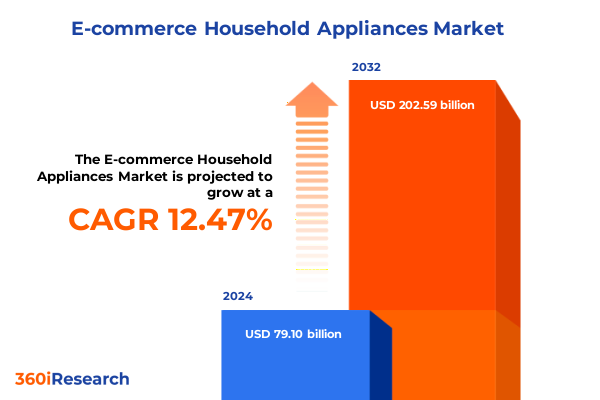

The E-commerce Household Appliances Market size was estimated at USD 88.50 billion in 2025 and expected to reach USD 99.15 billion in 2026, at a CAGR of 12.55% to reach USD 202.59 billion by 2032.

Establishing a Comprehensive Context for the E-Commerce Household Appliances Market by Examining Core Drivers, Stakeholder Expectations and Emerging Opportunities

Over the past decade, the e-commerce channel has swiftly become a defining frontier for retailing household appliances, transforming how consumers discover, research, and acquire devices for the modern home. Advancements in digital platforms, mobile-first experiences, and seamless payment ecosystems have dismantled traditional barriers, enabling shoppers to compare energy efficiency ratings, brand reputations, and pricing with unprecedented ease. Launching this executive summary, we establish the critical context needed to understand the interplay between shifting consumer expectations, omnichannel fulfillment capabilities, and the expanding footprint of global supply chains.

Against this backdrop, stakeholders-from pure-play online retailers to legacy manufacturers-are recalibrating their strategies to capitalize on data-driven personalization, subscription-based maintenance models, and the proliferation of connected appliances. This introduction frames the subsequent analysis by spotlighting the synergies between emerging technologies, evolving sustainability standards, and macroeconomic factors such as regulatory changes and trade policies. By comprehensively capturing these core drivers, decision makers can confidently navigate the complexities of the digital marketplace and align organizational priorities with the evolving imperatives of the household appliances ecosystem.

Analyzing the Transformational Shifts Revolutionizing Online Household Appliances from Technological Innovations to Evolving Consumer Behaviors

The landscape of e-commerce household appliances is undergoing a profound transformation fueled by technological innovations and shifting consumer behavior. On the technology front, the integration of Internet of Things connectivity has enabled appliances to communicate usage patterns, predict maintenance needs, and integrate with smart home ecosystems, thereby redefining value propositions. Meanwhile, artificial intelligence and machine learning algorithms power advanced recommendation engines, delivering hyper-relevant product suggestions that drive both conversion rates and customer loyalty. These developments converge to elevate user experiences and set new benchmarks for convenience and performance.

Concurrently, consumer preferences have gravitated toward frictionless shopping journeys and compelling post-purchase services. Subscription-based models for extended warranties and predictive maintenance plans are gaining traction, while augmented reality tools enable virtual product demonstrations, reducing return rates and building confidence. Sustainability and energy efficiency considerations have also become non-negotiable, prompting brands to innovate around recyclable materials, energy management features, and circular economy initiatives. This section uncovers the layered shifts reshaping the sector and illuminates the interconnected forces that will guide future competitive dynamics.

Assessing the Cumulative Effects of 2025 United States Tariff Measures on the Cost Structures and Supply Chains within E-Commerce Appliances

In 2025, the United States introduced a new slate of tariff measures targeting a range of imported household appliances, triggering tangible ripple effects throughout e-commerce supply chains. Import duties on units such as refrigerators and air conditioners elevated landed costs, compelling many online retailers to reassess pricing strategies and supplier partnerships. Manufacturers dependent on global component sourcing faced compressed margins and, in many cases, expedited efforts to localize production or diversify suppliers into duty-free markets.

The tariff-induced cost pressures extended beyond direct import expenses to influence inventory planning and distribution dynamics. Increased tariffs encouraged nearshoring initiatives, with several producers relocating assembly operations closer to end-market demand to mitigate duty impacts and optimize lead times. This shift also accelerated investment in advanced automation to offset higher local labor costs. On the consumer end, some retailers absorbed portion of these incremental expenses through promotional financing and bundled service offerings, while others passed costs through, prompting downward pressure on purchase frequency for high-ticket appliances. This section delves into the holistic impact of the 2025 tariff regime, illustrating how trade policy can recalibrate sourcing frameworks and competitive positioning across the online household appliances landscape.

Unveiling Key Segmentation Insights to Decode Consumer Preferences across Product Types Brands Energy Efficiency End Users and Distribution Channels

Segmentation analysis reveals a complex web of product categories and consumer priorities that define the e-commerce household appliances market. Based on product type the market encompasses kitchen appliances, which include blenders, coffee makers, grillers and toaster; large appliances, represented by air conditioners, refrigerators and washing machines; and small appliances, featuring air fryer, food processor and microwaves. This layered categorization underscores the need for tailored digital merchandising strategies that highlight category-specific features such as capacity, power consumption and smart connectivity.

Equally pivotal is the brand segmentation, where premium brands coexist with private label offerings that leverage cost advantages and exclusive distribution agreements. Energy efficiency serves as a further distinguishing factor, dividing demand between Energy Star certified models and those without certifications, reflecting consumer willingness to balance upfront investment against operating costs. End user segmentation bifurcates the landscape into commercial buyers-spanning cafes, restaurants and shops-and residential purchasers, each governed by distinct buying cycles and service requirements. Finally, distribution channel segmentation spans brick and mortar stores, online retailers and specialty stores, demonstrating the importance of omnichannel integration and differentiated service models.

This comprehensive research report categorizes the E-commerce Household Appliances market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Brand

- Energy Efficiency

- End User

- Distribution Channel

Unraveling Strategic Regional Perspectives Highlighting Growth Differentials across Americas Europe Middle East Africa and Asia-Pacific Online Appliances Markets

Regional analysis showcases divergent trajectories and nuanced growth drivers across the Americas, Europe, Middle East & Africa and Asia-Pacific. In the Americas, the United States remains at the forefront, driven by elevated consumer spending on smart home upgrades and robust online infrastructure, while Canada and select Latin American markets exhibit surging demand for energy-efficient and space-saving appliances in urban centers. Across Europe, digital penetration and stringent regulatory standards for sustainability foster a fertile environment for advanced, eco-conscious models, whereas Middle Eastern markets prioritize premium luxury appliances in line with hospitality sector growth and high discretionary income.

Meanwhile, the Africa landscape presents pockets of opportunity tied to electrification initiatives and mobile commerce expansion, especially in urban hubs. In the Asia-Pacific region, escalating disposable incomes in India and Southeast Asia, coupled with rapidly maturing e-commerce ecosystems in China and Japan, fuel unprecedented volumes of small kitchen appliances and modular cooling systems. Cross-border trade agreements, local manufacturing incentives and digital payment innovations further shape each region’s competitive contours, demanding that global players adapt their go-to-market approaches to diverse regulatory and consumer landscapes.

This comprehensive research report examines key regions that drive the evolution of the E-commerce Household Appliances market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Competitive Strategies Shaping the Future Landscape of the E-Commerce Household Appliances Sector

Leading companies in the e-commerce household appliances arena are distinguished by their ability to blend product innovation with digital sophistication. Veteran manufacturers leverage decades of engineering prowess to embed smart capabilities and sustainability features into flagship models, differentiating through design and reliability. At the same time, digital-native platforms and pure-play online retailers excel in delivering personalized shopping experiences and data-driven customer journeys, harnessing AI-driven chat support and tailored content to reduce decision-making friction.

Collaborative partnerships represent another salient trend, with established brands aligning with technology providers and logistics specialists to orchestrate seamless omnichannel experiences. For instance, alliances that integrate white-glove installation and after-sales service into e-commerce checkout processes have demonstrated strong customer retention rates. Additionally, disruptive direct-to-consumer startups emphasize nimble supply chains and subscription-based replacement parts services, challenging incumbents to innovate around customer lifetime value and recurring revenue streams. This section offers an in-depth look at corporate strategies, alliance structures and innovation ecosystems shaping competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-commerce Household Appliances market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Ltd.

- Amazon.com, Inc.

- Antista AS

- AO.com

- Argos Limited

- Best Buy

- Costco Wholesale Corporation

- Croma Electronics by Tata Group

- Currys PLC

- eBay Inc.

- FNAC QATAR

- Inter IKEA Group

- JD.com, Inc.

- John Lewis PLC

- Lan Mark Shops India Private Limited

- myG India Private Limited

- Reliance Retail Limited

- Shopee Mobile Malaysia Sdn. Bhd.

- Shopify Inc.

- Target Brands, Inc.

- Tesco PLC

- The Home Depot

- Ubuy Co.

- Walmart, Inc.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Competitive Dynamics and Accelerating Sustainable Growth

To navigate the evolving competitive terrain and capitalize on emerging opportunities, industry leaders should spearhead comprehensive digital ecosystem investments that align end-to-end operations with customer expectations. Prioritizing advanced analytics platforms will enable real-time demand sensing, optimizing inventory across distribution nodes and reducing fulfillment costs. Strategic diversification of supplier networks, including partnerships in low-tariff regions and investment in nearshoring capabilities, can bolster supply chain resilience against future policy shifts.

Equally critical is the cultivation of differentiated customer experiences through modular financing options, subscription-based maintenance plans and immersive technologies such as augmented reality for virtual product demos. Embedding sustainability credentials into product portfolios and service propositions not only appeals to environmentally conscious consumers but also anticipates tightening energy regulations. Finally, forging cross-industry collaborations-spanning fintech providers for flexible payment solutions and logistics innovators for same-day installation services-will be instrumental in sustaining growth momentum and reinforcing market leadership.

Detailing the Rigorous Research Methodology Adopted to Ensure Data Integrity Analytical Rigor and Actionable Intelligence for Market Stakeholders

Our research methodology combines primary engagement with industry executives, engineering teams and distribution partners alongside comprehensive secondary intelligence harvested from trade associations, regulatory filings and financial disclosures. We conducted in-depth interviews with key decision makers across manufacturing, logistics and retail sectors to capture firsthand perspectives on technological adoption, tariff mitigation tactics and channel strategies. These qualitative insights were complemented by a rigorous survey of active e-commerce shoppers to quantify preferences around energy efficiency, brand perceptions and after-sales service priorities.

To ensure data integrity and analytical rigor, we triangulated findings through cross-verification with customs import data, logistics throughput statistics and patent filing trends related to smart appliance innovations. Quantitative analysis was performed using advanced statistical techniques to identify correlations between consumer segments and purchase behavior, while scenario modeling assessed the potential impact of tariff adjustments and emerging regulatory standards. The result is a holistic, evidence-based framework designed to deliver actionable intelligence that empowers stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-commerce Household Appliances market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-commerce Household Appliances Market, by Product Type

- E-commerce Household Appliances Market, by Brand

- E-commerce Household Appliances Market, by Energy Efficiency

- E-commerce Household Appliances Market, by End User

- E-commerce Household Appliances Market, by Distribution Channel

- E-commerce Household Appliances Market, by Region

- E-commerce Household Appliances Market, by Group

- E-commerce Household Appliances Market, by Country

- United States E-commerce Household Appliances Market

- China E-commerce Household Appliances Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights Synthesizing Critical Findings and Strategic Implications to Guide Decision Makers in the E-Commerce Appliances Space

Bringing together multifaceted insights on technological disruption, trade policy influences and regional growth drivers, this executive summary illuminates the strategic imperatives facing participants in the online household appliances domain. The convergence of IoT-enabled products, AI-driven customer experiences and heightened environmental standards underscores the imperative for agility and innovation. Firms that proactively adapt their sourcing models in response to tariff shifts, while simultaneously enriching their digital ecosystems and sustainability credentials, will be best positioned to differentiate and capture value.

As consumer expectations continue to evolve, the integration of immersive technologies, flexible ownership models and predictive maintenance services will further delineate market leaders from laggards. Moreover, regional nuances-from regulatory environments in Europe to digital infrastructure maturity in Asia-Pacific-demand tailored go-to-market strategies calibrated to localized consumer agendas. By synthesizing these critical findings, decision makers are equipped to align organizational priorities with the most consequential trends and unlock sustained competitive advantage.

Engage with Ketan Rohom to Gain Exclusive Access to In-Depth Market Intelligence and Drive Competitive Advantage in Household Appliances E-Commerce

We invite you to collaborate directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored copy of the market research report and accelerate your organization’s strategic decision making. With unmatched expertise in e-commerce and household appliances, Ketan delivers deep insights that unlock new avenues for growth, optimize product portfolios, and align go-to-market strategies with the most pressing trends.

Reach out to Ketan Rohom to explore custom data packages, exclusive briefings, and advisory sessions that ensure your leadership team is empowered with precise, actionable intelligence. Leverage this partnership to orient your roadmap to emerging consumer needs, supply chain resilience, and competitive differentiation. Embark on your journey toward market leadership by engaging with Ketan today

- How big is the E-commerce Household Appliances Market?

- What is the E-commerce Household Appliances Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?