarettes Market, by Country

- United States E-Cigarettes Market

- China E-Cigarettes Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Major Findings and Emphasizing Strategic Imperatives to Navigate Competitive Challenges and Leverage Opportunities in the E-Cigarette Landscape

The synthesis of technological innovation, regulatory evolution, and shifting consumer behaviors underscores the complexity and opportunity within the contemporary e-cigarette sector. Key findings reveal that advanced device platforms, precise formulation technologies, and digital connectivity features are central to establishing competitive differentiation. At the same time, adapting to evolving policy landscapes-particularly tariff structures and flavor regulations-remains a strategic imperative, demanding agile supply chain and governance mechanisms.

Segmentation insights highlight the importance of aligning product development with user preferences, from premium pod delivery systems for frequent users to cost-effective disposables for occasional vapers. Meanwhile, divergent regional trajectories necessitate tailored market entry strategies that account for unique regulatory environments and consumer mindsets in the Americas, Europe Middle East & Africa, and Asia-Pacific.

Corporate activity, including strategic partnerships and targeted acquisitions, is accelerating innovation cycles and expanding distribution footprints. Consequently, industry participants that blend proactive regulatory engagement, robust compliance programs, and consumer-centric product portfolios are best positioned to capture growth. As the market continues to mature, stakeholders equipped with granular insights and adaptive strategies will sustain momentum, navigate emerging challenges, and unlock new avenues for value creation.

Connect Directly with Ketan Rohom to Secure Exclusive In-Depth E-Cigarette Market Research Tailored to Propel Your Strategic Decision-Making

Ready to elevate your strategic initiatives with unparalleled market insights tailored for decision-makers, engaging directly with Ketan Rohom will grant you access to a comprehensive report that decodes the complexities of the e-cigarette landscape. This meticulously crafted research delivers actionable intelligence on regulatory trends, competitive dynamics, and consumer preferences, designed to accelerate your go-to-market strategies and strengthen your market positioning. Seize the opportunity to transform insights into growth by consulting Ketan Rohom, whose expertise will guide you through a customized briefing aligned with your organizational objectives, ultimately empowering your team to make informed investments and forge enduring competitive advantages.

- How big is the E-Cigarettes Market?

- What is the E-Cigarettes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?