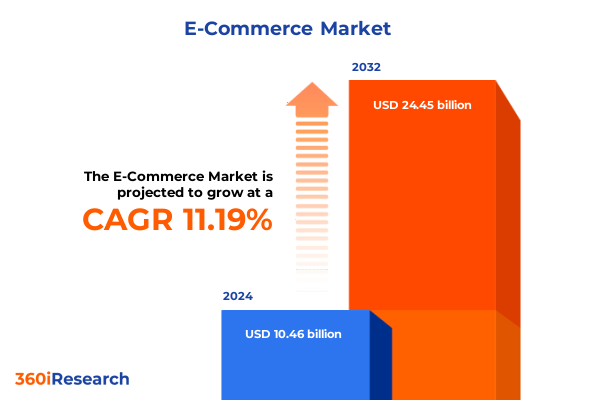

The E-Commerce Market size was estimated at USD 11.42 billion in 2025 and expected to reach USD 12.47 billion in 2026, at a CAGR of 11.48% to reach USD 24.45 billion by 2032.

Setting the Stage for the Future of E-Commerce: Exploring Key Market Drivers, Pioneering Digital Innovations, and Evolving Consumer Expectations

The digital commerce ecosystem has evolved into a dynamic marketplace where consumer expectations, technological breakthroughs, and business models intersect in unprecedented ways. Today’s consumers demand seamless experiences across channels, immediate fulfillment, and personalized interactions that anticipate their needs. Meanwhile, emerging technologies-ranging from artificial intelligence–powered recommendation engines to immersive augmented reality interfaces-are reshaping how brands engage with their audiences. This interplay of consumer empowerment and technological innovation underscores the imperative for businesses to adapt or risk obsolescence.

Within this landscape, strategic agility and data-driven decision making have become the cornerstone of thriving enterprises. Companies that leverage analytics to decipher behavioral trends and optimize each touchpoint are establishing new benchmarks for customer satisfaction and operational efficiency. As digital commerce matures, firms that prioritize a holistic integration of front-end experiences and back-end supply chain resilience are poised to capture market share. This introduction sets the stage for an exploration of the transformative forces, regulatory influences, segmentation nuances, and actionable strategies that define the modern e-commerce arena.

Navigating Fundamental Transformations in Online Retail: How Emerging Technologies and Shifting Behaviors Redefine the Shopping Ecosystem

Fundamental shifts are redefining the contours of online retail, driven by a confluence of advanced technologies and shifting consumer behaviors. Artificial intelligence and machine learning are elevating personalization to granular levels, crafting individual shopping journeys rooted in predictive analytics. At the same time, augmented reality and virtual showrooms are blurring the line between physical and digital, enabling immersive product interactions that bolster customer confidence. These innovations, in turn, are catalyzing expectations for richer, more engaging experiences across devices.

Concurrently, behavioral trends such as the proliferation of social commerce, the rise of buy-now-pay-later financing, and the mounting emphasis on sustainable practices are transforming how value is exchanged. Social platforms are evolving into full-fledged marketplaces, while eco-conscious shoppers increasingly reward brands with transparent sourcing and carbon-neutral operations. Together, these transformational currents necessitate that businesses rethink traditional models, embrace cross-functional collaboration, and cultivate ecosystems that anticipate both technological possibilities and ethical imperatives.

Assessing the Far-Reaching Consequences of U.S. Tariff Adjustments in 2025 on Cost Structures, Supply Chains, and Competitive Dynamics

In 2025, revised U.S. tariff measures reshaped cost structures and supply chain architectures for numerous product categories. Heightened duties on imported electronics compelled companies to reevaluate their sourcing strategies, triggering a shift toward regional manufacturing hubs and nearshoring partners to mitigate elevated landed costs. Similarly, apparel and fashion suppliers faced increased overhead, prompting renegotiations with overseas factories and accelerated adoption of fabric recycling initiatives to offset margin pressures.

These tariff adjustments have rippled across logistics networks, extending lead times and pressuring inventory management systems to become more agile. Businesses have invested in enhanced supply chain visibility tools and diversified their vendor portfolios to reduce dependency on any single geography. On the consumer side, modest price adjustments for high-ticket goods have been partially absorbed by brands seeking to preserve loyalty, yet increasingly transparent pricing models are emerging as a trust-building mechanism. Ultimately, the cumulative impact of 2025 tariff changes underscores the need for strategic resilience and a proactive approach to regulatory shifts.

Unveiling Critical Market Segmentation Insights: Deconstructing Product Categories, Device Preferences, and Fulfillment Strategies for Targeted Growth

Dissecting the e-commerce landscape through the lens of product category reveals nuanced behaviors that inform targeted growth strategies. Within Electronics, demand remains robust for Smartphones and Computers & Tablets, yet emerging segments such as Audio Equipment and Cameras are experiencing accelerated adoption driven by content creation trends. The broader Fashion category underscores the value of Accessories to enhance average order values, while Apparel growth is propelled by a resurgence in Men’s and Women’s Apparel collections targeted at athleisure and performance wear enthusiasts. In Food & Beverage, Non Alcoholic Beverages continue to capture shopper interest, but Perishable Food innovations in subscription models have emerged as a differentiator for agile operators.

Device preferences further delineate user journeys, with Mobile channels dominating traffic and conversion funnels, while Desktop usage sustains higher average transaction values for complex purchases. Tablet engagement, though smaller in share, yields significant uplift in cross-sell metrics when coupled with interactive features. Fulfillment paradigms highlight the importance of Business To Consumer networks, particularly among Online Only Retailers whose agility in last-mile delivery enhances customer satisfaction. Meanwhile, Business To Business channels are leveraging distributor partnerships to streamline bulk order cycles. Lastly, Channel Type segmentation underscores the ascendancy of Marketplaces as volume drivers, even as Direct To Consumer touchpoints via Brand Websites and Mobile Apps deepen brand affinity through cohesive experiences.

This comprehensive research report categorizes the E-Commerce market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Device Type

- Fulfillment Model

- Channel Type

Gaining Strategic Regional Perspectives: Distinct E-Commerce Trends Shaping Consumer Engagement and Operational Models Across Key Geographies

Regional dynamics continue to shape e-commerce trajectories in unique ways, reflecting economic, cultural, and regulatory influences. In the Americas, digital commerce is fueled by established omnichannel infrastructures and high digital adoption rates, with an emphasis on next-day and same-day delivery models that underscore consumer expectations for immediacy. Evolving payment ecosystems, including mobile wallets and digital currencies, are enhancing transaction efficiency and financial inclusion across diverse markets.

Moving to Europe, Middle East & Africa, the landscape is characterized by a mosaic of markets where cross-border trade regulations and linguistic diversity demand highly localized strategies. Countries across Western Europe focus on privacy and data compliance, while rapidly growing markets in the Middle East emphasize mobile-first experiences and social commerce innovations. Africa’s digital commerce penetration, though nascent, is accelerating through partnerships with fintech platforms that bridge connectivity gaps.

In Asia-Pacific, e-commerce encounters perhaps the most intense competitive environment, driven by trailblazing innovations in live-stream shopping, super app ecosystems, and seamless integration of social features. Local giants continue to experiment with embedded financial services and hyper-personalized logistics offerings, setting the pace for global best practices in digital retail.

This comprehensive research report examines key regions that drive the evolution of the E-Commerce market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players: Strategic Initiatives, Competitive Positioning, and Innovation Agendas Elevating Top E-Commerce Companies

Leading e-commerce enterprises are charting new paths by harnessing technology and refining customer experiences to fortify their market positions. Amazon’s relentless focus on infrastructure expansion and predictive analytics capabilities has enabled it to maintain cost leadership while raising the bar for fulfillment speed. Conversely, Shopify’s platform-driven model empowers small and mid-sized merchants with turnkey solutions that scale flexibly, fostering a thriving ecosystem of entrepreneurial brands.

Meanwhile, traditional retailers such as Walmart are leveraging omnichannel synergies to seamlessly integrate digital and brick-and-mortar operations, strengthening their marketplace offerings and leveraging existing logistics assets. Alibaba continues to innovate in ecosystem playbooks through investments in cloud computing and digital payment services that anchor consumer loyalty. Emerging contenders are differentiating through niche verticals and specialized fulfillment networks, demonstrating that focused value propositions can disrupt established hierarchies even in saturated segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Commerce market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Automattic Inc.

- BigCommerce Pty. Ltd.

- commercetools GmbH

- Ecwid Inc.

- Elastic Path Software, Inc.

- International Business Machines Corporation

- Intershop Communications AG

- Lightspeed Commerce Inc.

- Mailchimp

- Microsoft Corporation

- nopSolutions

- Odoo S.A.

- Optimizely, Inc.

- Oracle Corporation

- Oro Inc.

- PrestaShop SA

- Salesforce, Inc.

- SAP SE

- Shift4Shop LLC

- Shopify Inc.

- Shopware AG

- Spryker Systems GmbH

- Squarespace, Inc.

- Unilog Content Solutions

- VTEX Inc.

- Znode by Amla Commerce

Implementing Actionable Strategies for E-Commerce Leaders: Enhancing Operational Efficiency, Customer Experience, and Sustainable Growth Trajectories

Industry leaders should prioritize investments in advanced personalization engines that deliver real-time recommendations and dynamic pricing adjustments tailored to individual preferences. By integrating machine learning models with behavioral data, brands can anticipate purchase intent and proactively address churn risk. Simultaneously, diversifying supply chain sources through regional partnerships and nearshoring arrangements will bolster resilience against geopolitical and tariff-related disruptions.

To enhance customer loyalty, companies must refine last-mile strategies by exploring micro-fulfillment centers and collaborating with local delivery networks for scalable, low-cost options. Strengthening cybersecurity frameworks is also critical, as rising transaction volumes and sophisticated threats necessitate robust data protection protocols. Finally, embedding sustainability across the value chain-from eco-friendly packaging to carbon offset initiatives-will resonate with socially conscious consumers and unlock long-term brand equity.

Detailing Rigorous Research Methodology: Integrating Quantitative Analyses, Qualitative Insights, and Multi-Source Validation for Robust Findings

This analysis synthesizes quantitative and qualitative inputs drawn from primary stakeholder interviews, expert consultations, and proprietary survey data. The research process commenced with a comprehensive desk review of public filings, trade journals, and industry reports to establish foundational context. Primary research involved structured discussions with supply chain executives, marketing leaders, and technology providers to capture firsthand perspectives on emerging trends.

Quantitative analysis incorporated aggregated transactional datasets and traffic metrics provided by leading analytics platforms, enabling benchmarking across categories and regions. A rigorous multi-source validation protocol was applied to reconcile discrepancies and ensure data integrity. Supplementary secondary sources, such as governmental trade databases and reputable financial disclosures, informed the examination of regulatory impacts, including the 2025 tariff revisions. The methodology was designed to deliver robust, actionable insights while maintaining transparency and reproducibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Commerce market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Commerce Market, by Product Category

- E-Commerce Market, by Device Type

- E-Commerce Market, by Fulfillment Model

- E-Commerce Market, by Channel Type

- E-Commerce Market, by Region

- E-Commerce Market, by Group

- E-Commerce Market, by Country

- United States E-Commerce Market

- China E-Commerce Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Concluding Synthesis of E-Commerce Momentum: Summarizing Core Findings and Imperatives That Will Shape Future Digital Commerce Landscapes

The convergence of advanced technologies and evolving consumer preferences has accelerated the sophistication of the e-commerce landscape. From immersive shopping experiences enabled by augmented reality to the elevated personalization powered by artificial intelligence, market participants must embrace continuous innovation. The 2025 tariff adjustments have underscored the importance of flexible supply chain strategies and transparent pricing models to maintain customer trust.

Segmentation analysis reveals that targeted approaches-spanning product categories, device types, fulfillment models, and channel preferences-unlock meaningful performance differentials. Regional insights remind us that localization and adaptability remain non-negotiable in an interconnected world. Leading companies demonstrate that strategic investments in infrastructure, platforms, and cross-channel integration are distinguishing factors. By synthesizing these findings, industry stakeholders can craft informed strategies that address immediate challenges while positioning themselves for sustained success in the digital commerce era.

Driving Informed Decisions with Expert Guidance: Reach Out to Ketan Rohom to Explore Comprehensive E-Commerce Market Intelligence Solutions

For stakeholders looking to deepen their understanding of evolving e-commerce strategies and capitalize on actionable market intelligence, an opportunity awaits. Reach out directly to Ketan Rohom, who serves as Associate Director, Sales & Marketing, to explore how this comprehensive research report can inform your strategic planning and drive growth. Ketan’s expertise in guiding organizations through complex digital commerce landscapes will help tailor insights to your unique challenges and ambitions, ensuring you extract maximum value from the findings. Engage with Ketan Rohom to secure your copy of the report and embark on a data-driven journey toward sustainable competitive advantage.

- How big is the E-Commerce Market?

- What is the E-Commerce Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?