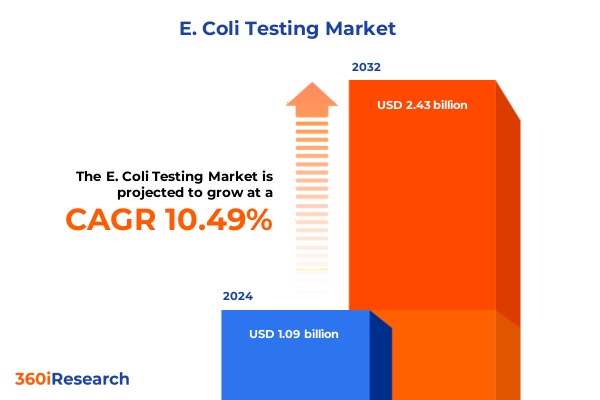

The E. Coli Testing Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.31 billion in 2026, at a CAGR of 10.63% to reach USD 2.43 billion by 2032.

Understanding the Critical Imperative and Evolving Dynamics of E coli Testing in Ensuring Public Health Safety in Modern Healthcare and Environmental Surveillance

Each year in the United States, an estimated nine million individuals fall ill due to foodborne diseases, underscoring the persistent threat posed by contaminating pathogens in our food and water supply. Among these, Shiga toxin–producing Escherichia coli (STEC) remains a leading concern, with surveillance data recording 2,925 cases in 2018, including 648 hospitalizations and 13 deaths. The adoption of culture-independent diagnostic tests for STEC detection has risen markedly over recent years, climbing from 17.6% of laboratory confirmations in 2018 to 24.0% in 2023, reflecting a broader shift towards rapid, molecular-based diagnostics in clinical and food safety settings.

Against this backdrop, regulatory frameworks have evolved to address emerging risks. In May 2024, the FDA published a final rule under the Food Safety Modernization Act (FSMA) that replaces prescriptive microbial water testing for covered produce with systems-based agricultural water assessments aimed at hazard identification and risk management. Effective July 5, 2024, this rule mandates annual pre-harvest water assessments, with large farms required to achieve compliance by April 7, 2025, marking a pivotal shift toward preventive controls in agricultural water safety.

Together, these public health imperatives and regulatory reforms have created a compelling environment for innovation in E. coli diagnostics. As the industry adapts to more rigorous safety standards and rising demand for rapid, high-throughput testing, the stage is set for transformative technological advancements, to be explored in the next section.

Revolutionary Technological Breakthroughs and Analytical Transformations Redefining the Future Landscape of E coli Detection and Diagnostics Globally

The landscape of E. coli testing has undergone a sweeping transformation driven by breakthroughs in molecular diagnostics, advanced biosensor engineering, and digital integration. Quantitative Polymerase Chain Reaction (qPCR), multiplex panels, and Loop-Mediated Isothermal Amplification (LAMP) are rapidly supplanting traditional culture methods, delivering results in under four hours compared to the 24-hour timeframe typical of agar-based assays. Industry insiders predict that these techniques will continue to erode the dominance of culture-based approaches, supported by superior specificity and regulatory mandates requiring faster pathogen identification.

Complementing molecular assays, next-generation biosensors are revolutionizing point-of-care and field testing. Real-time colorimetric systems now yield quantitative E. coli results in under 12 minutes, enabling on-site verification without the need for centralized laboratories. These portable platforms, often integrated with smartphone interfaces, facilitate immediate data capture and geolocation, streamlining outbreak response and environmental monitoring in remote or resource-constrained settings.

Moreover, digital and artificial intelligence enhancements are amplifying diagnostic capacity. AI-driven image analysis automates colony enumeration and anomaly detection on culture plates, reducing human error by up to 22%. Cloud-based networks now aggregate testing data across laboratories in real time, improving traceability and regulatory compliance. Looking ahead, CRISPR-enabled diagnostics promise ultra-sensitive, low-cost detection, poised to capture significant market share as regulatory approvals accelerate beyond 2026, reflecting the sector’s continual push toward integrated, high-precision solutions.

These technological revolutions not only enhance analytical performance but also expand the range of use cases-from water utilities and food processors to clinical laboratories-laying the groundwork for resilient, scalable testing workflows that address both current and emerging public health challenges.

Assessing the Cumulative Consequences of United States 2025 Trade Tariffs on E coli Testing Supply Chains Innovation and Operational Costs

In April 2025, the U.S. government imposed a uniform 10% global tariff on nearly all imported goods, encompassing active pharmaceutical ingredients, medical devices, and diagnostic equipment. This sweeping measure, intended to stimulate domestic manufacturing, has had immediate repercussions for providers of E. coli testing solutions, driving up costs for imported reagents, instruments, and assay kits and pressuring profit margins across the diagnostic supply chain.

Simultaneously, proposals for steep tariffs of up to 200% on foreign-manufactured pharmaceuticals and biologics have prompted leading life sciences companies to realign their operational footprints. In response, major firms such as Biogen are injecting billions into U.S. manufacturing facilities to pre-empt the tariff impacts, bolstering domestic capacity for gene therapy fill-finish operations and automated production lines. While drugs have historically been exempt, these proposed levies underscore the administration’s focus on onshoring critical biomanufacturing capabilities for economic and national security reasons.

A survey by the Biotechnology Innovation Organization (BIO) further highlights the dilemma faced by diagnostic innovators: nearly 90% of U.S. biotech companies rely on imported components for at least half of their FDA-approved products, and 94% anticipate manufacturing costs surging if tariffs target key markets such as the European Union. Half of those surveyed indicated potential delays or rework of regulatory filings, while 80% expect at least a 12-month transition period to secure alternative suppliers, and 44% foresee disruptions extending beyond two years, jeopardizing product pipelines and innovation timelines.

Faced with escalating import duties and supply chain volatility, many companies are exploring strategic pivots, including relocating research activities to tariff-exempt regions in Europe and Asia. This geographic diversification, while mitigating cost pressures, risks fragmenting R&D efforts and eroding the U.S. knowledge base-a trade-off that industry leaders must navigate carefully as they balance resilience and innovation in a shifting trade environment.

Deciphering Key Segment Dynamics Across Test Methods End Users Product Types Technologies and Sample Types Shaping E coli Testing Market

The E. coli testing market is characterized by diverse analytical platforms, each tailored to specific performance criteria and end-use applications. Within the testing methods domain, biosensor technologies offer rapid, real-time detection, while conventional culture media remain the benchmark for regulatory compliance. Immunoassays provide sensitive antigen-based screening, and molecular assays-spanning digital PCR, traditional PCR, and real-time PCR-deliver unparalleled accuracy and throughput, particularly valuable during outbreak investigations.

Across end-user segments, academic research institutions leverage advanced assays for pathogen biology studies and method development. Clinical diagnostics environments, including both diagnostic laboratories and hospital settings, adopt high-precision molecular platforms to guide patient management. In the food industry, processors within dairy, meat and poultry, and processed foods operations integrate on-site kits and automated systems to meet stringent safety standards, while water testing facilities-covering both drinking water utilities and wastewater treatment plants-rely on robust instrumentation to monitor regulatory thresholds.

Product portfolios span instruments, kits, and reagents, allowing stakeholders to assemble complete testing workflows or supplement existing infrastructure. Technology layers, notably chromatography, enzyme-linked immunosorbent assays, mass spectrometry, and polymerase chain reaction, underpin analytical diversity, enabling laboratories to select methods aligned with sample matrices and detection limits. Finally, sample types-ranging from clinical specimens to food and water samples-dictate pre-analytical processing requirements and validation protocols.

By understanding how each segmentation dimension intersects with regulatory demands, operational budgets, and performance objectives, industry participants can tailor solution offerings to capture emerging opportunities and optimize resource allocation within the competitive E. coli testing landscape.

This comprehensive research report categorizes the E. Coli Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Method

- Technology

- Sample Type

- End User

Unveiling Regional Divergences and Strategic Positioning Across Americas Europe Middle East Africa and Asia Pacific in E coli Testing

The Americas region, led by the United States, commands a significant share of the global E. coli testing market owing to rigorous EPA and FDA mandates, expansive water infrastructure, and a well-established food safety ecosystem. Investments in automated culture imaging and next-generation molecular workstations are prevalent as laboratories seek to accelerate turnaround times and address growing public health surveillance requirements. In Latin America, rising consumer awareness and regulatory harmonization efforts are driving incremental adoption of advanced diagnostics.

Europe, Middle East & Africa (EMEA) presents a heterogeneous landscape. Western Europe’s mature regulatory environment-with its emphasis on the European Food Safety Authority guidelines-supports widespread use of high-throughput PCR and immunoassay systems. Collaborative research initiatives and public health networks further bolster market growth. In the Middle East and Africa, expanding water and food safety programs, often backed by donor-funded public-health partnerships, fuel demand for portable test kits capable of withstanding diverse environmental conditions.

Asia-Pacific registers the highest growth trajectory, propelled by rapid urbanization, stringent water quality regulations, and large-scale rural electrification projects that enable decentralized testing. Countries such as China and India are scaling bioreagent manufacturing to reduce costs and supply chain dependencies, while governments integrate microbial monitoring into smart-city frameworks. This momentum is reinforced by public-private collaborations to upgrade laboratory networks and enhance outbreak preparedness.

These regional disparities underscore the importance of geographically informed strategies that align product innovation, regulatory engagement, and distribution partnerships with local market dynamics.

This comprehensive research report examines key regions that drive the evolution of the E. Coli Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation Partnerships Acquisitions and Competitive Strategies within the Global E coli Testing Sector

Leading diagnostic players are intensifying innovation efforts and executing strategic alliances to maintain competitive differentiation in the E. coli testing field. Thermo Fisher Scientific has introduced a fully automated PCR platform capable of processing 2,400 samples per day with sub-35 minute turnaround, targeting high-volume clinical and food safety laboratories seeking throughput acceleration. Simultaneously, NanoLogix’s portable biosensor system delivers colorimetric pathogen detection in under 12 minutes, empowering field operators with immediate decision support.

Bio-Rad Laboratories has rolled out smart PCR cartridges featuring RFID tracking to streamline result logging and chain-of-custody compliance, reflecting a growing emphasis on data integrity and traceability in regulated environments. Meridian Bioscience’s recent acquisition of a molecular diagnostics specialist expands its pathogen detection portfolio, strengthening its position in the competitive molecular assay space. IDEXX Laboratories continues to refine chromogenic media formulations to detect multiple E. coli serotypes simultaneously, achieving a 22% reduction in false negatives and reinforcing its leadership in water testing domains.

Beyond product innovation, the market’s top firms are forging collaborative research partnerships and licensing agreements to accelerate next-generation assay development. These alliances not only harness complementary expertise in assay chemistry and instrument design but also facilitate global distribution networks and regulatory submissions. Collectively, these strategic initiatives underscore the industry’s concerted drive to meet escalating performance expectations and regulatory mandates across diverse application sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the E. Coli Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Accugen Laboratories, Inc.

- Agilent Technologies, Inc.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- bioMérieux SA

- Bio‑Rad Laboratories, Inc.

- Enzo Life Sciences, Inc.

- Hach Company

- IDEXX Laboratories, Inc.

- Luminex Corporation

- Merck KGaA

- NEMIS Technologies AG

- Neogen Corporation

- Pall Corporation

- QIAGEN N.V.

- Roche Diagnostics

- Sigma‑Aldrich Corporation

- Thermo Fisher Scientific Inc.

Strategic Actionable Recommendations for Industry Leaders to Accelerate Innovation Enhance Resilience and Navigate Emerging E coli Testing Challenges

To thrive in the evolving E. coli testing environment, industry leaders should prioritize targeted investments in advanced molecular platforms that deliver rapid, multiplexed results and facilitate seamless data integration. Establishing flexible manufacturing frameworks-combining onshore production for core reagents with strategic partnerships for specialized components-can mitigate tariff-related cost pressures and maintain operational agility.

Collaboration with regulatory agencies and participation in guideline development will ensure that new technologies align with emerging standards and gain timely market access. In parallel, expanding point-of-use capabilities through portable biosensors and smartphone-enabled assays can unlock underserved segments in remote and resource-limited settings, driving revenue diversification.

Competitive advantage also hinges on robust data-management ecosystems. Investing in cloud-based networks and AI-driven analytics will enable real-time surveillance, predictive maintenance of instrumentation, and adaptive quality control, thereby enhancing laboratory efficiency and compliance.

Finally, fostering cross-sector partnerships-linking food producers, water utilities, and clinical laboratories-can catalyze joint validation studies and end-user training programs. By aligning innovation roadmaps with customer needs and regulatory trajectories, companies can accelerate technology adoption, deepen market penetration, and build resilient supply chains for sustainable growth.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation for E coli Testing Insights

This analysis integrates both secondary and primary research methodologies to ensure rigor and objectivity. Secondary data were gathered from regulatory publications, peer-reviewed journals, industry white papers, and credible news outlets to establish market context, technological trends, and policy developments. Key sources included FDA rulemakings, CDC surveillance reports, and industry press releases.

Primary research involved structured interviews with subject-matter experts in clinical microbiology, food safety, water testing, and regulatory affairs. These engagements provided qualitative insights into purchasing criteria, validation challenges, and emerging application areas. Expert perspectives were triangulated with quantitative data to validate assumptions and refine market segmentation.

Data credibility was further reinforced through cross-validation with multiple independent sources. Market dynamics were analyzed via thematic coding and scenario analysis to identify disruptive forces, growth drivers, and potential barriers. Finally, all findings underwent peer review by an internal quality assurance team to ensure consistency, accuracy, and completeness.

This comprehensive approach balances depth and breadth, enabling stakeholders to make informed decisions grounded in robust evidence while remaining adaptable to future shifts in the E. coli testing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E. Coli Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E. Coli Testing Market, by Product Type

- E. Coli Testing Market, by Test Method

- E. Coli Testing Market, by Technology

- E. Coli Testing Market, by Sample Type

- E. Coli Testing Market, by End User

- E. Coli Testing Market, by Region

- E. Coli Testing Market, by Group

- E. Coli Testing Market, by Country

- United States E. Coli Testing Market

- China E. Coli Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Core Insights Highlighting Strategic Imperatives and Future Priorities for Stakeholders in E coli Testing Ecosystem

Throughout this executive summary, we have highlighted the intersection of public health imperatives, regulatory evolution, and technological innovation that is redefining the E. coli testing market. The convergence of rapid molecular diagnostics, advanced biosensors, and digital analytics is delivering unprecedented speed and accuracy, while trade policies and supply chain considerations are reshaping operational strategies.

Segmentation analysis underscores the diverse requirements across testing methods, end-user environments, product types, and sample matrices. Regional insights reveal distinct growth patterns, necessitating customized go-to-market approaches. Meanwhile, leading companies are leveraging collaborations, acquisitions, and platform enhancements to maintain competitive momentum.

Actionable recommendations emphasize the importance of supply chain resilience, regulatory engagement, data-centric workflows, and cross-sector alliances. By adopting these strategies, industry participants can navigate emerging tariffs, meet stringent safety standards, and capitalize on new market opportunities.

As stakeholders chart their paths forward in this dynamic ecosystem, these insights offer a clear roadmap for aligning innovation, compliance, and operational excellence to safeguard public health and drive sustainable business growth.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Customized E coli Testing Market Research Report Today

To delve deeper into the complete analysis of the E. coli testing market, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through tailored insights, answer any questions, and facilitate securing your comprehensive report to drive informed decision-making in your organization.

- How big is the E. Coli Testing Market?

- What is the E. Coli Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?