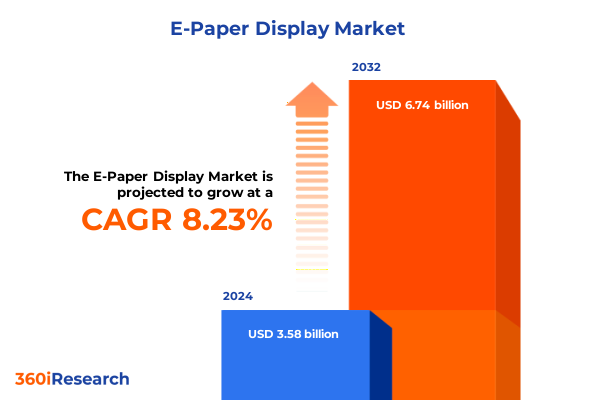

The E-Paper Display Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.18 billion in 2026, at a CAGR of 8.27% to reach USD 6.74 billion by 2032.

Unveiling the Pivotal Role of E-Paper Display Technology in Shaping Energy-Efficient Digital Interfaces and Next-Generation Consumer Experiences

E-paper display technology has swiftly evolved from a niche innovation into a cornerstone of modern low-power digital interfaces. Initially lauded for its paper-like readability and minimal energy requirements, it now underpins an expanding array of commercial applications. Over the past decade, advances in materials science and microelectronics have bolstered performance metrics such as refresh rates, contrast ratios, and durability, cementing e-paper as a preferred alternative to traditional LCD and OLED screens in scenarios where battery life and sunlight readability are paramount.

Today’s devices leverage passive and active matrix configurations to balance power consumption with functional complexity. As a result, modern e-readers deliver seamless page turns while electronic shelf labels operate autonomously for years on a single battery. This confluence of low-power operation and enhanced user experience has triggered a paradigm shift in retail, logistics, and publishing. Moreover, e-paper’s inherently lightweight and flexible form factors facilitate innovative designs, ranging from wearable health monitors to digitally updated signage in public transit systems.

Looking ahead, the intersection of sustainability imperatives and the Internet of Things will continue to amplify e-paper’s relevance. Companies seeking to reduce ultra-short-cycle consumables are increasingly gravitating toward displays that eliminate frequent recharging and paper waste. Against this backdrop, the ensuing sections explore how technological advances, policy developments, and strategic segmentation collectively shape the e-paper display landscape.

Exploring the Transformative Technological Advances and Market Dynamics Redefining the E-Paper Display Landscape Across Varied Industry Verticals

The e-paper display arena is experiencing transformative shifts driven by breakthroughs in electrochromic, electrophoretic, and electro-wetting mechanisms. Traditional monochrome applications have given way to full-color implementations that rival conventional signage in vibrancy, while maintaining the energy benefits that define e-paper. Concurrently, hybrid architectures blending active matrix driving schemes with micro-encapsulated electrophoretic particles are yielding displays that accommodate video playback and interactive touch functionalities without compromising battery longevity.

Additionally, supply chain digitization and modular manufacturing frameworks have streamlined production cycles. This has enabled rapid scaling of electronic shelf labels, smart cards, and asset-tracking tags. At the same time, partnerships between materials innovators and semiconductor foundries have reduced component costs, accelerating deployment in price-sensitive verticals such as retail and logistics. Such alliances are further supported by open standards for wireless connectivity, which allow e-paper units to integrate seamlessly with cloud-based inventory and content management platforms.

Taken together, these developments underscore a broader shift from single-purpose readers to multi-functional display ecosystems. This evolution is forging new value propositions in sectors as diverse as healthcare diagnostics and smart packaging. By bridging the gap between static printed materials and high-power dynamic screens, the industry is charting a course toward more sustainable, context-aware communication channels.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on Supply Chains Production Costs and Competitive Positioning within E-Paper Sector

In 2025, new tariff measures imposed by the United States have injected greater complexity into the e-paper supply chain. Duties on display driver integrated circuits and advanced polymer films have translated into higher import expenses, compelling manufacturers to rethink procurement strategies. Components once sourced primarily from East Asia are now under scrutiny, leading to the diversification of supplier bases across Southeast Asia and Europe to mitigate cost fluctuations.

These adjustments have had a cascading effect on production economics. Original equipment manufacturers are negotiating longer-term contracts to secure stable pricing, while exploring local assembly options to sidestep steep cross-border levies. At the same time, design teams are prioritizing compatibility with alternative substrates and driver technologies, reducing dependency on tariff-affected components. This agile approach preserves time-to-market objectives and shields end customers from abrupt price increases.

Despite these headwinds, the industry is adapting by fostering strategic alliances with regional fabrication facilities. Such collaborations not only attenuate tariff impacts but also support compliance with localized content regulations. Consequently, the sector is poised for a more resilient and geographically distributed manufacturing footprint while retaining its commitment to low-power, high-contrast display performance.

Decoding Critical Segmentation Perspectives Illuminating the Diverse Technological Types Displays Applications and End Uses Shaping E-Paper Market Dynamics

Segmenting the e-paper display arena by technology reveals a clear dichotomy between active matrix architectures that enable rapid refresh and intricate graphical interfaces and passive matrix designs prized for their simplicity and minimal power draw. Within color versus monochrome classifications, monochrome panels continue to dominate cost-sensitive applications, whereas emerging multicolor variants are unlocking novel customer engagement opportunities in retail signage and advertising.

When examining display types by composition, cholesteric liquid crystal displays harness bistability to maintain images indefinitely without power, while electrophoretic systems rely on pigment particle movement for crisp, high-contrast visuals. Electro-fluidic and electro-wetting displays are gaining traction for their dynamic color capabilities and swift transitions, and electrochromic elements offer gradual, energy-efficient tone adjustments suitable for wearable monitors.

Applications-wise, e-readers epitomize the technology’s literary roots, providing extended reading sessions with virtually no eye strain. Electronic shelf labels automate price updates and promotional content in retail aisles. Meanwhile, smart cards leverage integrated e-paper faces for secure, dynamic data display. The smart label sector extends applications into asset tracking by reflecting location status, inventory management through real-time count displays, and ticketing via scannable, updatable credentials.

Finally, end-use segmentation underscores the breadth of e-paper utility. Consumer electronics exploit the technology for secondary screens and wearable patches, whereas government and defense adopt ruggedized panels for secure communiqués. Healthcare applications range from disposable diagnostic equipment readouts to continuous monitoring devices and patient-worn wearables, illustrating the technology’s versatility across environments.

This comprehensive research report categorizes the E-Paper Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Display Type

- Technology

- Size

- Application

- End Use

Highlighting Key Regional Differentiators in the Americas Europe Middle East Africa and Asia Pacific Influencing Adoption Patterns and Growth Trajectories

Regional contrasts play a pivotal role in shaping the trajectory of e-paper adoption. In the Americas, infrastructure investments and retail modernization initiatives have spurred rapid uptake of electronic shelf labels and smart packaging solutions. North American manufacturers are collaborating with logistics providers to embed e-paper tags in cold-chain operations, optimizing perishables management and traceability in real time.

Across Europe, Middle East, and Africa, stringent environmental regulations and circular economy policies are driving demand for sustainable display alternatives. The region’s focus on reducing single-use plastics has amplified interest in flexible, recyclable substrates. Furthermore, public transport systems in major European cities are integrating large-format e-paper stations to convey schedules and service alerts without the maintenance demands of conventional digital signage.

Meanwhile, the Asia-Pacific region continues to serve as both a production hub and a dynamic consumption market. Emerging economies are leveraging cost-effective monochrome displays in microfinance and identification cards, while metropolitan centers are trialing full-color e-paper billboards. Government-led smart city frameworks are also incorporating e-paper nodes for energy-efficient public information dissemination, signaling robust regional momentum.

This comprehensive research report examines key regions that drive the evolution of the E-Paper Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives Collaborations and Competitive Differentiators Among Leading Firms Driving Innovation in the E-Paper Display Arena

Prominent players in the e-paper sector are distinguishing themselves through targeted research investments and cross-industry partnerships. Companies specializing in electrophoretic materials are collaborating with semiconductor fabricators to develop bespoke driver ICs, thereby optimizing power management and refresh capabilities. At the same time, firms with expertise in flexible substrates are forging alliances with packaging and wearables manufacturers to co-create novel form factors.

Strategic acquisitions are also reshaping the competitive landscape. Leading display houses have integrated niche electro-fluidic and electrochromic specialists into their portfolios, consolidating intellectual property and accelerating time to market for next-gen modules. Meanwhile, semiconductor companies are establishing dedicated e-paper divisions to supply turnkey solutions, encompassing everything from backplane electronics to encapsulated pigment formulations.

Collectively, these initiatives underscore a shift toward vertically integrated models, where control over both materials and drivers yields performance advantages. As a result, the industry is witnessing faster innovation cycles and deeper alignment between display capabilities and end-customer requirements, reinforcing the market’s trajectory toward more immersive and energy-conscious visual communications.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Paper Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AUO Corporation

- BOE Technology Group Co., Ltd.

- Delta Electronics, Inc.

- E Ink Holdings Inc.

- e-Paper Innovation

- EL International Ltd

- Evelta Electronics

- FlexEnable Technology Limited

- Fujitsu Limited

- Koninklijke Philips N.V.

- LG Display Co., Ltd.

- Mouser Electronics, Inc.

- Orient Display

- PERVASIVE DISPLAYS, INC.

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- Sharp Display Solutions Europe GmbH

- Solum Co., Ltd.

- Sony Group Corporation

- TCL Corporation

- Teleste Corporation

- Unisystem

- Visionect LLC.

- Wuxi Clearink Display Technology Co., LTD

- YNVISIBLE INTERACTIVE INC.

- ZhSunyco

Formulating Actionable Strategic Roadmaps and Best Practices to Empower Industry Leaders to Capitalize on Emerging Opportunities in E-Paper Technologies

Industry leaders should prioritize modular platform development that enables rapid customization without sacrificing economies of scale. By architecting configurable backplane-driver modules and leveraging open reference designs, companies can respond swiftly to diverse application needs, from smart labels to wearable health monitors. Additionally, cultivating an ecosystem of specialized partners-ranging from materials suppliers to wireless module vendors-will ensure that integrated solutions meet stringent performance benchmarks while maintaining cost efficiencies.

Moreover, decision-makers ought to invest in cross-functional talent capable of bridging hardware engineering, user experience design, and data analytics. This multidisciplinary approach will facilitate the creation of interactive e-paper applications that transcend static imagery, such as context-aware signage that dynamically updates based on inventory levels or environmental cues. Concurrently, forging strategic relationships with regulatory bodies and standards organizations can streamline compliance pathways and reinforce market credibility.

Ultimately, firms that embed sustainability metrics into their product roadmaps-focusing on recyclable materials and minimal lifecycle energy consumption-will gain a competitive edge as global enterprises and government agencies escalate their ESG mandates. In doing so, industry pioneers will unlock new revenue streams and strengthen their positioning as the preferred partners for next-generation low-power display solutions.

Detailing Rigorous Multistage Research Frameworks Data Collection Techniques and Analytical Approaches Underpinning the E-Paper Market Investigation

The research underpinning these insights was conducted through a comprehensive, multistage framework. Initially, primary data was gathered via expert interviews with display engineers, materials scientists, and MEMS specialists, ensuring direct access to cutting-edge developments. This was complemented by a systematic review of patent filings and academic publications to map emerging technologies, such as novel electro-fluidic formulations and advanced pigment microstructures.

Secondary data collection included analyses of publicly available regulatory filings, supplier catalogs, and industry conference proceedings to quantify component availability and supplier capabilities. Market feedback loops were established through collaboration with end users in retail, logistics, and healthcare, providing qualitative perspectives on performance requirements and deployment challenges. All insights were triangulated using a bottom-up validation process, wherein prototype performance metrics were reconciled against vendor specifications and user acceptance tests.

Finally, a scenario analysis approach was employed to model the implications of trade policy shifts and regional adoption rates on supply chain configurations. This rigorous methodology ensured that the findings reflect both current realities and plausible future states, equipping decision-makers with a resilient foundation for planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Paper Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Paper Display Market, by Type

- E-Paper Display Market, by Display Type

- E-Paper Display Market, by Technology

- E-Paper Display Market, by Size

- E-Paper Display Market, by Application

- E-Paper Display Market, by End Use

- E-Paper Display Market, by Region

- E-Paper Display Market, by Group

- E-Paper Display Market, by Country

- United States E-Paper Display Market

- China E-Paper Display Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Core Findings Future Outlook and Strategic Imperatives Guiding Stakeholders toward Sustainable Growth and Technological Advancements in E-Paper

The convergence of advanced driving schemes, innovative materials, and strategic regional alliances positions the e-paper display sector at the forefront of low-power visual technologies. Core findings highlight that active matrix advancements are enabling richer interactivity, while color implementations broaden the scope of consumer and industrial use cases. Meanwhile, the imposition of 2025 tariff measures has catalyzed supply chain diversification, encouraging onshore assembly and new sourcing partnerships.

Looking forward, stakeholders must remain agile in adapting to both policy shifts and rapidly evolving end-customer expectations. Strategic imperatives include deepening vertical integration, embedding sustainability criteria into design protocols, and investing in modular architectures that serve multiple segments. By doing so, industry participants will unlock scalable pathways to deploy high-performance e-paper displays across an expanding range of applications.

In essence, the e-paper ecosystem is entering a phase characterized by heightened collaboration, regulatory complexity, and a renewed emphasis on energy efficiency. Organizations that harness these dynamics with forward-thinking strategies will emerge as market leaders, delivering solutions that resonate with the sustainability and connectivity demands of tomorrow’s digital environment.

Engage with Ketan Rohom to Unlock Targeted Insights Fueling Strategic Decisions and Accelerating Market Penetration via the E-Paper Research Report

To delve deeper into these insights and secure a customized roadmap tailored to your organization’s objectives, engage with Ketan Rohom. As Associate Director of Sales & Marketing, Ketan will guide you through the extensive findings of the e-paper research report and ensure you harness every strategic advantage. Embark on this journey with expert support to unlock actionable intelligence, drive decisive initiatives, and accelerate your market penetration efforts with confidence

- How big is the E-Paper Display Market?

- What is the E-Paper Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?