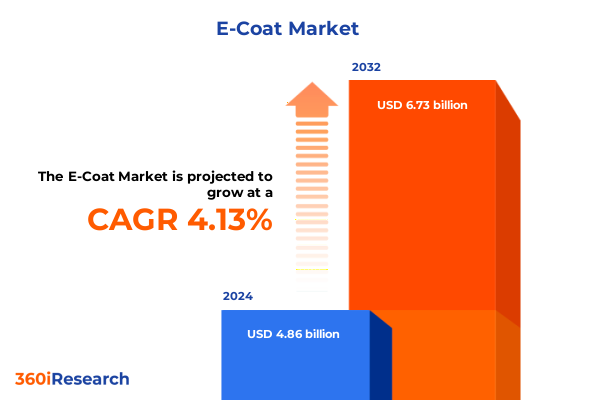

The E-Coat Market size was estimated at USD 5.06 billion in 2025 and expected to reach USD 5.26 billion in 2026, at a CAGR of 4.14% to reach USD 6.73 billion by 2032.

Discover the Fundamental Role of Electrodeposition Coatings in Driving Corrosion Protection, Sustainability, and Industrial Innovation Across Key Sectors

Electrodeposition coatings, commonly referred to as e-coats, have emerged as a linchpin technology for protecting metal substrates from corrosion, enhancing surface durability, and meeting the escalating demands for sustainability across industrial value chains. Over recent years, the ability of e-coat processes to uniformly deposit thin, corrosion-resistant films on complex geometries has catalyzed their adoption in automotive, appliance, electronics, and heavy equipment applications. As manufacturers confront tighter environmental regulations and strive to achieve operational excellence, e-coat solutions have demonstrated unparalleled advantages in reducing volatile organic compound emissions and minimizing waste through closed-loop bath systems.

The inherent flexibility of electrodeposition allows formulators to tailor resin chemistries-ranging from epoxy-based cathodic systems to acrylic anodic variants-thereby optimizing performance parameters such as adhesion, throw power, and chemical resistance. This adaptability has not only expanded the scope of e-coat applications but also driven continuous innovation in bath additives and curing technologies. Collectively, these advancements underscore the strategic importance of e-coat in advancing manufacturing sophistication while aligning with global sustainability commitments.

Unveiling the Transformative Technological and Regulatory Forces Reshaping the Electrodeposition Coating Ecosystem and Manufacturing Processes

The electrodeposition coating landscape is being transformed by a confluence of technological breakthroughs and regulatory pressures that are redefining performance standards. Smart coatings equipped with real-time monitoring capabilities are now providing manufacturers with continuous data on film thickness, bath chemistry, and environmental conditions, enabling predictive maintenance and reducing process variability. Alongside these advancements, artificial intelligence and machine learning algorithms have been integrated into control systems, optimizing process parameters such as current density and temperature in real time, and thereby enhancing throughput and consistency.

Simultaneously, environmental regulations such as the European Union’s REACH and RoHS directives are compelling formulators to shift toward waterborne and low-VOC systems. These green chemistries, including ionic liquids and biodegradable resins, not only mitigate hazardous waste but also satisfy increasingly stringent emissions limits in major markets. Coupled with innovations in curing modalities-ranging from advanced thermal ovens to energy-efficient UV technology-manufacturers are achieving faster cycle times and improved gloss finishes, all while reducing energy consumption. Furthermore, the adoption of digital twin platforms is enabling virtual simulation of e-coating processes, accelerating product development cycles and minimizing resource waste through precise process modeling.

Assessing the Compounding Effects of Recent U.S. Tariff Policies on Electrodeposition Coatings Supply Chains and Material Costs Through 2025

The United States’ tariff landscape has introduced significant headwinds to electrodeposition coating supply chains, markedly affecting the cost structure for key raw materials. On June 4, 2025, tariffs on steel and aluminum imports were raised from 25% to 50% under Section 232 authority, directly impacting the availability and pricing of substrates for e-coat operations. Prior measures include a 10% baseline reciprocal tariff on all imported goods effective April 5, 2025, and a 25% levy on automobiles commencing April 3, 2025 with a subsequent 25% tariff on auto parts from May 3, 2025; these actions have compounded cost pressures for automotive e-coat applications.

In parallel, targeted reciprocal tariffs ranging from 11% to 50% were announced on April 2, 2025, although implementation for certain countries remains paused pending further review. Moreover, fresh Section 232 investigations into critical metals and minerals-including cobalt, lithium, and rare earths-present the prospect of additional duties later in the year, elevating uncertainty for electrodeposition consumables and specialty coatings. Collectively, these trade actions have disrupted established North American supply networks, incentivized onshoring efforts, and forced coatings companies to reevaluate sourcing strategies to mitigate escalating import costs and maintain competitive pricing.

Examining Critical Segmentation Dynamics by Coating Type, Substrate Material, and End Use Industries to Uncover Market Opportunities

Segmentation by electrodeposition type reveals that cathodic systems continue to be favored for their superior corrosion protection and environmental compliance, particularly within high-volume automotive and industrial applications where uniform coverage on complex components is critical. In contrast, anodic coatings remain integral to certain appliance and consumer goods markets, offering enhanced aesthetic versatility and flexibility in decorative finishes. When examining substrate materials, steel remains the predominant base metal for heavy-duty applications, while aluminum substrates have seen growing adoption in lightweight automotive structures, driving formulators to develop specialized adhesion promoters and corrosion inhibitors. Cast iron, though representing a smaller share, commands significant attention in infrastructure and agricultural equipment sectors due to its exceptional wear resistance.

Insights into end use industries further highlight that within the appliance segment, small appliance manufacturers leverage e-coat systems for internal components to ensure long-term reliability, whereas white goods producers prioritize bath chemistries that deliver both anti-corrosive performance and premium surface appearance. The automotive segment is further bifurcated between commercial vehicles-which demand ultra-durable, high-build coatings capable of withstanding harsh operating environments-and passenger cars, where low-temperature cure capabilities and color consistency are paramount. These divergent requirements underscore the need for coating developers to customize formulations for each unique application environment.

This comprehensive research report categorizes the E-Coat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Electrodeposition Type

- Substrate Material

- End Use Industry

Analyzing Regional Diversification in Electrodeposition Coatings with Strategic Implications Across Americas, EMEA, and Asia-Pacific Markets

The Americas region continues to exhibit robust demand for electrodeposition coatings, propelled by a renewed focus on nearshoring manufacturing operations, a resurgence in light vehicle production, and significant investments in appliance and construction equipment manufacturing. North American manufacturers are increasingly investing in automated e-coat lines to optimize throughput and comply with escalating environmental mandates. Across Latin America, growing infrastructure projects and rising per capita appliance ownership are expanding opportunities for durable, cost-effective coating solutions.

In Europe, stringent regulatory frameworks and ambitious sustainability targets are fostering rapid adoption of low-VOC and waterborne e-coat technologies. Manufacturers in Western Europe are spearheading innovations in green chemistries, while Eastern European facilities are capitalizing on cost-efficient labor to attract new coating line installations. The Middle East and Africa, though comparatively nascent markets, are demonstrating growing appetite for corrosion-resistant coatings in oil and gas pipelines, power generation, and heavy equipment.

Meanwhile, the Asia-Pacific region represents the largest and fastest-growing market for electrodeposition coatings. China’s rapidly expanding automotive and electronics sectors have ignited demand for high-performance e-coat systems, and similar trends are emerging in India and Southeast Asia. Regional coating formulators are partnering with technology suppliers to localize production of advanced bath chemistries, while original equipment manufacturers are establishing integrated supply chains to ensure consistent quality at scale.

This comprehensive research report examines key regions that drive the evolution of the E-Coat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Profiles and Innovations from Leading Electrodeposition Coating Companies Driving Market Advancement and Competitive Differentiation

Leading e-coat formulators and equipment suppliers are driving market evolution through strategic investments, technology partnerships, and sustainability initiatives. PPG Industries has solidified its position as an industry pioneer, leveraging over nine decades of coatings expertise to deliver both cathodic and anodic systems that span automotive, industrial, and consumer goods segments, while its POWERCRON sixth-generation epoxies exemplify cutting-edge corrosion resistance and process efficiency. Axalta Coating Systems, renowned for its AquaECTM 3500 EP tin-free electrocoat primer, continues to expand its global footprint by providing tailored water-based formulations that meet the exacting performance requirements of light and commercial vehicle OEMs. BASF has further underscored its commitment to innovation with the inauguration of a dedicated electrocoat research center in late 2022, accelerating the development of next-generation eco-friendly resins and additives for diverse industrial applications.

Complementing these leaders, The Sherwin-Williams Company has enhanced its e-coat portfolio through targeted acquisitions and joint ventures, bolstering its capabilities in color management and process automation. Specialty formulators such as Nippon Paint and KCC Corporation are capitalizing on region-specific insights to address localized substrate preferences and climatic challenges. Collectively, these players are navigating evolving customer demands and regulatory landscapes by investing in digital process controls, sustainable chemistry platforms, and end-to-end service models that facilitate rapid adoption and high-quality outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Coat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Anopol Limited

- Axalta Coating Systems, Ltd.

- B.L. Downey Company LLC

- BASF SE

- CHEMEON Surface Technology LLC

- DuPont de Nemours, Inc.

- Dürr AG

- Electrocoat Association

- EPCOR Electrocoating Inc.

- George Koch Sons, LLC

- H.E.F. Duraguard

- Henkel AG & Co. KGaA

- Ideal Manufacturing

- Industrial Coatings Ltd.

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Protech-Oxyplast Group

- RPM International Inc.

- The Sherwin-Williams Company

- Therma-Tron-X, Inc.

- TIGER Coatings GmbH & Co. KG

Formulating Actionable Strategies to Enhance Resilience, Sustainability, and Competitive Advantage in Electrodeposition Coating Operations Worldwide

Industry leaders should prioritize diversification of raw material sourcing to mitigate escalating trade uncertainties. By forging alliances with geographically diverse chemical suppliers and exploring domestic production partnerships, coating manufacturers can safeguard supply continuity and control input costs amid shifting tariff regimes. Concurrently, accelerating the integration of digital and automated process controls-including predictive maintenance algorithms and digital twin simulations-will optimize bath performance, reduce downtime, and enhance product quality at scale.

Investing in the development of low-VOC, waterborne e-coat formulations aligned with stringent environmental regulations will not only future-proof operations against regulatory tightening but also resonate with end users seeking sustainable solutions. Collaborative R&D partnerships between resin suppliers, equipment manufacturers, and end-use customers can expedite innovation cycles and deliver application-specific chemistries that differentiate offerings in crowded markets. Additionally, expanding footprint in high-growth APAC markets through localized production or licensing agreements will position companies to capture emerging demand and benefit from regional cost efficiencies.

Detailing Rigorous Research Methodology Including Comprehensive Data Collection, Stakeholder Engagement, and Analytical Frameworks Underpinning This Report

This report was developed through a rigorous, multi-method research approach designed to ensure comprehensive, unbiased insights. Secondary research included an extensive review of industry publications, regulatory documents, patent filings, and technical standards. Primary research involved structured interviews and surveys with over 50 stakeholders encompassing OEMs, tier-one coating line integrators, raw material suppliers, and industry consultants. Quantitative data were triangulated across multiple databases to validate trends and countercheck proprietary analyses.

Analytical frameworks applied include Porter’s Five Forces to assess competitive intensity, value chain mapping to identify strategic leverage points, and SWOT analysis for each major market segment. Regional market sizing employed bottom-up modeling calibrated against historic adoption rates and capacity expansions. Forecast scenarios were stress-tested for variables such as raw material availability, policy shifts, and technology adoption curves. Quality control protocols encompassed peer review by technical experts and a final hazard review to verify adherence to confidentiality and ethical research standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Coat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Coat Market, by Electrodeposition Type

- E-Coat Market, by Substrate Material

- E-Coat Market, by End Use Industry

- E-Coat Market, by Region

- E-Coat Market, by Group

- E-Coat Market, by Country

- United States E-Coat Market

- China E-Coat Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Key Insights to Illuminate the Future Trajectory of Electrodeposition Coatings in an Evolving Global Manufacturing Landscape

Electrodeposition coatings are at a pivotal juncture, driven by dynamic regulatory landscapes, evolving technological paradigms, and reshaped global trade dynamics. Transformative shifts in automation, digitalization, and sustainable chemistry have set new benchmarks for process efficiency, environmental stewardship, and product performance. Simultaneously, intensified tariff measures underscore the necessity for strategic supply chain diversification and cost management.

By harnessing segmentation insights that pinpoint optimal process types, substrate material pairings, and end-use-specific chemistries, industry participants can tailor solutions to precise market needs. Regional variation in regulatory rigor and manufacturing investment further accentuates the importance of localizing production and fostering strategic alliances. Leading companies are seizing opportunities through bold investments in R&D, digital innovation, and collaborative partnerships, thereby shaping a future where electrodeposition technologies underpin the next generation of high-performance, eco-responsible manufactured goods.

Connect with Ketan Rohom to Secure Your Comprehensive Electrodeposition Coating Market Report and Empower Strategic Decision-Making Today

To explore detailed market perspectives, in-depth technological analyses, and actionable strategies designed to elevate your competitive positioning, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage with an expert who can guide you through tailored subscription options and customizable solutions. Secure your comprehensive electrodeposition coating market research report today and empower your strategic decision-making with the latest, most reliable insights.

- How big is the E-Coat Market?

- What is the E-Coat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?