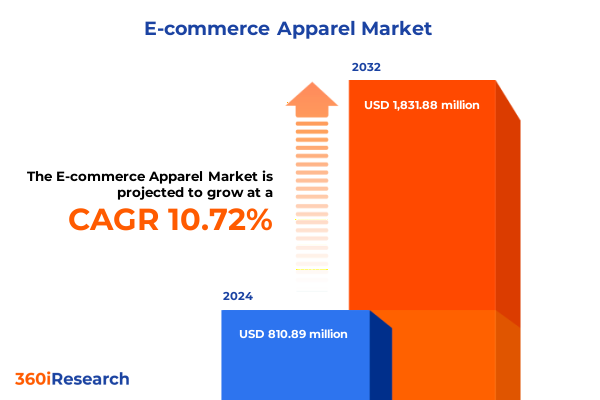

The E-commerce Apparel Market size was estimated at USD 896.38 million in 2025 and expected to reach USD 982.13 million in 2026, at a CAGR of 10.74% to reach USD 1,831.88 million by 2032.

Introducing the E-commerce Apparel Market's Growth Driven by Shifting Consumer Behavior, Omnichannel Initiatives and Digital Innovation

Over the past decade, the e-commerce apparel sector has emerged as a critical frontier for fashion retailers and digital disruptors alike. Fueled by the proliferation of smartphones, the ubiquity of social media and the demand for seamless shopping experiences, traditional retail paradigms have been reshaped by click-and-ship convenience. In this hyper-competitive environment, the interplay between technology and consumer expectations has propelled the market beyond simple transactional interactions toward highly personalized encounters. The COVID-19 pandemic further accelerated digital adoption, compelling brands to pivot toward robust online infrastructures and invest in scalable cloud-native platforms to support surging traffic and maintain uptime.

As the lines between online and offline channels continue to blur, brands are investing in omnichannel initiatives that integrate mobile commerce, social commerce and interactive digital touchpoints. AI-driven personalization engines anticipate shopper preferences, while virtual try-on features and immersive augmented reality tools replicate the in-store experience from the comfort of home. These innovations have not only elevated customer satisfaction but also deepened brand loyalty through the delivery of customized recommendations and streamlined checkout processes. Meanwhile, payment technologies and digital wallets are facilitating frictionless transactions, setting a new benchmark for speed and security that consumers now expect as standard.

This executive summary offers a concise yet comprehensive overview of the e-commerce apparel landscape. It unpacks the transformative shifts shaping retail strategies, examines the 2025 United States tariff impacts, distills key segmentation insights, illuminates regional dynamics and highlights competitive company maneuvers. Actionable recommendations and a transparent research methodology round out this document, empowering decision-makers to navigate the evolving market with confidence. By leveraging these insights, organizations can position themselves at the forefront of digital innovation and adapt to emergent consumer trends.

Revealing How Technological Advancements and Sustainability Imperatives Are Redefining E-commerce Apparel Retail Strategies Worldwide

In the wake of rapid technological progress and heightened consumer awareness, the e-commerce apparel landscape is undergoing profound transformations. Retailers are leveraging advanced data analytics to gain real-time visibility into inventory levels, consumer behavior and supply chain performance. By harnessing AI and machine learning, brands can optimize demand forecasting, minimize overstocks and tailor marketing campaigns with unparalleled precision. Moreover, blockchain solutions are being piloted to enhance product traceability, reinforcing commitments to ethical sourcing and transparency in an increasingly conscious marketplace. Beyond transparency, digital twins simulate production processes to yield operational efficiencies and support sustainable material innovation.

Concurrently, sustainability imperatives have moved to the forefront of strategic planning. From adopting eco-friendly packaging materials to integrating circular business models, market leaders are seeking to reduce environmental footprints and meet evolving regulatory requirements. The push toward responsible manufacturing and extended producer responsibility has spurred collaborations across the value chain, enabling designers, suppliers and logistics providers to co-innovate on low-impact materials and regenerative processes. Companies are also experimenting with carbon accounting platforms to measure and offset emissions associated with product lifecycles and last-mile deliveries.

These paradigm shifts are further amplified by next-generation customer engagement tools. Voice commerce interfaces, social media marketplaces and live-stream shopping events are redefining touchpoints, fostering direct interactions between brands and communities. As a result, the sector is witnessing a shift away from commodity-driven price wars toward experience-centric differentiation, positioning apparel e-tailers to capture both mindshare and wallet share in a digitally native era. Additionally, the emergence of the metaverse and 3D configurators is setting the stage for truly immersive retail experiences that transcend physical boundaries.

Examining the Ripple Effects of United States Tariffs Implemented in 2025 on Cross-Border E-commerce Apparel Trade Dynamics

With the implementation of new tariffs in 2025, the United States has introduced a series of import duties on certain apparel categories, recalibrating the economics of cross-border e-commerce. These measures have prompted retailers and brands to reassess sourcing strategies, as landed costs for goods manufactured in traditional offshore hubs have risen significantly. In response, many companies are exploring diversification of supplier portfolios, branching into nearshore production facilities and forging partnerships with regions offering favorable trade agreements to cushion margin pressures. Some forward-leaning organizations are also negotiating risk-sharing arrangements with suppliers to hedge against future policy volatility.

The tariff landscape has also accelerated investments in advanced supply chain technologies. Automated warehouses, smart logistics platforms and digital procurement systems are being deployed to streamline operations and mitigate the impact of elevated duty rates. By optimizing inventory positioning and leveraging data-driven route planning, forward-thinking organizations are reducing time-to-market and maintaining competitive pricing in an environment of rising input costs. Dynamic pricing algorithms have emerged as a key tool for adjusting final price points in real time, ensuring margins are protected without deterring value-sensitive customers.

Beyond the balance sheet, these policy shifts have influenced consumer perceptions. Shoppers are increasingly valuing transparency around product origins and ethical practices, making tariff-driven narratives an opportunity for storytelling rather than a mere cost pass-through. As brands communicate the rationale behind pricing adjustments and highlight commitments to local manufacturing, they have reinforced customer loyalty and differentiated themselves in a crowded digital marketplace. This interplay between policy, operations and consumer sentiment underscores the importance of integrated strategy development across merchandising, marketing and logistics functions.

Unveiling Actionable Insights by Product Type, Distribution Channels, Demographics, and Lifestyle Segmentation for E-commerce Apparel Leaders

In an increasingly intricate e-commerce apparel ecosystem, granular segmentation reveals the nuanced behaviors driving consumer choices. Apparel offerings span a diverse array of categories, from high-performance activewear encompassing athleisure and sportswear subsegments like gym, running and yoga apparel, to category staples such as jeans, shorts and trousers. Outerwear demand, illustrated by the popularity of coats and jackets, coexists with the perennial appeal of topwear, including blouses, shirts and T-shirts. Accessories, most notably bags and belts, complete the wardrobe matrix, while innerwear segments from bras to underwear reinforce the importance of comfort and fit. Footwear, whether boots or sneakers, provides a critical finishing touch to the ensemble.

Distribution avenues mirror this product diversity. Proprietary brand websites, third-party online marketplaces and emerging social commerce platforms each play distinct roles in shaping purchase journeys. Demographics further refine these patterns: kids, men and women exhibit unique purchasing rhythms and styling preferences, influenced by life stage and spending power. Price tiers-from luxury through premium and mid-market to value offerings-create stratified experiences that align with distinct consumer mindsets and brand aspirations.

Generational dynamics add another layer of complexity. Baby Boomers’ desire for quality and durability contrasts with Generation X’s emphasis on service excellence, while Millennials and Generation Z prioritize values-driven brands, digital community engagements and seamless mobile experiences. Style classifications such as athleisure, casual and formal guide assortments, and choices around fabric-cotton blends, pure cotton or synthetics-underscore the balance between performance, comfort and sustainability. Size inclusivity, spanning petite to tall and plus through regular sizes, ensures that retailers meet the diverse needs of a global audience.

As segmentation data becomes richer, marketers deploy hyper-targeted campaigns, adjusting creative assets and promotional offers to resonate with each cohort’s unique preferences as revealed through browsing history, social media engagement and transactional patterns. The synergy between segmentation and real-time analytics allows for continuous optimization of product assortments, ensuring assortments and price points align with evolving consumer demands and competitive benchmarks.

This comprehensive research report categorizes the E-commerce Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gender

- Price Tier

- Age Group

- Style

- Fabric

- Distribution Channel

Highlighting Distinct Regional Dynamics Shaping E-commerce Apparel Markets across Americas, Europe Middle East & Africa, and Asia-Pacific Regions

Regional nuances are central to decoding global e-commerce apparel performance. In the Americas, robust digital infrastructures and advanced logistics networks have accelerated consumer adoption of online fashion channels. The United States leads with mobile-first shopping behaviors, while Canada demonstrates growing enthusiasm for sustainable and socially responsible brands. Latin American markets, buoyed by rising internet penetration, are witnessing rapid uptake of localized payment solutions and innovative last-mile delivery models to overcome geographic challenges and foster trust among new online shoppers. In the Americas, Mexico has emerged as both a manufacturing partner and consumer market, benefiting from nearshoring incentives and a growing middle-class appetite for fashion. Brazil’s e-commerce infrastructure has been bolstered by strategic investments in digital payment systems, including instant bank transfers and local payment gateways, which have minimized cart abandonment rates and fostered trust among first-time online buyers. The United States market continues to witness consolidation in the logistics sector, as last-mile providers invest in micro-fulfillment centers to enable same-day delivery in dense urban areas.

Across Europe, the Middle East and Africa, divergent economic maturity levels shape buyer preferences and digital readiness. Western European nations exhibit a high expectation for personalized experiences and eco-certified products, whereas emerging markets in Eastern Europe and the Middle East are characterized by a blend of aspirational purchasing and price sensitivity. In Africa, digital wallets and mobile-based commerce are leapfrogging traditional banking channels, enabling small-scale entrepreneurs to participate in cross-border trade. Regulatory frameworks and regional trade agreements are also influencing cross-border flows, encouraging harmonization while requiring agility from multinational players. Within Europe, the Middle East and Africa region, the European Union’s regulatory landscape, including digital services directives and cross-border VAT reforms, is shaping how global retailers approach market entry. In the Gulf Cooperation Council, luxury segment growth is being catalyzed by high per-capita spending and a burgeoning youth demographic, while Africa’s informal sector is finding digital expression through mobile-first platforms that cater to peer-to-peer commerce.

The Asia-Pacific region stands out for its scale and innovation. China’s vast consumer base drives experimentation with live-stream selling and super app ecosystems, while Southeast Asian markets leverage social commerce and hyper-local fulfillment hubs. In Japan and South Korea, premium craftsmanship and brand heritage resonate with discerning shoppers, and Australia’s blend of urban and remote populations fosters hybrid models that combine digital convenience with pop-up experiences. These distinct dynamics underscore the importance of region-specific strategies, as global brands navigate a mosaic of consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the E-commerce Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategies and Competitive Moves of Leading E-commerce Apparel Brands Driving Market Innovation and Growth

Leading companies in the e-commerce apparel domain are deploying differentiated strategies to capture market share and deepen customer engagement. Legacy fashion conglomerates are investing in proprietary digital platforms that integrate rich storytelling, virtual try-on capabilities and loyalty programs structured around curated content. Meanwhile, digitally native brands leverage agile supply chains and data analytics to rotate styles at a rapid cadence, aligning drops with trending social media conversations and micro-influencer campaigns that resonate with niche audiences.

E-tail giants with diversified portfolios are capitalizing on their scale to negotiate favorable sourcing arrangements and subsidize free or expedited shipping options, further entrenching consumer expectations for convenience. Collaborations between established labels and celebrity or influencer-led lines have proven successful at driving hype and capturing incremental market segments. At the same time, disruptive entrants emphasize sustainability credentials, transparent pricing models and rental or resale services to appeal to environmentally conscious shoppers and circular economy proponents.

Technology providers and logistics innovators are also vital players, offering end-to-end solutions that encompass everything from AI-powered demand sensing and warehouse robotics to real-time tracking and last-mile autonomous delivery pilots. These partnerships enable retailers to accelerate time-to-consumer, reduce operational complexity and adapt swiftly to shifting tariff environments and consumer preferences.

Notably, Nike’s direct-to-consumer channels have expanded double-digit volumes through a combination of membership-based perks and immersive storytelling around product innovation. Inditex continues to refine its fast-fashion playbook by leveraging in-house manufacturing for rapid turnaround, supported by a robust RFID ecosystem for inventory visibility. Fast-fashion disruptor Shein has honed its algorithmic supply chain to deliver new styles within days of trending topics, while premium players such as Lululemon are reinforcing community ecosystems through experiential retail storefronts that double as wellness hubs. Additionally, Amazon’s private-label initiatives are introducing competitively priced basics that challenge brands across multiple price tiers.

Mid-market and value-oriented brands are also innovating through targeted subscriptions and rental services, tapping into the growing demand for flexible consumption models. These initiatives demonstrate that regardless of scale, companies are recognizing the strategic imperative to blend operational excellence with customer-centric narratives.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-commerce Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- ASOS plc

- Coupang, Inc.

- eBay Inc.

- Etsy, Inc.

- Flipkart Internet Private Limited

- MercadoLibre, Inc.

- Myntra Designs Private Limited

- Nykaa E-Retail Private Limited

- Pinduoduo Inc.

- Rakuten Group, Inc.

- Shein Group Ltd.

- Shopify Inc.

- Target Corporation

- Walmart Inc.

- Wayfair Inc.

- Zalando SE

- Zappos.com, Inc.

Establishing Data-Driven and Agile Strategies to Capitalize on Emerging Trends while Enhancing Customer Experience and Operational Efficiency

To thrive amid intensifying competition and external headwinds, industry leaders must prioritize a suite of data-driven and agile initiatives. First, investing in advanced analytics platforms will allow companies to deepen their understanding of customer cohorts and anticipate shifts in product demand, thereby optimizing inventory allocations and minimizing markdowns. Deploying AI-enabled visual search and personalized recommendation engines can enhance conversion rates by delivering the right product suggestions at the precise moment of intent. At the same time, ensuring compliance with data privacy regulations such as GDPR and CCPA is critical to maintaining consumer trust and safeguarding brand reputation.

Second, forging strategic alliances with technology providers and logistics specialists will strengthen supply chain resilience. Embracing modular warehousing models, integrating warehouse automation and piloting autonomous delivery options can drive cost efficiencies while meeting consumer expectations for rapid fulfillment. Simultaneously, establishing nearshore and regional manufacturing partnerships will help mitigate the impact of evolving tariff regimes and geopolitical uncertainties. Collaborating on packaging innovations and carbon-neutral shipping programs will align operations with sustainability goals and meet rising consumer demands for environmentally responsible commerce.

Third, embedding sustainability as a core pillar of brand identity will resonate with purpose-led consumers. By integrating eco-friendly fabrics, transparent lifecycle assessments and circular business models, retailers can differentiate their value proposition and command premium pricing. Thoughtful storytelling around ethical sourcing and environmental stewardship can further solidify brand affinity and foster long-term loyalty. Additionally, expanding loyalty programs to reward sustainable behaviors, such as garment recycling or purchase of recycled materials, can amplify engagement and drive repeat business.

Finally, cultivating employee expertise through cross-functional training in digital marketing, data science and customer experience design will ensure organizations can rapidly iterate on their strategies. A culture that emphasizes experimentation, continuous learning and customer-centric innovation will unlock new revenue streams and position companies to lead the next wave of growth in e-commerce apparel.

Outlining the Rigorous Research Methodology Employed to Deliver Robust Insights into E-commerce Apparel Market Dynamics and Trends

The foundation of this analysis rests on a rigorous multi-stage research methodology designed to ensure accuracy and relevance. Primary research engaged senior executives, category managers and supply chain experts through structured interviews and online surveys, yielding qualitative insights into strategic priorities and operational challenges. These voices were complemented by in-depth conversations with technology providers, logistics partners and sustainability advisors to capture the full spectrum of market influences.

Secondary research involved a comprehensive review of publicly available information, including corporate disclosures, industry journals, trade association reports and academic publications. This was supplemented by real-time data feeds from e-commerce platforms and analytics services to track consumer behavior indicators and sales channel performance. The interplay between primary intelligence and secondary data sources was triangulated to validate trends and reconcile disparate viewpoints.

Analytical frameworks such as Porter’s Five Forces and value chain mapping were applied to dissect competitive pressures and identify opportunities for differentiation. Segmentation matrices were developed to classify consumer cohorts by product preferences, distribution habits, demographic attributes and lifestyle factors. Finally, findings were subjected to a peer review process, incorporating feedback from subject matter experts to ensure methodological rigor and actionable clarity.

The research spanned a 12-month fieldwork period, encompassing interviews with over 150 industry stakeholders across North America, Europe, Asia-Pacific and Latin America. Survey instruments were designed to capture both quantitative metrics and qualitative feedback on topics ranging from digital maturity to sustainability priorities. Rigorous data cleaning and validation procedures were applied, including consistency checks, outlier analysis and expert panel reviews, to guarantee the integrity of the findings.

Furthermore, proprietary web-scraping techniques monitored pricing and assortment changes across top e-commerce platforms in real time, enriching the dataset with a dynamic view of competitive activity. Ethical guidelines and confidentiality protocols were strictly adhered to, ensuring that all participant data remained anonymized and compliant with prevailing privacy regulations. This robust methodological framework underpins the confidence that market participants can place in the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-commerce Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-commerce Apparel Market, by Product Type

- E-commerce Apparel Market, by Gender

- E-commerce Apparel Market, by Price Tier

- E-commerce Apparel Market, by Age Group

- E-commerce Apparel Market, by Style

- E-commerce Apparel Market, by Fabric

- E-commerce Apparel Market, by Distribution Channel

- E-commerce Apparel Market, by Region

- E-commerce Apparel Market, by Group

- E-commerce Apparel Market, by Country

- United States E-commerce Apparel Market

- China E-commerce Apparel Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesizing Critical Findings to Illuminate Future Pathways for Success in the E-commerce Apparel Sector amid Digital Transformation

The insights distilled in this executive summary underscore the dynamic nature of the e-commerce apparel sector, where innovation, regulation and consumer expectations converge. Digital transformation is not merely an operational imperative but a strategic catalyst that shapes brand narratives, supply chain resilience and competitive advantage. As tariff landscapes evolve and sustainability considerations ascend, companies equipped with robust data capabilities and agile business models will navigate complexity more effectively.

By embracing omnichannel experiences, leveraging advanced analytics and championing ethical practices, industry participants can forge deeper connections with diverse consumer segments. Regionally tailored approaches will be critical to unlocking new growth pockets, while strategic collaborations with technology and logistics partners will fortify the operational backbone. Ultimately, the brands that integrate continuous learning, experimentation and purpose-driven initiatives will emerge as the architects of the next era in e-commerce apparel.

In the face of evolving trade policies, technological disruptions and shifting consumer priorities, adaptability emerges as the defining trait of market winners. The findings presented herein offer a blueprint for integrating digital innovation with operational agility and ethical stewardship. Companies that leverage continuous scenario planning to anticipate policy changes and consumer sentiment shifts will be better positioned to capture emerging opportunities ahead of competitors.

Looking forward, the convergence of immersive technologies, circular economy principles and data-driven personalization will shape the next decennial cycle of growth. Collaboration across industry consortia, between retailers and technology partners, will accelerate the diffusion of best practices and drive collective progress. As this market enters its next phase, organizations embracing a holistic approach that balances profitability with purpose will lead the transformation. This executive summary serves as both a compass and a catalyst, guiding strategic decision-makers toward initiatives that deliver sustainable and profitable growth.

Connect with Ketan Rohom to Secure Comprehensive Insights and Drive Strategic Growth with Our E-commerce Apparel Market Research Report

Ketan Rohom, Associate Director of Sales & Marketing, extends a personal invitation to explore the full market research report, crafted to illuminate every facet of the e-commerce apparel landscape. Whether you seek to refine your digital strategy, optimize your supply chain or engage new customer segments, this report offers an indispensable resource. Engage in a tailored consultation to uncover how the latest trends in technology, tariff shifts and consumer behavior can inform your roadmap for sustainable growth.

Schedule a meeting or webinar with Ketan to see a live walkthrough of the report’s most impactful analyses, including deep-dive case studies and interactive dashboards. Early access packages include supplemental workshops and custom benchmarking exercises to align insights with your organizational objectives. Let us partner with you to translate these research findings into actionable plans that accelerate market leadership and unlock new revenue streams.

- How big is the E-commerce Apparel Market?

- What is the E-commerce Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?